The Trump Family Project WLFI Sells Off ETH at a Loss of Millions, How Many Chips Does It Still Hold?

Will WLFI continue to divest in the future?

Original Article Title: "The Behind-the-Scenes of WLFI's ETH Dump: Stop Loss or Another Scheme?"

Original Article Author: Luke, Mars Finance

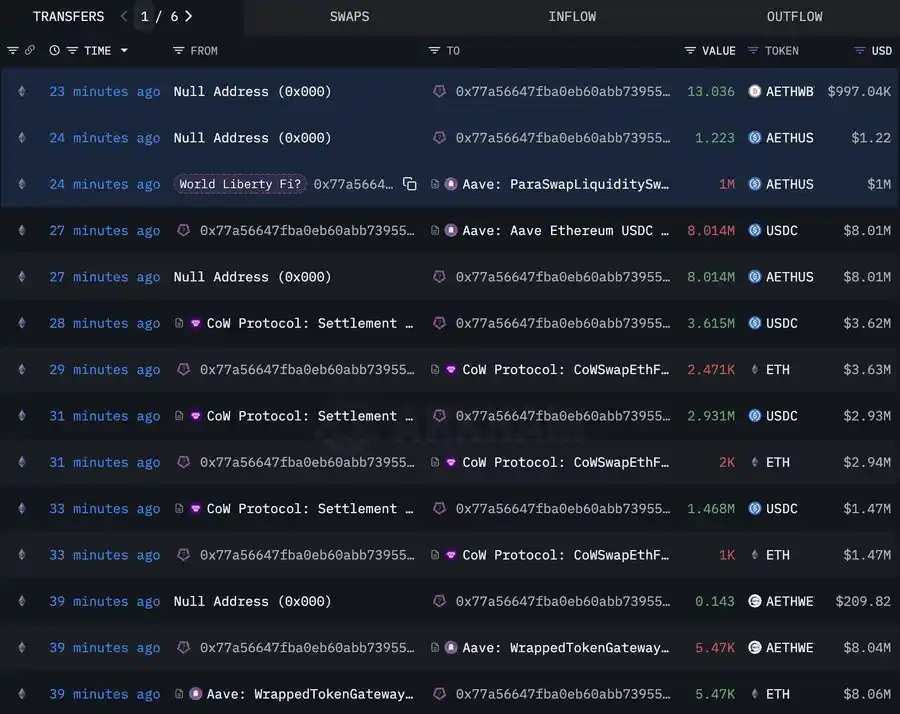

On April 9, 2025, a wallet allegedly linked to World Liberty Financial (WLFI) dumped 5,471 ETH at an average price of $1,465, cashing out approximately $8.01 million. This was no small matter—this wallet had previously splurged $210 million to accumulate 67,498 ETH at an average price of $3,259, now facing an unrealized loss of $125 million. As a DeFi star project endorsed by the Trump family, WLFI's move is puzzling: why liquidate at this critical moment? How much more ETH can be sold? Will there be more dumps in the future?

A Tough Decision in the Chilling Market

Currently, the crypto market seems to be shrouded in cold air, with ETH price fluctuating between $1,465 and $1,503, more than halving from WLFI's purchase price. Looking back to the beginning of 2025, the optimism brought by Trump's inauguration had prompted WLFI to significantly increase its ETH holdings, seemingly attempting to soar with the policy tailwind. Unfortunately, the good times did not last long, and the continued slump of ETH turned this enthusiasm into a massive $125 million unrealized loss. From $89 million in March to $125 million now, the snowball of losses keeps growing.

The timing of the sell-off is intriguing. On the same day, a whale scooped up 4,677 ETH at $1,481, intensifying the market's long vs. short game. WLFI's decision to act at this moment may indicate a sense of a short-term bottom or a fear of further price decline. Regardless, this $8.01 million cash-out is like selling an old coat in the winter—it's reluctant but inevitable.

Why Sell: Stop Loss or Another Plan?

Why did WLFI cut losses at this point? The answer may not be simple.

