Bernstein cuts price targets for Bitcoin miners amid underperformance relative to BTC in 2025

Quick Take Bernstein analysts have cut their 2025 price targets for Bitcoin miners in their coverage amid this year’s underperformance against BTC. Meanwhile, the analysts raised their price target for Coinbase shares earlier this week, sparking comparisons to Robinhood’s momentum.

Analysts at research and brokerage firm Bernstein have cut their 2025 price targets for Bitcoin miners IREN, CleanSpark and Riot Platforms amid significant underperformance compared to BTC so far this year.

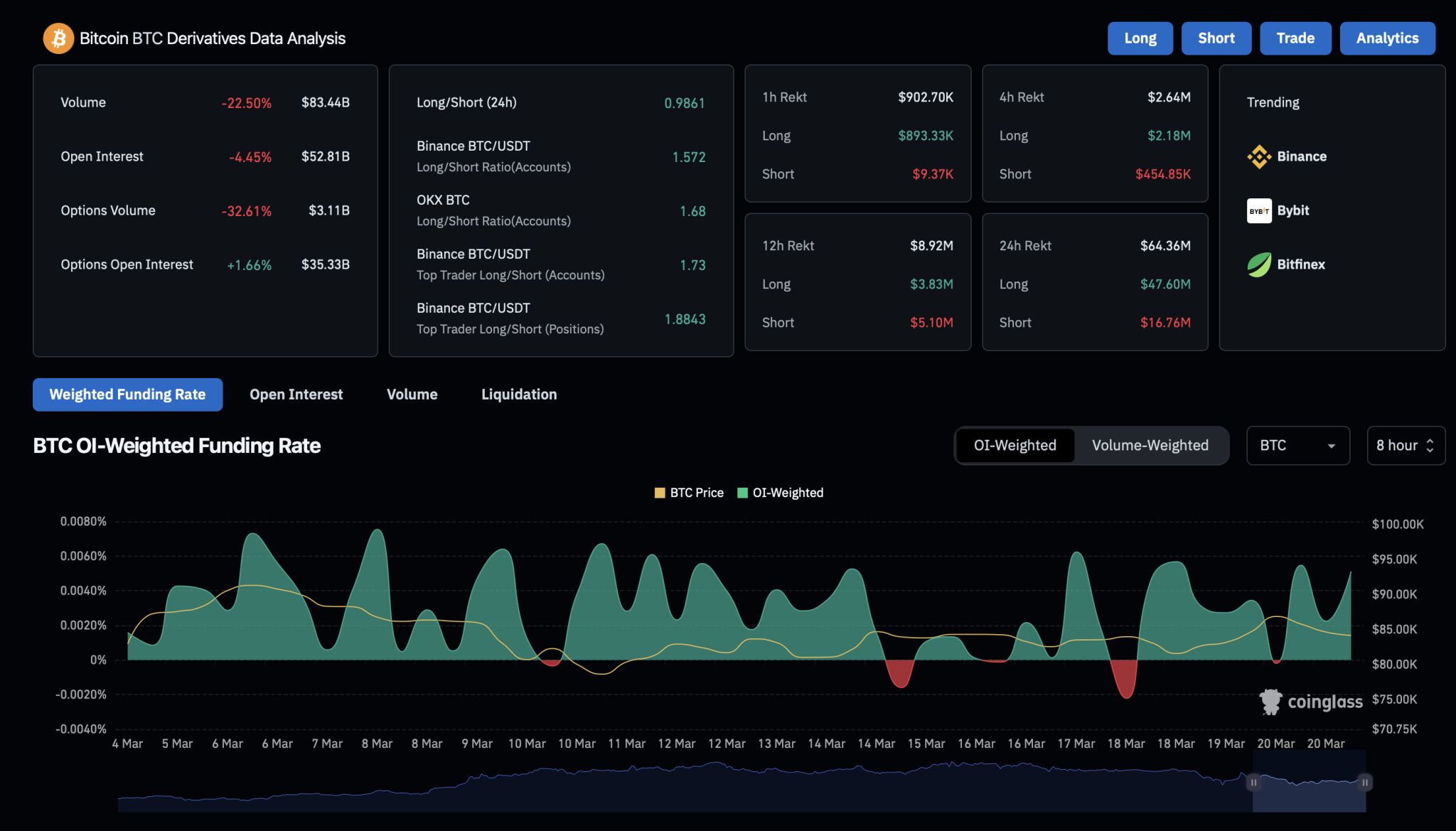

"Bitcoin miners have gone through a painful correction this year (down 20-40%) vs. bitcoin being down 10%," analysts led by Gautam Chhugani wrote in a Thursday note to clients. "Overall, miners' price action has been disappointing, with no significant upside participation in Q4 last year and worse than bitcoin correction YTD."

Institutional interest in miners has been more focused on the AI/HPC (high-performance computing) narrative and not as much on the bitcoin commodity cycle, the analysts added. However, the strongest AI data center hosting diversification advocates like IREN and Core Scientific have performed worse than historically pure-play Bitcoin miners such as Riot and MARA this year despite substantial outperformance in 2024.

Bitcoin vs. miner YTD returns. Image: Bernstein.

Bernstein's updated year-end price target for IREN is now $20 compared to $26 previously, primarily due to the higher overall industry hash rates negatively impacting IREN's bitcoin production and market share. Additionally, IREN is facing higher cash outflows due to ongoing bitcoin capital expenditures, the analysts said.

IREN's stock closed up 9.3% at $7.20 on Wednesday, according to The Block's IREN Price page , at a $1.4 billion market cap.

The firm's price target for CleanSpark has also been lowered from $30 to $20 for similar hash rate and market share reasons, alongside its bitcoin treasury strategy, again resulting in lower cash flows. CLSK closed up 5.5% at $8.01 with a $2.1 billion market cap.

