News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.16)|CME to Launch ADA, LINK and XLM Futures on Feb 9; Bitmine Purchases 24,068 ETH; Polygon Lays Off 30% to Pivot Toward Stablecoin Payments2Atomic Wallet raises red flags in viral $479k Monero loss claim3Bitcoin Sheds 30% of Open Interest: Is a Rebound Imminent?

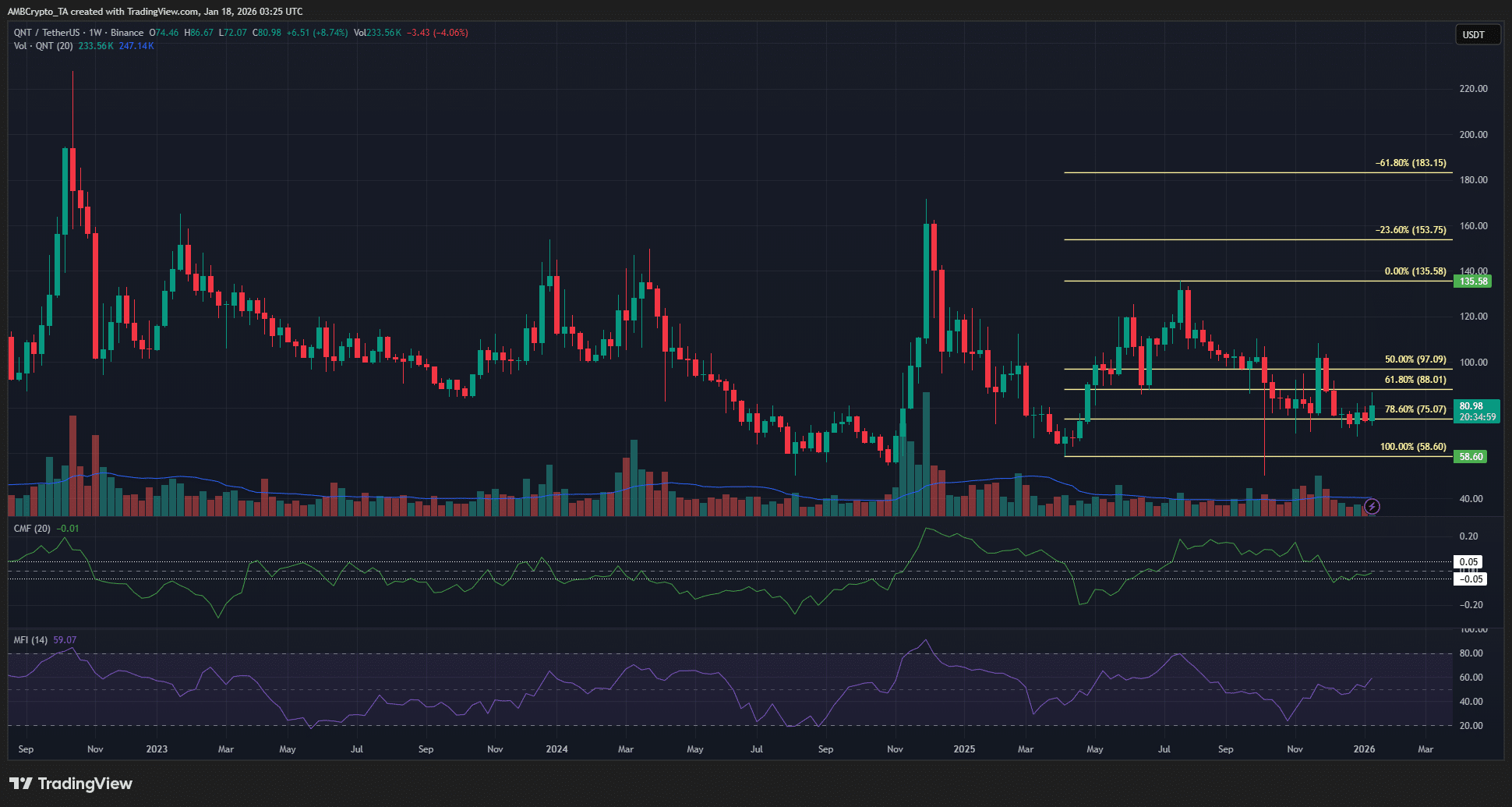

QNT jumps 12% as volume triples — Can Quant bulls defend THIS floor?