Firstly, the logic of stop-loss is obvious. With each ETH dropping by $1,794, selling 5,471 ETH may incur a near-million-dollar loss, but it's better than watching the remaining 62,027 ETH continue to depreciate. It's like cutting off a "deadbeat stock" in the stock market, securing cash first. After all, if fully liquidated at the current price, the loss would almost hit $111 million—who can bear that?

Furthermore, the pressure on cash flow cannot be ignored. WLFI basked in the glory of a $590 million token sale for a while, but expenses for operations, partnerships, and new projects will not stop. While $8.01 million may not be a lot, it can provide relief in a market downturn. Just think, a project backed by the Trump family surely cannot let its wallet run dry, right?

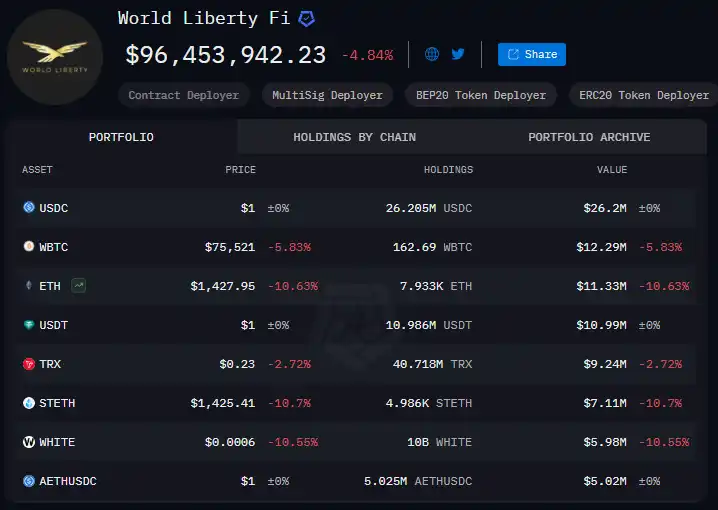

Moreover, this may be an attempt at a strategic pivot. WLFI's asset pool contains not only ETH but also "veterans" like WBTC, TRX, and "rising stars" in the RWA space. By reducing ETH holdings, freeing up funds to invest in partners like Ondo Finance or betting on the potential of Layer 2 could be a way to prepare for the future. After all, the stage of DeFi is large, and ETH is just one of the players.

Lastly, don't forget about external perception. As the "favorite son" of the Trump family, WLFI shines with prestige but also carries controversy. With 75% of profits in the whitepaper going to the family while risks are shifted to token holders, this model has long raised suspicions. Could this sell-off be due to investor pressure to prove that they are not solely relying on the "celebrity effect" to thrive? It's unlikely, but not entirely unreasonable.

Overall, stop-losses and liquidity are the most immediate driving forces, while strategic adjustments may hint at what's to come. As for external pressures, perhaps they are just the background music of this drama.

How Much More Can Be Sold: Trump Card and Bottom Line

After selling 5,471 tokens, WLFI still holds 62,027 ETH, which is worth approximately $90.9 million at the current price. How much more can this trump card reveal?

From a funding perspective, if each sale targets around $8 million in cash flow, selling another approximately 5,000 tokens would suffice, leaving a "safety net" of $56 million in holdings. However, if there is a larger funding gap, such as for a new project launch or debt maturity, selling a few tens of thousands of tokens is not out of the question. However, doing this would undoubtedly raise doubts about ETH's core position.

The market's ability to handle this is also crucial. The recent $8.01 million sale did not cause much of a stir, and the daily trading volume of ETH at $5 billion seems able to absorb it. But if WLFI were to dump tens of millions of dollars' worth of assets in one go, panic could further drive down prices. For precaution, selling in small batches appears to be their style.

Much more crucial is the strategic bottom line. WLFI views ETH as a "strategic reserve," and if holdings drop below half (around 33.74 million tokens), its image as a DeFi leader may be at risk. Unless absolutely necessary, they are unlikely to easily deplete this reserve. In the short term, selling another 5,000 to 10,000 tokens (approximately $7.3 million to $14.65 million) is a reasonable estimate, both quenching thirst and avoiding harm.

Will the Sell-off Continue?

In the future, will WLFI continue to sell off? The answer lies within three key clues.

