Top RWA Token OM and ONDO Testing Key Support – Is It Time to Accumulate the Dip?

Date: Tue, March 11, 2025 | 04:10 AM GMT

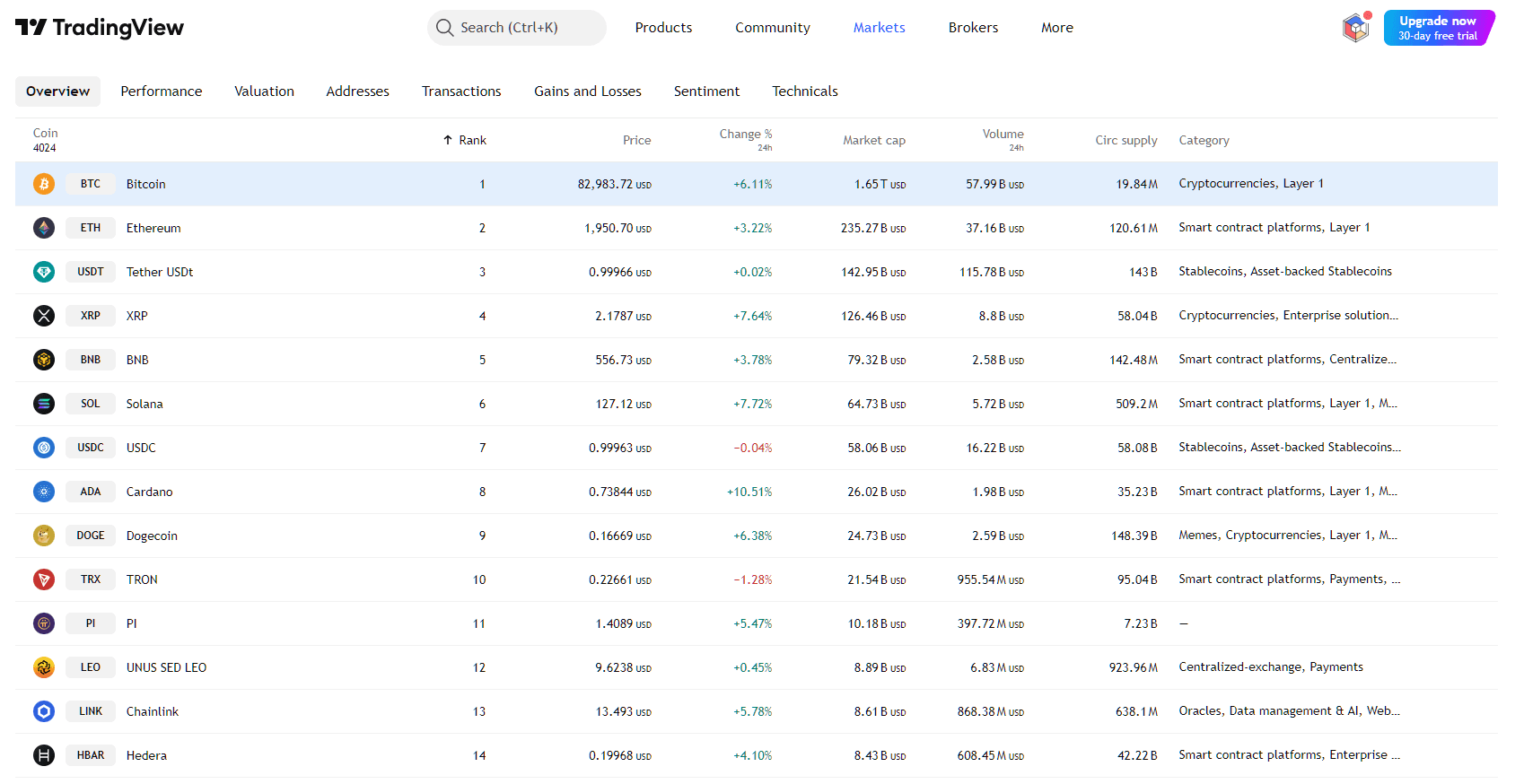

The cryptocurrency market continues its strong downtrend, which began after the late 2024 rallies. In the past 24 hours, Ethereum (ETH) has dropped over 10%, plummeting from its December high of $4,000 to its current level of $1,850, adding immense pressure across the major altcoins .

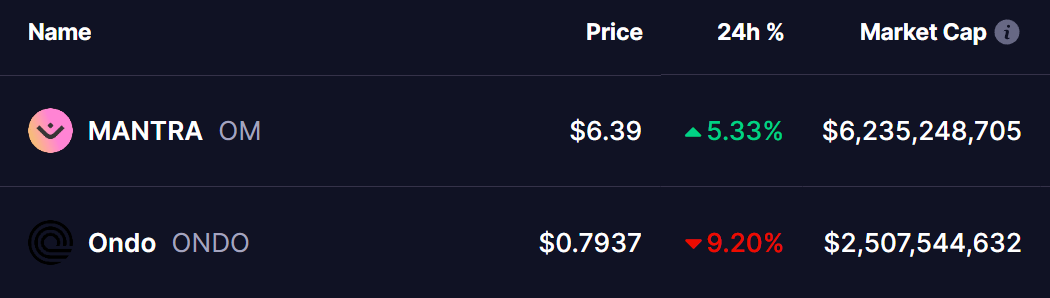

Amid this bearish momentum, two top Real World Asset (RWA) tokens, Mantra (OM) and Ondo (ONDO), have been pulled down to test key support levels. While OM maintains resilience, trading in green, ONDO has suffered a sharp 9% drop.

