News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (February 5) | Eric Trump advocates for ETH; SEC actions spark "regulatory relaxation"2Shiba Inu (SHIB) Gains Momentum After Major UAE Partnership: Is a Rebound Ahead?3Dogecoin Unmoved as $370,000 Institutional Buy Fails to Spark Rally

ai16Z Price Prediction: AI16Z Plummets 19% Amid The Crypto Crash, But Traders Rush To Buy This ICO With Time Running Out

Insidebitcoin·2025/01/10 04:11

Bitcoin’s Trump trade dented by rising yields and strong US dollar

Bitcoin’s ability to hold $100,000 is being suppressed by rising treasury yields and a strengthening dollar. Is the “Trump trade” ending?

Cointelegraph·2025/01/10 03:22

SUI Open Interest Doubles, Price Now 6% From All-Time High

SUI is within 6% of a new all-time high, backed by surging Open Interest and bullish technicals. Momentum points to further upside.

BeInCrypto·2025/01/10 03:00

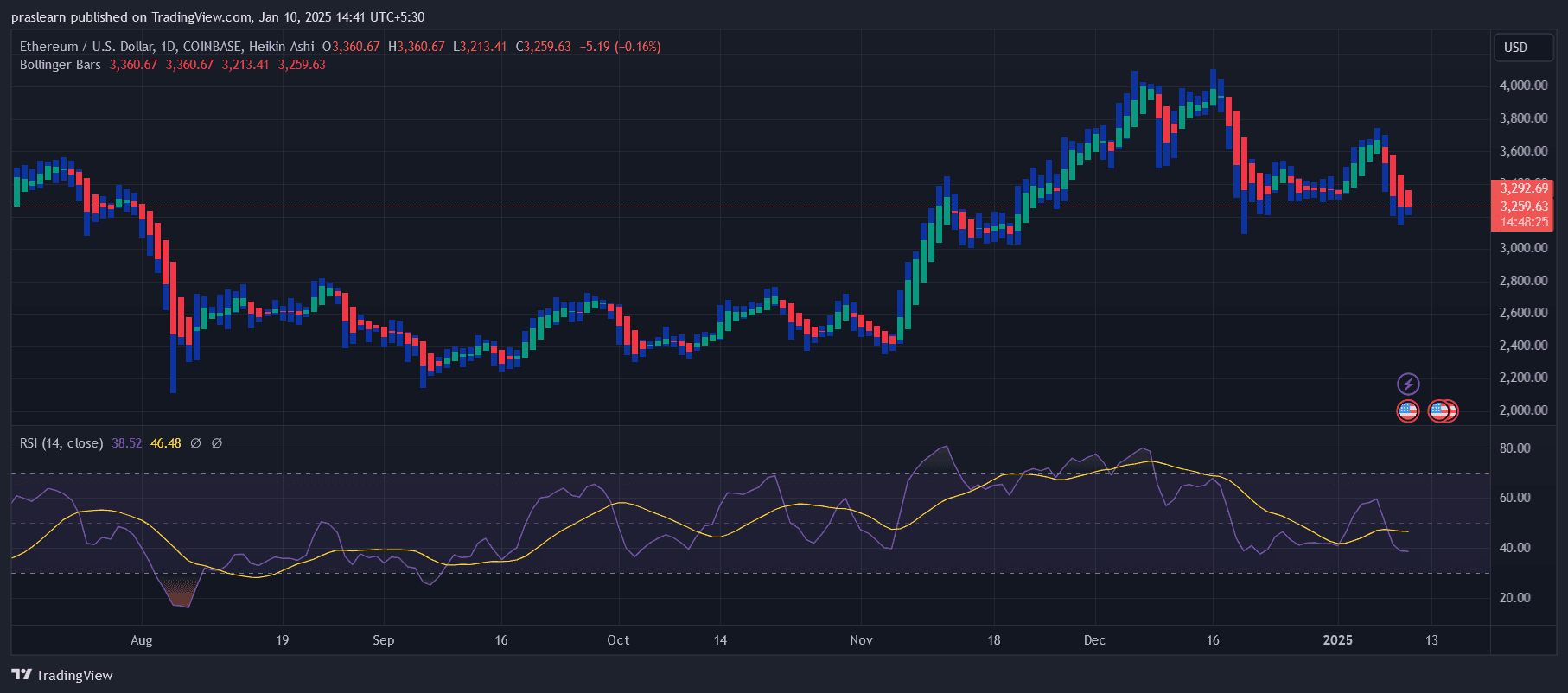

ETH price: A DROP or SURGE is NEXT?

Cryptoticker·2025/01/10 01:40

AI16Z Leads Market Gains with 8% Jump, but Rally’s Strength Is Questioned

AI16Z’s 8% surge and $450M trading volume dominate the market, but bearish technicals point to speculative trading and fading momentum. Demand will decide its next move.

BeInCrypto·2025/01/10 01:30

Krypton DAO (KRD) price soars 513% over the week: will it hold the gains?

Coinjournal·2025/01/09 22:44

How Many Interest Rate Cuts Will the Fed Make This Year? Analyst Answered – “But Pay Attention to the Date…”

StoneX's Chief Market Strategist Kathryn Rooney Vera evaluated the FED's possible policy in her statement.

Bitcoinsistemi·2025/01/09 21:55

Shiba Inu Grapples With Heavy Bearish Forces: Will Support Levels Hold?

CryptoNewsNet·2025/01/09 20:55

Time to Buy Bitcoin? $1.02B BTC Outflow Raises Hopes of Price Rebound

CryptoNewsNet·2025/01/09 20:55

Crypto Market Continues to Bleed – $460 Were Liquidated in the Past 24 Hours

Cryptodnes·2025/01/09 20:22

Flash

- 22:09U.S. Treasury Secretary Besant: Trump didn't call on Fed to lower ratesU.S. Treasury Secretary Vicente said he and Trump are focused on the 10-year U.S. Treasury yield, which rose after the Federal Reserve cut rates sharply. Besant said Trump has not called on the Federal Reserve to lower interest rates.

- 22:08Strategy reports $3.03 GAAP loss per share for 2024 Q4Bitcoin strategy firm Strategy (formerly known as MicroStrategy) reported a net loss of $3.03 per share for the fourth quarter of 2024, compared to earnings of $0.50 per share in the same period last year. The loss resulted from the company taking an impairment charge on its bitcoin holdings. As of December 31, 2024, the bitcoin position was 447,470, compared to the market expectation of 425,149 bitcoins. The company recently closed a series of bitcoin purchases and currently holds 471,107 bitcoins valued at approximately $45 billion. The U.S. Financial Stability Accounting Board (FASB) last year implemented a new fair value accounting rule for companies holding digital assets, the use of which is voluntary until the end of 2024 but will be mandatory starting in the first quarter of this year.

- 21:18Analyst: Bitcoin's Market Capitalization Needs to Exceed 70% to Start a New “Cottage Season”According to crypto analyst Rekt Capital, Bitcoin's market capitalization (BTC Dominance) needs to exceed 70% before a new cottage season can begin. Bitcoin's market capitalization has risen to 64.3 percent, before falling back to 61 percent, but the overall trend is still rising. Analysts say the cottage season is over at the end of 2024, and Bitcoin has rallied since falling below 55% last December, and is now up 6%. Historical data shows that 71 percent is a key point in bitcoin's market capitalization share, and if BTC.D is blocked at that level, the market may see a new round of cottage market