News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (March 11)|Strategy raises $21 billion, possible BTC buy, Tesla stock plunges2Shiba Inu Team Sends Strong Message: ‘SHIB Is Our BTC’ in Uncertain Times3Cardano Could Drop to $0.40 If This Happens Next

Акции Strategy упали на 50%, но Майкл Сэйлор не передумал покупать биткоины

HappyCoinNews·2025/03/11 16:00

Research Report | PAWS Project Overview & Market Value Analysis

西格玛学长·2025/03/11 09:21

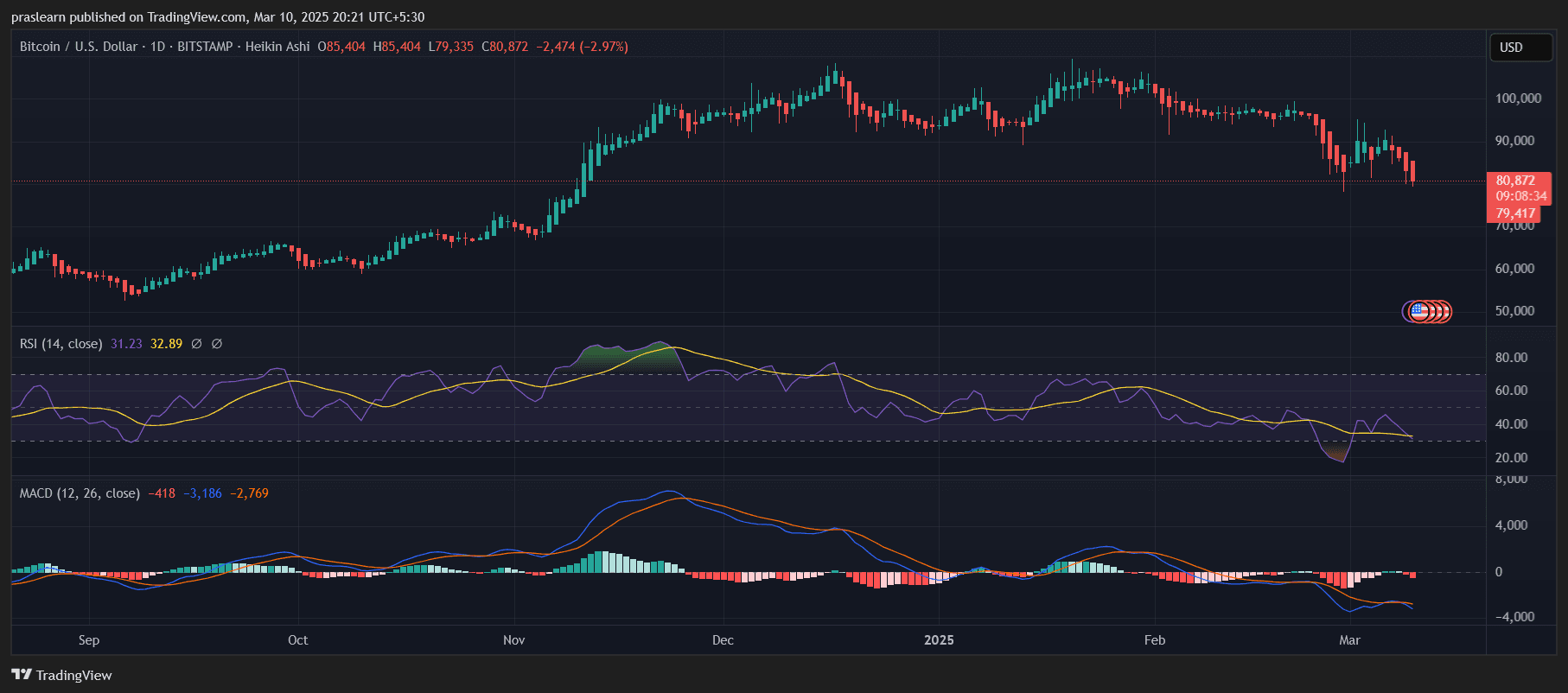

BIG Bitcoin News: Bitcoin Price to Crash to $47,000?

Cryptoticker·2025/03/11 07:55

Smart Investments for the Future: Top 3 Altcoins to Buy Today for Long-Term Growth

Cryptoticker·2025/03/11 07:55

Movement (MOVE) Jumps After ETF Filings and Public Mainnet Beta Launch – What’s Next?

CoinsProbe·2025/03/11 07:00

Sui (SUI) Testing Key Support Level – Is It Time to Accumulate the Dip?

CoinsProbe·2025/03/11 07:00

Top RWA Token OM and ONDO Testing Key Support – Is It Time to Accumulate the Dip?

CoinsProbe·2025/03/11 07:00

Top AI Tokens RENDER and NEAR Hit Key Demand Zones – Is a Rebound Possible?

CoinsProbe·2025/03/11 07:00

Research Report | Bubblemaps Project Overview & BMT Market Analysis

远山洞见·2025/03/11 06:25

Movement Labs Launches Mainnet with $250M TVL, Reveals First US Movement ETF

This is the first Move-based chain that settles to Ethereum, allowing developers to deploy smart contracts without approval and users to “freely engage” with the Movement ecosystem, the team says.

CryptoNews·2025/03/11 05:00

Flash

- 18:02Today's top 100 cryptocurrency tokens by market cap rise and fall: KAS up 9.66 per cent, FET down 10.83 per centOn 11 March, according to Coinmarketcap, the top 100 cryptocurrency tokens by market cap performed as follows. Top 5 Gainers: Kaspa (KAS) is up 9.66% and now trades at $0.06593; Bittensor (TAO) is up 7.79% to its current price of $251.94; Curve DAO Token (CRV) is up 4.06% and now trades at $0.3935; Jupiter (JUP) is up 2.53 per cent and now trades at $0.5096; Cardano (ADA) up 2.44 per cent, now at $0.724. Top five losers: Artificial Superintelligence Alliance (FET) down 10.83 percent, now $0.4896; Ethena (ENA) fell 8.24 percent to its current price of $0.3891; Ethereum Name Service (ENS) has fallen 8.15 per cent and is now trading at $16.40; Lido DAO (LDO) has fallen 7.92 per cent and is now trading at $0.8937; Uniswap (UNI) has fallen 7.51 per cent and is now trading at $5.97.

- 18:00BTC falls below $80,000On 11 March, BTC fell below $80,000, down 0.19% on the day, according to market data.

- 17:59US stocks extend losses, Nasdaq down 1 per centU.S. stocks extended their losses, with the Nasdaq falling as much as 1 per cent.