News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

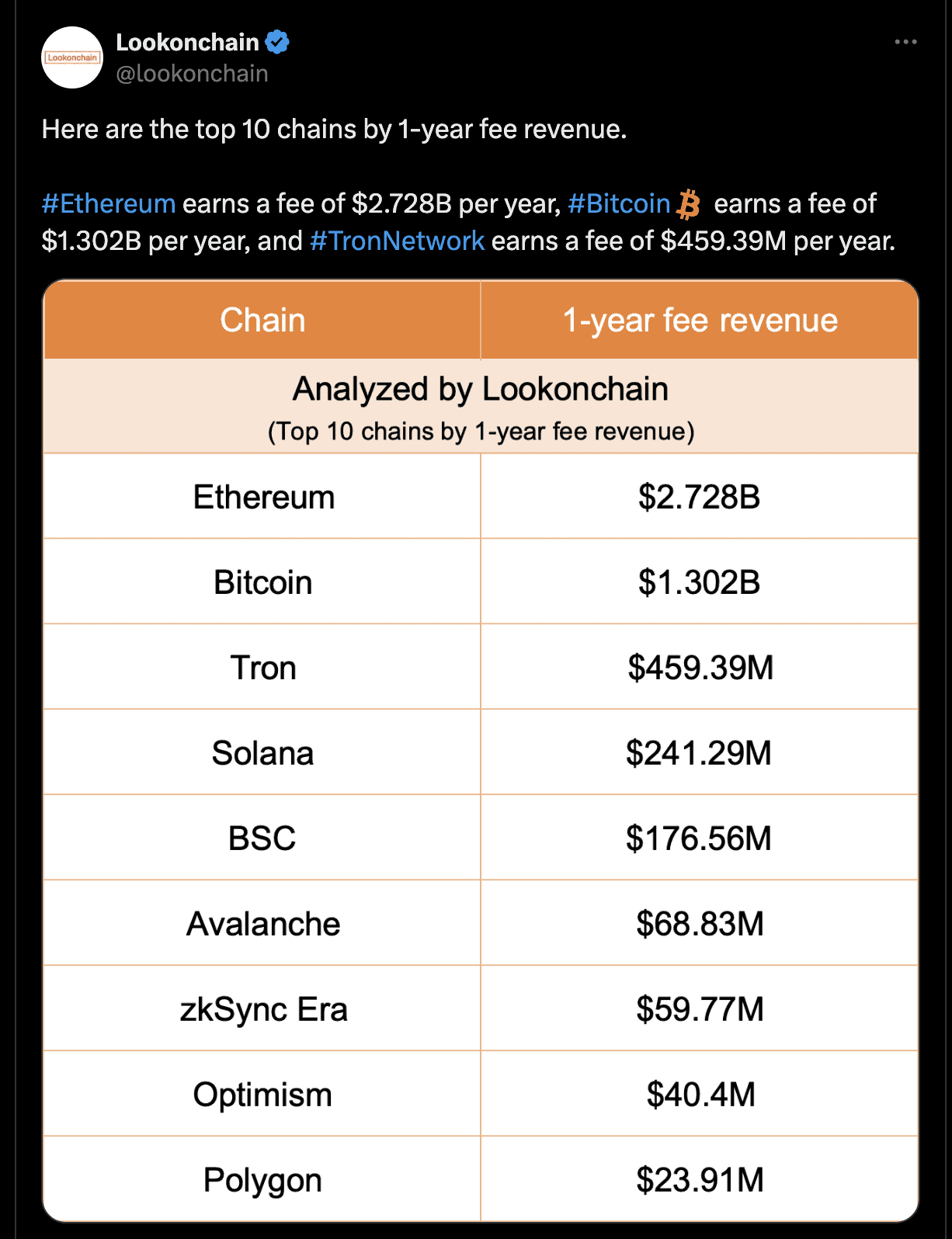

Ethereum’s $2.7 billion fee revenue demonstrated user preference over lower-cost alternatives.

Buyers will need to keep Bitcoin above $53,500 to start a recovery in SOL, DOT, NEAR and KAS.

Bullish divergence on the price chart, September rate cut prospects, and increasing M2 supply are some catalysts that could resume the Bitcoin bull market cycle.

Throughout the rest of July, several important projects in the crypto sphere will unlock hundreds of millions of dollars of tokens, from Worldcoin and Aptos to Layer 2 chains like Arbitrum and even a Layer 3 chain, Xai.Here are all the unlocks crypto investors should know about in July, according to Token Unlocks data.

Shiba Inu’s team issued a critical warning of a potentially compromised Telegram group.

Here’s what might follow for BTC after the latest market decline.

Share link:In this post: BitMEX founder Arthur Hayes repeated his advice to buy Bitcoin dip. He thinks this is the perfect opportunity to invest in BTC. Thanks to the high rate of adoption on all fronts this year, Arthur says it’ll be a while before we see a bear market.Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a

- 21:05Fed's Kugler: Anti-inflation process may have stalledThe Federal Reserve's Kugler said that the latest data suggest that progress towards the 2 per cent inflation target may have stalled. Given the stability of economic activity and employment, as long as the upside risks to inflation persist, it supports keeping the current policy rate unchanged. Inflation expectations are rising and there are upside risks to upcoming policy changes (to inflation). Pleased that the rise in longer-term inflation expectations has been small so far. Given the recent high inflation, consumer expectations are likely to be more sensitive to further price increases. Labour market indicators point to a continued slowdown, but not a significant weakening.

- 21:04Trump: a major bill in Congress will include tax cutsPresident Trump: a major bill in Congress will include tax cuts.

- 21:00Crypto ETFs saw net outflows of over $145 million todayOn April 2, 10 Bitcoin ETF products combined saw a net outflow of 1,705 BTC, or about $146 million, according to monitoring by chain analyst Lookonchain (@lookonchain), with the Fidelity Bitcoin ETF seeing a single-day outflow of 1,045 BTC (about $89.24 million), which is still holding 195, 888 BTC (~$16.73 million). On the same day, nine Ether ETF products saw net outflows of 1,535 ETH (~$2.87 million), while the Bitwise Ether ETF saw outflows of 1,363 ETH (~$2.55 million) and currently holds 93,728 ETH (~$175 million). This data shows that mainstream cryptocurrency ETF products continue to face outflow pressure.