News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (4.24)|New US SEC Chairman Supports Crypto, Top $TRUMP Holders to Dine with Trump2$TRUMP Holders Dinner: Token Rockets 64% as Top Investors Chase Rare Trump Invite3Bitcoin (BTC) to Rise Further? Key Harmonic Pattern Signaling a Move Over $100K

Spot Ethereum ETFs to Launch Next Tuesday Ending Excruciating Waits

Newscrypto·2024/07/16 13:10

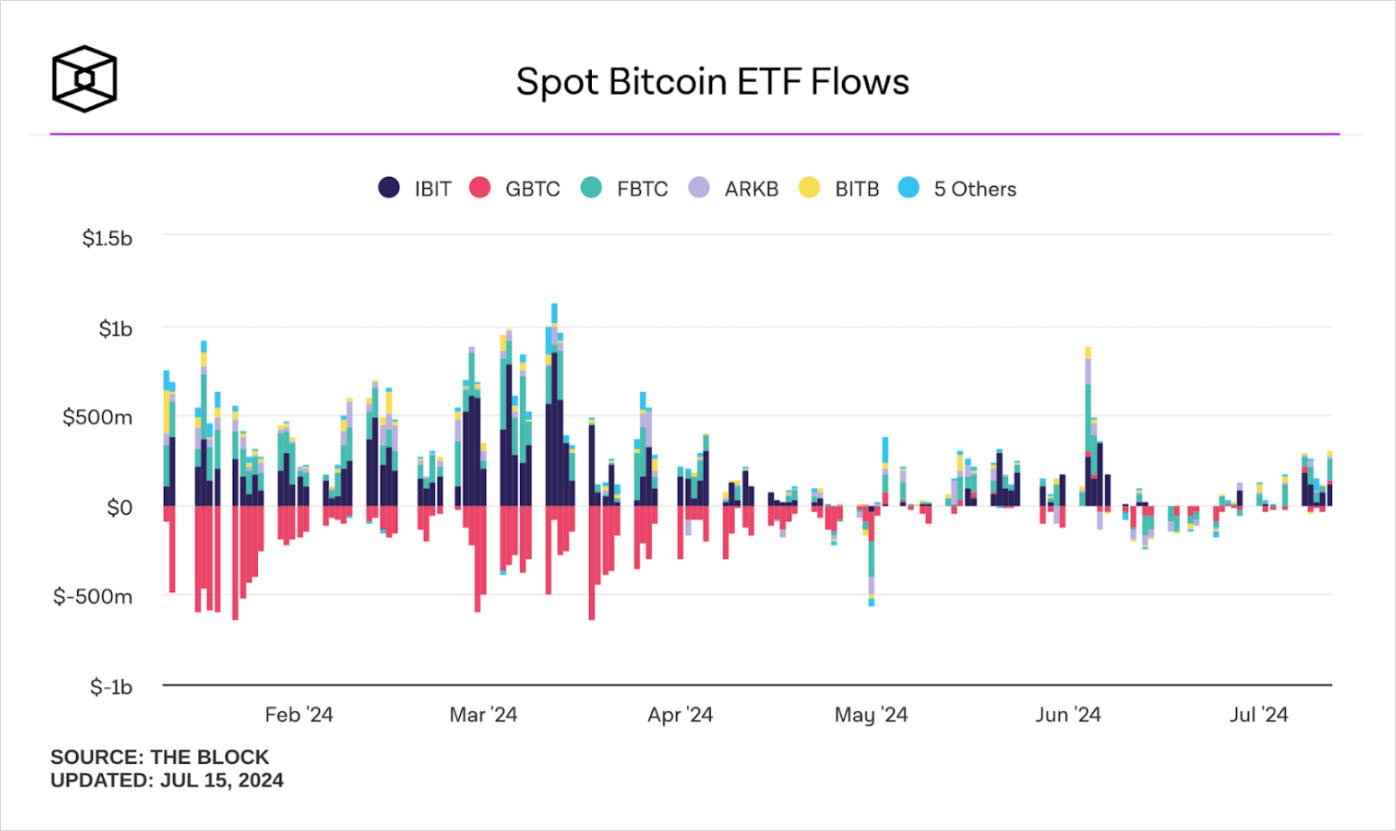

Bitcoin Booms: ETFs Surge & Ether ETF Approval Imminent!

Cointime·2024/07/16 12:50

Pepe With a Major Surge After a Significant VC Purchase

Cryptodnes·2024/07/16 12:37

Will PEPE Hit New Highs by the End of July?

Newscrypto·2024/07/16 10:31

Memecoin Floki Targets $0.0003 After 28% Daily Gain

Newscrypto·2024/07/16 10:31

PEPE, WIF, FLOKI Explode by Double Digits While BTC Retraces After Mt. Gox News (Market Watch)

PEPE is today’s top performer, followed by OM and WIF.

Cryptopotato·2024/07/16 09:58

Mt. Gox Moved $3 Billion in Bitcoin – Will There be Another Price Drop?

Cryptodnes·2024/07/16 09:52

Ether ETF Launch Date: July 23rd on the Horizon? Experts Weigh In

Coinedition·2024/07/16 09:37

Crypto Analyst Predicts Bitcoin Bull Run as Hash Rate Drops

Coinedition·2024/07/16 09:37

Flash

- 09:26SUI's Market Cap Surpasses LINKAccording to Cointelegraph data, the market cap of Sui (SUI) has surpassed Chainlink (LINK). Currently, the market cap of SUI tokens is $9.88 billion, while LINK tokens have a market cap of approximately $9.54 billion.

- 09:25Analysis: TRUMP Dinner TOP 10 Whales Hold a Total of 1.65 Million TRUMPAccording to monitoring by ai_9684xtpa, the TOP 10 whales of the TRUMP dinner hold a total of 1.65 million TRUMP, valued at $20.49 million, with a total floating loss of $1.26 million. Only two whales use the earliest addresses for building positions, while the rest obtained tokens from exchanges or built positions on-chain after hearing the dinner news. The TOP 1 whale address may belong to Wintermute.

- 09:25U.S. Prosecutors Recommend Up to 8 Years in Prison for Mango Markets AttackerOn Tuesday, U.S. prosecutors submitted a letter to the district judge recommending a prison sentence of 78 to 97 months (approximately 6.5-8 years) for Mango Markets attacker Avi Eisenberg. Eisenberg previously claimed his actions were part of a legitimate trading strategy, but prosecutors argue he was aware that these actions were illegal. His sentencing hearing is scheduled for May 1st. Previously, it was reported that the Solana ecosystem DeFi platform Mango Markets was hacked in October 2022, resulting in over $100 million in bad debt.