AMBCrypto·2026/01/18 08:03

GRAM Ecosystem Joins EtherForge to Boost Web3 Gaming Across Chains

BlockchainReporter·2026/01/18 08:00

Everyone to get their own AI friend in five years, Microsoft executive says

Cointelegraph·2026/01/18 07:21

Bitcoin’s Weekend Journey Sparks New Market Trends

Cointurk·2026/01/18 06:36

Solana DEX Jupiter Unveils JupUSD, Returning Native Treasury Yield to Users

BlockchainReporter·2026/01/18 03:00

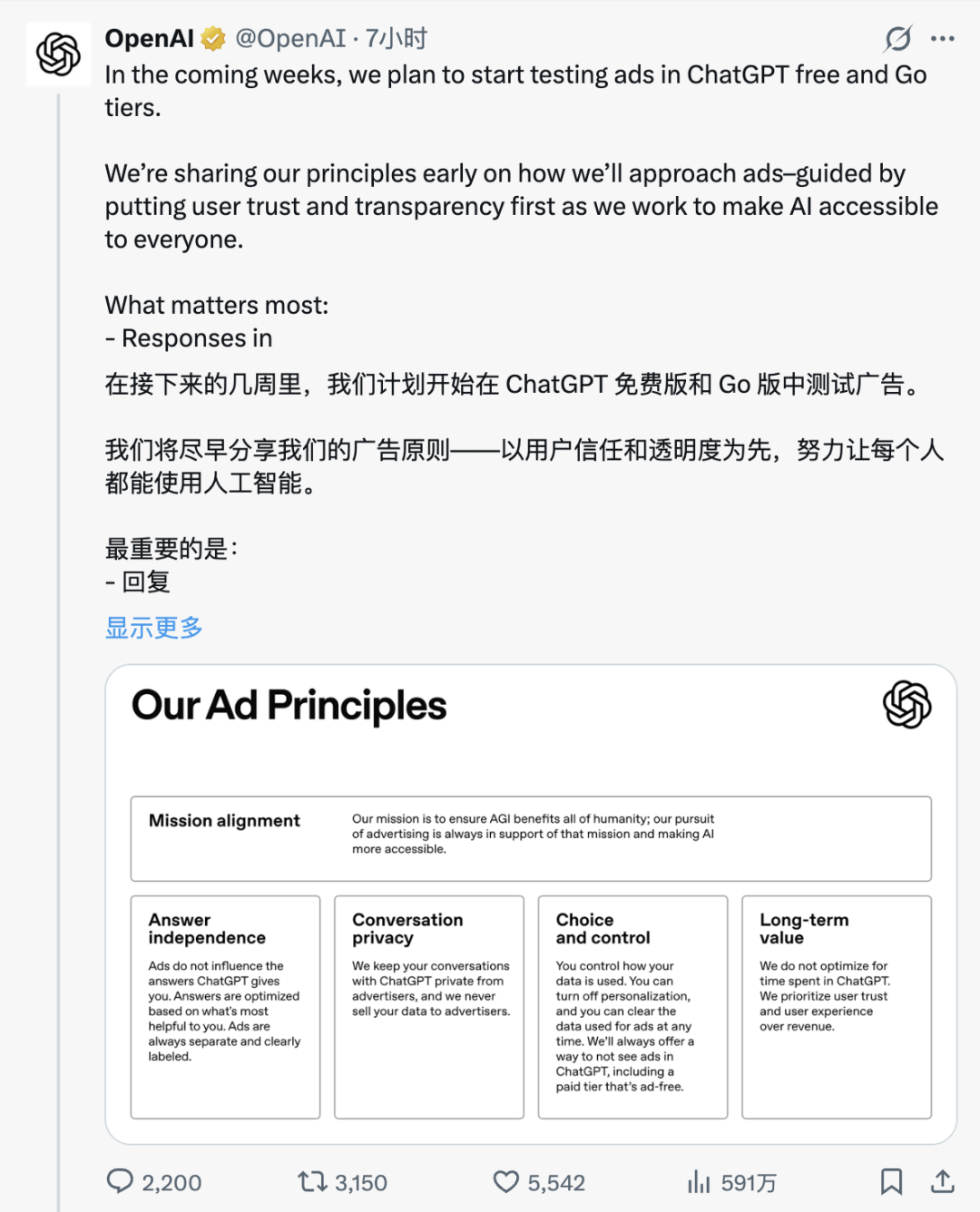

ChatGPT suddenly announces ads, $8 subscription plan can't avoid them

