News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

An analyst compares Ethereum to Nokia, suggesting it may lose relevance as Solana outperforms in scalability and user experience. While Ethereum maintains dominance in DEX volume, it must accelerate its development to avoid being overtaken.

While Bitcoin spot ETFs face continued outflows, derivatives markets remain optimistic, with positive funding rates and strong demand for call options signaling bullish sentiment.

Over $2.5 billion in Bitcoin and Ethereum options expire today, with analysts anticipating market volatility due to fading call premiums and global uncertainty. Traders are eyeing these expirations for clues on short-term price direction.

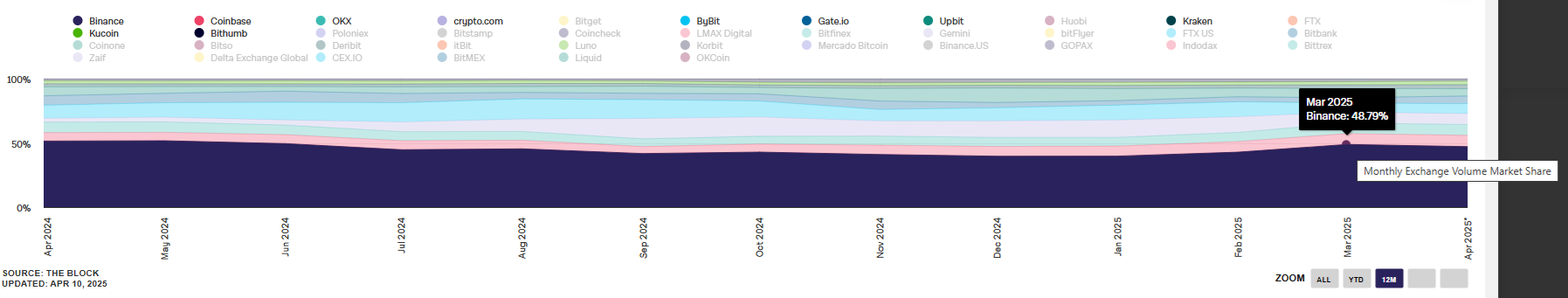

Share link:In this post: In March, trading volumes on centralized exchanges continued to slow down, following the trend for the first two months of the year. Crypto derivatives markets declined by 5%, while spot markets lost 16.4% of their volumes. Binance retained the biggest share among centralized exchanges, for both spot and crypto derivatives activity.

- 19:01Trump: Unlikely to Pause Tariffs Again for 90 Days, Hopes to Reach AgreementU.S. President Trump stated that he is unlikely to approve another 90-day pause on tariffs. Speaking to reporters aboard Air Force One, Trump said, "We hope to reach trade agreements with a number of countries. We will be reasonable." (WSJ)

- 18:49U.S. Treasury Secretary Becerra to Attend House Hearing on May 7According to market reports, U.S. Treasury Secretary Becerra will attend the House hearing on May 7.

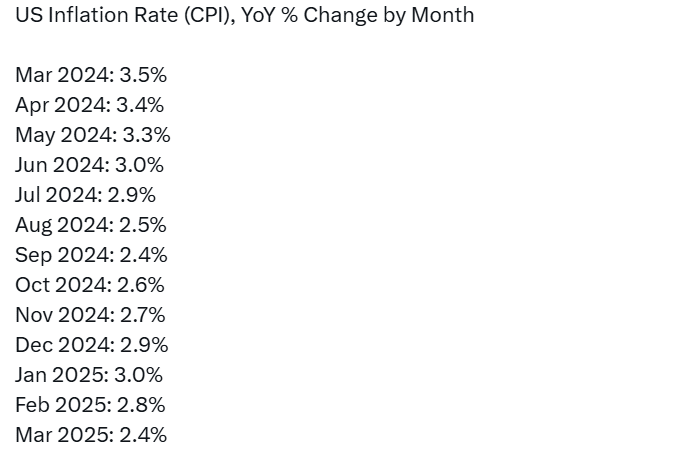

- 18:33"Fed's Mouthpiece": Market Overinterprets Hammack's Comments on June Rate Cut"Fed's Mouthpiece" Nick Timiraos stated that Fed's Hammack's remarks on Thursday garnered widespread attention, as some market participants overinterpreted them as a signal that the Fed might be prepared for a rate cut in June. Hammack did not actually indicate that a June rate cut was imminent. When discussing a June rate cut, Hammack used two qualifiers, "if": "If we receive clear and convincing data before June, if we know what action is correct at that point, then I believe the committee could take action." The danger of overly relying on these broad "if" assumptions is that they do not provide particularly clear answers. (Jinshi)