First, watch the market sentiment. If ETH drops below $1,400 and the unrealized losses increase by another one or two hundred million, the urge to sell off may be unstoppable. However, if the price rebounds to $1,800, and unrealized losses shrink to $90 million, they might hold onto their assets tightly, even regaining confidence to buy back. Currently, the $1,450 support level and $1,600 resistance level serve as indicators.

Second, internal calculations are also crucial. If WLFI still aims to play a leading role in the DeFi space, they cannot afford to see ETH's position heavily impacted. In this case, the sell-off may gradually slow down. However, if they set their sights on other trends, such as RWA or emerging tokens, ETH may become a "cash machine," accelerating the sell-off pace.

Third, external factors matter. The pro-crypto stance of the Trump administration acts as a shield for WLFI. If a significant move is made in the second quarter leading to market recovery, they might sit comfortably on the sidelines. Yet, if the family is caught up in political turmoil or investors demand transparency, the pressure to cash out will be inevitable.

In the short term (one to two months), there is a possibility of small-scale sell-offs, with the total amount ranging from $10 to $20 million. If the market continues to slump, a mid-term sell-off could account for 30% to 50% of the remaining holdings, totaling $27 to $45 million. Looking ahead, unless ETH stages a complete turnaround, WLFI may gradually fade from this field, moving their chips to a new battleground.

Ethereum Fundamental Transition: Why Are Whales Turning Bearish?

