News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (4.28)|Arizona Bitcoin Reserve Legislation Set for Vote, ProShares Trust's XRP ETF to Be Publicly Listed2Pudgy Penguins Token PENGU Makes 100% Gains Amid Meme Coin Mania3Research Report | Detailed Analysis of Sign Protocol & Sign Market Value

Bitcoin may face short-term pressure despite recession hopes

Grafa·2025/04/11 16:20

Billionaires Pour $96,300,000 Into Several Stocks in High-Stakes Bet on Themselves: Report

Daily Hodl·2025/04/11 16:00

Reasons Why Ethereum Price Falling despite potential

Newscrypto·2025/04/11 16:00

Pi Network (PI) Soars 20% as Bullish Indicators Signal Breakout Above $0.75

Newscrypto·2025/04/11 16:00

Bittensor (TAO) Price Surges 7%—Bulls Eye Breakout Above $280 Resistance

Newscrypto·2025/04/11 16:00

BONK Price Gains Momentum Bulls Push for Breakout Above Key Levels

Newscrypto·2025/04/11 16:00

ONDO Price Rebounds 10% from Recent Low, Targets $1.20 Amid Bullish Momentum

Newscrypto·2025/04/11 16:00

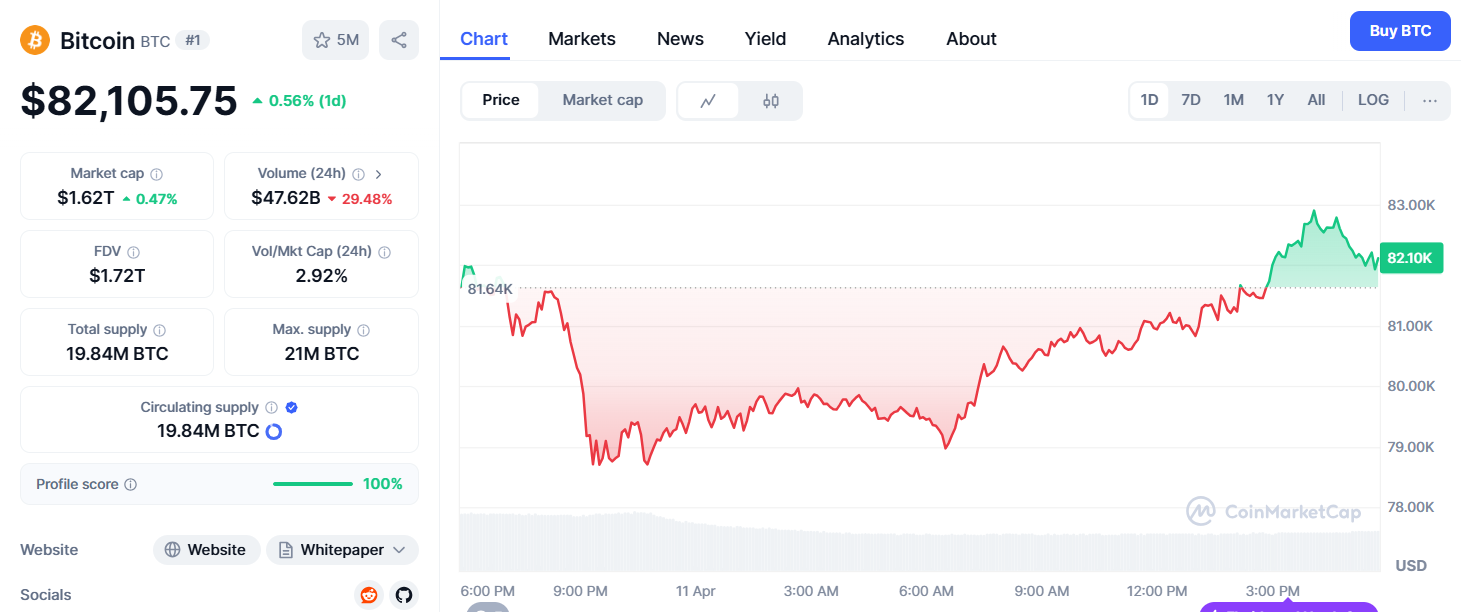

Crypto Price Today (April 11, 2025): Bitcoin Hovers at $82k, ETH Loses Momentum While SOL Spikes

Cryptotimes·2025/04/11 13:11

Bitcoin may hit a wall at $84K if bullish conditions don’t pick up: CryptoQuant

Bitcoin could face resistance around $84,000, but if it breaks through, the next major hurdle sits at $96,000, according to CryptoQuant.

Cointelegraph·2025/04/11 08:12

Flash

- 14:35Bitcoin ETF Net Inflow of 4,201 BTC Today, Ethereum ETF Net Inflow of 59,538 ETHAccording to Lookonchain statistics, 10 Bitcoin ETFs saw a net inflow of 4,201 BTC today (approximately $397 million), with iShares having a single-day net inflow of 2,523 BTC, bringing the total holdings to 588,687 BTC. At the same time, 9 Ethereum ETFs saw a net inflow of 59,538 ETH (approximately $107 million), with iShares having a net inflow of 30,272 ETH, and current holdings reaching 1,215,231 ETH.

- 14:17Tether Releases First Tether Gold Audit Report: Market Cap Approximately $770 MillionTether has released the first audit report for XAU₮ (Tether Gold), showing the token's circulation growth. Each XAU₮ in circulation is backed by an equivalent amount of pure gold (246,523.33 ounces equivalent to over 7.7 tons of gold). The report, issued by independent audit firm BDO Italy, confirms Tether's gold reserves. Tether stated that the growth of XAU₮ reflects increasing investor interest in physically-backed digital tokens amid changes in the current monetary environment. Additionally, Tether plans to enhance transparency in the future, including regular audit reports and reserve updates.

- 14:17Presto Head of Research: Bitcoin Expected to Rise to $210,000 by End of 2025According to Cointelegraph, Peter Chung, Head of Research at quantitative trading firm Presto, has reiterated his prediction that Bitcoin will rise to $210,000 by the end of 2025. Chung indicated that global liquidity expansion is a key driver of his long-term bullish outlook for Bitcoin. However, he also acknowledged that this year's market environment has not been as ideal as expected, especially with the challenges of the macroeconomic situation and market reactions. Nonetheless, he described the recent market pullback as a healthy correction, laying a more solid foundation for Bitcoin to advance as a mainstream financial asset. He stated, "In hindsight, I believe this was actually a healthy correction, paving the way for Bitcoin to be repriced further as a mainstream asset."