Ethereum Price Prediction: Can ETH Reach $7,000?

Ethereum (ETH) , the second-largest cryptocurrency by market capitalization, has been a key player in the crypto market, driving innovation in decentralized finance (DeFi), smart contracts, and blockchain applications. However, after reaching an all-time high of $4,878 in November 2021, ETH has struggled to reclaim those heights, facing multiple price corrections.

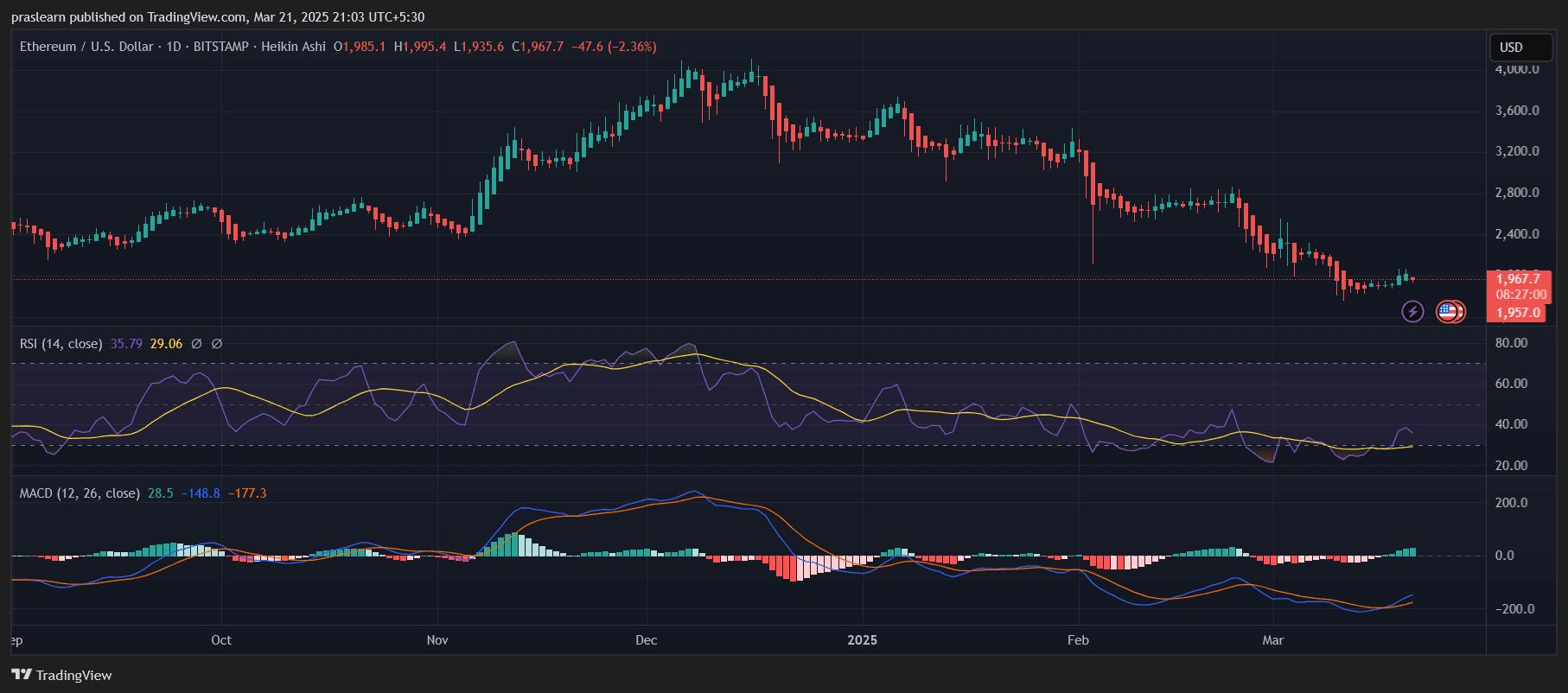

Currently trading around $1,967, ETH price has been in a prolonged downtrend, raising concerns among investors. With the crypto market showing signs of recovery and institutional interest growing, the question remains: Can Ethereum break out of its bearish trend and rally to an ambitious target of $7,000?