爱范儿·2026/01/18 02:40

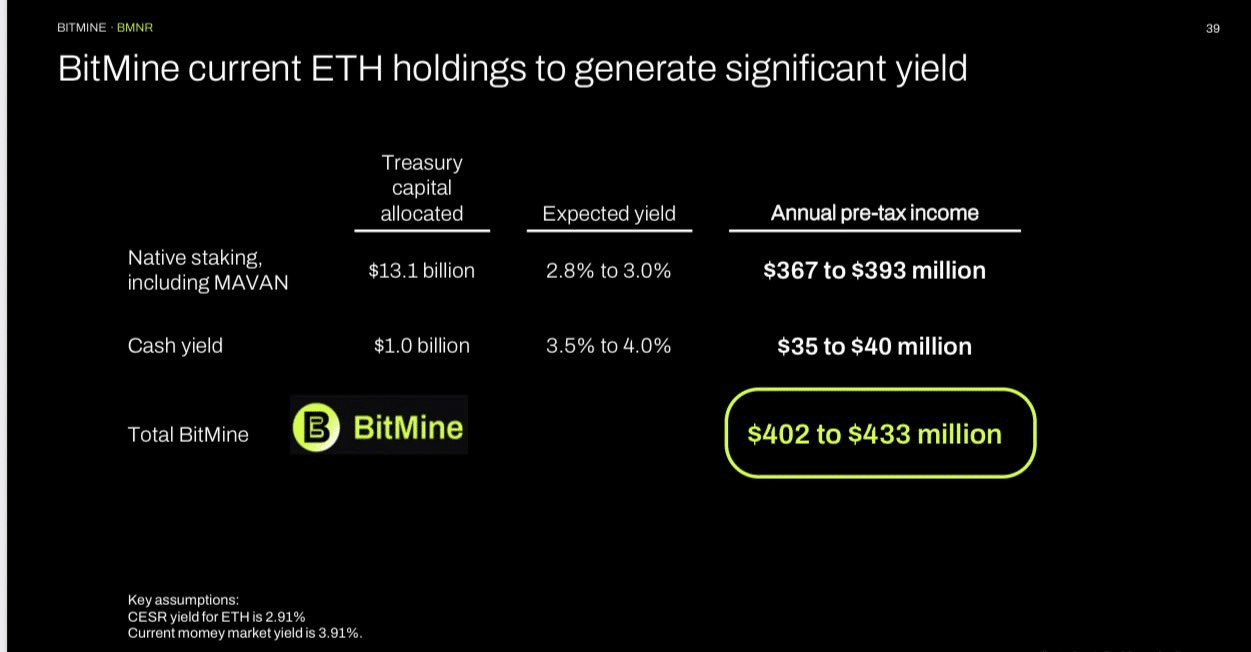

From $3.5K to $12K? Here’s why BMNR’s Ethereum forecast makes sense

AMBCrypto·2026/01/18 02:03

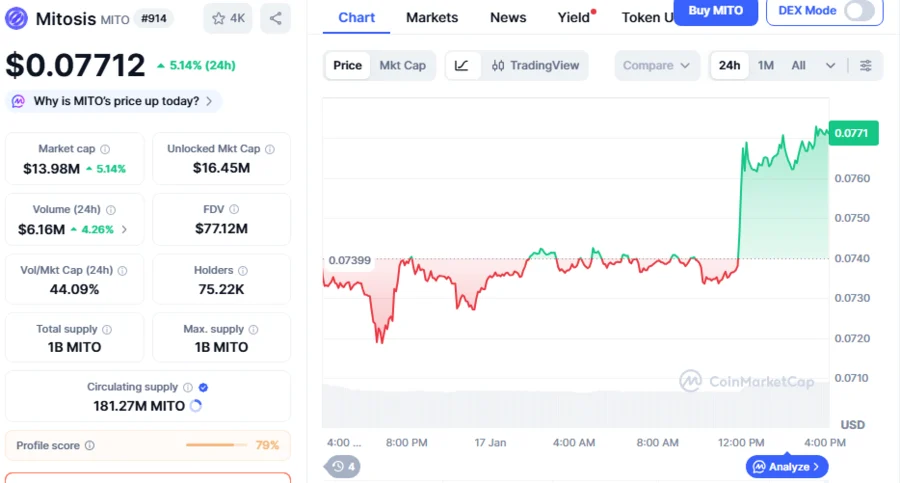

Mitosis Price Flashes a Massive Breakout Hope; Cup-And-Handle Pattern Signals MITO Targeting 50% Rally To $0.115305 Level

BlockchainReporter·2026/01/18 01:00

Flash

08:23

Algorand Enables USDC Bridging From Solana, Ethereum, Base, Sui, and StellarAllbridge Core now supports native USDC bridging to Algorand from Solana, Ethereum, Base, Sui, and Stellar.

