News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

Share link:In this post: XRP drops 4% after failing to sustain a breakout above $2.50, with support at $2.30. The RSI remains neutral as market uncertainty continues. Key US inflation reports this week, including CPI and PPI, may influence Fed policy and impact high-risk assets like crypto. Bitcoin and gold broke their inverse relationship with the S&P 500, while the insurance stock fall due to LA wildfire losses could boost crypto interest.

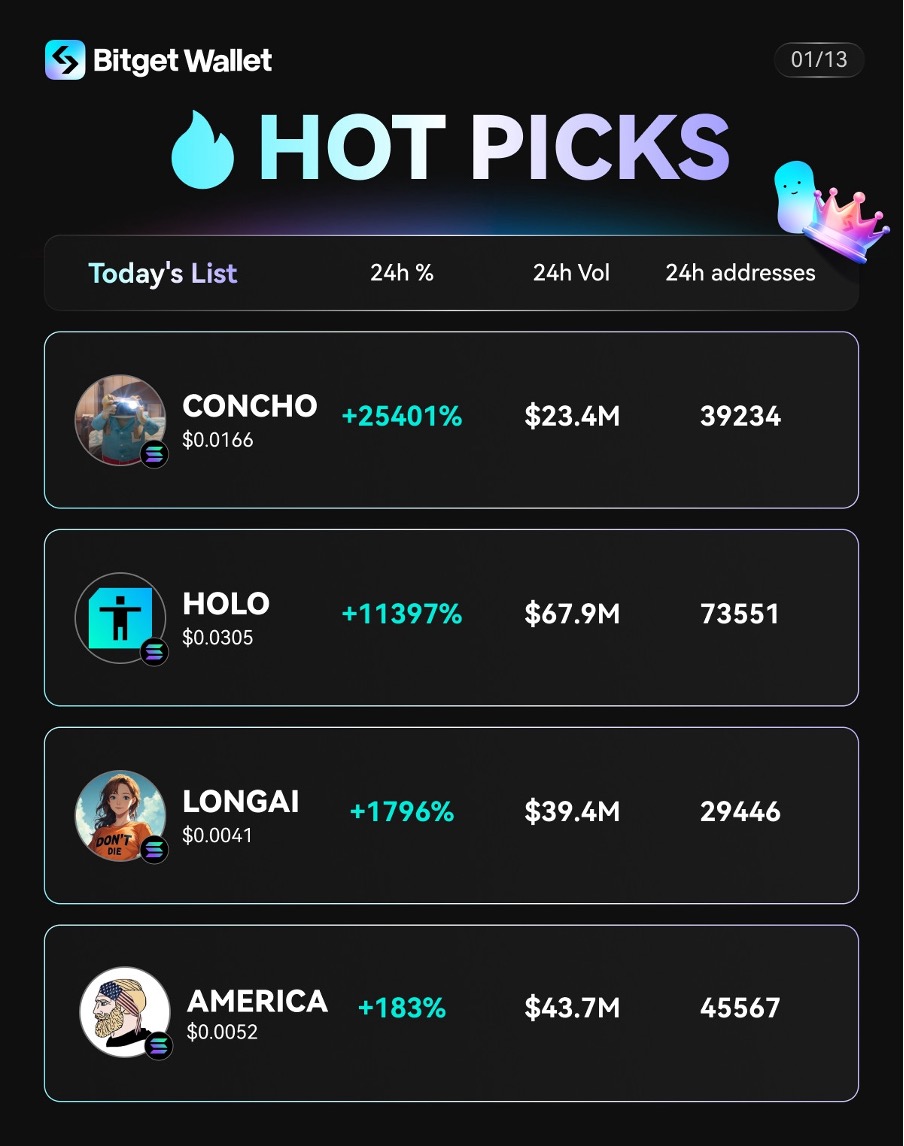

Solana's price is down 20% this week, facing strong bearish momentum. While supports are under threat, a potential rebound could aim for $203.

Bitcoin offset its meagre inflation with massive increase while US DXY increased by just 12% with compound inflation hitting 20%.

MicroStrategy has purchased another 2,530 BTC for approximately $243 million at an average price of $95,972 per bitcoin.The latest acquisitions follow the sale of MicroStrategy shares equivalent to the same amount.

It still needs to consolidate for a while to form a structure resembling a relative bottom.

- 00:23Goldman Sachs doubles investment in Bitcoin ETF, holdings increase to 1.5 billion USD by Q4 2024According to the latest 13F file submitted by Goldman Sachs on Tuesday, it increased its holdings in the two largest spot Bitcoin ETFs in Q4 of 2024. As of December 31 last year, Goldman Sachs held $1.27 billion (or 24.07 million shares) worth of BlackRock's IBIT, an increase of 88% from the previous quarter. Goldman Sachs also increased its holdings in Fidelity Wise Origin Bitcoin Fund and held $288 million worth FBTC (3.5 million shares), a quarterly increase of 105%. Goldman Sachs also reported smaller positions in Bitcoin ETFs that were either reduced or liquidated. It is understood that every quarter, institutional investment managers managing at least $100 million in stock assets will submit a 13F report to the U.S. SEC. These reports are required to be submitted within 45 days after the end of each quarter to understand the manager's stock holding situation.

- 00:21Overview of Financing Information in the Past 24 Hours (February 12th)1. Ethereum security platform Drosera has completed a $3.25 million financing round; 2. Web3 development studio Mirai Labs has completed a $4 million seed funding round; 3. DeFi platform Legends has raised $15 million in funding, with participation from investors such as a16z; 4. Quantum computing company QuEra Computing announced it has raised over $230 million in funding; 5. DeFi asset management platform UFarm.Digital has completed an early seed funding round of $500,000; 6. Decentralized computational power monetization network NodeGo has secured $8 million in financing, led by Hash Capital.

- 00:18U.S. SEC Commissioner Hester Peirce: "TRUMP" and other Meme coins may not be within the jurisdiction of the U.S. SECIn an interview with Bloomberg on Tuesday, Hester Peirce, a commissioner of the U.S. Securities and Exchange Commission (SEC), was asked about President Donald Trump's and his wife's official Meme coins TRUMP and MELANIA, as well as whether such cryptocurrencies fall under the jurisdiction of this agency. The newly appointed head of the U.S. SEC cryptocurrency task force stated that these types of assets may not be within their jurisdiction. President Donald Trump launched his own Solana-based memorandum token TRUMP before his inauguration ceremony on January 20th, and Melania Trump also quickly launched her own token.