News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (March 10) | Texas establishes $BTC reserve fund, BASE Chain's $Cocoro and $DRB gain traction2Story (IP) Approaches Key Resistance – Could a Breakout Spark Rally?3Can PI Coin Reach $3 by End of April 2025?

Bitcoin Price Forecast: Monte Carlo Model Suggests Range of $51,430 to $713,000 by September 2025

Coinotag·2025/03/10 22:33

Why are crypto and stock markets crashing so hard today?

Share link:In this post: Markets are crashing fast—the S&P 500 and crypto have lost $5.5 trillion in two months. Institutional investors dumped early, shorting Ethereum and pulling out of tech stocks before the collapse. Record outflows hit crypto, small-cap, mid-cap, and tech stocks, with billions withdrawn in days.

Cryptopolitan·2025/03/10 22:22

Expert Says UAE May Establish a Shiba Inu Reserve—What It Means for SHIB

Ethnews·2025/03/10 22:00

Will XRP Price Crash? 77% Traders are betting against XRP

XRP Holds Above $2, But More Losses Could Be Coming

Cryptotimes·2025/03/10 17:44

Crypto Price Today (March 10, 2025): Bitcoin Dips to $80k; ETH, XRP, SOL Falls 6% in 24 Hours

Cryptotimes·2025/03/10 17:44

Hyperliquid Insider Whale Made $2.15M Profit on Quick ETH Price Pump

Cryptotimes·2025/03/10 17:44

BTC Dips to $83K as Whale Short Targets $70K—Crash Incoming?

Cryptonewsland·2025/03/10 17:11

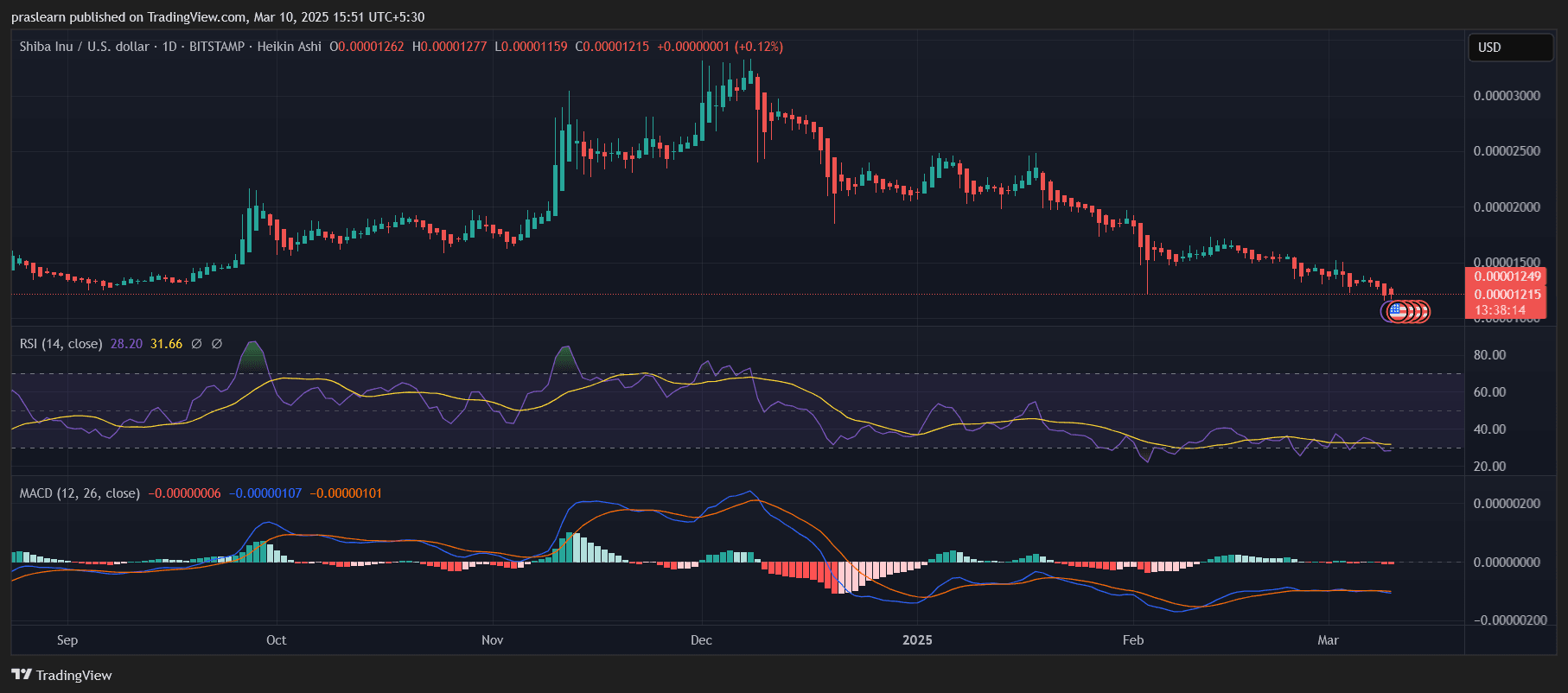

SHIB Price: Will Shiba Inu Price Crash to Zero?

Cryptoticker·2025/03/10 15:11

Litecoin (LTC) Defends Crucial Support Amid Market Turbulence – Is a Bounce Back Ahead?

CoinsProbe·2025/03/10 14:22

Flash

- 05:37Overview of important developments on March 11th at noon1. SBF is seeking a pardon from Trump; 2. Japanese and Korean stock markets open significantly lower following the fall of US stocks; 3. The Beta version of Movement's main network is officially online; 4. VanEck registers Avalanche ETF in Delaware; 5. Musk responds to Tesla's big drop: Everything will get better in the long run; 6. Mt.Gox transfers 11,500 BTC to an unknown address, worth about $905 million; 7. U.S Senate updates stablecoin bill GENIUS Act 2025: Expanding overseas jurisdiction for reciprocal provisions on stablecoin payments.

- 05:35A certain whale has withdrawn 195,000 SOL from multiple CEXs, equivalent to about 23.2 million US dollarsAccording to Lookonchain monitoring, a certain whale has withdrawn 195,000 SOL worth 23.2 million US dollars from multiple CEXs in the past 9 hours.

- 05:35Federal Reserve Spokesperson: The US economy may face a hard landingNick Timiraos, a mouthpiece for the Federal Reserve, published an article in The Wall Street Journal stating that over the past year, U.S. economic policymakers have been focused on achieving a so-called soft landing - reducing inflation without causing an economic recession. Now, a new group of "pilots" are considering adjusting their course and they admit this could potentially lead to a hard landing for the economy. In recent days, President Trump and his senior advisors have shown indifference towards rising risks of private sector investment being hampered by trade uncertainties. They believe that while there may be need for detoxification in terms of spending and hiring, falling stock values aren't worrisome and inflation might rise in the short term. Some analysts warn that Trump's messages may reflect strategic efforts to improve bargaining positions with trade partners at the expense of leaving bond investors and the Fed dumbfounded thereby maintaining inclination towards rate cuts. Trump's impulsive actions have prompted European authorities to take measures increasing economic stimulus and defense spending. Analysts say events from past two weeks indicate that market plunges won't likely change Trump's course which will help reset Wall Street expectations. Andy Laperriere, head of US policy research at Piper Sandler says: Everything he does tells us he is not joking around; he fundamentally believes in tariffs.