News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (4.28)|Arizona Bitcoin Reserve Legislation Set for Vote, ProShares Trust's XRP ETF to Be Publicly Listed2Bitcoin ETFs Saw $3 Billion Weekly Inflows As US Investors Pivot to BTC3Crypto Whale Invests Over $5 million in TRUMP for Presidential Dinner Invitation

Prophetic Vision Declares XRP a ‘Profound Investment’ – Could It Soar to $10,000?

Unearthed video shows deceased prophet Kim Clement predicting that something with 'x' and 'p' in its name would become a big investment.

CryptoNews·2024/08/22 15:23

Shocking: Coin Value Drops 50% to 100% Even Six Months After a Hack

“Getting hacked is the beginning of the damage, not the end.”

CryptoNews·2024/08/22 15:23

Bitcoin could rally to $65,000 if key support level holds

Cryptobriefing·2024/08/22 15:06

PSE Trading: Macro and data analysis reveals a positive outlook

Odaily·2024/08/22 13:10

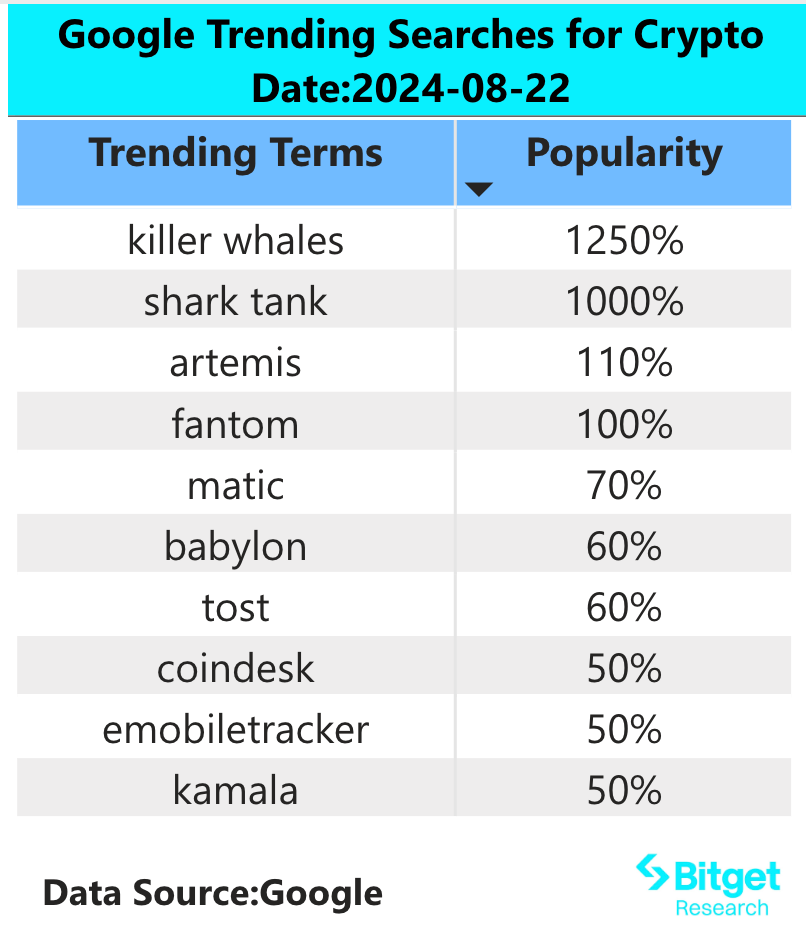

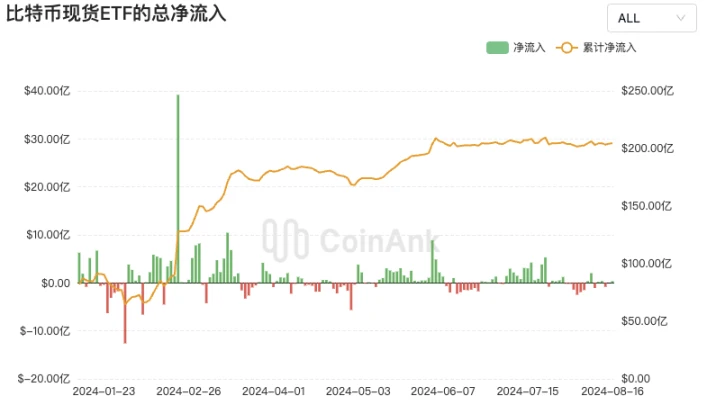

Spot Ethereum ETFs record longest outflow streak amid drying investments

Ethereum ETFs in the US face significant outflows, contrasting Bitcoin ETFs, which continue to attract investments.

Cointelegraph·2024/08/22 08:36

To break the altcoin bear market, a DeFi revival is needed

Odaily·2024/08/22 08:34

Tron’s SunPump Meme Coin Launchpad Outperforms Solana’s Pump.fun

7,352 new tokens have been launched on SunPump over the past day.

CryptoNews·2024/08/22 08:27

Bitcoin Metrics Signal Weak Demand Dynamics, Growth Slows: CryptoQuant

Growth in total holdings of large Bitcoin investors has also slowed from a monthly pace of 6% to 1%.

CryptoNews·2024/08/22 08:27

Flash

- 05:23Executive Director of the Ethereum Foundation: Today's EOF Discussion is Unrelated to the Pectra Upgrade Scheduled for May 7Jinse reports that the newly appointed Co-Executive Director of the Ethereum Foundation, Tomasz K. Stańczak, stated that there is an important EOF discussion today, but there is a crucial misunderstanding that needs to be clarified: the current EOF discussion has no relation to the Pectra upgrade scheduled for May 7. The Pectra upgrade does not include EOF, nor is EOF intended to be included. All progress on Pectra is proceeding as planned and is expected to be released on May 7 (EIP-7600: Hardfork Meta-Pectra [DRAFT]). Today's EOF discussion pertains to the subsequent network upgrade Fusaka, which has not yet been scheduled, but we plan to implement it in the third/fourth quarter (around September/October).

