News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.29)|HYPE, SUI, and EIGEN tokens are set to undergo large unlocks this week; Bitcoin spot ETFs recorded a net outflow of $276 million in a single day, marking six consecutive days of net outflows2Bitget US Stock Daily Report | Spot Silver Continues to Surge, Refreshing 83 USD High; CME Raises Metal Performance Margins; US Stocks Focus on Fed Policy at Year-End (December 29, 2025)

China’s Digital RMB Remains Non-Interest-Bearing

Bitcoininfonews·2025/12/29 07:06

Michael Burry’s AI Bubble Bet: $1 Billion Short

Bitcoininfonews·2025/12/29 07:06

China Prepares for a Major Policy Shift in the Digital Yuan Journey

Cointurk·2025/12/29 07:03

Bitcoin to $10,000? Bloomberg Makes Shocking Crash Prediction

UToday·2025/12/29 06:30

Bitcoin ETFs See Largest Drawdown Since Launch

UToday·2025/12/29 06:30

933,890,048,712 SHIB in 24 Hours: Can Shiba Inu Still Get a Chance?

UToday·2025/12/29 06:30

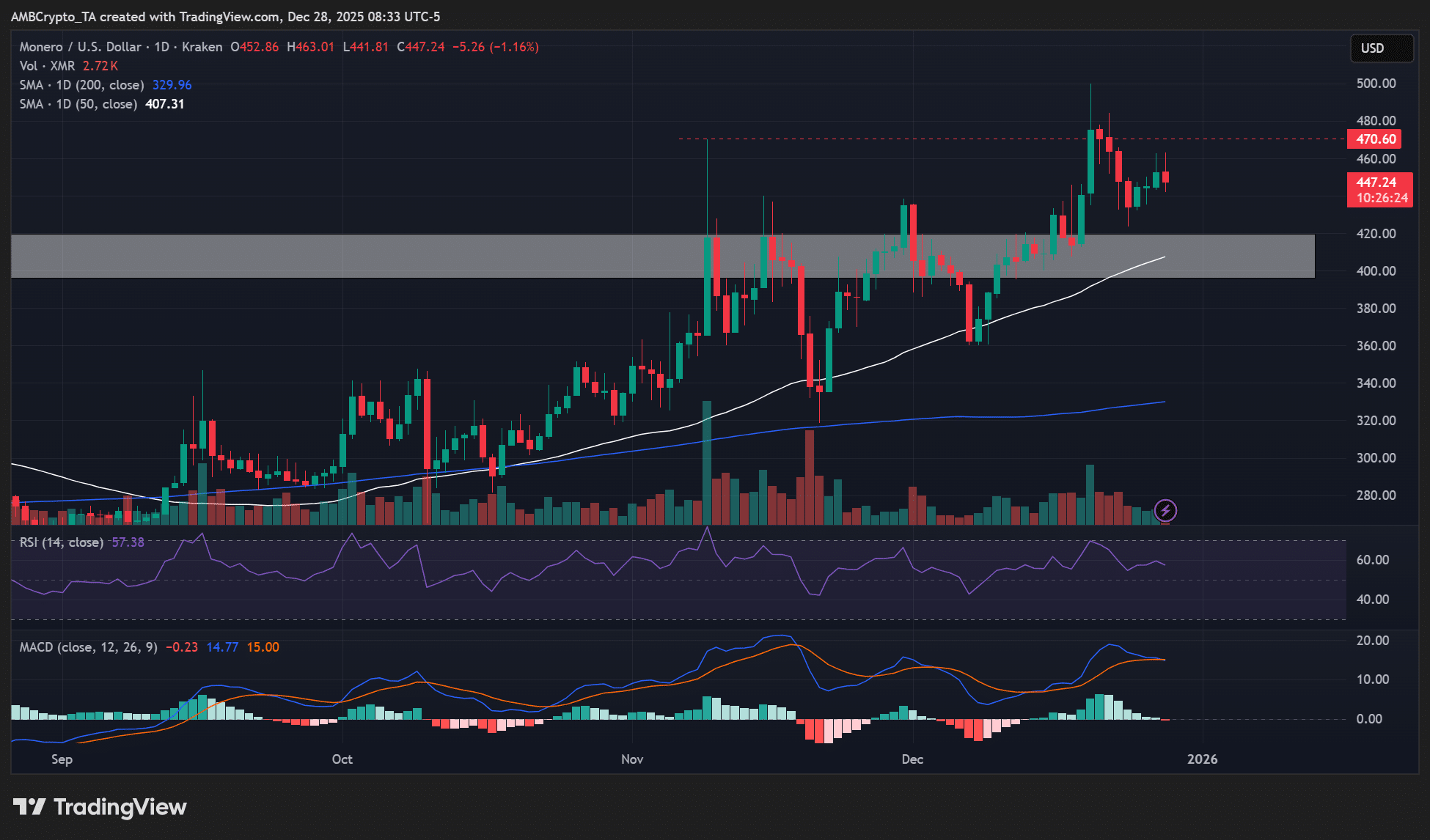

Monero – Why XMR buyers should wait for this potential opportunity

AMBCrypto·2025/12/29 06:03

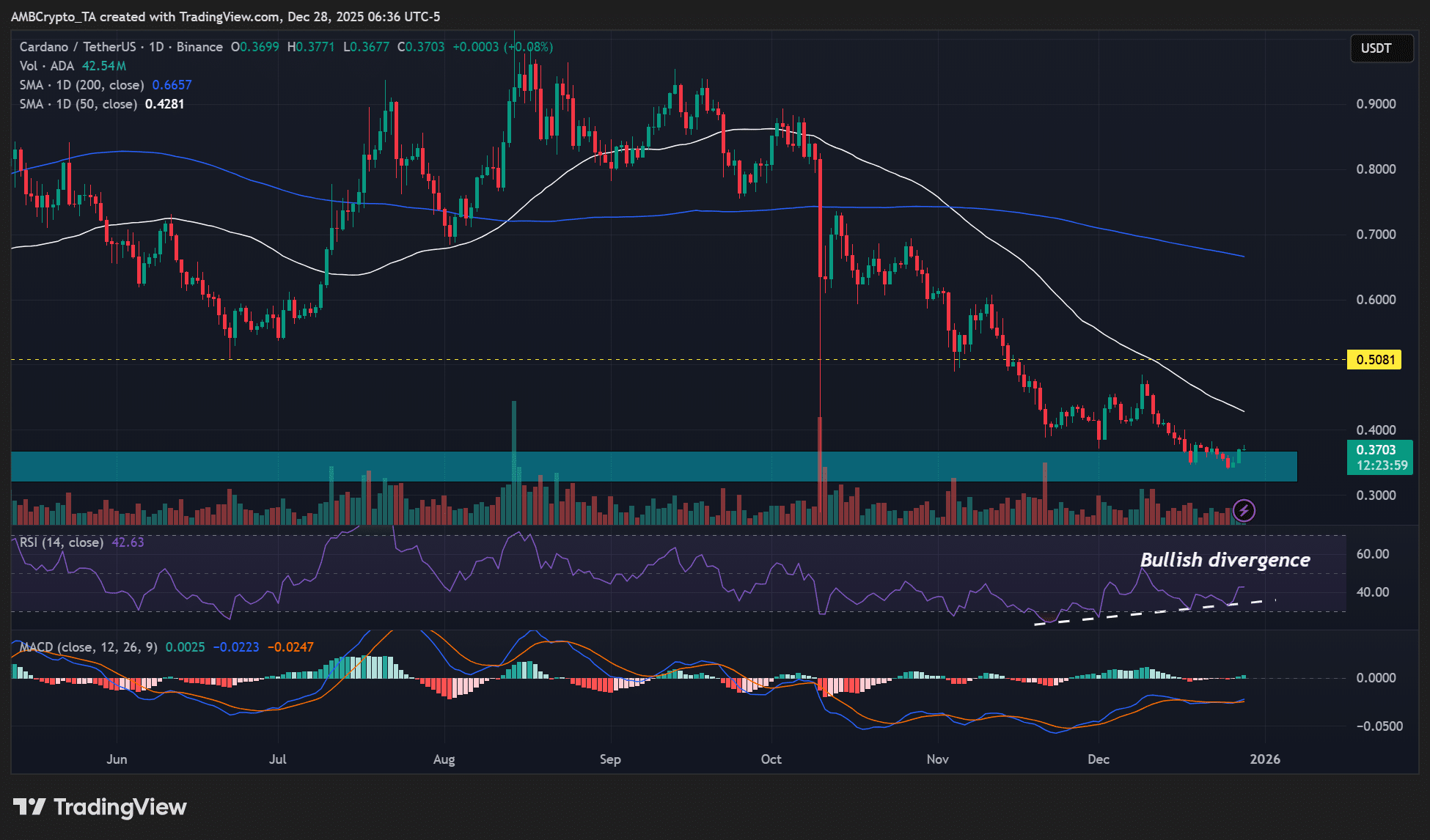

Cardano’s 10% hike – Will ADA’s price recovery extend into 2026?

AMBCrypto·2025/12/29 05:03

Why Bitcoin traders stay cautious despite global liquidity boom

AMBCrypto·2025/12/29 04:03

