Bitget Daily Digest (March 26) | Ripple agrees to drop cross-appeal, GameStop adds Bitcoin to reserves

远山洞见2025/03/26 10:15

By:远山洞见

Today's preview

1. U.S. EIA crude oil inventory data for the week ending March 21 will be released today. The previous reading was 1.745 million barrels.

2. Celo will activate the hard fork to transition to Ethereum Layer 2 on March 26.

Key market highlights

1. Ripple has reached a settlement with the U.S. Securities and Exchange Commission (SEC). Following the SEC's unconditional withdrawal of its appeal last week,

Ripple has now agreed to drop its cross-appeal. Under the agreement, the SEC will retain $50 million of the original $125 million penalty, with the remainder returned to Ripple. The SEC will also petition the court to lift the previously imposed injunction against Ripple.

2. A quiet wave of token buybacks is sweeping the industry, with several projects rolling out buyback programs. Since January, 12 projects—

including Aave, Arbitrum, dYdX, Movement, Raydium, Jupiter, GoPlus, and MyShell—have announced buybacks ranging from a few million to tens of millions of dollars. The funds for these buybacks come from protocol revenue, seized assets, and treasury allocations. In the face of a sluggish market and mounting market-making risks, buybacks have become a key strategy for project teams to boost confidence and ease selling pressure.

3. PumpSwap, a Solana-based DEX backed by Pump.fun, has surpassed

$1.045 billion in total trading volume just six days after launch. Its daily volume hit $455 million yesterday alone, accounting for 19.2% of all DEX activity on Solana—overtaking Meteora and trailing only Raydium. PumpSwap now has a total of 385,200 users, with 243,000 daily active addresses and approximately $1.06 million in daily fee revenue.

4. Game retailer

GameStop updates its investment policy to include Bitcoin as part of its treasury reserve assets. According to the filing, the company is now permitted to invest in certain crypto assets, including Bitcoin and U.S. dollar-denominated stablecoins. It also notes that holding such assets may expose the company to risks specific to Bitcoin or stablecoins, as well as affecting its ability to maintain effective internal financial reporting controls. Following the announcement, GameStop shares rose over 6% in after-hours trading.

5. U.S. consumer confidence dropped sharply in March, with the index falling to 92.9—a four-year low—while the expectations index sank to its lowest level in 12 years. The decline underscores growing concerns over rising prices linked to Trump's new tariff policies and an uncertain economic outlook.

Consumers' expectations for future income have weakened significantly, inflation expectations have climbed to a two-year high, and stagflation risks are on the rise. Gold is up 15% year-to-date as risk-averse sentiment deepens.

Market overview

1. $BTC trades sideways in the short term as the broader market sees a general rally. Small-cap coin $SLT leads the gains, while gaming tokens like $

MAVAI and $

FIRE have surged. $

MOVE is showing signs of recovery, possibly driven by recent market maker activity. On the flip side, BSC-related tokens such as $SIREN and $BUBB are trending lower.

2. U.S. stocks closed slightly higher, while Chinese stocks declined. U.S. Treasury yields rebounded. Meanwhile, reports suggest Trump may consider a 25% tariff on copper, pushing copper futures to a record high.

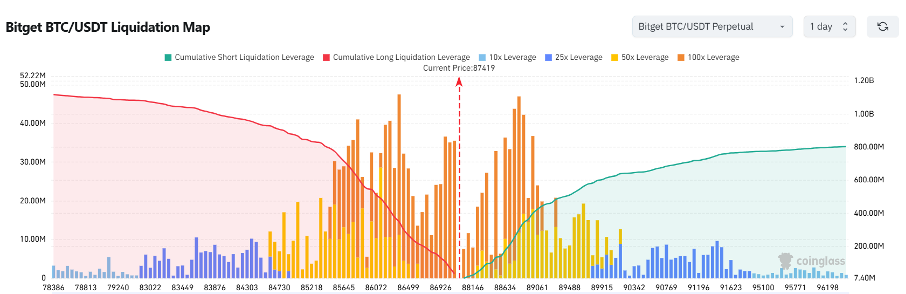

3. Currently standing at 87,396 USDT, Bitcoin is in a potential liquidation zone. A 1000-point drop to around 86,396 USDT could trigger

over $348 million in cumulative long-position liquidations. Conversely, a rise to 88,396 USDT could lead to

more than $134 million in cumulative short-position liquidations. With long liquidation volumes far surpassing short positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

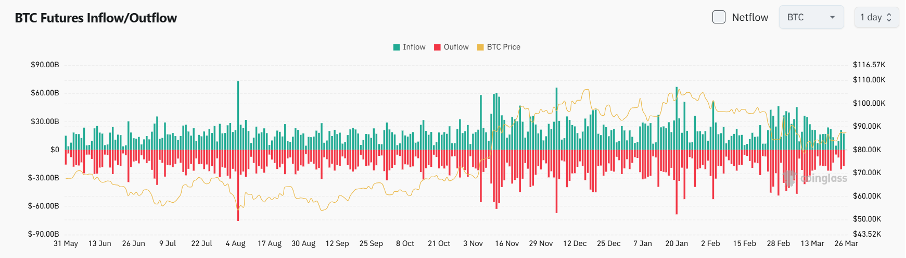

4. Over the last 24 hours, BTC spot saw $17.2 billion in inflows and $17 billion in outflows, resulting in

a net inflow of $200 million.

