Bitget: Ranked top 4 in global daily trading volume!

BTC market share60.49%

New listings on Bitget:Pi Network

Altcoin season index:0(Bitcoin season)

BTC/USDT$84339.83 (+0.45%)Fear and Greed Index32(Fear)

Total spot Bitcoin ETF netflow +$83.1M (1D); +$549.9M (7D).Coins listed in Pre-MarketPAWS,WCTWelcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app. Download now

Bitget: Ranked top 4 in global daily trading volume!

BTC market share60.49%

New listings on Bitget:Pi Network

Altcoin season index:0(Bitcoin season)

BTC/USDT$84339.83 (+0.45%)Fear and Greed Index32(Fear)

Total spot Bitcoin ETF netflow +$83.1M (1D); +$549.9M (7D).Coins listed in Pre-MarketPAWS,WCTWelcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app. Download now

Bitget: Ranked top 4 in global daily trading volume!

BTC market share60.49%

New listings on Bitget:Pi Network

Altcoin season index:0(Bitcoin season)

BTC/USDT$84339.83 (+0.45%)Fear and Greed Index32(Fear)

Total spot Bitcoin ETF netflow +$83.1M (1D); +$549.9M (7D).Coins listed in Pre-MarketPAWS,WCTWelcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app. Download now

Coin-related

Price calculator

Price history

Price prediction

Technical analysis

Coin buying guide

Crypto category

Profit calculator

/Reach priceREACH

Not listed

Quote currency:

USD

Data is sourced from third-party providers. This page and the information provided do not endorse any specific cryptocurrency. Want to trade listed coins? Click here

$0.008803+307.37%1D

Price chart

Last updated as of 2025-03-22 07:36:56(UTC+0)

Market cap:--

Fully diluted market cap:--

Volume (24h):$182,928.89

24h volume / market cap:0.00%

24h high:$0.01003

24h low:$0.002057

All-time high:$0.1631

All-time low:$0.001105

Circulating supply:-- REACH

Total supply:

100,000,000REACH

Circulation rate:0.00%

Max supply:

100,000,000REACH

Price in BTC:0.{6}1045 BTC

Price in ETH:0.{5}4435 ETH

Price at BTC market cap:

--

Price at ETH market cap:

--

Contracts:

0x8B12...79316E3(Ethereum)

More

How do you feel about /Reach today?

Note: This information is for reference only.

Price of /Reach today

The live price of /Reach is $0.008803 per (REACH / USD) today with a current market cap of $0.00 USD. The 24-hour trading volume is $182,928.89 USD. REACH to USD price is updated in real time. /Reach is 307.37% in the last 24 hours. It has a circulating supply of 0 .

What is the highest price of REACH?

REACH has an all-time high (ATH) of $0.1631, recorded on 2023-12-18.

What is the lowest price of REACH?

REACH has an all-time low (ATL) of $0.001105, recorded on 2025-02-15.

/Reach price prediction

What will the price of REACH be in 2026?

Based on REACH's historical price performance prediction model, the price of REACH is projected to reach $0.003285 in 2026.

What will the price of REACH be in 2031?

In 2031, the REACH price is expected to change by +3.00%. By the end of 2031, the REACH price is projected to reach $0.005090, with a cumulative ROI of +27.23%.

/Reach price history (USD)

The price of /Reach is -88.98% over the last year. The highest price of in USD in the last year was $0.09928 and the lowest price of in USD in the last year was $0.001105.

TimePrice change (%) Lowest price

Lowest price Highest price

Highest price

Lowest price

Lowest price Highest price

Highest price

24h+307.37%$0.002057$0.01003

7d+136.33%$0.002057$0.01003

30d-64.61%$0.002057$0.05008

90d-26.92%$0.001105$0.05008

1y-88.98%$0.001105$0.09928

All-time-72.05%$0.001105(2025-02-15, 35 days ago )$0.1631(2023-12-18, 1 years ago )

/Reach market information

/Reach holdings by concentration

Whales

Investors

Retail

/Reach addresses by time held

Holders

Cruisers

Traders

Live coinInfo.name (12) price chart

/Reach ratings

Average ratings from the community

4.6

This content is for informational purposes only.

About /Reach (REACH)

What Is /Reach?

/Reach is a SocialFi (Social Finance) ecosystem, aiming to redefine how creators and community members interact in the digital space. At its core, /Reach addresses a critical challenge faced by creators across platforms: the prevalence of fake engagements and the inefficiency of traditional engagement methods. By leveraging blockchain technology, /Reach introduces a novel approach to foster genuine interactions, ensuring that creators can connect with an active and relevant audience without relying on pseudo-influencers or agencies that fail to deliver authentic engagement.

