News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

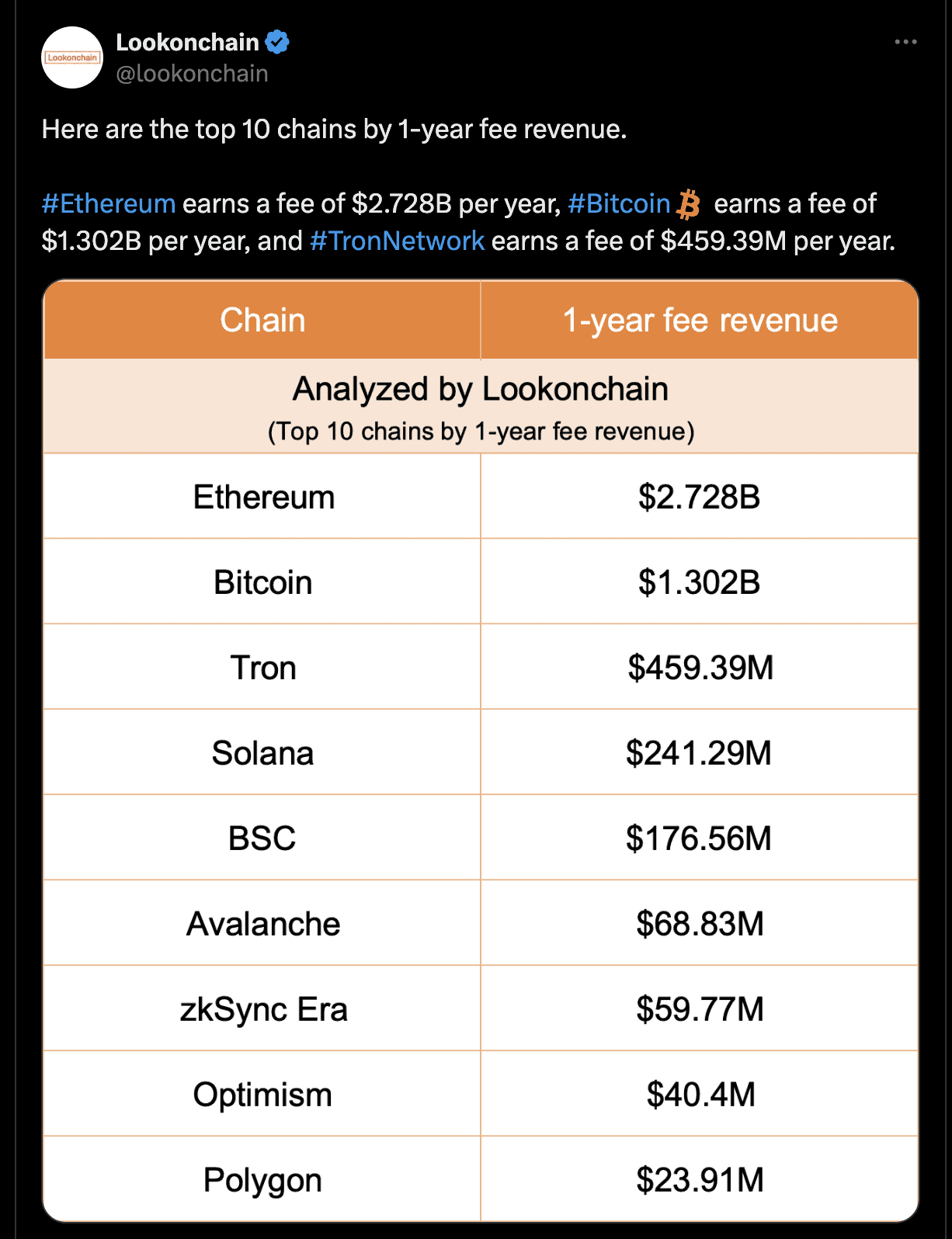

Ethereum’s $2.7 billion fee revenue demonstrated user preference over lower-cost alternatives.

Buyers will need to keep Bitcoin above $53,500 to start a recovery in SOL, DOT, NEAR and KAS.

Bullish divergence on the price chart, September rate cut prospects, and increasing M2 supply are some catalysts that could resume the Bitcoin bull market cycle.

Throughout the rest of July, several important projects in the crypto sphere will unlock hundreds of millions of dollars of tokens, from Worldcoin and Aptos to Layer 2 chains like Arbitrum and even a Layer 3 chain, Xai.Here are all the unlocks crypto investors should know about in July, according to Token Unlocks data.

Shiba Inu’s team issued a critical warning of a potentially compromised Telegram group.

Here’s what might follow for BTC after the latest market decline.

Share link:In this post: BitMEX founder Arthur Hayes repeated his advice to buy Bitcoin dip. He thinks this is the perfect opportunity to invest in BTC. Thanks to the high rate of adoption on all fronts this year, Arthur says it’ll be a while before we see a bear market.Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a

- 04:03Analysis: Luna 2.0 and low liquidity assets may not meet the eligibility for claims from Terraform LabsTerraform Labs has announced plans to launch a cryptocurrency loss claim portal on March 31, 2025. The deadline for submitting claims is April 30, 2025, and late claims will lose the right to compensation. The portal website prioritizes API keys for faster verification; manual evidence may cause delays. However, it is reported that Luna 2.0 and low liquidity assets (with a $100 threshold) will not be eligible for claims.

- 04:02Data: Berachain, Aptos and zkSync Era rank in the top three for net inflow of cross-chain bridge funds in the past 7 daysNews on March 31, according to DefiLlama data, Berachain's cross-chain bridge net inflow of funds reached $195.55 million, ranking first among all public chains. Next are Aptos and zkSync Era, with net inflows of $24.36 million and $14.02 million respectively. Arbitrum, Ethereum and Avalanche had net outflows of $256 million, $69.71 million and $42.35 million respectively.

- 04:00Opinion: "Tariff Day" boots hit the ground, risk assets may experience a brief reboundIn his latest report, Matt Weller, the global market research director at StoneX, emphasized that "the market hates uncertainty" is an old adage on Wall Street. The ambiguity of tariff statements has undoubtedly hit risk preferences hard. "Once the shoe drops, risk assets and the dollar may experience a brief rebound." However, he warned that if Trump continues to increase tariffs after April 2nd, "any rebound in risk assets will be fleeting unless traders are convinced these disruptive policies have completely ended". Meanwhile, Jed Ellerbroek, portfolio manager at Argent Capital observed that this uncertainty over tariff policy is driving funds into low-volatility stocks and value stocks. The weak performance of tech giants in recent weeks confirms a defensive market mentality. He believes that to reverse this aversion to risk,"improved visibility on tariff policy is a necessary prerequisite".