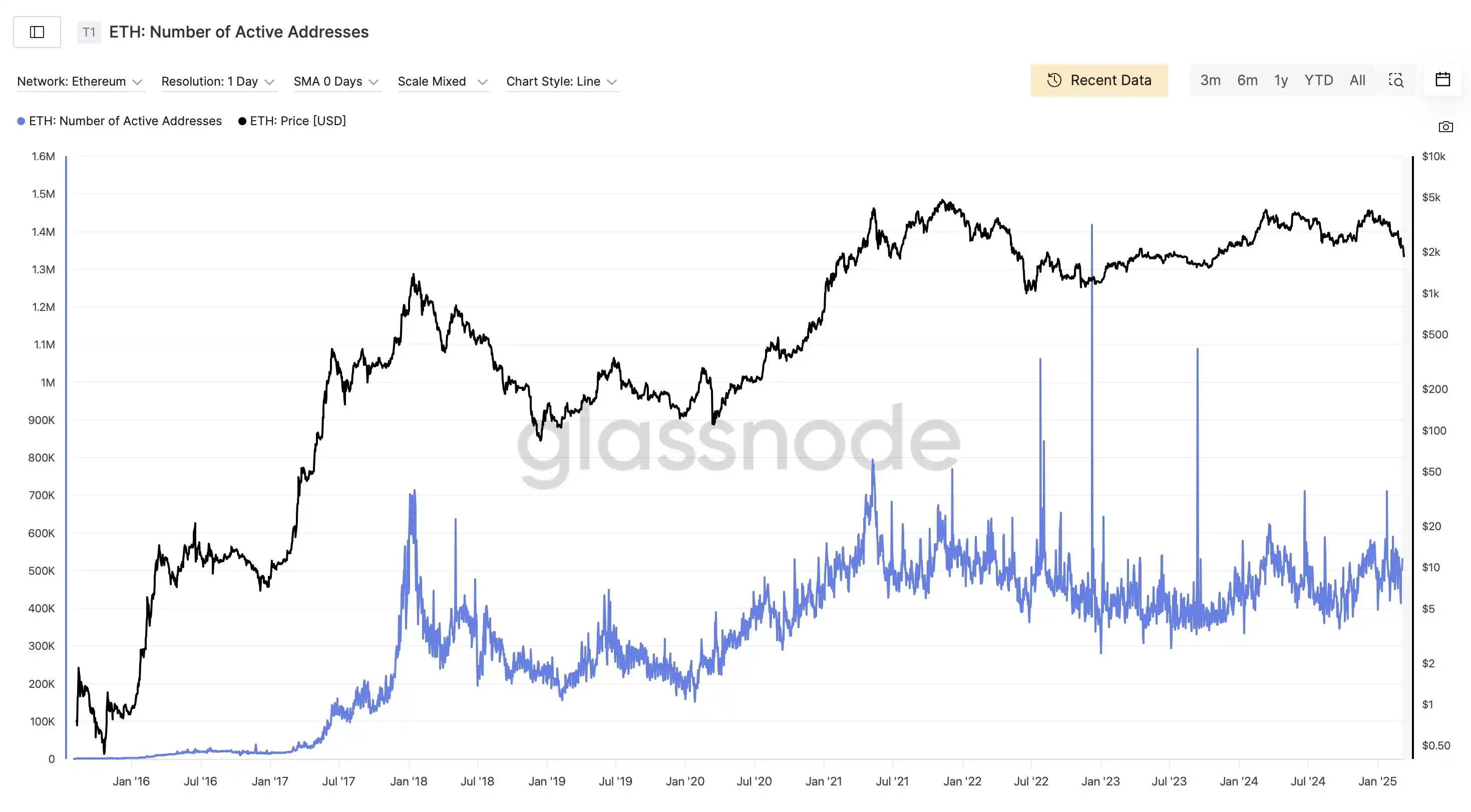

In recent years, Ethereum's fundamentals seem to be undergoing a quiet transition, which may be a crucial reason why whales are becoming pessimistic about ETH's future. Glassnode data shows that over the past four years, Ethereum's active address count has remained almost stagnant, hovering around the same level, failing to significantly grow alongside market trends. This is not the "efficiency range" of technical optimization but rather resembles a depletion of growth momentum, indicating Ethereum's fatigue in attracting new users and developers.

Meanwhile, the emergence of Layer 2 (L2) solutions was supposed to bring new vitality to Ethereum but unexpectedly weakened its value capture ability. L2 significantly reduced mainnet Gas fees by diverting transaction volume (Gas fees dropped over 70% in March 2025). While this is user-friendly, it allows L2 to intercept the value that was supposed to be fed back to ETH holders through the EIP-1559 burning mechanism, further squeezing Ethereum's "profit space." Some analyses suggest that unless the mainnet can revitalize its demand for block space through large-scale tokenization, Ethereum's long-term competitiveness may be at risk.

The perspective of institutions also reflects this concern. In a report, CoinShares pointed out that the frequent adjustments to the Ethereum protocol (such as the Dencun hard fork) have brought about uncertainty, hindering institutional investors from building reliable valuation models, thereby diminishing its attractiveness. In March 2025, Standard Chartered lowered its price target for Ethereum in 2025 to $4,000, citing structural decay as the reason.

Jon Charbonneau, Co-Founder of the crypto investment firm DBA, also stated that Ethereum's issuance model under the Proof of Stake (PoS) mechanism faces fundamental trade-off issues, with adjustment being difficult to resolve the core contradiction. On the X platform, some users even bluntly said that Ethereum has "barely changed since 2016," with upgrades being slow and missing the window for rapid transformation, seemingly becoming a "victim" of its own success.

Meanwhile, EigenLayer's Stakedrop event also left the market disappointed, as the narrative of enhancing ETH holding rewards through Restaking was shattered due to unfair distribution, further undermining the confidence of large holders. These signals collectively point to a reality: Ethereum's fundamentals are being eroded by internal and external factors, with its once growth engine now showing signs of fatigue, and the pessimism of large holders may indeed be a direct response to this trend.

Summary

This sell-off event not only revealed WLFI's struggle in the market downturn but also highlighted Ethereum's deeper predicament. The stagnant growth of active addresses, L2 value diversion, signals of institutional pessimism, all contribute to casting a shadow over Ethereum's fundamentals, with the confidence of large holders wavering. WLFI's next move, whether to continue selling or strategically pivot, will unfold in the dual game of markets and policies.

For investors, while chasing the hype may be enticing, a more composed judgment is needed: Can Ethereum's future be revitalized? Where will WLFI's bold gamble lead? The answer, perhaps, can only be revealed with time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Senate bill targets emissions from AI and crypto data centers

SEC eyes crypto trading overhaul amid calls for reform

Vitalik Buterin emphasises social philosophy in app layer

NFT trader faces prison for $13 million tax evasion