News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (4.22) | Trump Calls on Powell to Cut Rates Again, SEC Welcomes Crypto-Friendly Chairman2Research Report | HyperLane Project Overview & HYPER Market Cap Analysis3Spot bitcoin ETFs see $381 million inflow as BTC holds steady amid TradFi sell-off

Bitcoin, ETH, and XRP Price Prediction For Next Week!

Cryptotimes·2025/04/20 05:55

Solana Faces Correction: Key Support at $118 and $109 Levels

Cryptonewsland·2025/04/20 05:22

MELANIA Plunges to All-Time Low After $14.75 Million Sell-Off By Insiders

MELANIA crashes 97% as team-linked wallets dump $14.75 million in tokens, sparking renewed concerns over insider activity and market manipulation.

BeInCrypto·2025/04/20 04:02

US China Tariff War Over: Will BTC Price Hit $100K?

Cryptoticker·2025/04/20 03:22

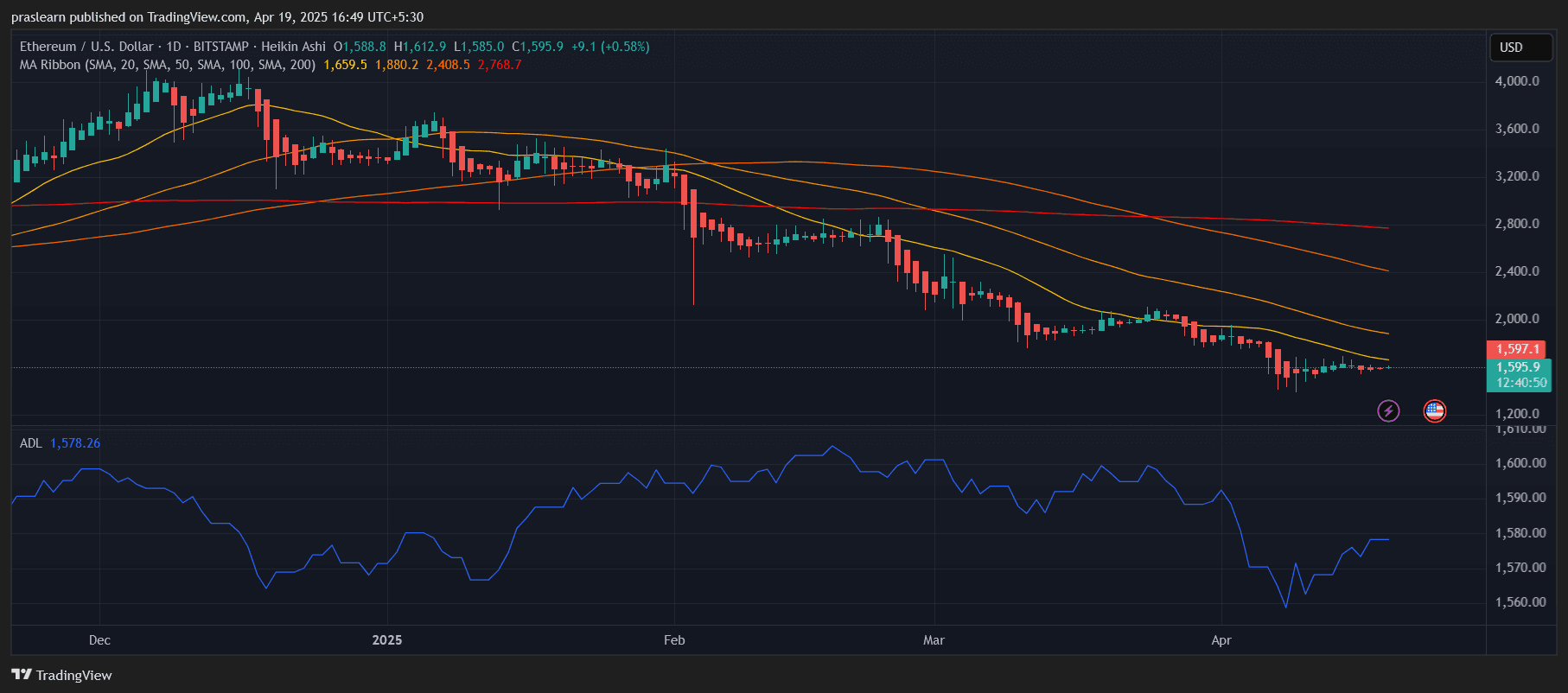

Can Ethereum Hit $1,800 Again?

Cryptoticker·2025/04/20 03:22

TRUMP Coin (TRUMP) Analysis: Here’s What the Chart Says (Bearish!)

CryptoNews·2025/04/20 01:00

Cardano Price Analysis: What Needs to Happen for a 400% Rally

CryptoNews·2025/04/20 01:00

XRP Price Analysis: Can Bulls Push Past $2.15 Resistance This Week?

CryptoNews·2025/04/20 01:00

Bitcoin Reclaims $85,000 as ETF Inflows Surge—Can Bulls Push BTC to a New All-Time High?

CryptoNews·2025/04/20 01:00

Ethereum Loses Ground To Bitcoin In The ETF Battle

Cointribune·2025/04/19 23:33

Flash

- 17:44DXY Dollar Index Intra-day Gains Expand to 0.50%, Currently at 98.85Jinse reports that the DXY Dollar Index intra-day gains have expanded to 0.50%, currently at 98.85.

- 17:30The Sell-off of U.S. Treasuries Weakens Trump's Leverage in Lowering the Dollar NegotiationsRabobank foreign exchange strategist Jane Foley stated that the recent sell-off of U.S. Treasuries has weakened Trump's leverage in negotiations for dollar depreciation with other countries. "If the U.S. Treasuries market becomes more fragile, he cannot bully everyone to the same extent." Earlier this month, after a significant drop in U.S. Treasuries, Trump announced a 90-day suspension of imposing higher retaliatory tariffs on most countries. There is speculation that Trump may seek a new "Plaza Accord," dubbed the "Mar-a-Lago Accord," to devalue the dollar. If this happens, it is likely to occur within the 90-day tariff suspension period, in exchange for a trade agreement. However, based on Trump's response to the U.S. Treasuries turmoil, this seems unlikely, Foley said.

- 17:27U.S. Stock Market Gains Expand, Cryptocurrency Stocks Lead the WayOn April 23, according to market information, U.S. stock market gains expanded during the session, with the Nasdaq up over 3%, the Dow Jones up 2.7%, and the S&P 500 Index up 2.67%. Cryptocurrency stocks led the gains among U.S. stocks, including: CEX (COIN) up 9.3%; MicroStrategy (MSTR) up 8.86%; MARA Holdings (MARA) up 10.9%; Riot Platforms (RIOT) up 13.2%; Hut 8 Corp. (HUT) up 11.8%. Tesla rose 6.16% and is set to announce its earnings report after today's market close.