News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitcoin all-time high due in '2-3 weeks' as traders see BTC copying gold2Goldman Sachs doubles down on Bitcoin ETFs, boosting holdings to $1.5 billion in Q4 20243Bitcoin Stalls: Is a Market Correction Looming? In-Depth Technical Analysis for February 11, 2025

ai16Z Price Prediction: AI16Z Plummets 19% Amid The Crypto Crash, But Traders Rush To Buy This ICO With Time Running Out

Insidebitcoin·2025/01/10 04:11

Bitcoin’s Trump trade dented by rising yields and strong US dollar

Bitcoin’s ability to hold $100,000 is being suppressed by rising treasury yields and a strengthening dollar. Is the “Trump trade” ending?

Cointelegraph·2025/01/10 03:22

SUI Open Interest Doubles, Price Now 6% From All-Time High

SUI is within 6% of a new all-time high, backed by surging Open Interest and bullish technicals. Momentum points to further upside.

BeInCrypto·2025/01/10 03:00

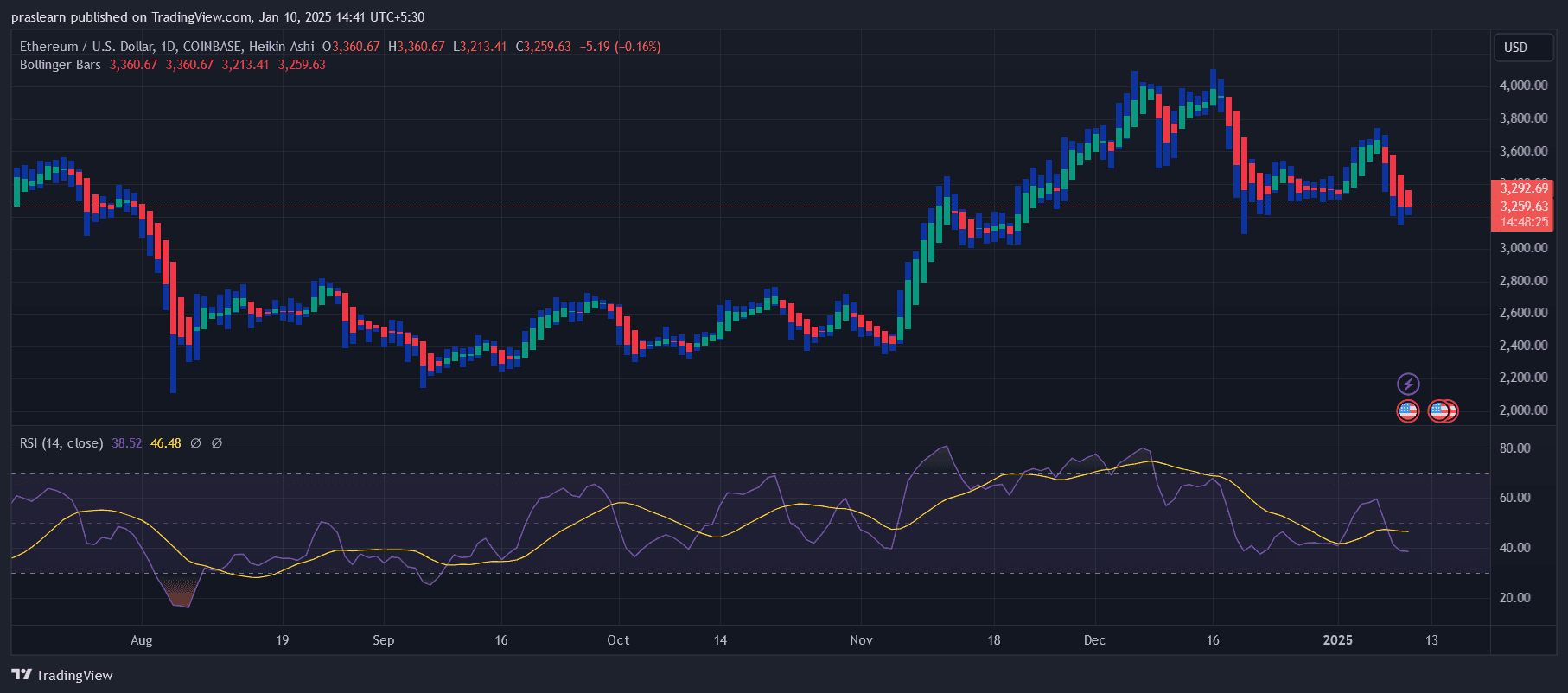

ETH price: A DROP or SURGE is NEXT?

