News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (4.24)|New US SEC Chairman Supports Crypto, Top $TRUMP Holders to Dine with Trump2Ethereum (ETH) Price Jumps Over 10%: Can It Keep Rising?3Publicly Traded Company Initiates $5 Billion 'Buy Buy Buy' Mode, SOL Becomes MicroStrategy's Next BTC

Bitcoin surges to $58,000 amid renewed ETF inflows

Cryptobriefing·2024/08/08 15:27

Putin Officially Legalized Cryptocurrency Mining in Russia

Cryptodnes·2024/08/08 14:57

Bitcoin Report from JPMorgan Analysts: 'Institutional Investors Support Bitcoin!'

JPMorgan analysts led by Nikolaos Panigirtzoglou attributed Bitcoin's recovery to support from institutional investors.

Bitcoinsistemi·2024/08/08 14:30

Brazil’s SEC Approves The Country’s First Solana ETF

Insidebitcoin·2024/08/08 13:53

CATDOG (CATDOG): The Meme Coin That Ends the War Between Cats and Dogs

Bitget Academy·2024/08/08 12:28

How to earn Telegram ⭐ Stars with MAJOR app

Medium·2024/08/08 08:53

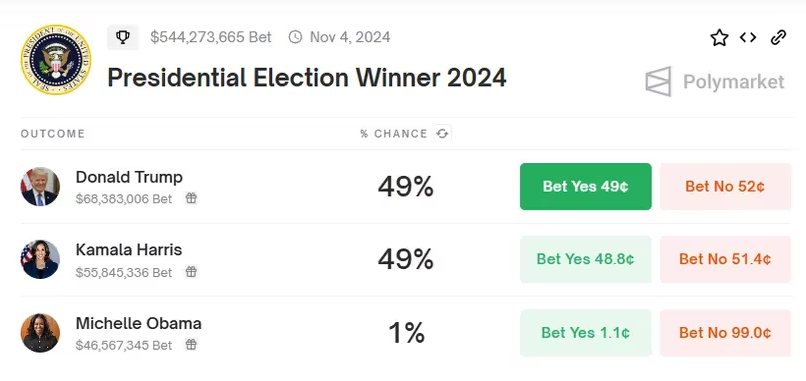

Kamala Harris Makes a Big Cryptocurrency Move, Catches Donald Trump!

Polymarket users currently predict that former US President Donald Trump and incumbent Vice President Kamala Harris have a 49% chance of winning the upcoming November presidential election.

Bitcoinsistemi·2024/08/08 08:45

The Stakes Are High!!! Critical Dates for Bitcoin Traders

Institutional Crypto Research Written by Experts

10xResearch·2024/08/08 03:57

Flash

- 16:44Fed Officials Hint at "Rate Cut," U.S. Stocks Rise IntradayAccording to Jinse, on Thursday, U.S. stocks rose intraday, with the Nasdaq at one point climbing over 2% and the S&P 500 rising nearly 1.5%. The volatility index VIX hovered around 27. President Trump seemed to be reassessing some of his more aggressive stances on trade and the Federal Reserve. "Since the market has reclaimed a significant portion of its losses, it can begin to extend this momentum," said David Laut, Chief Investment Officer at Abound Financial. "While the market's recovery won't be a straight line, it is encouraging to see the market begin to price in a post-tariff environment." Bets that the Federal Reserve will cut rates sooner than expected buoyed the stock market. Fed Governor Waller stated that he would support a rate cut if tariffs lead to job losses. Meanwhile, Cleveland Fed President Mester indicated that officials could take action as early as June if there is clear evidence of economic trends.

- 16:44U.S. SEC Delays Decision on Grayscale Spot DOT ETF ApplicationAccording to market news, the U.S. SEC has delayed the decision on the Grayscale Spot Polkadot (DOT) ETF application.

- 16:43Atlanta Fed GDPNow Model Estimates U.S. First Quarter GDP Growth at -2.5%The Atlanta Fed GDPNow model estimates U.S. first quarter GDP growth at -2.5%, previously estimated at -2.2%.