White House plans to reduce tariffs in April

White House is considering adjusting the tariff policy originally scheduled to be implemented on April 2, planning to take more targeted measures to avoid imposing tariffs on specific industries, only implementing "equal tariffs" on countries with trade imbalances, triggering a market sentiment easing. Analysts pointed out that although tariffs do not directly affect the prices of cryptocurrencies, the market is particularly sensitive to the macro uncertainty brought about by Trump's trade policy. Zach Pandl, head of research at Grayscale, said, "Policy uncertainty has led investors to overall reduce their risk exposure, and Bitcoin has also been affected by this."

In addition, the Federal Reserve recently announced a slowdown in the pace of balance sheet reduction, reducing the monthly cap on Treasury bonds from $250 billion to $50 billion to ease market liquidity pressures.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

IMX surges 15% after Immutable says SEC ended probe

Ripple agrees to drop SEC cross-appeal

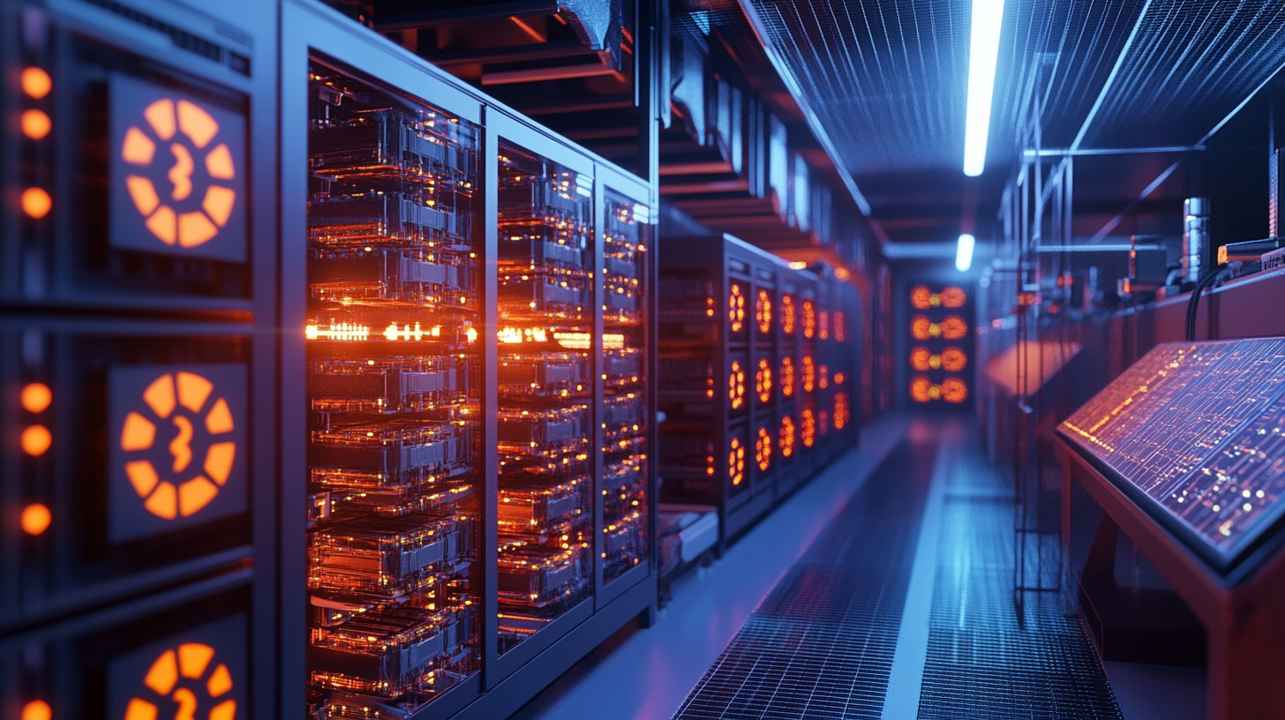

Bitcoin miners’ revenue stabilises post-halving