The platform operates on the principle of rewarding real, meaningful contributions within the community. Through a system of missions tailored by creators, participants can engage in activities such as follows, likes, retweets, and comments, primarily on the X platform ( commonly known as Twitter). These missions not only facilitate genuine engagement but also offer rewards in

Ethereum (ETH) and points, incentivizing participants to contribute value to the community.

Resources

Official Documents:

https://docs.getreach.xyz/lang/

Official Website:

https://www.getreach.xyz/

How Does /Reach Work?

/Reach's operational model is designed to democratize the value exchange between creators and their audience. By setting up missions with specific targets, creators can directly engage with their community, ensuring that their content reaches interested and engaged individuals. Participants who complete these missions are rewarded with /Reach points, which reflect the value of their contribution. These points serve as entries into raffles, offering chances to win Ethereum rewards, thereby creating a compelling incentive for active participation.

Moreover, /Reach implements advanced anti-bot measures and engagement verification processes to ensure genuine interactions and mitigate the impact of automated systems. This approach not only enhances the user experience but also contributes to the platform's overall integrity and value proposition, making it a trusted space for genuine social networking and collaboration.

What Is REACH Token?

REACH is the utility token of the /Reach platform. It enables users to access exclusive features, conduct transactions, and participate in governance decisions within the /Reach community. REACH has a total supply of 100 million tokens.

What Determines REACH’s Price?

The price of the REACH token, like any

cryptocurrency, is influenced by a myriad of factors that reflect its demand, utility, and market sentiment within the blockchain ecosystem. Key determinants include its adoption rate, the overall performance of the /Reach platform, and broader market trends in the cryptocurrency sector. Investors and users closely monitor price predictions for REACH in 2024, delve into its historical price charts, and analyze its potential as a viable investment against the backdrop of fluctuating market conditions. As the token's utility within the /Reach ecosystem grows, and as it garners attention from the wider blockchain community, these factors collectively shape REACH's valuation, guiding investors and users in their decision-making process regarding this digital asset.

For those interested in investing or trading /Reach, one might wonder: Where to buy REACH? You can purchase REACH on leading exchanges, such as Bitget, which offers a secure and user-friendly platform for cryptocurrency enthusiasts.

REACH to local currency

1 REACH to MXN$0.181 REACH to GTQQ0.071 REACH to CLP$8.181 REACH to HNLL0.231 REACH to UGXSh32.281 REACH to ZARR0.161 REACH to TNDد.ت0.031 REACH to IQDع.د11.531 REACH to TWDNT$0.291 REACH to RSDдин.0.951 REACH to DOP$0.551 REACH to MYRRM0.041 REACH to GEL₾0.021 REACH to UYU$0.371 REACH to MADد.م.0.081 REACH to AZN₼0.011 REACH to OMRر.ع.01 REACH to KESSh1.141 REACH to SEKkr0.091 REACH to UAH₴0.37

- 1

- 2

- 3

- 4

- 5

Last updated as of 2025-03-22 07:36:56(UTC+0)