Algorand USDC transfers require an ASA opt-in and a small ALGO balance, usually around 0.1 ALGO per asset.

Allbridge Core has added Algorand to its cross-chain bridge network, allowing support of environments other than EVMs, as well as native transfers of USDC to the Algorand ecosystem. The update enables users to transfer the USDC in its own form, as opposed to wrapped tokens.

Allbridge Core said the integration is designed to help users access Algorand-based DeFi applications with lower friction. The announcement positions Algorand as the latest non-EVM Layer 1 supported by the bridging platform.

The @Allbridge_io Algorand integration is now live.

Users can now bridge USDC to Algorand from several chains, including Solana, Avalanche, Base, Ethereum, Sui, Stellar, and more.

Interoperability on Algorand is here 🤝

Learn more below. pic.twitter.com/RayLsXTv5r

— Algorand Foundation (@AlgoFoundation) January 16, 2026

The integration is centered on Algorand’s network design, which differs from Ethereum-compatible chains in tooling and asset standards. Algorand uses Algorand Standard Assets (ASAs), where tokens are implemented at the protocol level rather than through token smart contracts.

Native USDC Arrives on Algorand Through Allbridge Core Integration

With the launch, users can bridge native USDC between Algorand and multiple networks supported on Allbridge Core, including Solana, Ethereum, Base, Sui, and Stellar. The service is aimed at users who want to move stablecoin liquidity across ecosystems without converting into wrapped versions that may introduce additional steps or contract risk. Allbridge Core is providing a direct stablecoin entry point into the DeFi market of Algorand by offering native support for native USDC on Algorand.

Algorand instant finality is another feature that Allbridge Core cited when performing transfers. Transactions in Algorand are finalized as soon as they are added to a block, eliminating the possibility of having to wait until they have received multiple confirmations. This will help minimize transfer uncertainty in bridge operations, where users usually check confirmations before money is disbursed.

The update also introduces an Algorand-specific requirement that users must complete before receiving USDC. Algorand accounts must “opt in” to an asset ID before that token can be deposited into the wallet. The opt-in is an on-chain transaction that links the asset to the account and requires a small ALGO balance, commonly around 0.1 ALGO per asset, to cover storage rules on the network. Allbridge Core noted that its interface and supported wallets guide users through this step before the bridge finalizes the transfer.

Wallet support is handled through Algorand-native options rather than MetaMask. Allbridge Core said it integrates with Pera Wallet for mobile users and Lute for users who prefer a browser extension. The bridge also includes an option to send a small additional amount of ALGO alongside a transfer to cover basic network fees and enable account setup steps, including the USDC opt-in.

Earlier on, CNF reported that the Algorand Foundation has released key milestones for its 2026 roadmap, following technical progress made across 2025. The plan includes a confirmed expansion into the US, a new board announcement, and upcoming product releases such as Rocca Wallet and AlgoKit 4.0.

08:04

Pantera Capital Crypto Fund Makes Over $21 Million Profit This WeekBlockBeats News, January 18th, according to Nansen data, crypto fund Pantera Capital is far ahead on the P&L leaderboard this week, with three wallets making profits of $12.1 million, $6 million, and $3.6 million, respectively. Meanwhile, Arrington XRP Capital also saw gains, but on a smaller scale compared to Pantera Capital. Most other funds had a mediocre performance this week.

07:59

Meme coin "1" reaches a market cap of over $10 million and a trading volume of $12.3 million within 6 hours of launchBlockBeats News, January 18, according to GMGN data, the Meme token "1" (Ucan fix life in1day, you can change your life in one day) on BNB Chain saw its market capitalization briefly surpass 10 million USD, and is now reported at 7.6 million USD, with a trading volume of 12.3 million USD within 6 hours of launch. BlockBeats reminds users that most Meme coins have no real use cases and their prices are highly volatile. Please invest cautiously.

News