How $31 Trillion in US Treasury Bonds Could Shape Crypto Markets in 2025

US Treasury plans to issue over $31 trillion in bonds this year—around 109% of GDP and 144% of M2. This would be the highest recorded level of bond issuance in history. How will it impact the crypto market? Heavy supply may push yields higher, as Treasury financing needs outstrip demand. Higher yields increase the opportunity …

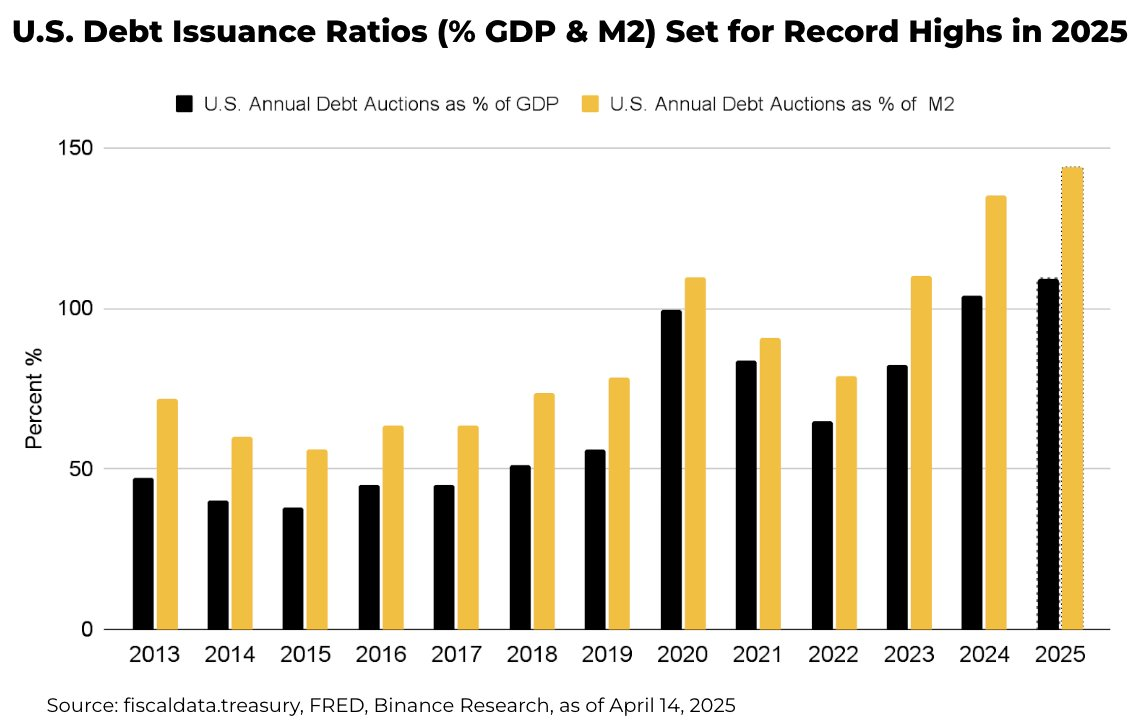

US Treasury plans to issue over $31 trillion in bonds this year—around 109% of GDP and 144% of M2. This would be the highest recorded level of bond issuance in history. How will it impact the crypto market?

Heavy supply may push yields higher, as Treasury financing needs outstrip demand. Higher yields increase the opportunity cost of holding non‑yielding assets like Bitcoin and Ethereum, potentially drawing capital away from crypto.

US Bonds Might Add to the Crypto Market’s Volatility

The whole narrative potentially boils down to foreign demand for US bonds. Overseas investors hold roughly one‑third of US debt.

Any reduction in appetite—whether due to tariffs or portfolio rebalances—could force the Treasury to offer even steeper yields. Rising yields tend to tighten global liquidity, making risk assets like cryptocurrencies less attractive.

US Debt Issuance Ratio. Source:

X/Binance Research

US Debt Issuance Ratio. Source:

X/Binance Research

When yields climb, equities and crypto can face selling pressure. For example, during the 2022 bond sell‑off, Bitcoin fell more than 50% alongside Treasury yields spiking. A repeat scenario could test crypto’s appeal.

Meanwhile, the US dollar’s strength could compound headwinds. As yields rise, the dollar typically gains. A stronger dollar makes Bitcoin’s USD‑denominated price more expensive for overseas buyers, dampening demand.

Yet crypto offers unique attributes. In periods of extreme monetary expansion, such as post‑pandemic, investors turned to Bitcoin as an inflation hedge.

Even if higher yields curb speculative flows, crypto’s finite supply and decentralized nature may sustain a baseline of buyer interest.

Technically, Bitcoin’s correlation to yields may weaken if Treasury issuance triggers broader macro volatility. When bond markets are hit by trade or fiscal policy shocks, traders may turn to digital assets to diversify since they don’t move in step.

However, that thesis hinges on continued institutional adoption and favorable regulation.

5/ What This Means for CryptoPersistent upward pressure on rates from Treasury supply could weigh on risk assets—crypto included. However, if the government eventually turns to debt monetization—essentially printing money to fund deficits—it could strengthen the case for…

— Binance Research (@BinanceResearch) April 18, 2025

Crypto’s liquidity profile also matters. Large bond sales often drain bank reserves—tightening funding markets.

In theory, tighter liquidity could boost demand for DeFi protocols offering higher yields than traditional money markets.

Overall, record US debt supply points to higher yields and a stronger dollar—volatility for crypto as a risk asset.

Yet crypto’s inflation‑hedge narrative and evolving technical role in diversified portfolios could temper volatility. Market participants should watch foreign demand trends and liquidity conditions as key indicators for crypto’s next moves.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Sui (SUI) Soars Following Key MA Breakout – Can Ondo (ONDO) Do the Same?

Has PEPE’s Comeback Begun? Familiar Fractal Setup Signaling an Upside Move

JasmyCoin (JASMY) Mirrors Past Bullish Breakout Setup — Is a Major Move Ahead?