/Reach news

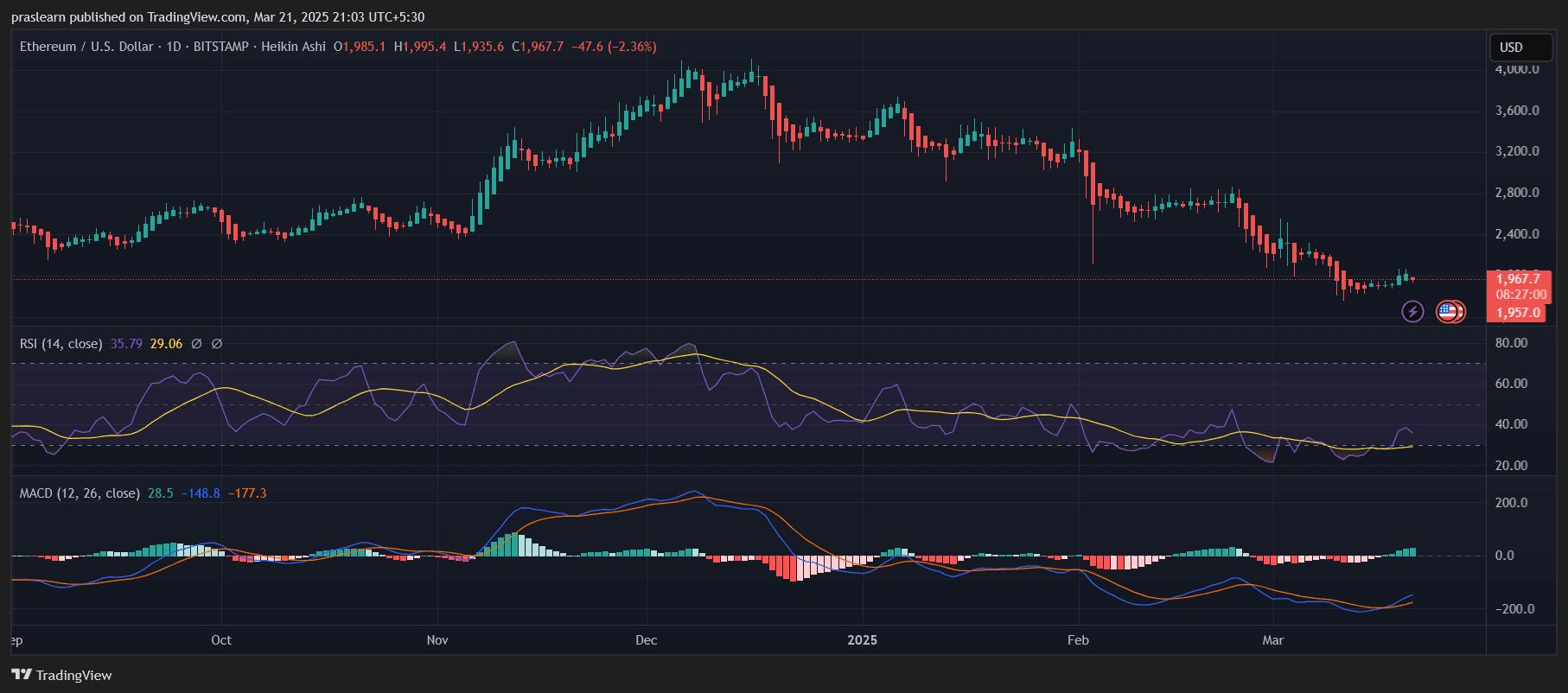

Ethereum Price Prediction: Can ETH Reach $7,000?