Cryptoticker·2025/01/10 01:40

AI16Z Leads Market Gains with 8% Jump, but Rally’s Strength Is Questioned

AI16Z’s 8% surge and $450M trading volume dominate the market, but bearish technicals point to speculative trading and fading momentum. Demand will decide its next move.

BeInCrypto·2025/01/10 01:30

Krypton DAO (KRD) price soars 513% over the week: will it hold the gains?

Coinjournal·2025/01/09 22:44

How Many Interest Rate Cuts Will the Fed Make This Year? Analyst Answered – “But Pay Attention to the Date…”

StoneX's Chief Market Strategist Kathryn Rooney Vera evaluated the FED's possible policy in her statement.

Bitcoinsistemi·2025/01/09 21:55

Shiba Inu Grapples With Heavy Bearish Forces: Will Support Levels Hold?

CryptoNewsNet·2025/01/09 20:55

Time to Buy Bitcoin? $1.02B BTC Outflow Raises Hopes of Price Rebound

CryptoNewsNet·2025/01/09 20:55

Crypto Market Continues to Bleed – $460 Were Liquidated in the Past 24 Hours

Cryptodnes·2025/01/09 20:22

Flash

- 12:02QCP Capital: Wall Street shows no signs of panic, CPI data may become a key catalyst for the dollar indexSingaporean cryptocurrency investment firm QCP Capital stated today that the market has been very boring over the past two weeks. Despite ongoing tariff measures between the United States, Canada, and Mexico, as well as tariffs imposed on Chinese imports and US steel and aluminum imports, traditional financial (TradFi) markets have yet to find a clear direction. According to various indicators, Wall Street does not show signs of panic. Credit yields remain at cyclical lows and there is no widening in credit spreads between investment-grade bonds and junk bonds. The VIX index seems stable around 16, indicating that market participants have bought protection against any further negative news. Powell's testimony in the Senate reinforced the Federal Reserve's 'wait-and-see' attitude towards interest rate cuts, suggesting a possible slowdown in rate cuts by 2025. However, despite this hawkish rhetoric, the US Dollar Index (DXY) failed to rise. Referring to data from the Commodity Futures Trading Commission (CFTC), we infer that there is heavy long positioning in USD. Interest rate differentials also suggest that USD is overvalued relative to other currencies which may explain why DXY struggles for upward momentum. Given that negative news might already be priced in, we believe USD now faces greater downside risk. Any positive news could force investors who are long on USD to close their positions en masse potentially pushing up prices of risky assets.The release of Consumer Price Index (CPI) tonight could trigger a significant drop in DXY. However,this rally may not benefit everyone.Bitcoin continues underperforming stocks and gold,suggesting some hesitation within crypto community.Liquidity remains thin for many new projects listed each week,and last week’s large-scale liquidation left many traders penniless.For those still holding long positions on cryptocurrencies,following institutional capital flows and buying downside protection might be best strategy—especially since put options are relatively cheap right now.

- 11:59Greeks.Live: The range of $92,000-$94,000 is an important support area for BTC. If it breaks through, it may "trigger a massive sell-off"Analyst Adam from Greeks.live has released the daily brief for the English community, stating that Bitcoin's price is testing a key support level at $95,000. Market data shows that the range of $92,000-$94,000 forms an important technical support area and breaking through it could "trigger massive sell-offs". The current market volume volatility is sluggish, remaining in the 45%-48% range with spot market trading volumes showing a decline.

- 11:57Skybridge Partner: Solana has a clear advantage over Ethereum in the field of tokenizationAccording to DL News, Skybridge Capital's founder and managing partner Anthony Scaramucci said on CNBC's Squawk Box that he will bet his money on Solana. Although the company holds a "small amount" of Ethereum, Solana's lower fees and faster transaction speed make him more optimistic about SOL, especially in terms of tokenization. In the field of tokenization, Solana will win this competition. If BlackRock CEO Larry Fink is right that we will eventually tokenize stocks and bonds, then Solana would be an even more obvious choice.