News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

This week’s crypto news covers Pi Network’s integration with Chainlink, Mantra’s OM token crash, Grayscale’s altcoin update, and rumors surrounding XRP and SWIFT. A weakening US dollar also boosts Bitcoin’s price.

US Treasury plans to issue over $31 trillion in bonds this year—around 109% of GDP and 144% of M2. This would be the highest recorded level of bond issuance in history. How will it impact the crypto market? Heavy supply may push yields higher, as Treasury financing needs outstrip demand. Higher yields increase the opportunity …

Crypto whales showed increased interest in Cardano (ADA), ApeCoin (APE), and Toncoin (TON) in mid-April 2025, hinting at a possible market rebound as they accumulate these altcoins.

- 15:01Paul Atkins, Chairman of the U.S. SEC, to Speak at the Next Cryptocurrency RoundtableAccording to Jinse, the U.S. Securities and Exchange Commission (SEC) has officially announced that SEC Chairman Paul Atkins will deliver a speech at the next cryptocurrency roundtable on April 25.

- 14:53U.S. Treasury Secretary Besent: The U.S. Continues to Maintain a Strong Dollar PolicyAccording to Jinshi, U.S. Treasury Secretary Besent reiterated that the U.S. continues to maintain a strong dollar policy.

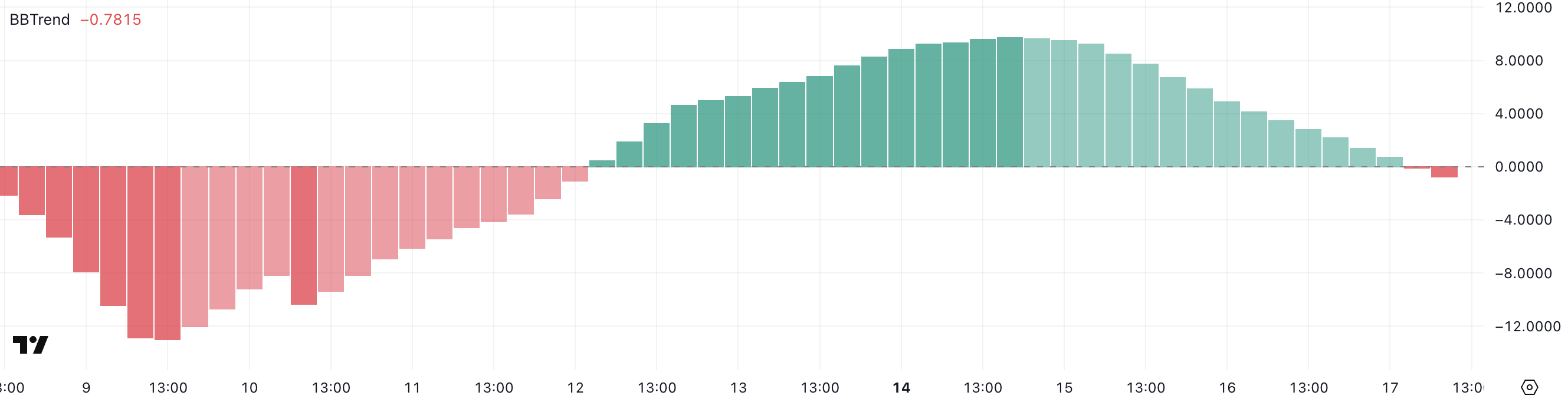

- 14:30Greeks.live: Market Generally Bullish After Bitcoin Breaks $90,000, But Future Trends Show DivergenceAdam, a macro researcher at Greeks.live, published a brief in the Chinese community, pointing out that the market is generally bullish, especially after Bitcoin broke $90,000, with high enthusiasm. However, there is a divergence in future trend expectations. Some traders anticipate that Bitcoin will continue to push into the $100,000-$110,000 range, while others believe a significant correction may occur after reaching $100,000. Ethereum has finally seen a strong rise, with increased correlation to Bitcoin, but traders are concerned that the EB exchange rate is struggling to recover and cannot return to the original 0.04 range.