News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitcoin network activity hits 12-month lows as transactions drop 55% from peak2SAND and MANA Near Key Resistance – Will Breakouts Trigger a Recovery?3POL and RENDER Approaching Key Resistance – Will Breakouts Trigger a Recovery?

ai16Z Price Prediction: AI16Z Plummets 19% Amid The Crypto Crash, But Traders Rush To Buy This ICO With Time Running Out

Insidebitcoin·2025/01/10 04:11

Bitcoin’s Trump trade dented by rising yields and strong US dollar

Bitcoin’s ability to hold $100,000 is being suppressed by rising treasury yields and a strengthening dollar. Is the “Trump trade” ending?

Cointelegraph·2025/01/10 03:22

SUI Open Interest Doubles, Price Now 6% From All-Time High

SUI is within 6% of a new all-time high, backed by surging Open Interest and bullish technicals. Momentum points to further upside.

BeInCrypto·2025/01/10 03:00

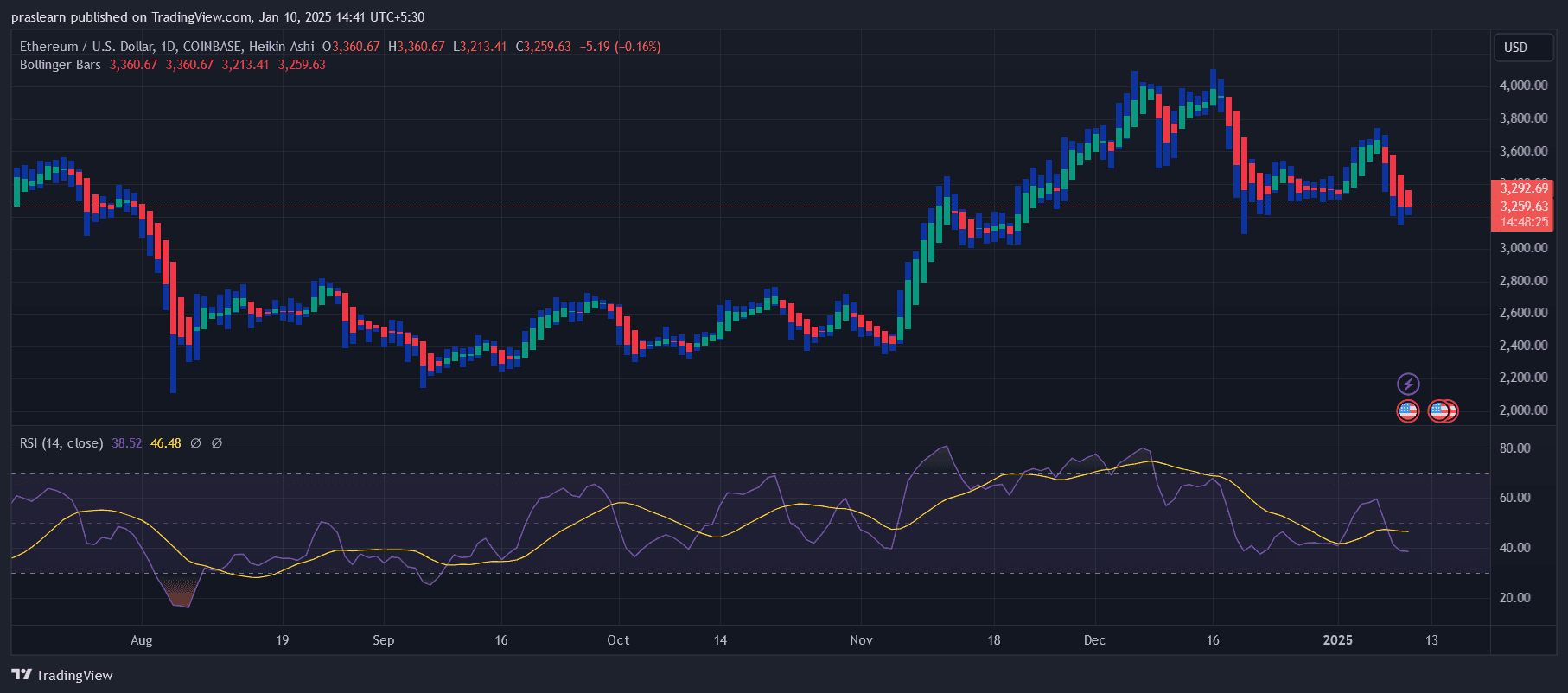

ETH price: A DROP or SURGE is NEXT?

Cryptoticker·2025/01/10 01:40

AI16Z Leads Market Gains with 8% Jump, but Rally’s Strength Is Questioned

AI16Z’s 8% surge and $450M trading volume dominate the market, but bearish technicals point to speculative trading and fading momentum. Demand will decide its next move.

BeInCrypto·2025/01/10 01:30

Krypton DAO (KRD) price soars 513% over the week: will it hold the gains?

Coinjournal·2025/01/09 22:44

How Many Interest Rate Cuts Will the Fed Make This Year? Analyst Answered – “But Pay Attention to the Date…”

StoneX's Chief Market Strategist Kathryn Rooney Vera evaluated the FED's possible policy in her statement.

Bitcoinsistemi·2025/01/09 21:55

Shiba Inu Grapples With Heavy Bearish Forces: Will Support Levels Hold?

CryptoNewsNet·2025/01/09 20:55

Time to Buy Bitcoin? $1.02B BTC Outflow Raises Hopes of Price Rebound

CryptoNewsNet·2025/01/09 20:55

Crypto Market Continues to Bleed – $460 Were Liquidated in the Past 24 Hours

Cryptodnes·2025/01/09 20:22

Flash

- 10:53A certain address has transferred about 800,000 $OM to CEX, valued at 5.952 million US dollarsPANews reported on February 15th, blockchain data shows that about 6 minutes ago, a certain address transferred 800,100 $OM to CEX, valued at $5,952,744.

- 09:46Market News: Trump may consider revaluing gold reservesOn February 15, Bloomberg macro strategist Simon White wrote that gold and silver are flowing into U.S. warehouses at a rate unseen since the pandemic began. The hoarding by emerging market central banks over the years may have caused a shortage of physical metals in Western countries. However, another less likely theory is that the United States is preparing to revalue its gold reserves. Recently, large amounts of gold and silver have been pouring into the warehouses of the New York Commodity Exchange (Comex), leading to speculation that the U.S. is about to revalue its vast gold stocks according to market prices (currently close to $3,000). The U.S. government's gold reserves are currently accounted for at a historical price of $42 per ounce, while current market prices are nearing $3,000 per ounce - this huge valuation gap has sparked speculation on Wall Street and beyond. Under Trump's administration known for stirring things up, such speculation cannot be completely ruled out.

- 09:41Today's Fear and Greed Index has risen to 50, the level remains neutralPANews reported on February 15th, according to Alternative data, the Fear and Greed Index rose to 50 today (it was 48 yesterday), maintaining a neutral level. Note: The Fear Index threshold is 0-100, including indicators: Volatility (25%) + Market Trading Volume (25%) + Social Media Heat (15%) + Market Survey (15%) + Bitcoin's Proportion in the Entire Market (10%) + Google Hot Word Analysis (10%).