News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

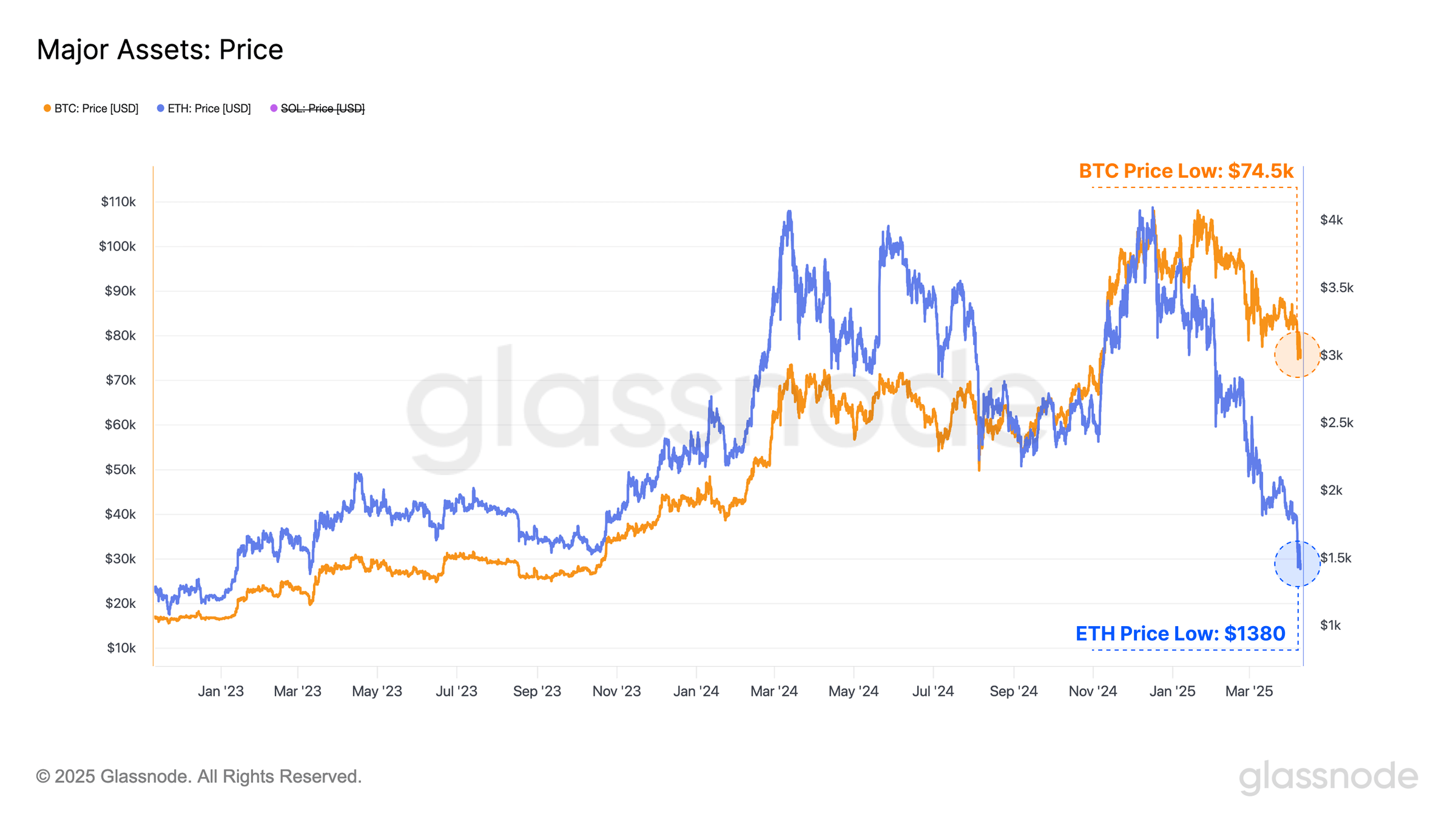

An analyst compares Ethereum to Nokia, suggesting it may lose relevance as Solana outperforms in scalability and user experience. While Ethereum maintains dominance in DEX volume, it must accelerate its development to avoid being overtaken.

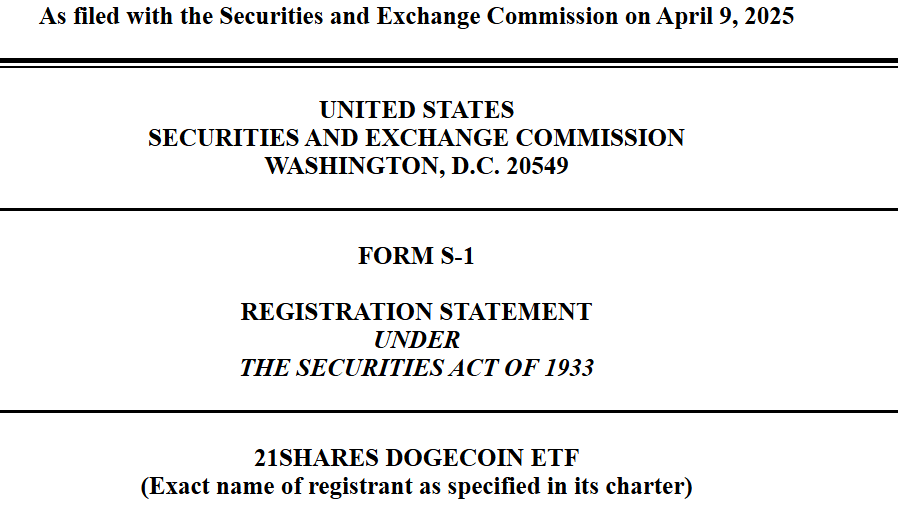

While Bitcoin spot ETFs face continued outflows, derivatives markets remain optimistic, with positive funding rates and strong demand for call options signaling bullish sentiment.