Source: Coinmarketcap

Source: Coinmarketcap

Mantra (OM)

On the daily chart of OM, today’s drop pushed its price down to test the 50-day Moving Average (50MA) support (marked in green circle) as well as the ascending trendline support. However, OM has shown resilience and is currently trading above this level at $6.38.

Mantra (OM) Daily Chart/Coinsprobe (Source: Tradingview)

Mantra (OM) Daily Chart/Coinsprobe (Source: Tradingview)

Looking at historical price action, similar tests of the 50MA support (marked in orange circles) led to strong rebounds, fueling major rallies. If this pattern repeats, OM could aim for a retest of its recent all-time high (ATH) of $9.11, with possible consolidation ahead.

Ondo (ONDO)

On the other hand, ONDO’s weekly chart highlights an ascending broadening wedge pattern. The ongoing correction started after its rejection from the upper trendline at $2.14 (Dec 16 high), which triggered a steady downtrend towards the lower support trendline.

ONDO Weekly Chart/Coinsprobe (Source: Tradingview)

ONDO Weekly Chart/Coinsprobe (Source: Tradingview)

With today’s drop, ONDO has tested the lower trendline support at $0.73 and is now trading above it at $0.79, showing some resilience. If ONDO follows its historical price movement within the pattern, a strong recovery toward the upper trendline could be on the horizon.

Is It Time to Accumulate the Dip?

Both OM and ONDO are currently at critical support levels, historically known to trigger rebounds. If these supports hold, the risk-reward ratio for accumulation becomes highly favorable for traders looking for a potential bounce. However, a breakdown below these levels could signal further downside in the short term.

Investors should closely monitor macro market conditions, BTC’s movement, and volume inflow to confirm a reversal before making decisions.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

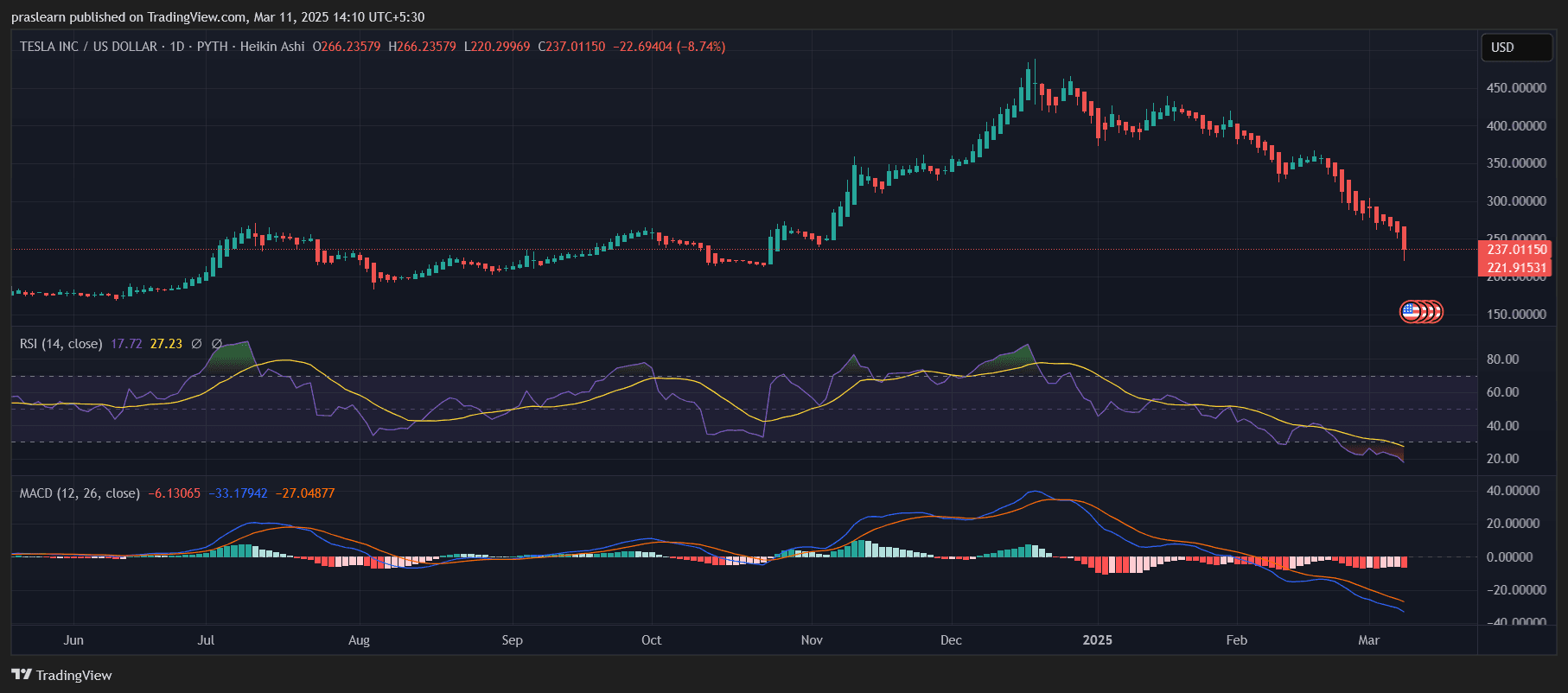

Correlation between equities and crypto has increased due to adoption

The market selloff is heavily tied to the increased correlation between equities and crypto, as crypto-friendly institutions are going more risk-off

Tesla vs. Bitcoin vs. Gold: Which Is the Best Investment for 2025?

US-Canada Trade Tensions Escalate: Is This the Precursor to World War 3?

Better Buy for 2025: XRP vs. Nvidia?