Finally, the Bernstein analysts cut their price target for Riot from $22 to $19, citing its substantial reallocation of resources for AI/HPC purposes, halting its Bitcoin mining extension plans and directly affecting revenue growth prospects. RIOT closed up 5.1% at $7.78 on Wednesday, raising its market cap to $2.6 billion.

Meanwhile, Bernstein kept its price targets for MARA and Core Scientific unchanged at $23 and $17, respectively, citing Core Scientific's valuable power contracts with AI Hyperscaler CoreWeave and MARA's fair value gains on its substantial bitcoin holdings of 46,374 BTC ($3.95 billion). MARA is the market-leading public Bitcoin miner, closing up 3.8% on Wednesday at $12.53 with a $4.2 billion market cap. CORZ closed up 8.2% at $8.68, with a market cap of $2.4 billion.

The Bernstein analysts also retained their $200,000 bitcoin price target by year-end.

Coinbase price target raised, sparking comparisons to Robinhood

On Tuesday, the Bernstein analysts initiated coverage for Coinbase with an outperform rating, setting a price target of $310 for its stock — 69% to the upside — despite COIN also underperforming bitcoin this year. Coinbase stock has fallen 26.2% in 2025 compared to bitcoin's 10.2% decline, according to The Block's COIN Price page , currently trading for around $190.

The top investor question that followed was whether they should invest in Coinbase or Robinhood, Chhugani said in a separate note on Thursday. While the analysts are bullish on both assets, they said Robinhood has the most impressive product pipeline driving momentum in scalable revenue lines, but Coinbase is more "misunderstood."

Investors often see Coinbase as a simple crypto trading thesis, according to the analysts, with concerns about rising competition affecting margins. However, they overlook key growth drivers like the increasing U.S. onshore trading volumes and the expected boost in stablecoin revenues from upcoming regulations amid the Trump Administration’s aspiration to make America the "crypto capital of the world," with Coinbase remaining the dominant platform to ride the tailwinds, they said.