Cryptoticker•2025-03-22 05:00

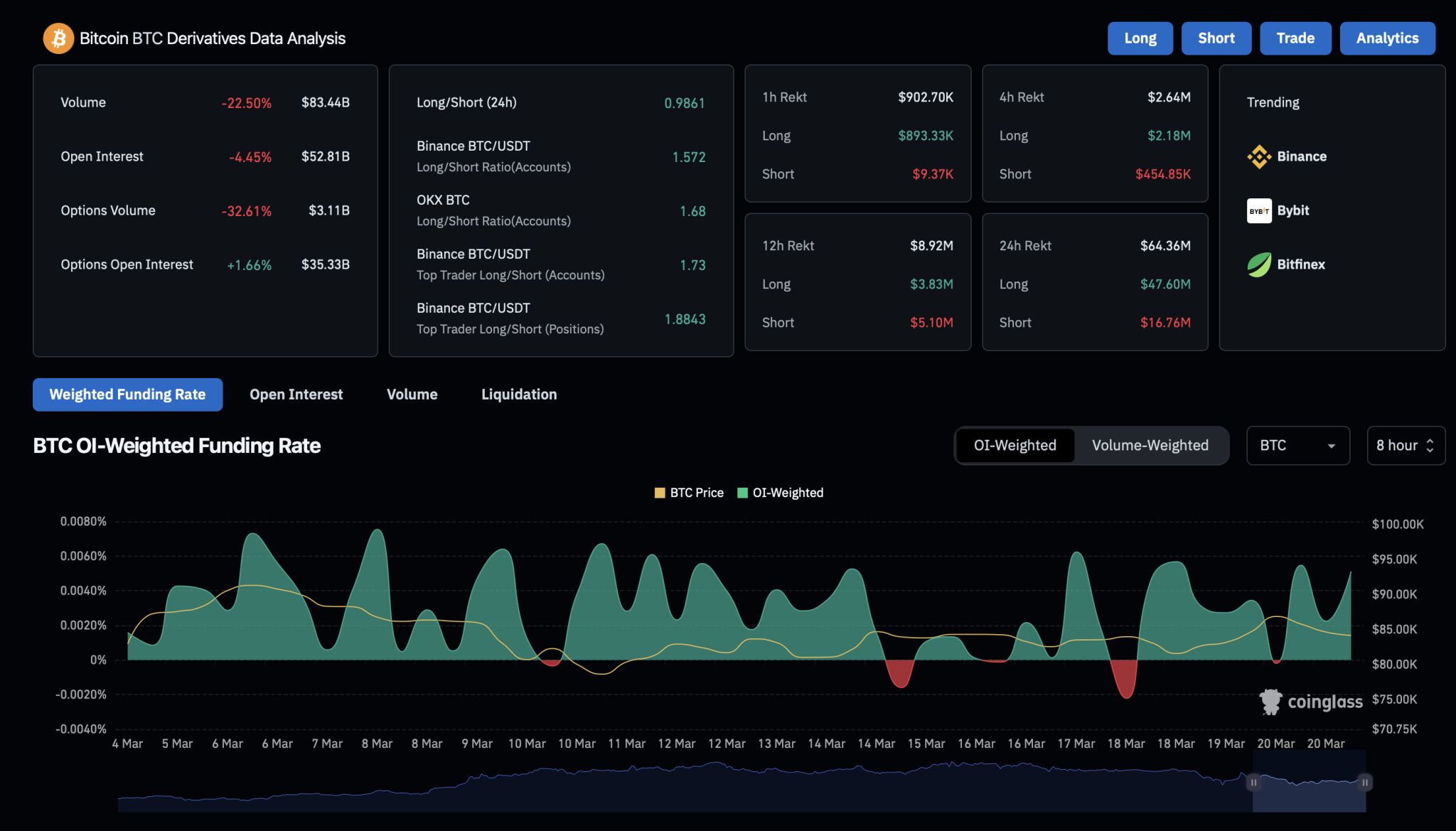

Bitcoin Breaks Below $85k as Leverage Spikes: Is $80k Next?

CryptoNewsNet•2025-03-21 11:11

BlockDAG’s Certik & Halborn Audits Amplify Credibility, Forging a Secure Future While Litecoin Fluctuates & Mantra Faces Volatility

Discover how BlockDAG's rigorous CertiK and Halborn audits are amplifying its credibility and forging a secure future, setting it apart from Litecoin's price fluctuations and Mantra's adoption volatility.Litecoin Price: Can It Break Past $137 and Reach $280?Mantra’s Price Climb: Is It Sustainable Amidst Adoption Concerns?BlockDAG’s Security: A Major Step Forward with Halborn and CertiK AuditsFinal Thoughts