To answer this, we will analyze ETH’s price action, key resistance and support levels, technical indicators like RSI and MACD, and the fundamental catalysts that could drive Ethereum to new highs. Let’s dive into the charts and explore whether ETH has the potential to make a parabolic move toward $7,000.

Ethereum Price Prediction: Is Ethereum Primed for a Major Breakout?

ETH/USD Daily Chart- TradingView

ETH/USD Daily Chart- TradingView

Ethereum’s price has been under pressure , struggling below key resistance levels. The daily chart shows a continued downtrend, with ETH currently hovering around $1,967 after failing to hold higher support zones. A critical question arises—can Ethereum overcome this bearish momentum and reach the ambitious $7,000 target?

From a technical perspective, the market structure reflects a bearish sentiment, but a potential reversal pattern may be forming. The Relative Strength Index (RSI) is near oversold levels, and the MACD is showing early signs of bullish divergence. These indicators suggest that Ethereum might be nearing a short-term bottom, which could set the stage for a recovery.

What Are the Key Resistance and Support Levels?

Ethereum faces strong resistance at $2,100 , where past price action has seen multiple rejections. If ETH price successfully breaks this level, the next targets would be $2,500 and $3,000. However, failure to do so could lead to a retest of support around $1,800.

A key bullish signal would be ETH reclaiming $2,500 as support, as this could provide the momentum needed for a long-term uptrend. On the downside, if Ethereum loses the $1,800 support, we could see further bearish movement toward $1,500 before any potential recovery.

What Does the RSI and MACD Indicate About Ethereum’s Next Move?

The RSI (14) is currently at 35.79, which is very close to the oversold territory (below 30). This indicates that selling pressure might be nearing exhaustion, and a relief rally could be on the horizon. If the RSI moves above 40 and sustains, it would confirm the start of bullish momentum.

The MACD (12, 26), however, remains bearish with negative histogram bars. The MACD line is below the signal line, confirming a downtrend, but the negative momentum appears to be slowing. If the MACD line crosses above the signal line, it would confirm a bullish trend shift, signaling a potential rally.

Ethereum Price Prediction: Can Ethereum Rally to $7,000?

For Ethereum price to reach $7,000 , it would need to experience a major macroeconomic shift or a significant fundamental catalyst, such as:

- Bitcoin Rallying Above $100K – ETH often follows BTC’s lead, and a parabolic Bitcoin rally could push Ethereum beyond its previous all-time high.

- Increased DeFi and Layer-2 Adoption – Growth in Ethereum’s ecosystem, including rollups like Arbitrum and Optimism, could boost demand for ETH.

- Global Liquidity Expansion – If central banks shift towards easing policies, liquidity-driven rallies could push ETH to new highs.

Currently, ETH price is far from the $7,000 target, but a break above $3,500 would be a major bullish confirmation, setting the stage for a long-term rally toward higher price targets.

Is Ethereum a Buy Right Now?

At $1,967, Ethereum is trading at a significant discount compared to its previous highs. The indicators suggest a potential bottom formation, but confirmation is needed through price reclaiming key resistance levels like $2,100 and $2,500.

For short-term traders, waiting for a breakout above $2,100 could be a safer strategy. For long-term investors, accumulating ETH at current levels might offer strong returns if Ethereum’s fundamentals continue improving.

While $7,000 is an ambitious target, it is not impossible. If ETH breaks out above $3,500 and Bitcoin reaches new highs, Ethereum could enter a parabolic phase, making $7,000 achievable in the next bull cycle.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is Bitcoin going to $65K? Traders explain why they're still bearish

Bitcoin Today Attempts to Surpass $85K While PI Network Recovers After 30% Drop

Crypto Fear & Greed Index: Market Sentiment Inches Away From Extreme Fear – Should You Be Worried?

Trump's top crypto advisor open to budget-neutral gold-to-Bitcoin reserve swap