Is Ethena (ENA) Gearing Up for Reversal? Cup and Handle Pattern Signals an Upside Move

Date: Thu, March 20, 2025 | 02:15 PM GMT

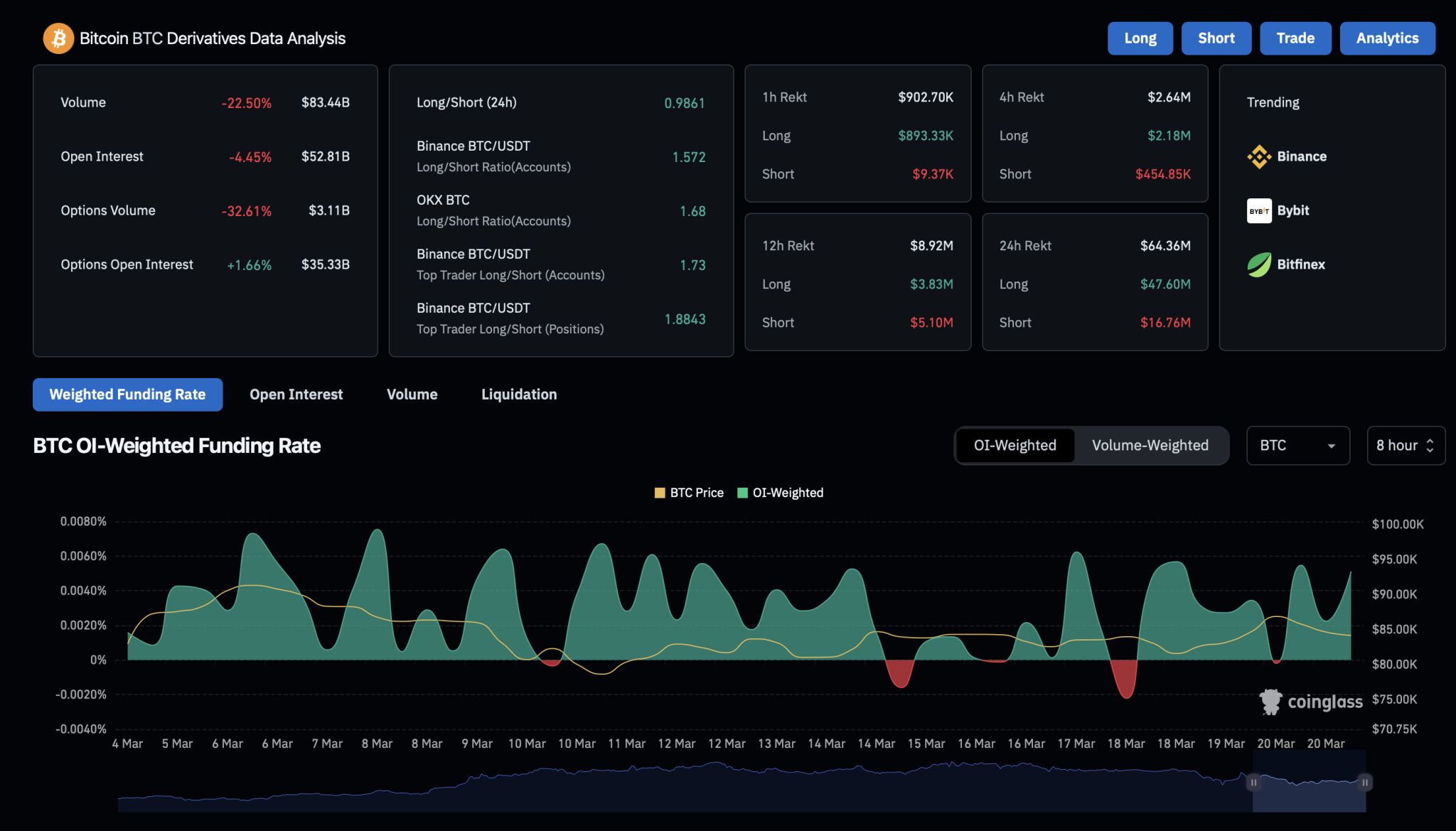

The crypto market is showing early signs of a rebound as Ethereum (ETH) has bounced back from last week’s low of $1,774 and is now trading above $2,000—a promising shift after a choppy start to March. As sentiment gradually improves, altcoins like Ethena (ENA) are beginning to stir as well.

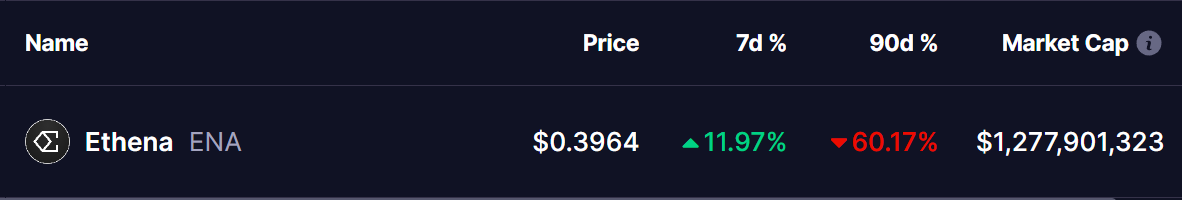

Source: Coinmarketcap

Source: Coinmarketcap

ENA has taken a heavy hit over the past few months, but with impressive weekly gains and ongoing price action, it suggests that a recovery may be underway.

Cup and Handle Pattern: A Bullish Signal?

On the daily chart, ENA is forming a classic cup and handle pattern, a well-known bullish continuation pattern that often precedes a strong breakout.

After facing rejection at $1.07 on December 2, ENA retraced to its critical support zone of $0.33. While ENA has shown resilience at this support, it has bounced strongly above $0.39, forming the handle portion of the pattern.

Ethena (ENA) Daily Chart/Coinsprobe (Source: Tradingview)

Ethena (ENA) Daily Chart/Coinsprobe (Source: Tradingview)

If ENA follows through with this structure, it could rally back toward the neckline around $1.26, which represents a potential 215% upside from its current levels.

The 50-day Simple Moving Average (SMA) is currently acting as an intermediate resistance. A break above this level would confirm the bullish recovery rally, with further resistance at the neckline of the pattern ($1.26). If ENA successfully breaks above this key resistance, it could signal the start of a strong uptrend.

The MACD indicator is also showing early bullish signs. The MACD line is attempting a crossover above the signal line, which could indicate growing momentum for a breakout. Additionally, the histogram is turning positive, further reinforcing the bullish outlook.

What’s Ahead?

If ENA maintains its current trajectory and breaks above the neckline, traders may witness a significant surge in price, potentially targeting the $1.50–$2.00 range in the coming months. However, failure to break above the neckline .could lead to further consolidation or a retest of lower support levels.

As always, traders should exercise caution, keeping an eye on broader market sentiment and key resistance zones before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before investing in cryptocurrencies

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TON Bounces from Crucial Support Zone — Will SUI Follow the Same Path?

INJ and KAVA Eye Breakout from Falling Wedge – Reversal on the Horizon?

Bitcoin Breaks Below $85k as Leverage Spikes: Is $80k Next?