News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

DappRadar warned that the surge in dUAW may be unsustainable, attributing part of the growth to “airdrop farming” activities.

Bitcoin is expected to witness a Q3 lull due to uncertainty over Mt. Gox repayment impact.

After two consecutive trading days of net outflows, US-based spot bitcoin ETFs on July 5 saw the largest net inflows since June 6, thirty days ago, largely led by gains to Fidelity’s FBTC fund, Coinglass data shows.“The outlook for Bitcoin has never been stronger,” Bitwise’s CEO posted on X.

Share link:In this post: Grayscale’s survey shows a 25% increase in US investor interest in Ethereum if a spot ETF is approved. Inflation and financial stability are driving increased interest in cryptocurrencies, especially among younger and minority groups. Cryptocurrencies have bipartisan support, with both Republicans and Democrats showing similar ownership rates and interest.Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based

- 05:14Bill Ackman "Admits Mistake": Lutnick did not pursue his own interestsHedge fund mogul Bill Ackman stated on social media: "My criticism of Lutnick was unfair. I don't think he is pursuing his own interests." Ackman had blasted Lutnick yesterday, claiming that the latter profited by shorting America. He said: "After our country and president have made great economic progress, what I consider to be a major policy mistake has occurred, and now we are facing risks due to tariffs, which makes me very frustrated." Previously, the director of the U.S. National Economic Council Hassett suggested that Ackman should soften his rhetoric on tariffs: "I urge everyone, especially Bill, to tone down their language a bit."

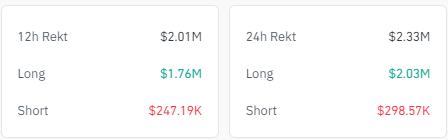

- 05:13The US Bitcoin ETF had a net outflow of 97.7 million dollars yesterdayAccording to data monitored by Farside Investors, the net outflow of the US spot Bitcoin ETF was 97.7 million USD yesterday.

- 05:12The US tariff policy threatens nearly $2 trillion in investment commitments to global businesses in the USAccording to an analysis by the Financial Times, since Trump's first term, global companies have pledged to invest at least $1.9 trillion in the United States. However, these investments may be threatened by Trump's new round of tariff policies. Recently, Trump announced large-scale tariffs on trade partners such as China, India and the European Union, causing concern among global supply chain companies. French President Macron has called for European businesses to suspend investment in the US and Japanese Prime Minister Ishiba Shigeru also expressed "strong concerns". Companies like Apple, Hyundai and SoftBank that have pledged large investments are facing tariff shocks with some already starting layoffs as a response measure. Experts warn that uncertainty brought about by tariff policies will make America a "less attractive place for investment."