News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (April 10) | Trump authorizes 90-day suspension of some reciprocal tariffs; CFTC clarifies cessation of industry regulation through litigatio2Florida Bitcoin Reserve bill moves forward with unanimous vote3MicroStrategy holds 528K BTC at risk as debt pressure builds

Analyst Predicts Combined Bitcoin, Ethereum, and Solana ETF is on the Horizon

BeInCrypto·2024/07/22 08:22

What is Fueling the Solana (SOL) Price Surge?

Cryptodnes·2024/07/22 07:37

Massive Meme Coin Volatility as Joe Biden Quits US Presidential Race: Details

Check out which meme coins experienced double-digit price swings following Biden’s announcement.

Cryptopotato·2024/07/22 07:31

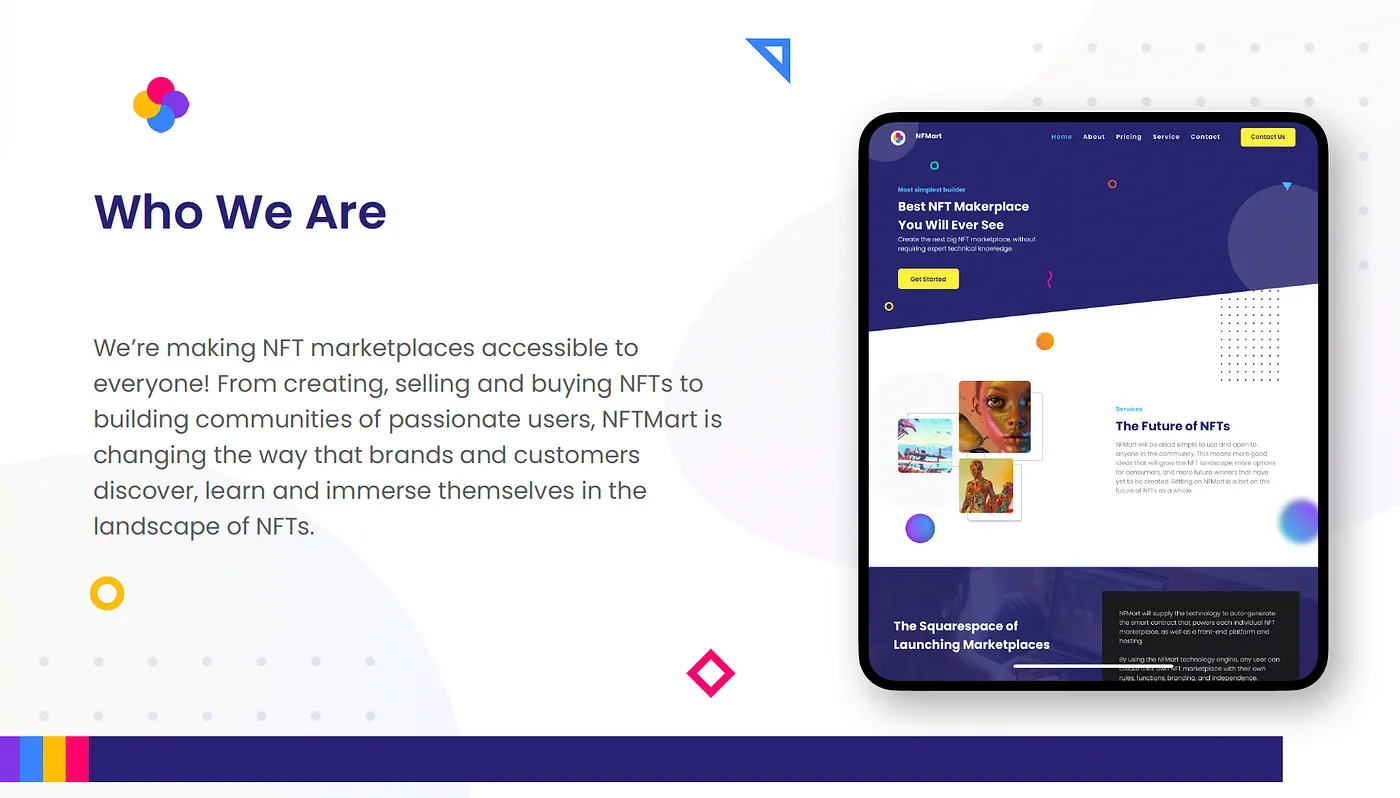

Welcome to NFMart: The Future of NFT Marketplaces

NFMart Blog·2024/07/22 07:20

Bitcoin–Another All-Time High Attempt Before Going Parabolic?

Institutional Crypto Research Written by Experts

10xResearch·2024/07/22 06:32

MIGGLES: The next meme star under the Base chain?

远山洞见·2024/07/22 06:05

‘Asia’s MicroStrategy’ Metaplanet buys another ¥200 million worth of Bitcoin, shares jump 13%

Cryptobriefing·2024/07/22 03:16

What global liquidity tells about Bitcoin’s future

Share link:In this post: When M2 liquidity, which includes cash and liquid assets, increases, BTC’s price rises. When it decreases, BTC falls. The Fed’s tightening policies and China’s cautious approach to liquidity due to economic struggles affects price. Inflows into ETFs and the growth of stablecoins like USDT and USDC show how new liquidity is entering the crypto market.Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the

Cryptopolitan·2024/07/21 23:22

Flash

- 07:46BlackRock's Ethereum ETF purchased 3,840 ETH on April 10thBlackRock's Ethereum ETF bought 3,840 ETH on April 10th, worth $6.4 million.

- 07:29Grayscale updates potential investment asset listGrayscale has announced a list of potential digital assets that may be included in its investment products in the future. The assets under consideration include APT, ARB, TIA, HBAR, MNT, TON, TRX, VET, AREO, BNB, ENA, HYPE, JUP, ONDO,PENDLE , PLUME , AIXBT , IMX , IP , AKT , FET , AR,EIGEN,GEO D,HNT and JTO. In addition to these assets not included in the crypto industry framework are Babylon,BERA,M onad MOVE,Lombard OM SYRUP ELIZA DEEP GRASS Prime Intellect Sentient Space and Time as well as WAL.

- 07:28Analysis: The 30-day average trading volume of the counterfeit coin has fallen below the annual average level, entering the buying rangeCryptoQuant analyst Darkfost suggests investors consider implementing a Dollar-Cost Averaging (DCA) strategy on altcoins. He points out that we have now entered the buying range, which is defined by the 30-day moving average trading volume being lower than the annual average. The last time this situation occurred was in September 2023, after the end of the bear market. Such stages could last several weeks or even months and historically have always provided good opportunities to set up DCA strategies.