While regulatory clarity will invite more competition from fintechs, brokers and banks, Coinbase is positioned to benefit from its strong U.S. market share amid a potential bull market, and Robinhood is expected to grow by adding new tokens, launching staking and stablecoin services and integrating with Bitstamp to expand into the global exchange market, the analysts added.

The Bernstein analysts have set a price target of $105 for Robinhood compared to its current trading price of around $43, having outperformed bitcoin with a 12.4% gain in 2025.

Chhugani maintains long positions in various cryptocurrencies. Certain affiliates of Bernstein act as market makers or liquidity providers in the debt or equities securities of Riot Platforms, Coinbase and Robinhood.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Price Today (March 21, 2025): Bitcoin & Altcoins Update; XRP, SOL Drops 4%

TON Bounces from Crucial Support Zone — Will SUI Follow the Same Path?

INJ and KAVA Eye Breakout from Falling Wedge – Reversal on the Horizon?

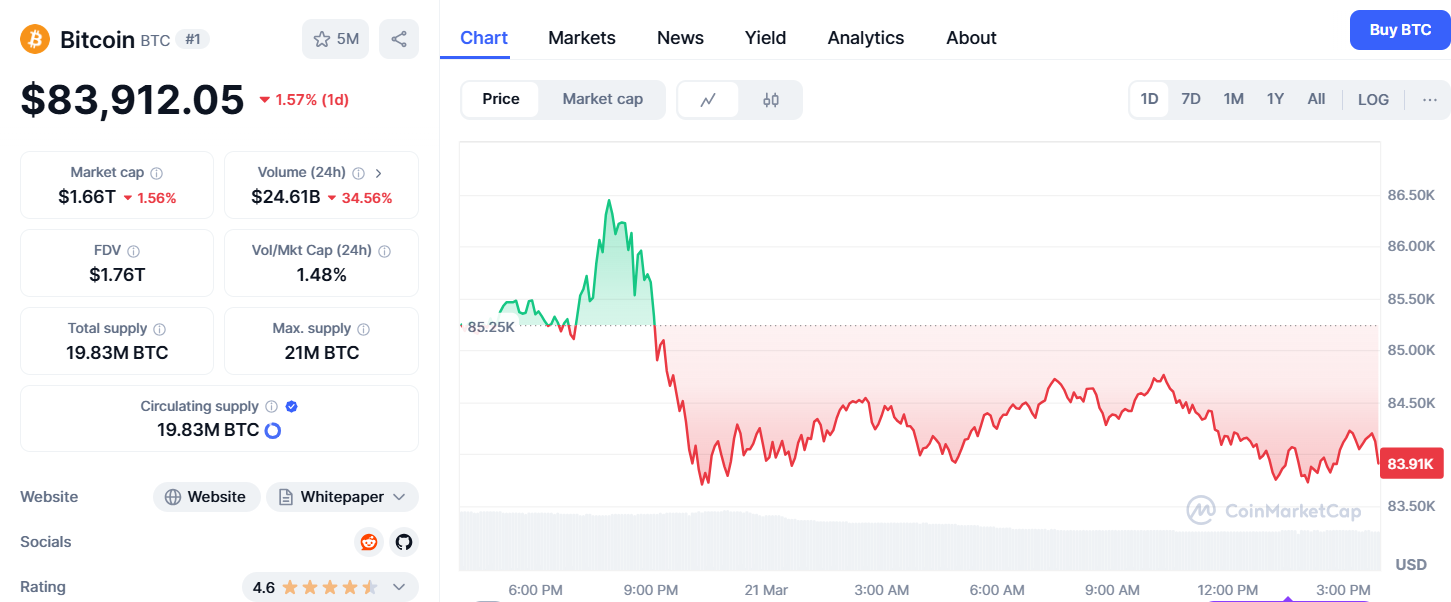

Bitcoin Breaks Below $85k as Leverage Spikes: Is $80k Next?