News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (4.25) | Trump Considers Tiered Tariff Plan for China, Federal Reserve Eases Crypto Regulation2ARK Invest Sees Bitcoin Hitting $1.5M By 2030 On Rising Institutional Demand3US spot bitcoin ETFs log $442 million in net inflows as BTC price shows resilience

PEPE Mirrors Its Past Bottom – Will RSI Divergence Spark Another Rebound Rally?

CoinsProbe·2025/04/11 07:44

Is Kaspa (KAS) Gearing Up for a Bullish Reversal? This Fractal Says Yes!

CoinsProbe·2025/04/11 07:44

RENDER’s Recovery Kicks Off With a Classic Pattern – Will TAO Follow the Same Path?

CoinsProbe·2025/04/11 07:44

Research Report | In-Depth Overview of Mind Network & FHE Market Valuation

Bitget·2025/04/11 06:52

Helium cleared by SEC as HNT market cap hits $480 million

Grafa·2025/04/11 02:40

Florida Bitcoin Reserve bill moves forward with unanimous vote

Grafa·2025/04/11 02:40

MicroStrategy holds 528K BTC at risk as debt pressure builds

Grafa·2025/04/11 02:40

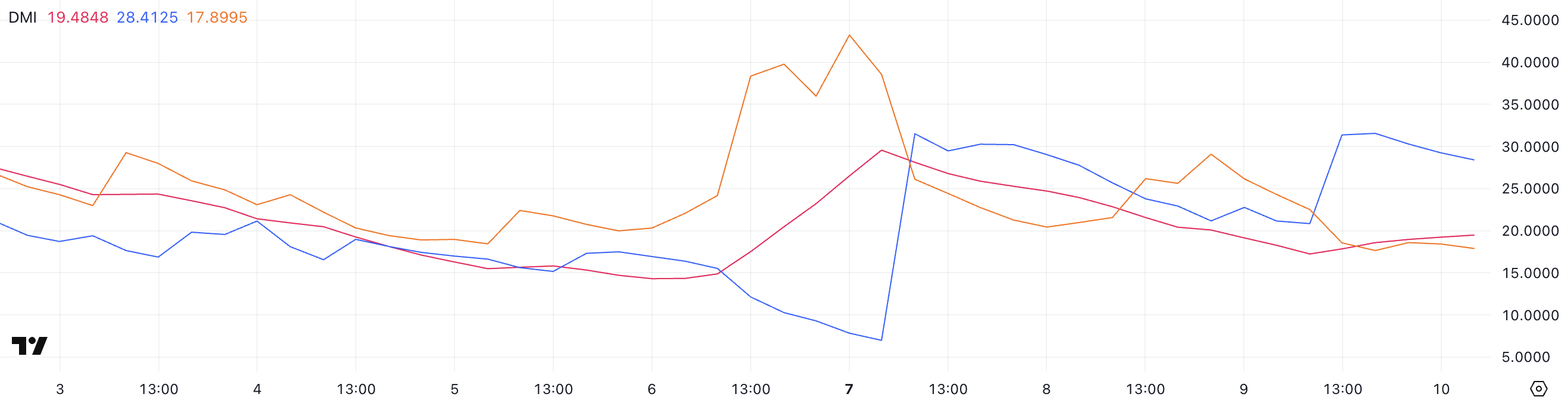

Bitcoin’s Recent Surge Suggests Potential Consolidation Amid Weakening Trend Indicators

