Bitcoin Breaks Below $85k as Leverage Spikes: Is $80k Next?

Bitcoin has pulled back within a rising channel, signaling a potential retest of the $80k mark amid increasing leverage. Will the inflows into Bitcoin ETFs sustain the bullish momentum?

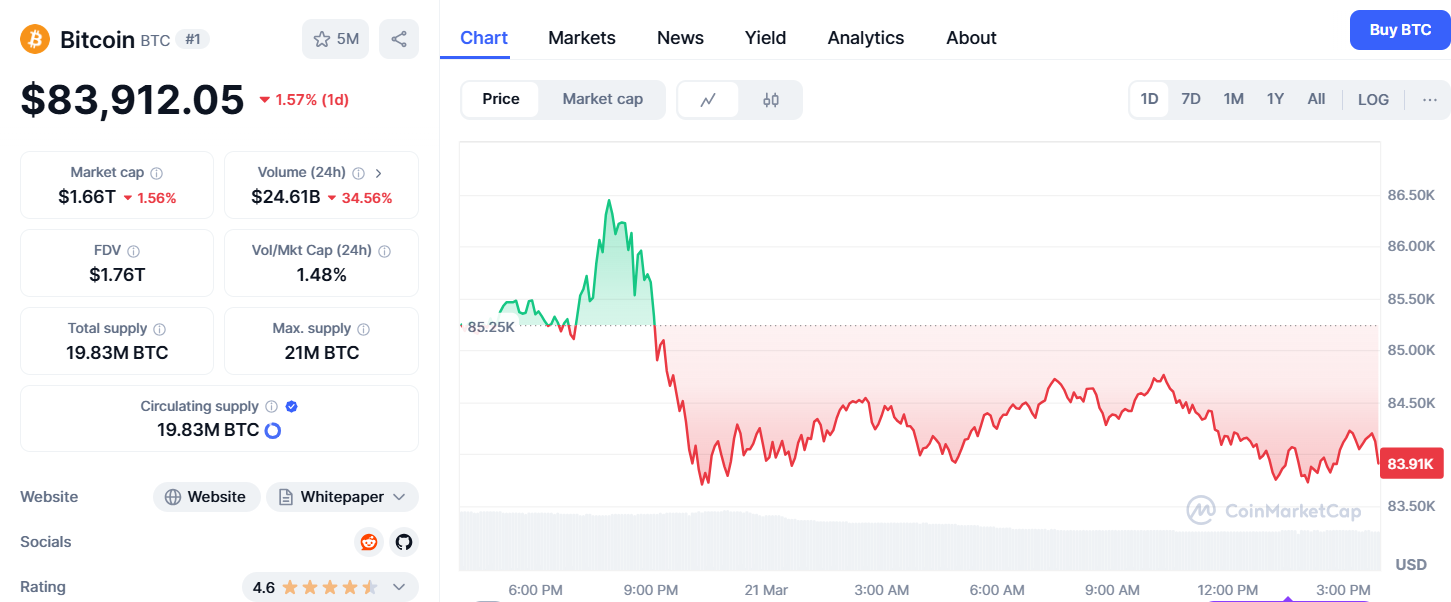

Bitcoin’s drop below the $85,000 mark indicates a gradual decline in bullish momentum. With this ongoing pullback, BTC is down by 2% over the past 24 hours.

Meanwhile, liquidations in the crypto market are approaching $200 million over the last 24 hours, with long liquidations accounting for $131 million. Will the resurgence of bearish sentiment push Bitcoin back below the $80,000 mark?

Bitcoin Potential Breakdown to $80k

On the 4-hour price chart, BTC’s price trend shows a rising channel pattern. After a short-term recovery, BTC is testing a long-standing resistance trendline.

However, Bitcoin is currently experiencing a short-term pullback within the rising channel, dipping below the $85,000 mark. Additionally, this pullback has failed to maintain dominance at the 23.60% Fibonacci level at $84,841.

At present, Bitcoin is trading at $84,135, forming its second-highest price rejection candle, signaling an extended pullback on the 4-hour chart. With increased bearish momentum, the MACD and signal lines have crossed negatively, potentially signaling a sell-off.