- 05:23Bitlayer Announces BitVM Bridge Integration with Monad Testnet, Unlocking New Experiences for BitVM ApplicationsApril 28, News: Bitlayer, a project implementing BitVM technology based on the Bitcoin ecosystem, announced the integration of BitVM Bridge with the emergent high-performance Layer 1 Monad, allowing users to experience cross-ecosystem BTC bridging with minimal trust. Monad is an emerging high-performance Layer 1, with the network's total active users now exceeding 9.8 million and over 69 million unique wallets. Following this integration, Monad's tens of millions of ecosystem users will have the chance to directly experience the first BitVM-based application, BitVM Bridge, by bridging vBTC from the BitVM Bridge test network (BitVMNet) to the Monad Testnet and minting the corresponding YBTC, exploring the potential for financial yield developments in the Monad ecosystem with YBTC.

- 05:22NYDIG: Bitcoin rises over 10% since Trump's so-called "Liberation Day," initially demonstrating non-sovereign value storage attributesPANews, April 28 - According to CrowdfundInsider, the latest research report by the New York Digital Investment Group (NYDIG) indicates that amidst the current economic and geopolitical uncertainties, Bitcoin is initially exhibiting characteristics of a non-sovereign value storage tool. The report mentions that since Trump's so-called "Liberation Day" on April 2, 2025, the U.S. dollar and long-term U.S. Treasury bonds have performed weakly, while gold, the Swiss franc, and Bitcoin have gained market favor. Meanwhile, as the U.S. stock market declined, Bitcoin has counter-trended with a 10.3% increase, indicating a decoupling from traditional risk assets. NYDIG emphasizes that although this trend is still in its early stages, the current data is insufficient to confirm that Bitcoin's role as a safe haven asset has been widely accepted by the market. However, given the current increase in structural volatility in the market and investors' weakened confidence in traditional safe-haven assets, Bitcoin may become one of the choices for investors seeking alternative value storage methods.