Coinomedia•2025-03-21 08:11

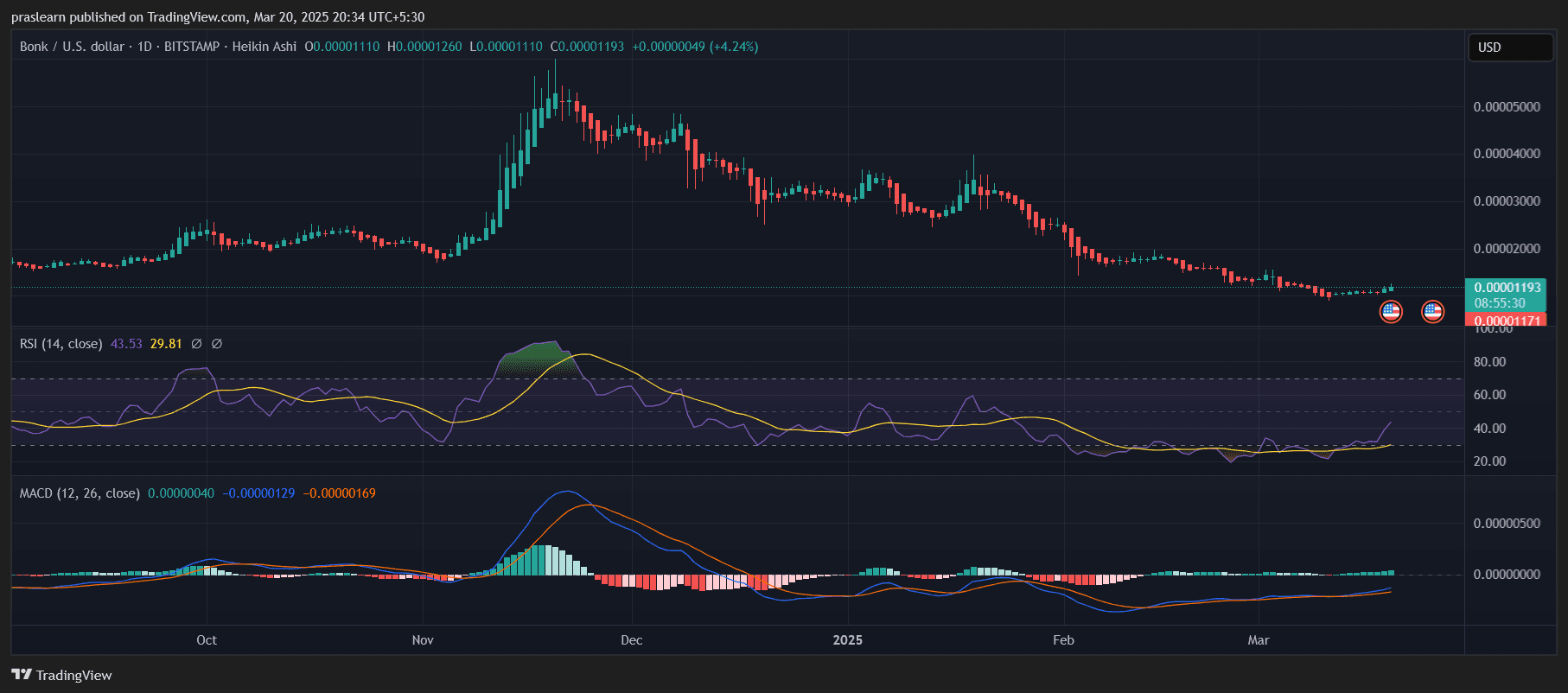

Will BONK Price Reach $1 in the Next 30 Days?

Cryptoticker•2025-03-20 20:33

Chainlink (LINK) Price Prediction 2025-2030: Can LINK Reach New Highs in the Coming Years?

Coinedition•2025-03-20 16:00

Buy more

FAQ

What is the current price of /Reach?

The live price of /Reach is $0.01 per (REACH/USD) with a current market cap of $0 USD. /Reach's value undergoes frequent fluctuations due to the continuous 24/7 activity in the crypto market. /Reach's current price in real-time and its historical data is available on Bitget.

What is the 24 hour trading volume of /Reach?

Over the last 24 hours, the trading volume of /Reach is $182,928.89.

What is the all-time high of /Reach?

The all-time high of /Reach is $0.1631. This all-time high is highest price for /Reach since it was launched.

Can I buy /Reach on Bitget?

Yes, /Reach is currently available on Bitget’s centralized exchange. For more detailed instructions, check out our helpful How to buy guide.

Can I get a steady income from investing in /Reach?

Of course, Bitget provides a strategic trading platform, with intelligent trading bots to automate your trades and earn profits.

Where can I buy /Reach with the lowest fee?

Bitget offers industry-leading trading fees and depth to ensure profitable investments for traders. You can trade on the Bitget exchange.

Where can I buy crypto?

Video section — quick verification, quick trading

How to complete identity verification on Bitget and protect yourself from fraud

1. Log in to your Bitget account.

2. If you're new to Bitget, watch our tutorial on how to create an account.

3. Hover over your profile icon, click on “Unverified”, and hit “Verify”.

4. Choose your issuing country or region and ID type, and follow the instructions.

5. Select “Mobile Verification” or “PC” based on your preference.

6. Enter your details, submit a copy of your ID, and take a selfie.

7. Submit your application, and voila, you've completed identity verification!

Cryptocurrency investments, including buying /Reach online via Bitget, are subject to market risk. Bitget provides easy and convenient ways for you to buy /Reach, and we try our best to fully inform our users about each cryptocurrency we offer on the exchange. However, we are not responsible for the results that may arise from your /Reach purchase. This page and any information included are not an endorsement of any particular cryptocurrency. Any price and other information on this page is collected from the public internet and can not be consider as an offer from Bitget.

Bitget Insights

Barchart

10h

United States is projected to reach a Global Market Cap of $116 Trillion by 2075, more than India, Japan, UK, France, and Germany combined! And about 60% higher than China! 🚨

Crypto-Ticker

18h

Chainlink Price Prediction: Can LINK Reach $50?

Chainlink (LINK) has been one of the most resilient cryptocurrencies in the market, showing strong potential despite broader market volatility. At the time of writing, LINK price is trading at $14.21, reflecting a slight downward movement of -2.82%. Investors are eyeing a potential surge toward the $50 mark, but key technical indicators suggest a critical period of consolidation before any major breakout.

The RSI currently stands at 42.83 , which indicates that Chainlink price is neither overbought nor oversold. Typically, an RSI reading below 30 signals an oversold condition, while above 70 suggests overbought levels. This neutral zone suggests that there is still room for upside movement if buying pressure increases.

The MACD (Moving Average Convergence Divergence) is currently at 0.24, with the signal line at -1.06. This slight bullish divergence suggests that LINK price could be forming a bottoming pattern, but it still lacks strong momentum to push toward higher resistance levels. A confirmed crossover above the signal line could indicate an upward push.

Immediate Support: $14.00 – This level has acted as a strong accumulation zone, and if Chainlink price maintains above it, an upward rally could be possible.

Major Resistance: $16.50 – A breakout above this resistance level could pave the way for a rapid climb toward $20.

Psychological Resistance: $50 – Achieving this level would require significant institutional buying and a strong market sentiment shift.