Bitcoin Futures Market Shows Shift in Whale Sentiment

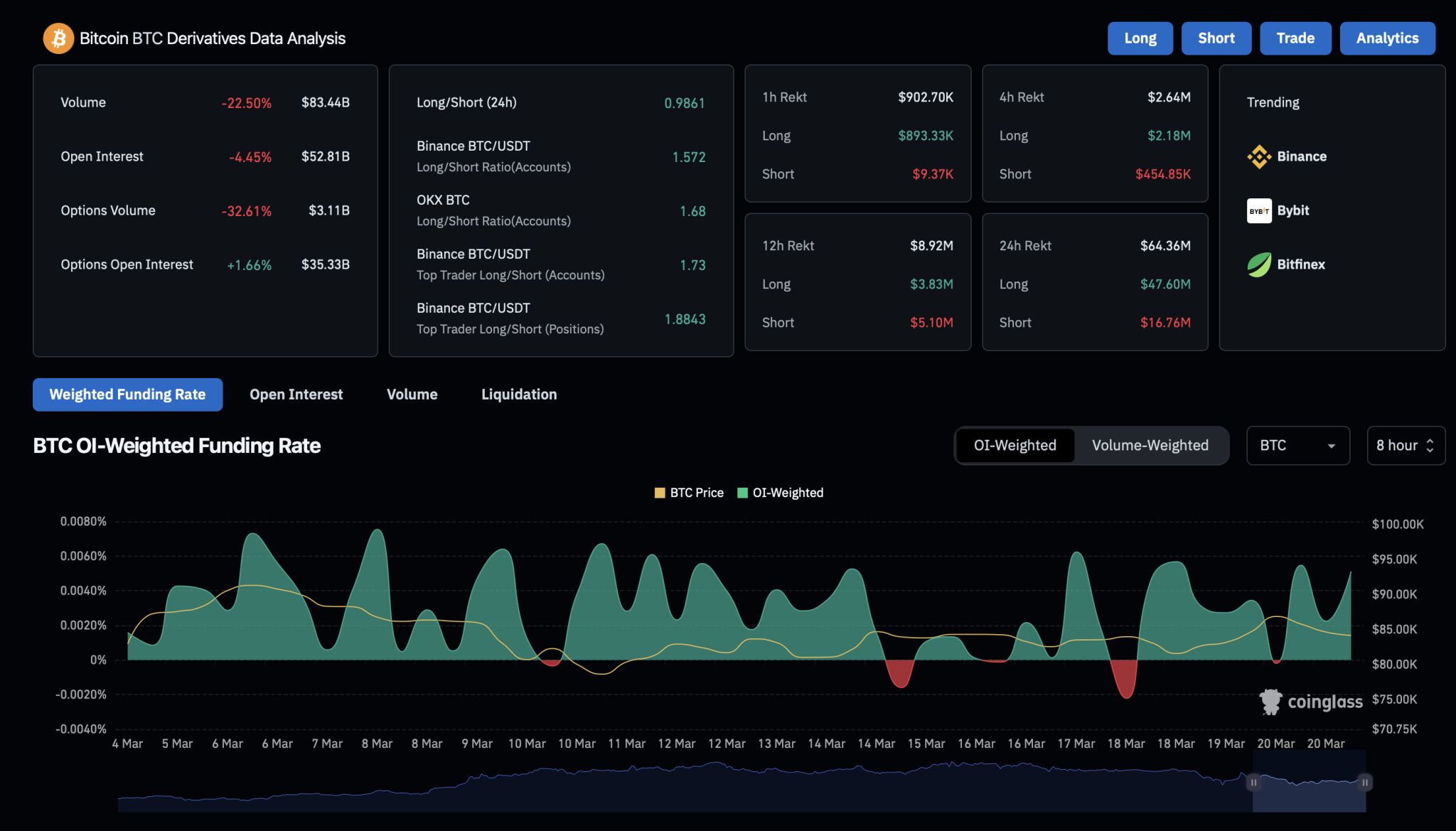

Bitcoin’s open interest has decreased by 4.45%, reaching a low of $52.81 billion. The long-to-short ratio has also seen a subtle rise in bearish positions, now at 0.9861.

Despite this, the funding rate has continued to fluctuate over the past few weeks, occasionally dipping into negative territory. Currently, the open interest stands at 0.0051%, reflecting a bullish sentiment toward long positions despite paying the extra premium.

Alphractal, an advanced crypto platform, notes an increase in bearish positions within the Bitcoin market. According to a recent tweet, whales have shifted from locked positions to new open short contracts as Bitcoin surpassed $87k in the short term.

Furthermore, the open interest-to-market cap ratio has spiked again, signaling an increase in market leverage. With higher leverage, the market could face a new wave of volatility, potentially triggering mass liquidations.

🐳Whales Enter Short Positions on Bitcoin as Leverage Increases!

Whales have decided to close their long positions and open shorts as BTC surpassed $87k in the short term. Additionally, the Open Interest/Market Cap ratio is rising again, signaling increased market leverage. This…

— Alphractal (@Alphractal) March 20, 2025

Inflows Surge in Bitcoin ETFs, BlackRock Drives the Pack

Despite the increased volatility in the derivatives market, institutional support for Bitcoin is returning. On March 20, the total daily net inflows for U.S. spot Bitcoin ETFs reached $165.75 million.

BlackRock led the way, acquiring more Bitcoin with an inflow of $172.14 million. Following BlackRock, VanEck, Fidelity, and Grayscale Bitcoin Mini Trust recorded inflows of $11.90 million, $9.19 million, and $5.22 million, respectively.

However, Bitwise, Grayscale Bitcoin Trust, and Franklin Templeton’s Bitcoin ETFs saw outflows of $17.40 million, $7.98 million, and $7.31 million, respectively. The remaining ETFs had a net-zero flow.

As U.S. spot Bitcoin ETFs record their fifth consecutive day of inflows, institutional support is likely to spark a new Bitcoin price rally.

Will Bitcoin Sustain Recovery To Reach $95k?

Despite short-term volatility in the derivatives market, growing institutional support is expected to drive Bitcoin prices higher. According to the 4-hour price chart, the current recovery will likely retest the local support trendline near $83,000.

However, a breakdown below this support level could lead to a further correction to the $78,350 support level. On the other hand, a bullish rebound could challenge the long-standing resistance trendline.

Based on Fibonacci levels, a breakout rally could extend to the 61.80% Fibonacci level, around $95,350.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Price Today (March 21, 2025): Bitcoin & Altcoins Update; XRP, SOL Drops 4%

TON Bounces from Crucial Support Zone — Will SUI Follow the Same Path?

INJ and KAVA Eye Breakout from Falling Wedge – Reversal on the Horizon?