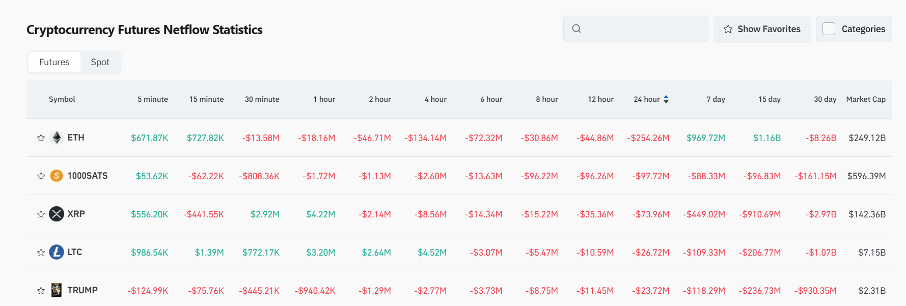

5. Over the last 24 hours, $XRP, $TRUMP, $ETH, $LTC, and $SATS led in

net outflows in futures trading, signaling potential trading opportunities.

Institutional insights

Standard Chartered: Ethereum is facing a "midlife crisis" as recent tech upgrades fail to gain mainstream traction

Read the full article here:

https://www.ft.com/content/9ae2b40b-c8cc-4baf-8392-1b4a2470e5e5

Matrixport: Bitcoin's correlation with the Nasdaq has hit extreme levels—hinting at a potential decoupling in price trends

Read the full article here:

https://x.com/Matrixport_CN/status/1904458030542127585

News updates

1. Fed governor Christopher Waller reiterates that the Fed can continue to keep interest rates unchanged.

2. SEC crypto task force will hold four public roundtable meetings over the next three months to discuss regulatory issues.

3. A bill to abolish DeFi broker rules will go for a final vote this Thursday and may be submitted to Trump for signing as early as Friday.

Project updates

1. North Carolina's Bitcoin investment bill will create an investment management bureau, directing 5% of the state's funds to be invested in digital assets.

2. The Arbitrum Foundation released its 2024 transparency report, funding a total of 276 projects.

3. BlackRock officially launched a Bitcoin ETF in the European market: IB1T GY and IB1T FP.

4. MIM Spell: Will negotiate with hackers and offer a 20% bounty; users' collateral remains unaffected.

5. Amnis Finance completed a snapshot for rewards, with 8% of the AMI tokens set for airdrop.

6. PumpSwap's daily trading volume surpassed $450 million, capturing 19.2% of the Solana ecosystem's share.

7. Bera, Noble, and Arbitrum topped the list for net inflows of cross-chain bridge funds in the past week.

8. The Movement Foundation will use $38 million of improper market maker-related funds for a token buyback.

9. The Trump family's crypto project, WLFI, officially announced plans to launch an institutional-grade stablecoin, USD1.

10. The RWA sector's TVL surpassed $11 billion, setting a new all-time high, with tokenized U.S. Treasury bonds now exceeding $5 billion.

Highlights on X

1. @CycleStudies: Bitcoin's rebound cycle, comparing October 2023 with the current pattern

The current Bitcoin market trends resemble those of the October 2023 rebound, following a series of oscillations, short-squeeze dips, volume-driven breakouts, pullbacks to moving averages, and continued rallies. This suggests that the current market is still a rebound rather than a trend reversal. The target price range is $90,000-$91,000, with partial profits being taken. If the price drops below $86,000, the rebound structure will fail, possibly indicating a trend change.

2. Phyrex: Short-term recovery, focus on Friday’s core PCE data and Michigan University's inflation expectations

Market sentiment is improving, especially with Trump's shift on tariffs and his comments on the Fed, both positively impacting market sentiment. Investor risk appetite has increased, leading to moderate rises in both U.S. stocks and Bitcoin. Although concerns about a U.S. recession remain, a reduction in tariffs or a short-term ceasefire in the Russia-Ukraine war, alongside easing inflationary pressures, could further strengthen the rally. The $93,000-$98,000 price range for Bitcoin remains solid, with a reduction in short-term selling, supporting further price increases. Friday's core PCE data and Michigan University's inflation expectations will be key focus points for the market.

