News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (February 14) | Dog-themed memecoins surge, OpenSea launches $SEA 2TRUMP Tops Meme Coins with $1.50 Billion Trading Volume as Market Rebounds3Shiba Inu Gains 8% in a Week But Whale Holdings Drop to a Two-Year Low

Pepe Price Prediction: Key Levels to Watch Next Week

Cryptoticker·2025/01/11 10:47

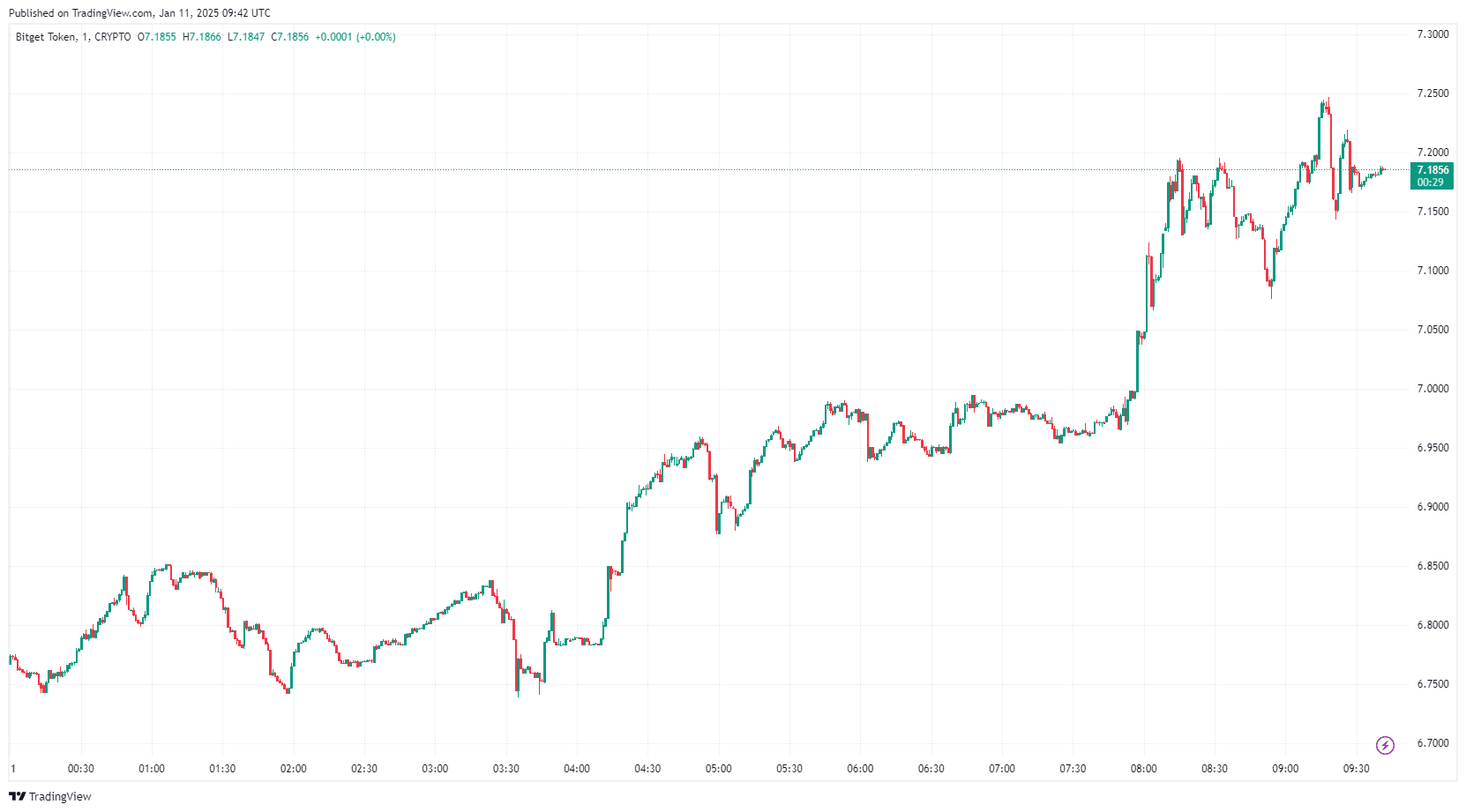

Bitget Token Price Surge amid Market Downturn: New 2025 BGB ATH?

Cryptoticker·2025/01/11 03:00

Bitcoin’s Resilience Above $94,000 May Indicate Potential for $100,000 Retest

Coinotag·2025/01/11 01:55

A comprehensive look at Pippin, which recently reached a market value of 200 million USD: An underrated dark horse in AI agent frameworks

Pippin aims to help developers and creators leverage advanced AI technology in a modular way.

Chaincatcher·2025/01/10 23:55

Best New Meme Coins with 1000X Potential: BTFD Coin’s Presale Rally Sparks Buzz While Pudgy Penguins and Osaka Protocol Thrive

CryptoNewsFlash·2025/01/10 22:33

Standard Chartered launches crypto custody services in Europe

Grafa·2025/01/10 22:10

72 hours after the market crash: Which on-chain tokens are rising against the trend?

Odaily·2025/01/10 18:55

Elon Musk’s Grok Says Cardano (ADA) Will Trade At This Price On January 31, 2025

Timestabloid·2025/01/10 18:01

Fantom (FTM) Climbs 3% While Whale Sell-Off Puts Recovery at Risk

Fantom struggles to recover from a 20% weekly drop despite a 3% daily gain. Weak whale activity and market trends weigh on recovery efforts.

BeInCrypto·2025/01/10 18:00

Flash

- 02:19a16z releases ElizaOS framework roadmapai16z posted the ElizaOS framework roadmap on platform X, with core content including: autonomy and adaptability, modularity and combinability, decentralization and open collaboration. In addition, the organization emphasized that the team's mission is to develop a scalable, modular, open-source AI agent framework that can thrive in both Web2 and Web3 ecosystems. They believe that AI agents are a key step towards AGI (Artificial General Intelligence), capable of creating increasingly autonomous and powerful systems.

- 02:16Analyst: Insufficient participation from retail investors may delay the altcoin market trend, sector rotation could replace general riseAccording to a message from ChainCatcher, as reported by Cointelegraph, the activity of several mainstream public chains has significantly declined from their 2021 peak, indicating that the altcoin market is still in a speculative phase. The total market value of altcoins excluding the top ten cryptocurrencies is currently $277 billion, down 77% from its November 2021 peak of $492 billion. Nansen analyst Nicolai Sondergaard pointed out that because meme coins have attracted a lot of investor attention and funds, the altcoin trend may be delayed. "The season for altcoins will still come, but it may take on a different form than before. There are more tokens now with greater decentralization; although most are rising in value, specific tracks and tokens will far exceed other sectors." Redstone co-founder Marcin Kazmierczak added that while some altcoin prices have risen without an increase in active addresses, this indicates that we're still in a speculative phase and haven't yet entered into widespread adoption.

- 02:14The New York Stock Exchange Arca has applied for permission to allow Grayscale's Ethereum ETF to be pledgedAccording to The Block, the latest documents show that the New York Stock Exchange Arca has applied for permission to stake Grayscale's Ethereum ETF. Earlier this week, Cboe BZX Exchange asked the SEC to allow staking of ETH held in 21Shares Core Ethereum ETF. If approved, these ETFs will be able to earn additional returns from their large holdings of ETH, which may be passed on to investors. The New York Stock Exchange's document notes that the "trust" will also receive a portion of the staking rewards.