News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

Bitcoin's realized cap hit a record $872 billion, but slowing growth, profit-taking, and underwater short-term holders suggest the market remains risk-off.

Ethereum is under bearish pressure with growing whale dominance and falling retail presence. Price risks deepen amid weakening trend signals.

Cardano's price is under threat as short-term holders are poised to sell their profitable positions. With resistance at $0.63 and negative market sentiment, ADA's future remains uncertain.

David Silverman of Polygon Labs critiques Total Value Locked (TVL) as an incomplete metric for evaluating blockchain value and introduces Chain-Aligned TVL (CAT) as a more accurate alternative. CAT highlights assets that actively enhance a chain's ecosystem, offering deeper insights into long-term growth and user benefits.

Hedera's HBAR is showing signs of recovery as it attempts to break its 7-week downtrend, with traders eyeing the $0.2 target. Positive funding rates suggest a potential breakout if key resistance levels are breached.

Bitcoin’s price could reach $90,000 as China's M2 money supply surges, driving liquidity into risk assets. Despite macroeconomic concerns, analysts remain optimistic about a potential price rally.

With 100 million PI tokens set to be unlocked in April, bearish sentiment and technical indicators suggest the altcoin may revisit its all-time low of $0.40.

TAO is on a bullish run, gaining 10% and signaling further growth as it eyes resistance at $279.70. Technicals suggest more upside ahead.

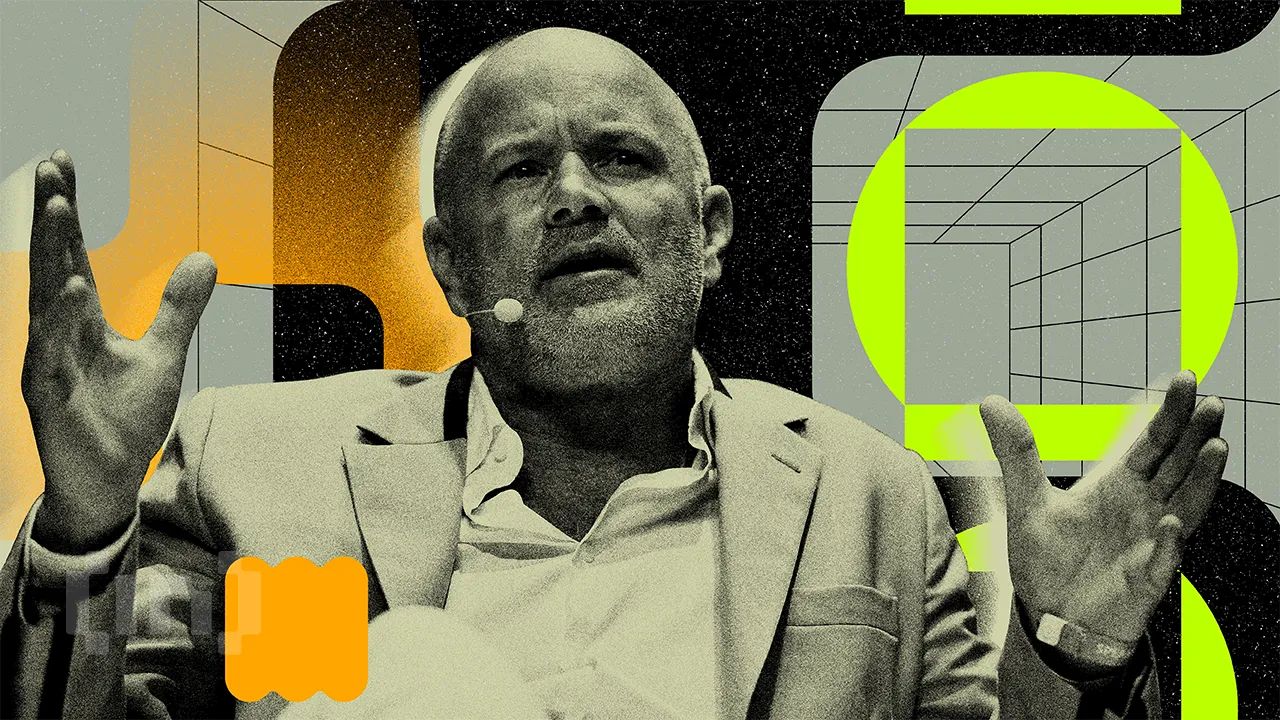

Galaxy Digital’s massive ETH moves to exchanges have stirred speculation about its crypto strategy, especially after a key Ethereum expert’s exit.

- 16:23TRUMP surpasses $11Reported by Jinse, the market shows that TRUMP has surpassed $11, currently quoted at $11.29, with a 24-hour increase of 23.7%. The market is highly volatile, so please ensure proper risk management.

- 16:06Analysis: Most Hedge Funds Expect BTC Dominance to Continue Rising, Altseason May Be DelayedOdaily reports that according to a survey conducted by Crypto Insights Group of 50 hedge funds managing over $5 billion in assets, 70% of respondents anticipate Bitcoin's dominance in the crypto market will further strengthen over the next six months, a threefold increase from the same period last year. This trend may delay the arrival of altseason. The report highlights three main factors driving the rise in Bitcoin dominance:1. Amid increasing macroeconomic uncertainty, Bitcoin has demonstrated strong resistance to declines, attracting more safe-haven capital;2. The introduction of Bitcoin ETFs and the establishment of U.S. strategic Bitcoin reserves have provided institutional investors with a clearer regulatory framework;3. Most altcoins have underperformed, leading investors to favor Bitcoin, which offers higher liquidity and lower risk.However, Crypto Insights Group CEO Andy Martinez stated that altseason is not entirely over, as funds are shifting towards projects with actual revenue, transparent finances, and reasonable token issuance plans. (DL News)

- 16:04Trump to Host “Trump Dinner” for TRUMP Token HoldersApril 23 news, according to market sources, Trump will host a “Trump Dinner” for TRUMP token holders, limited to the first 220 TRUMP token holders.