News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (4.24)|New US SEC Chairman Supports Crypto, Top $TRUMP Holders to Dine with Trump2Ethereum (ETH) Price Jumps Over 10%: Can It Keep Rising?3Publicly Traded Company Initiates $5 Billion 'Buy Buy Buy' Mode, SOL Becomes MicroStrategy's Next BTC

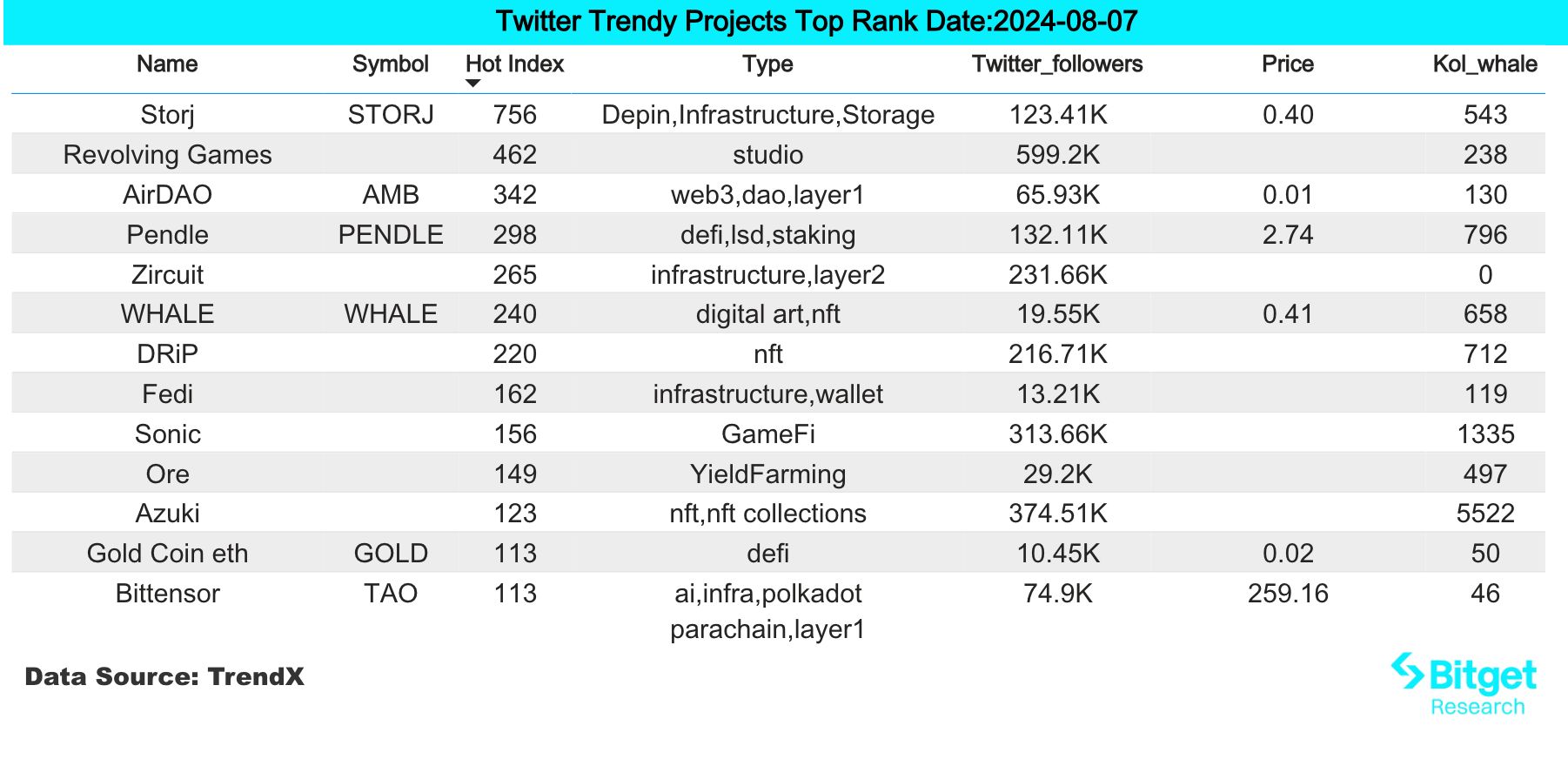

Grayscale introduces Bittensor and Sui trust products

Grayscale has added the Bittensor protocol and the Sui network to its list of crypto investment products.

Cointelegraph·2024/08/07 15:24

Solana (SOL) Reached a New All-Time High Against Ethereum (ETH)

Cryptodnes·2024/08/07 15:03

BREAKING: Top U.S. Bank to Allow Consultants to Promote Bitcoin ETF

Cryptodnes·2024/08/07 14:48

Plus Token Ponzi-linked wallet moves $2B ETH after 3.3 years of dormancy

Cointelegraph·2024/08/07 12:39

Jump Trading sells another $29M Ether with $63M left to go — Is the bottom near?

Cointelegraph·2024/08/07 12:39

Analysts Insist Bitcoin Crash Is Not as Bad as It Looks

Dailycoin·2024/08/07 12:33

Bitcoin needs $59.1K weekly close amid doubt over BTC price all-time high

Cointelegraph·2024/08/07 11:18

Bitcoin needs 'low $40,000s' for best bull market entry — 10x Research

Cointelegraph·2024/08/07 06:13

Grayscale Ethereum ETF outflows hit record low of nearly $40 million

Cryptobriefing·2024/08/07 04:51

Flash

- 13:58Circle has minted 13 billion USDC on Solana in 2025According to monitoring by Onchain Lens, Circle has minted an additional 250 million USDC on the Solana network. So far, Circle has minted a total of 13 billion USDC on the Solana network in 2025.

- 13:58The US SEC to Hold Cryptocurrency Roundtable on April 26 at 1 AMApril 24 news, the US SEC announced that the cryptocurrency roundtable will be held from 1 AM to 5 AM (UTC+8) on April 26. Previously reported, on April 17, the US Securities and Exchange Commission released details of its third cryptocurrency policy roundtable, focusing on custody issues, with two panel discussions—one on broker-dealers and wallet custody, and another on investment advisors and investment company custody.

- 13:58SophonOS is set to be released, with the core module Sophon Account making its debutAccording to official news, Sophon has unveiled the new smart contract account system Sophon Account. This innovative design aims to make crypto interactions as simple as using everyday apps. Users can log in using Google accounts, Passkey, or existing wallets, customize security rules, and enable various recovery methods, eliminating the hassle of mnemonic phrases. Sophon Account is one of the five core modules of the SophonOS operating system, which also includes Sophon Home (exploration center), Sophon+ (reward and reputation system), a blockchain based on the ZK-stack, and a data platform supported by zkTLS Social Oracles. With its modular design and seamless interaction experience, Sophon Account will serve as the "master key" for users to navigate the entire ecosystem, significantly enhancing the accessibility and user-friendliness of crypto products. The official statement mentions that this account system will be fully launched within the Sophon ecosystem, supporting applications in gaming, content, and digital culture. Sophon also revealed that relevant developer documentation and integration guides will be released soon, aiming to enable more developers to build the next-generation crypto consumer experience based on this system.