For Chainlink price to reach $50 , it would need a 252% increase from its current price. This is not impossible, but it requires several key catalysts:

Chainlink’s price action suggests short-term consolidation, with a strong support zone around $14.00. If buying pressure increases, LINK could retest $16.50 and $20 in the coming weeks. However, to reach $50, LINK will require a combination of market momentum, institutional adoption, and a broader cryptocurrency rally. For now, LINK remains in a strong accumulation phase, making it a compelling asset for long-term holders.

MAJOR-5.49%

LINK+1.29%

Coinedition

21h

Could These High FDV Altcoins Be the Driving Force Behind the Next Bull Run?

Altcoins with high Fully Diluted Valuations (FDV) are making some significant moves, and these shifts have some experts wondering if we’re seeing the early signs of a new bull run.

XRP, in particular, has seen its FDV skyrocket to $251 billion, pushing it past Ethereum. Meanwhile, other altcoins like SUI and HYPE have also been gaining traction, even surpassing some of the more established players like XLM, HBAR, and AVAX.

This has definitely got people talking about whether these high FDV altcoins could be the ones to kick off the next big wave of bullish momentum in the market.

XRP’s impressive surge in FDV has put it ahead of Ethereum and also significantly outperformed BNB, Solana, and Cardano in terms of projected valuation.

Related: High FDV, Low Circulating Supply Projects: Analyzing Market Potential and Risks

This jump suggests that investors are increasingly looking at assets with the potential for high future valuations.

BNB has also shown it can hold its own, increasing by 2.85% to reach $624.05.

Interestingly, its FDV matches its current market cap at $88.91 billion, and trading volume saw a big jump of 27.57% to $2.42 billion. This kind of performance usually indicates strong investor interest.

Similarly, Solana has climbed 1.80% to $130.47, with a FDV of $77.62 billion. What’s really notable with Solana is the massive 54.35% increase in trading volume, which points to growing excitement, likely fueled by its increasing use in decentralized applications.

Related: Ethereum Scaling Solutions Take Center Stage: Top 5 Layer 2 Tokens by FDV

Cardano, priced at $0.7315, has recorded a modest 0.25% increase. Its FDV stands at $32.91 billion, with a market cap of $25.77 billion. While Cardano’s growth might be steady rather than explosive, its potential is still considered strong thanks to its ongoing technological advancements.

Meanwhile, Sui’s valuation has surged , reaching an FDV of $24.47 billion. Its price increase of 2.92% to $2.44 indicates growing investor confidence in the platform.

Hyperliquid’s FDV has climbed to $14.72 billion, positioning it above Stellar, Hedera, and Avalanche. While its price did dip slightly by 1.78% to $14.73, its trading volume surged by 33.66%, indicating a lot of interest in this newer player.

Stellar and Hedera have faced declines, with their prices dropping to $0.2843 and $0.1915, respectively. Their FDVs stand at $14.21 billion and $9.57 billion , suggesting they may need stronger catalysts to regain momentum.

Avalanche has also experienced a decline, with its price falling 3.10% to $18.84. Despite this, its FDV of $13.5 billion still places it among top contenders.

With investor sentiment potentially shifting, these altcoins with high FDVs are definitely gaining attention. If they keep attracting significant investment, they could very well be the ones to fuel the next big rally across the crypto market.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

PEOPLE+6.91%

HYPE+0.94%

Cointribune EN

22h

AI Agents Take Over The Future Of Automation Is Here

Artificial intelligence has taken a decisive step forward with the meteoric rise of ChatGPT, which has revolutionized both the general public and businesses. Yet, faced with the limitations of giant models, a new approach is emerging: intelligent agents. Capable of acting and interacting with their digital environment, they redefine the future of AI by moving from simple text generation to executing concrete and autonomous tasks.

Just a few years ago, interacting with an artificial intelligence seemed like science fiction to the general public. But when ChatGPT appeared at the end of 2022, a radical evolution took place. Based on the GPT-3.5 model and freely accessible online, ChatGPT experienced a meteoric rise, reaching 100 million monthly users in just two months, a historic record for a consumer application.

In comparison, services like TikTok took nearly 9 months to reach such an audience. While democratizing text generation by AI, ChatGPT has enabled non-specialists to experience the power of large language models, also known as LLMs. From schoolchildren to professional engineers, everyone could ask questions, get summaries, create code, and generate content ideas through a natural language computing conversation.

The impact in the professional world has been just as significant. Several companies quickly integrated these models into their products and workflows. OpenAI generated nearly 1 billion dollars in revenue in 2023, potentially reaching 3.7 billion in 2024. This ascent was supported by the development of AI APIs and commercial licenses. The formation of major partnerships, such as with Microsoft, allowed ChatGPT to be included in users’ daily routines (search engines, office suites), further amplifying its impact.