Is Web3 gaming dead? How can compliance revive true asset ownership?

币界网·2025/12/29 03:09

Flash

07:12

Kong Jianping: The underlying logic of taking over bitcoin is undergoing a fundamental change, and the next rally may no longer require new narratives or beliefs.According to TechFlow, on December 29, Nano Labs founder Kong Jianping posted on social media stating, “The underlying logic of taking over bitcoin is undergoing a fundamental change.” The path of previous bull markets was very clear: geeks → programmers → retail investors → mainstream finance. Each round of price increase was the result of cognitive diffusion. But after 2024, ETFs and institutional holdings have changed the supply and demand structure. Some BTC is being converted into dormant assets that do not participate in short-term cycles, just like gold entering the central bank system. When chips are locked up for the long term and there are fewer and fewer sellers willing to repeatedly enter and exit, the price driver will shift from “cognitive diffusion” to “supply contraction.” The next round of price increases may no longer require new narratives or beliefs.”

07:06

BlockSec Phalcon: Detected a suspicious transaction targeting MSCST on BSC, with an estimated loss of around $130,000.Foresight News reported, according to BlockSec Phalcon monitoring, a suspicious transaction targeting MSCST on BSC has been detected, with an estimated loss of approximately $130,000. The vulnerability stems from the lack of access control (ACL) in MSCST's releaseReward() function, allowing attackers to exploit this flaw to manipulate the price of GPC in PancakeSwap pool 0x12da.

07:06

Kong Jianping: The driving force behind Bitcoin's price is shifting from "cognitive diffusion" to "supply contraction"BlockBeats News, December 29, Kong Jianping, former Co-Chairman of the Board at Canaan and now founder and Chairman of Nano Labs, stated yesterday: "The logic behind bitcoin's handover is undergoing a fundamental change. The bull market path in the past was very clear: geeks → programmers → retail investors → mainstream finance, with each round of price increase resulting from the spread of awareness. But after 2024, ETFs and institutional holdings have changed the supply and demand structure. A portion of BTC is being transformed into dormant assets that do not participate in short-term cycles, just like gold entering the central banking system. When chips are locked up for the long term and there are fewer and fewer sellers willing to repeatedly enter and exit, the price driver will shift from 'awareness diffusion' to 'supply contraction'. The next round of price increases may no longer require new narratives and beliefs."

News