News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

DappRadar warned that the surge in dUAW may be unsustainable, attributing part of the growth to “airdrop farming” activities.

Bitcoin is expected to witness a Q3 lull due to uncertainty over Mt. Gox repayment impact.

After two consecutive trading days of net outflows, US-based spot bitcoin ETFs on July 5 saw the largest net inflows since June 6, thirty days ago, largely led by gains to Fidelity’s FBTC fund, Coinglass data shows.“The outlook for Bitcoin has never been stronger,” Bitwise’s CEO posted on X.

Share link:In this post: Grayscale’s survey shows a 25% increase in US investor interest in Ethereum if a spot ETF is approved. Inflation and financial stability are driving increased interest in cryptocurrencies, especially among younger and minority groups. Cryptocurrencies have bipartisan support, with both Republicans and Democrats showing similar ownership rates and interest.Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based

- 21:05Fed's Kugler: Anti-inflation process may have stalledThe Federal Reserve's Kugler said that the latest data suggest that progress towards the 2 per cent inflation target may have stalled. Given the stability of economic activity and employment, as long as the upside risks to inflation persist, it supports keeping the current policy rate unchanged. Inflation expectations are rising and there are upside risks to upcoming policy changes (to inflation). Pleased that the rise in longer-term inflation expectations has been small so far. Given the recent high inflation, consumer expectations are likely to be more sensitive to further price increases. Labour market indicators point to a continued slowdown, but not a significant weakening.

- 21:04Trump: a major bill in Congress will include tax cutsPresident Trump: a major bill in Congress will include tax cuts.

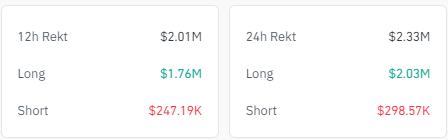

- 21:00Crypto ETFs saw net outflows of over $145 million todayOn April 2, 10 Bitcoin ETF products combined saw a net outflow of 1,705 BTC, or about $146 million, according to monitoring by chain analyst Lookonchain (@lookonchain), with the Fidelity Bitcoin ETF seeing a single-day outflow of 1,045 BTC (about $89.24 million), which is still holding 195, 888 BTC (~$16.73 million). On the same day, nine Ether ETF products saw net outflows of 1,535 ETH (~$2.87 million), while the Bitwise Ether ETF saw outflows of 1,363 ETH (~$2.55 million) and currently holds 93,728 ETH (~$175 million). This data shows that mainstream cryptocurrency ETF products continue to face outflow pressure.