News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

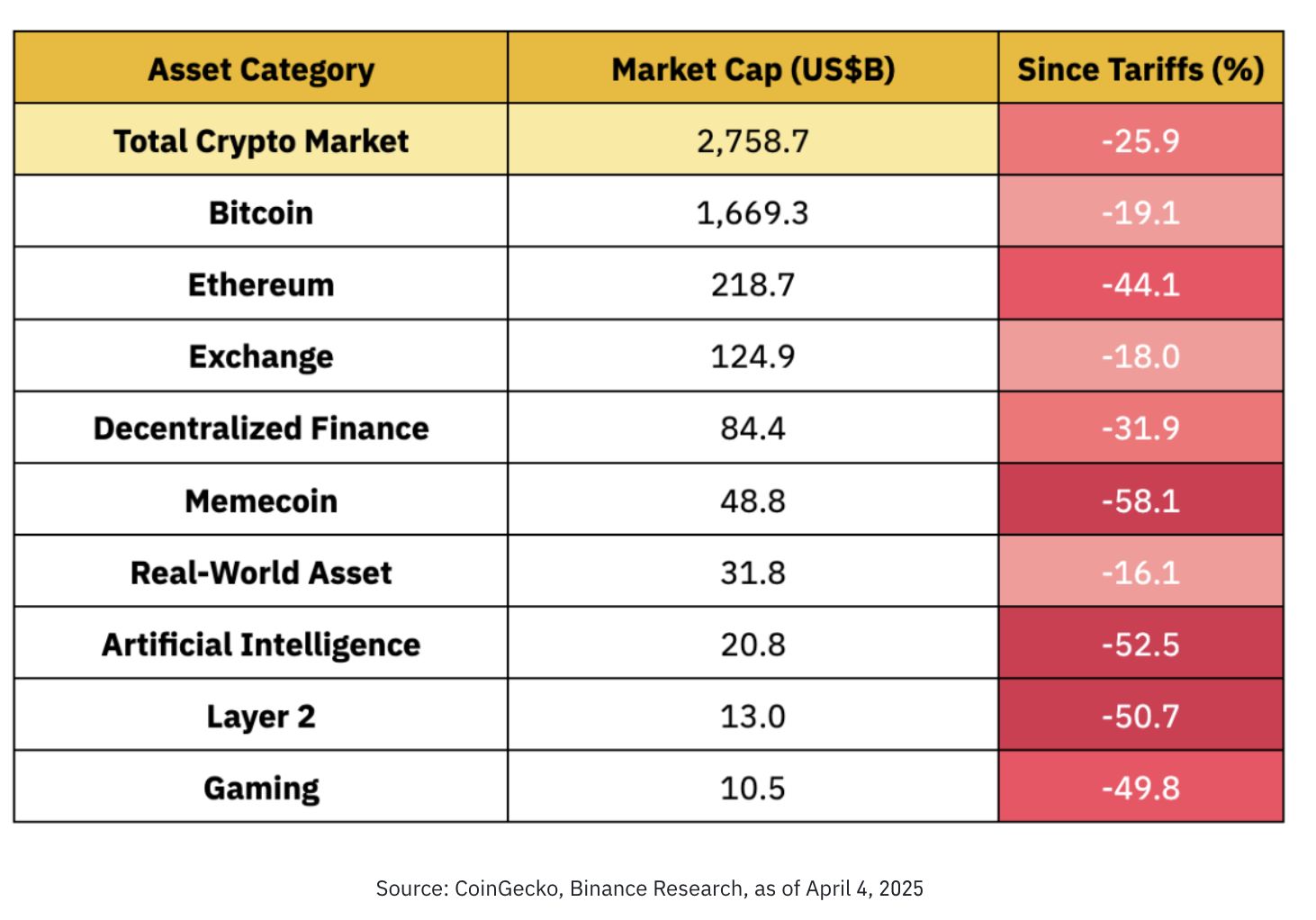

An altcoin season is looking less and less likely as the reciprocal tariffs loom

China’s potential yuan devaluation in response to U.S. tariffs could reignite Bitcoin demand as investors seek refuge from economic uncertainty, as analysts point to historical trends.