GPT-3.5 was a true turning point. AI could now compose coherent text on demand. GPT-4, created at the beginning of 2023, affirmed the revolutionary aspect of the software by notably improving its reasoning capabilities and image comprehension. In record time, text-generative AI has transitioned from a laboratory curiosity to an essential consumer tool, both for less experienced users and for companies seeking automation.

However, this meteoric rise has been called into question by the evolution of giant models. Indeed, major players in the web, such as Open AI and its competitors (Anthropic, Google, Meta, Grok in the United States, Mistral in France, Deepseek and Qwen in China) have worked to increase the power of their LLMs since 2024. Thus, new records of performance and intelligence have been established at the cost of significant efforts and massive expenses.

Nevertheless, gains tend to plateau compared to the initial spectacular jumps. Indeed, according to “scaling laws”, each new advancement now requires an exponential increase in resources (model size, data used, computing power), which progressively limits the real progress margin of artificial intelligences. In fact, doubling the intelligence of a model would not merely double the initial cost but multiply it by ten or a hundred: it would require both more computing power and more training data.

Where the transition from GPT-3 to GPT-4 brought significant improvements (with GPT-4 performing approximately 40% better than GPT-3.5 on certain standardized academic exams), OpenAI’s next model (codenamed Orion) is said to offer only minimal improvements over GPT-4, according to some sources.

This dynamics of diminishing returns affects the entire sector: Google reportedly found that its Gemini 2.0 model does not meet expected goals, and Anthropic even temporarily paused the development of its main LLM to reassess its strategy. In short, the exhaustion of large high-quality training data corpora, as well as the unsustainable costs in computing power and energy needed to improve models, lead to a sort of technical ceiling, at least temporarily.

The numbers confirm this on benchmarks. The multitask understanding scores (MMLU) of the best models converge: since 2023, almost all LLMs achieve similar performances on these tests, indicating we are approaching a plateau. Even much smaller open-source models are beginning to compete with the giants trained by billions of dollars in investments.

The race for enormity of models is therefore showing its limits, and the giants of AI are changing strategies: Sam Altman (OpenAI) stated that the path to truly intelligent AI will likely no longer come from simply scaling LLMs, but rather from a creative use of existing models. In clear terms, it involves finding new approaches to gain intelligence without simply multiplying the size of neural networks.

Certain techniques, such as Chain-of-Thought (or Tree-of-Thought), allow the model to generate a “reasoning” (often referred to as “thinking” models) before providing its answer, within which it can explore possibilities and realize its mistakes… This is the hallmark of models o1, o3 from OpenAI , R1 from Deepseek , and the „Think“ mode of Grok… This method offers remarkable intelligence gains, particularly in mathematical problems.

However, it still comes at a cost: one of the major benchmarks for testing model intelligence is the ARC-AGI (“Abstract and Reasoning Corpus for Artificial General Intelligence”), published by François Chollet in 2019, which tests the intelligence of models on generalization tasks like the one below :

This benchmark remained a challenge too difficult for the entirety of general models for a long time, taking 4 years to progress from 0 % completion with GPT-3 to 5 % with GPT-4o. But last December, OpenAI published the results of its range of o3 models, with a specialized model on ARC-AGI achieving 88 % completion :

However, each problem incurs a cost of over $3,000 to execute (not counting training expenses), and takes over ten minutes.

The limit of giant LLMs is now evident. Instead of accumulating billions of parameters for ever-smaller returns in intelligence, the AI industry now prefers to equip it with “arms and legs” to transition from simple text generation to concrete action. Now, AI no longer merely answers questions or generates content passively, but connects itself to databases, triggers APIs, and executes actions: conducting internet searches, writing code and executing it, booking a flight, making a call…

It is clear that this new approach radically transforms our relationship with technology. This paradigm shift allows companies to rethink their workflows and use the power of LLMs to automate tedious and repetitive tasks. This modular approach focuses on interaction intelligence rather than brute parametric force. The real challenge now is to enable AI to collaborate with other systems to achieve tangible results. Several intelligent agents already illustrate the disruptive potential of this approach:

Anthropic, creator of Claude, recently published a new standard, the Model Context Protocol (or MCP), which should ultimately allow connection between a compatible LLM and “servers” of tools chosen by the user. This approach has already garnered much attention in the community. Some, like Siddharth Ahuja (@sidahuj) on X (formerly Twitter), use it to connect Claude to Blender, the 3D modeling software, generating scenes just with queries :

The arrival of these agents marks a decisive turning point in our interaction with AI. By allowing an artificial intelligence to take action, we witness a transformation of work methods. Companies integrating agents into their systems can automate complex processes, reduce delays, and improve operational accuracy, whether it’s about synthesizing vast volumes of information or driving complete applications.