3. @Michael_Liu93: The rapid burnout of the BSC meme trend and the "mass disenchantment" behind it

Memecoin projects on BSC have quickly cooled, and the market has developed a "mass disenchantment" toward them. The current consensus includes: 1) "Building" has turned into a pump-and-dump operation; 2) "Diamond hands" are now seen as "fools"; 3) The community is just older holders trying to attract new buyers; 4) Calls for buying have turned into "pump and dump." The market mechanism of passing the baton can only work when everyone is attracted by the same expectation, but now meme projects have lost their "charm," and the collective momentum in the market is gradually disappearing.

4. Evie: Reasons behind adding more Sonic $S positions

After selling off $S, I've decided to re-enter and hold long-term, mainly because I see Andre Cronje personally leading the project, with many DeFi OGs and influencers deeply involved, especially with increasing discussion in the English-speaking community. Additionally, Sonic Chain offers a smooth transaction experience, a 90% gas rebate mechanism incentivizing developers to create ecosystem content, and recent launches like the SheepCoin (sheep-eating game) and Abyss (card game) have revitalized the community. The wealth effect is gradually showing, and the Sonic team's focus on the Chinese community has increased my confidence. Overall, the chain's narrative and momentum are still building, making it worth continued investment.

3

1

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Solana Rivals Poised for Massive Gains—Turn $100 Into $10K Before Q2 Ends

Cryptonewsland•2025/03/29 01:55

Movement (MOVE) Price Gains 27% as Accumulation Builds and Bullish Momentum Takes Over

Cryptonewsland•2025/03/29 01:55

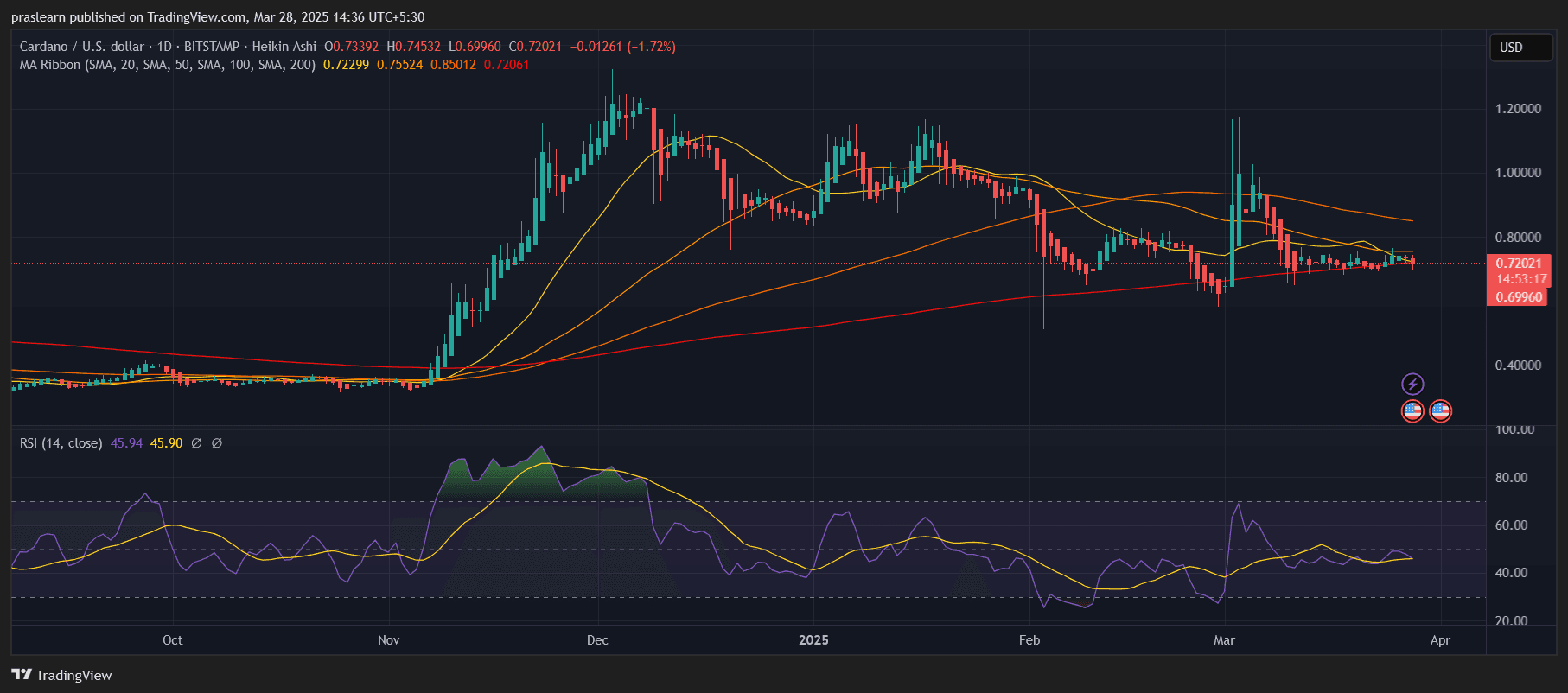

Cardano Aiming for $10? Big Move Coming?

