News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (February 11) | AI agents make a strong comeback, Trump family project WLFI buys $MOVE 2Goldman Sachs doubles down on Bitcoin ETFs, boosting holdings to $1.5 billion in Q4 20243Bitcoin Stalls: Is a Market Correction Looming? In-Depth Technical Analysis for February 11, 2025

Pepe Price Prediction: Key Levels to Watch Next Week

Cryptoticker·2025/01/11 10:47

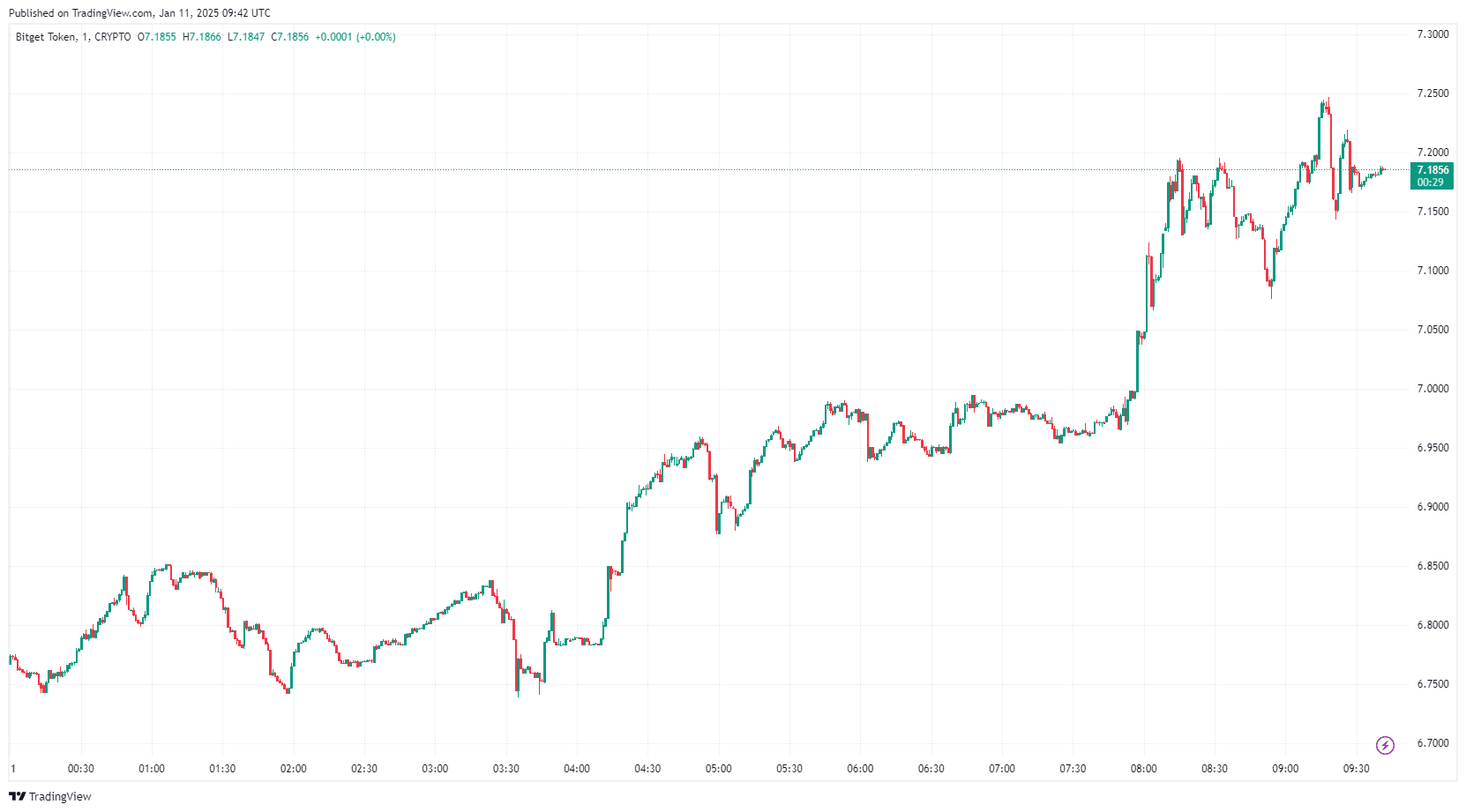

Bitget Token Price Surge amid Market Downturn: New 2025 BGB ATH?

Cryptoticker·2025/01/11 03:00

Bitcoin’s Resilience Above $94,000 May Indicate Potential for $100,000 Retest

Coinotag·2025/01/11 01:55

A comprehensive look at Pippin, which recently reached a market value of 200 million USD: An underrated dark horse in AI agent frameworks

Pippin aims to help developers and creators leverage advanced AI technology in a modular way.

Chaincatcher·2025/01/10 23:55

Best New Meme Coins with 1000X Potential: BTFD Coin’s Presale Rally Sparks Buzz While Pudgy Penguins and Osaka Protocol Thrive

CryptoNewsFlash·2025/01/10 22:33

Standard Chartered launches crypto custody services in Europe

Grafa·2025/01/10 22:10

72 hours after the market crash: Which on-chain tokens are rising against the trend?

Odaily·2025/01/10 18:55

Elon Musk’s Grok Says Cardano (ADA) Will Trade At This Price On January 31, 2025

Timestabloid·2025/01/10 18:01

Fantom (FTM) Climbs 3% While Whale Sell-Off Puts Recovery at Risk

Fantom struggles to recover from a 20% weekly drop despite a 3% daily gain. Weak whale activity and market trends weigh on recovery efforts.

BeInCrypto·2025/01/10 18:00

Flash

- 06:52Market Analysis: The European Central Bank's interest rate may need to be reduced to below neutralPGIM Fixed Income stated in a report that if the repeatedly predicted economic acceleration by the European Central Bank fails to materialize, its benchmark interest rate may need to be lowered below neutral. The bank predicts that the ECB's neutral interest rate range will be between 1.5% and 2.5%, slightly lower than the current deposit rate of 2.75%. By the end of this year, it is market-priced at 1.91%. The report states that given the weak macroeconomic situation, Europe is more susceptible to intensifying trade tensions. Nevertheless, Europe is better prepared than during the last round of tariff implementation and has significant influence in negotiations or returns.

- 06:47In the past week, whales have accumulated purchases of over 600,000 ETHAccording to on-chain analyst @ali_charts, whales have accumulated over 600,000 ETH in the past week.

- 06:44Nearly one-third of central banks have a lukewarm attitude towards the launch of CBDCs due to regulatory considerationsOn February 11, the think tank "Official Monetary and Financial Institutions Forum" (OMFIF) and security technology company Giesecke+Devrient Currency Technology released a survey report on 34 central banks. The report found that those central banks planning to launch CBDCs are still advancing their plans, while about 31% of central banks have postponed the implementation of CBDCs. The report stated that the main reasons for delay include "concerns about regulatory and governance frameworks" as well as unforeseen "economic challenges taking precedence over CBDC work". The report added: "The formulation of legislation also partly depends on political will rather than the technical capabilities or policy decisions of central banks."