Coinotag·2025/04/11 02:00

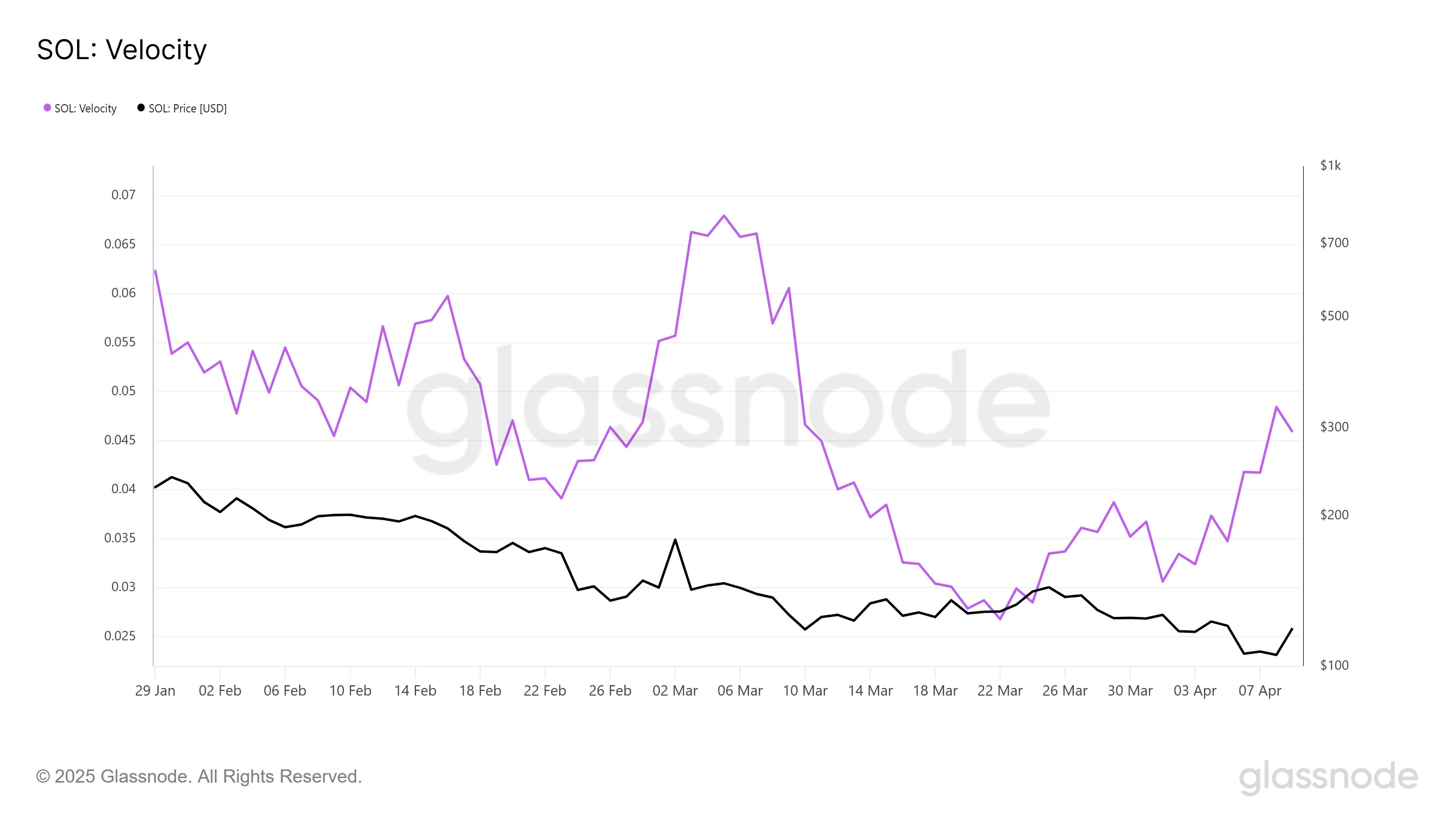

Solana Price Nears $120: Bullish Recovery Possible If Resistance Levels Are Broken

Coinotag·2025/04/11 02:00

Bitcoin flat as China announces new 125% tariff on US goods, gold spikes, oil declines

CryptoSlate·2025/04/11 00:48

Flash

- 19:01Trump: Unlikely to Pause Tariffs Again for 90 Days, Hopes to Reach AgreementU.S. President Trump stated that he is unlikely to approve another 90-day pause on tariffs. Speaking to reporters aboard Air Force One, Trump said, "We hope to reach trade agreements with a number of countries. We will be reasonable." (WSJ)

- 18:49U.S. Treasury Secretary Becerra to Attend House Hearing on May 7According to market reports, U.S. Treasury Secretary Becerra will attend the House hearing on May 7.

- 18:33"Fed's Mouthpiece": Market Overinterprets Hammack's Comments on June Rate Cut"Fed's Mouthpiece" Nick Timiraos stated that Fed's Hammack's remarks on Thursday garnered widespread attention, as some market participants overinterpreted them as a signal that the Fed might be prepared for a rate cut in June. Hammack did not actually indicate that a June rate cut was imminent. When discussing a June rate cut, Hammack used two qualifiers, "if": "If we receive clear and convincing data before June, if we know what action is correct at that point, then I believe the committee could take action." The danger of overly relying on these broad "if" assumptions is that they do not provide particularly clear answers. (Jinshi)