For professionals, the impact is immediate. An analyst can now delegate the research and compilation of information to Deep Research, freeing up time for strategic analysis. A developer, aided by v0, can turn an idea into reality in just a few minutes, while GitHub Copilot speeds up code production and reduces errors. The possibilities are already immense and continue to grow as new agents are created.

Beyond the professional realm, these agents will also transform our daily lives, sliding into our personal tools and making services once reserved for experts accessible: it is now much easier to “photoshop” an image, generate code for a complex algorithm, or obtain a detailed report on a topic…

Thus, the era of giant LLMs may be coming to an end, while the arrival of AI agents opens a new era of innovation. These agents – Deep Research, Manus, v0 by Vercel, GitHub Copilot, Cursor, Perplexity AI, and many others – seem to demonstrate that the true value of AI lies in its ability to orchestrate multiple tools to accomplish complex tasks, save time, and transform our workflows.

But beyond these concrete successes, one question remains: what does the future of AI hold for us? What innovations can we expect? Perhaps an even deeper integration with edge computing, or agents capable of learning in real time, or modular ecosystems allowing everyone to customize their digital assistant? What is certain is that we are still only at the beginning of this revolution, which may be the largest humanity will ever experience. And you, are you eager to discover Orion (GPT5), Claude 4, Llama 4, DeepHeek R2, and other disruptive innovations? Which tool from this future excites you the most?

UP-4.00%

X-10.17%

Crypto News Flash

23h

Dubai Kicks Off Real Estate Tokenization on Blockchain

The Dubai government has initiated a pilot phase of a real estate tokenization project to bring property into the digital world using blockchain technology. The project aims to allow ownership of property assets in the form of tokens, which trade more readily.

🚨JUST IN: DUBAI LAUNCHES THE PILOT PHASE OF ITS REAL ESTATE TOKENIZATION PROJECT, AIMING TO TOKENIZE REAL ESTATE ASSETS ON THE BLOCKCHAIN

— BSCN Headlines (@BSCNheadlines) March 20, 2025

Many people have always found Dubai’s property investment to be appealing. In terms of liquidity and accessibility, there have been significant obstacles yet.

Tokenization is here to offer a way whereby property ownership can be divided into smaller bits represented as digital tokens. Investors can thus acquire a little piece of the property with a more affordable capital instead of purchasing a whole apartment or villa.

Conversely, this approach can also lower bureaucracy, boost openness in real estate transactions, and hasten buying and selling times. Blockchain as a supporting technology helps transaction recording to become safer and effective, free from data manipulation danger.

The Dubai government, through the Dubai Land Department (DLD) and the Dubai Virtual Assets Regulatory Authority (VARA), is leading this project. Dubai is enhancing its standing as a center for digital finance innovation even more because tokenization transactions are estimated to reach AED60 billion (about $16 billion) by 2033.

The move also conforms to the Dubai Economic Agenda D33, which seeks to establish Dubai among the top three global economic centers in the next ten years. Apart from its aspirations to lead in technological innovation, Dubai also aims to draw more international capital to its property market.

Dubai is displaying aspirations in the blockchain and Web3 industries even while it is mostly focused on real estate tokenization. Dubai declared on January 16, 2025, the building of the 17-story Crypto Tower, a center for Web3 and blockchain research.

Startups and businesses operating in digital technology will find 150,000 square feet of space in the building. The project has first quarter of 2027 as its intended completion date.

Furthermore, the crypto ecosystem in Dubai continues to grow. On March 12, 2025, Ripple received approval from the Dubai Financial Services Authority (DFSA) to provide blockchain-based payment services at the Dubai International Finance Centre (DIFC). With this, Ripple became the first crypto payment provider to be licensed by the DFSA.

Moreover, as CNF has reported , Abu Dhabi, through MGX, has also demonstrated interest in this sector by funding $ 2 billion in Binance. It confirms that the United Arab Emirates is prepared to be a worldwide digital financial powerhouse, therefore strengthening the link between the biggest crypto exchange in the world and the country.

Given these developments, the question that arises is: Is the world ready for a major transition in property asset ownership? The concept of tokenization does offer many benefits, but it also poses new challenges, such as regulation, investor protection, and the price stability of property tokens.

But Dubai is most definitely the strongest candidate if there is one place in the world where this concept can be fully realized.

PEOPLE+6.91%

MAJOR-5.49%

Related assets

Popular cryptocurrencies

A selection of the top 8 cryptocurrencies by market cap.

Recently added

The most recently added cryptocurrencies.

Comparable market cap

Among all Bitget assets, these 8 are the closest to /Reach in market cap.