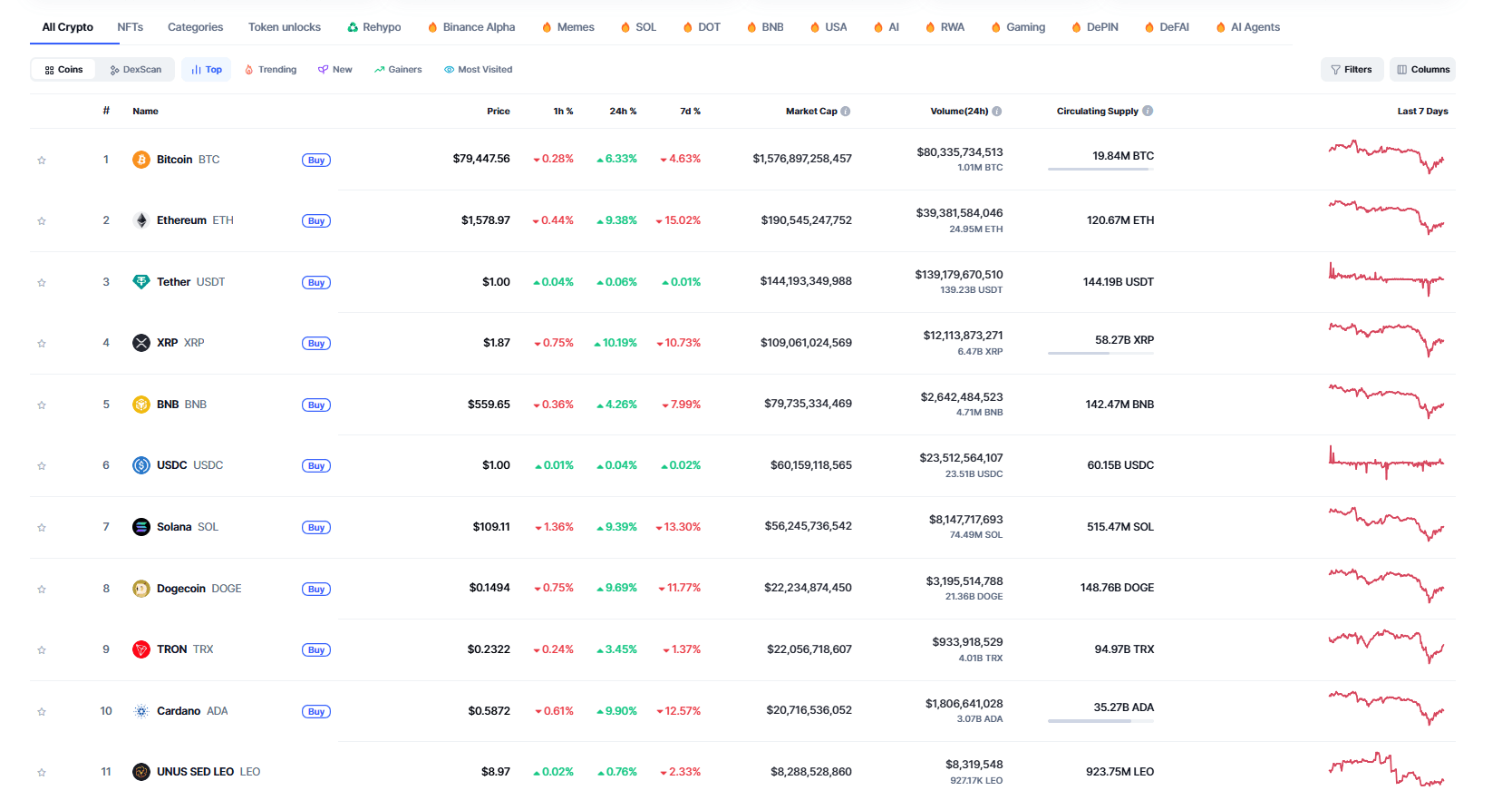

Quick Take Bitcoin and other major cryptocurrencies fell on Wednesday following Trump’s additional tariff measures. Analysts said bitcoin is still highly correlated to U.S. macroeconomic situations, given its recent price movements. U.S. Treasury yields also rose considerably on Wednesday, which shows “shrinking appetite” for risk assets including crypto.

Ripple agrees to buy prime broker Hidden Road for $1.25B to link TradFi & DeFi Analysis: Deal banks on XRPL’s power to handle Hidden Road’s $3T+ annual volume Ripple’s RLUSD stablecoin planned as collateral to ease cross-asset margining

- 17:20U.S. Stocks Extend Gains, MSTR Gains to 8.63%The Dow extended its gains to 1%, the S&P 500 rose 1.8% and the Nasdaq gained more than 2.5%, according to ticker data. Crypto stocks extended gains, with MicroStrategy (MSTR) up 8.63% and CEX (COIN) up 4.89%.

- 17:13Today's U.S. Bitcoin Spot ETFs Net Outflows of 5,239 BTC, Ethereum Spot ETFs Net Outflows of 2,589 ETHOn 9 April, 10 U.S. Bitcoin ETFs netted outflows of 5,239 BTC today, and 9 Ethereum ETFs netted outflows of 2,589 ETH as of publication, according to Lookonchain monitoring.

- 17:12Ether briefly breaks above $1,500On 9 April, Ether briefly broke above $1,500 and is now trading at $1,483.20, narrowing its 24-hour loss to 3.10%, according to ticker data.