Over $2.5 billion in Bitcoin and Ethereum options expire today, with analysts anticipating market volatility due to fading call premiums and global uncertainty. Traders are eyeing these expirations for clues on short-term price direction.

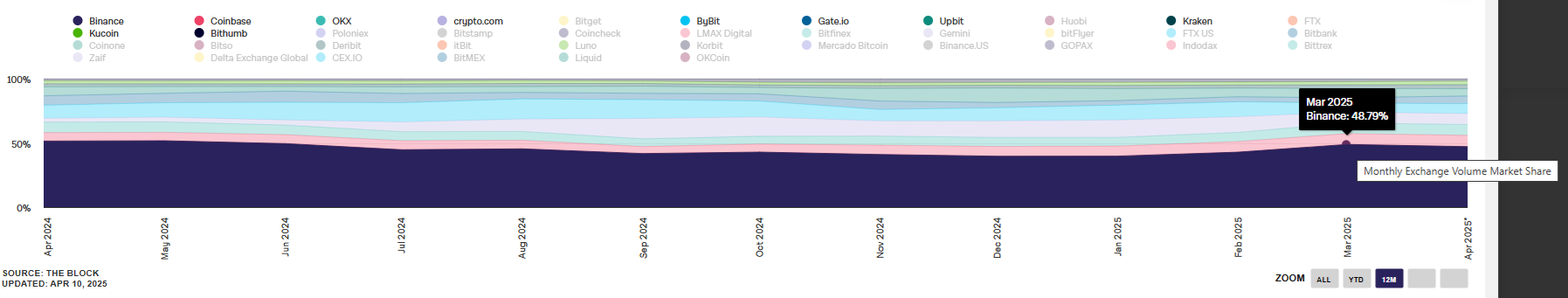

Share link:In this post: In March, trading volumes on centralized exchanges continued to slow down, following the trend for the first two months of the year. Crypto derivatives markets declined by 5%, while spot markets lost 16.4% of their volumes. Binance retained the biggest share among centralized exchanges, for both spot and crypto derivatives activity.

- 20:24Bloomberg Analyst: Listing Date for ProShares XRP ETF Not Yet DeterminedBlockbeats report on April 29: Bloomberg ETF analyst James Seyffart posted on social media stating, "Many are posting/reporting that ProShares will launch an XRP ETF on April 30. We have confirmed that this is not the case. There is currently no confirmed listing date, but we believe they will indeed launch—most likely in the short term, or in the midterm."

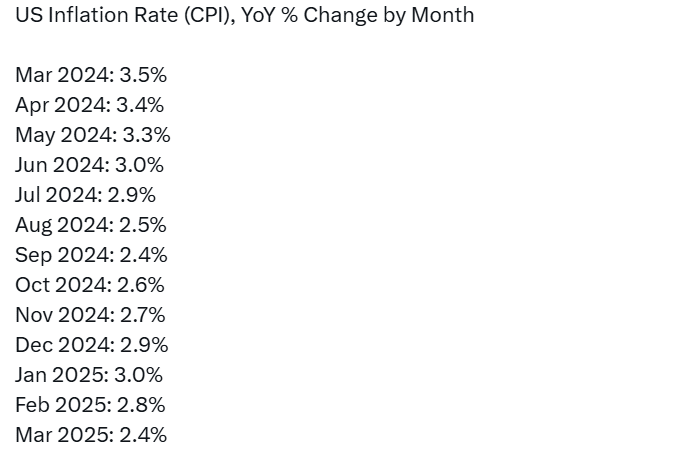

- 20:23Analyst: Manufacturing Data Causes Dollar to Retreat to Low LevelsAccording to Blockbeats, on April 28th, an analyst from the financial website Forexlive stated that the dollar has once again fallen to low levels, with the U.S. stock market stable but the dollar weakening. The dollar's decline is accelerating, which is an ominous sign. The latest round of decline followed the Dallas Fed manufacturing index dropping to its lowest level since May 2020. This report is filled with concerns over tariffs and uncertainty in the real economy. The market is weighing whether all this poor confidence data truly signals an impending economic slowdown, with each such data point weakening the bullish rationale, especially after last week's significant rebound in U.S. stocks and the dollar. (Jinshi)

- 20:23US Stock Markets Close MixedAccording to Jinse, the three major US stock indices closed mixed, with the Dow Jones up 0.28%, the S&P 500 up 0.06%, and the Nasdaq down 0.1%. Large tech stocks were mixed, with Intel up over 2%, and slight gains for Apple, Tesla, Netflix, and Meta; Nvidia fell over 2%, while Microsoft, Google, and Amazon saw slight declines.