Cryptoticker•2025/03/29 00:00

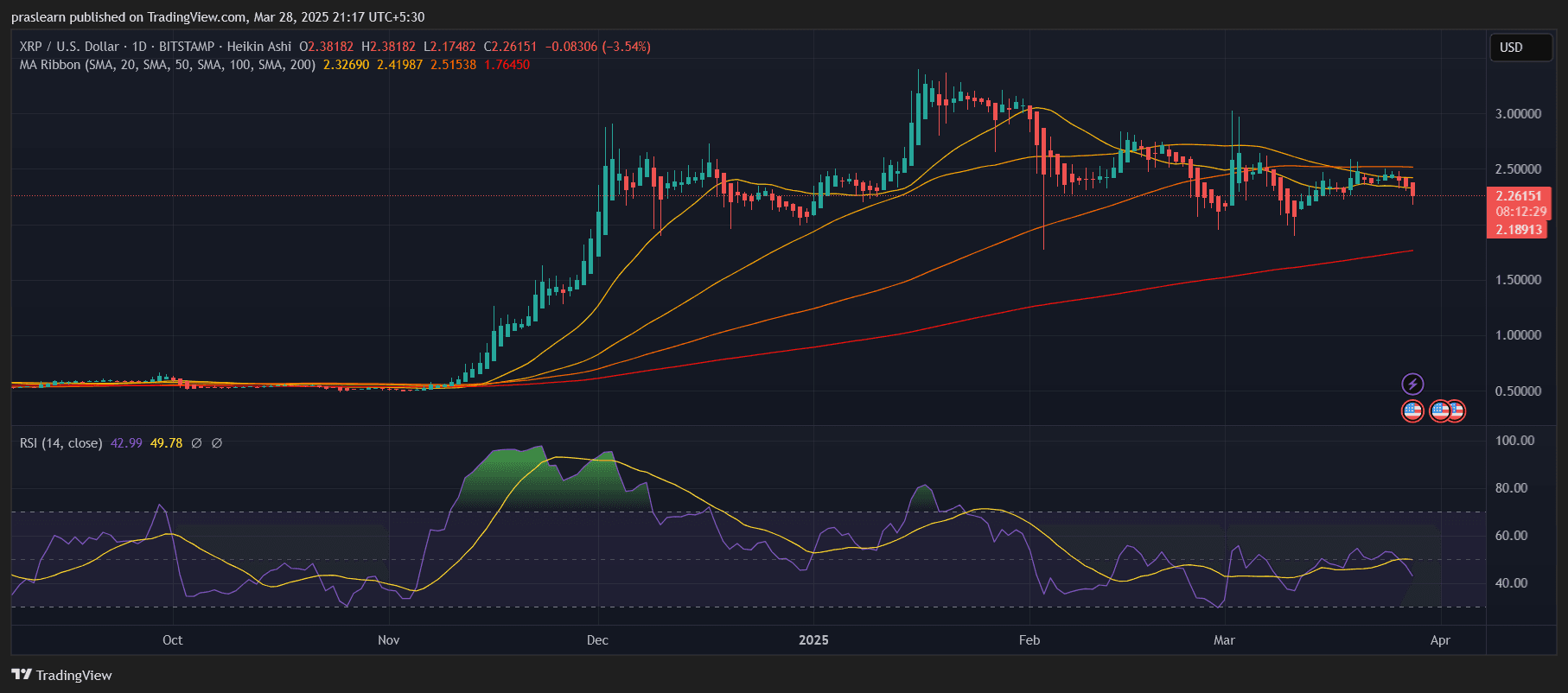

Will XRP Crash? Here’s What the Chart Is Warning Us About

Cryptoticker•2025/03/29 00:00

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$83,078.71

-2.34%

Ethereum

ETH

$1,870.9

-2.03%

Tether USDt

USDT

$0.9997

+0.01%

XRP

XRP

$2.08

-6.22%

BNB

BNB

$605.29

-3.88%

Solana

SOL

$126.16

-3.63%

USDC

USDC

$1

+0.01%

Dogecoin

DOGE

$0.1719

-5.00%

Cardano

ADA

$0.6746

-3.48%

TRON

TRX

$0.2347

+1.73%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now