News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (4.29)|Trump Seeks to Mitigate Auto Tariff Impact, Arizona House Passes Bitcoin Reserve Bill2Bitcoin ETFs Celebrate a Week of Wins, But Trouble Brews in the Derivatives Market | ETF News31inch launches on Solana, plans cross-chain swaps to boost liquidity

In the last 48 hours, the Musk-themed meme coin RFC surged by 200%. Could RFC become the next DOGE?

In 35 days, there were 22 interactions. Musk really «loves» this meme concept, doesn't he?

BlockBeats·2025/04/08 06:24

$SUI Price Drop Echoes $NEAR’s 2021 Crash: Rebound Ahead?

Cryptotale·2025/04/08 05:31

Linea Won’t Rush TGE — Waiting for the Bulls to Return

Cryptotale·2025/04/08 03:47

U.S. Tariff Truce Fiasco: BTC Flash Crashes Below $81K, May Rate Cut Expectation Soars

A Trump slip of the tongue upends the global market, with Bitcoin surging and then falling, US stocks experiencing huge volatility, and Fed rate cut expectations gaining momentum.

BlockBeats·2025/04/08 03:39

Ripple Issues Big Take On Tokenization, Predicts 3,050% Surge In Value

Ripple Labs is confident in the long-term growth of the tokenization market. The firm sees the RWA tokenization market as one that can transform traditional finance. Ripple’s RLUSD and associated XRP are also poised to drive a more defined role in tokenization.

TheCoinRepublic·2025/04/08 03:07

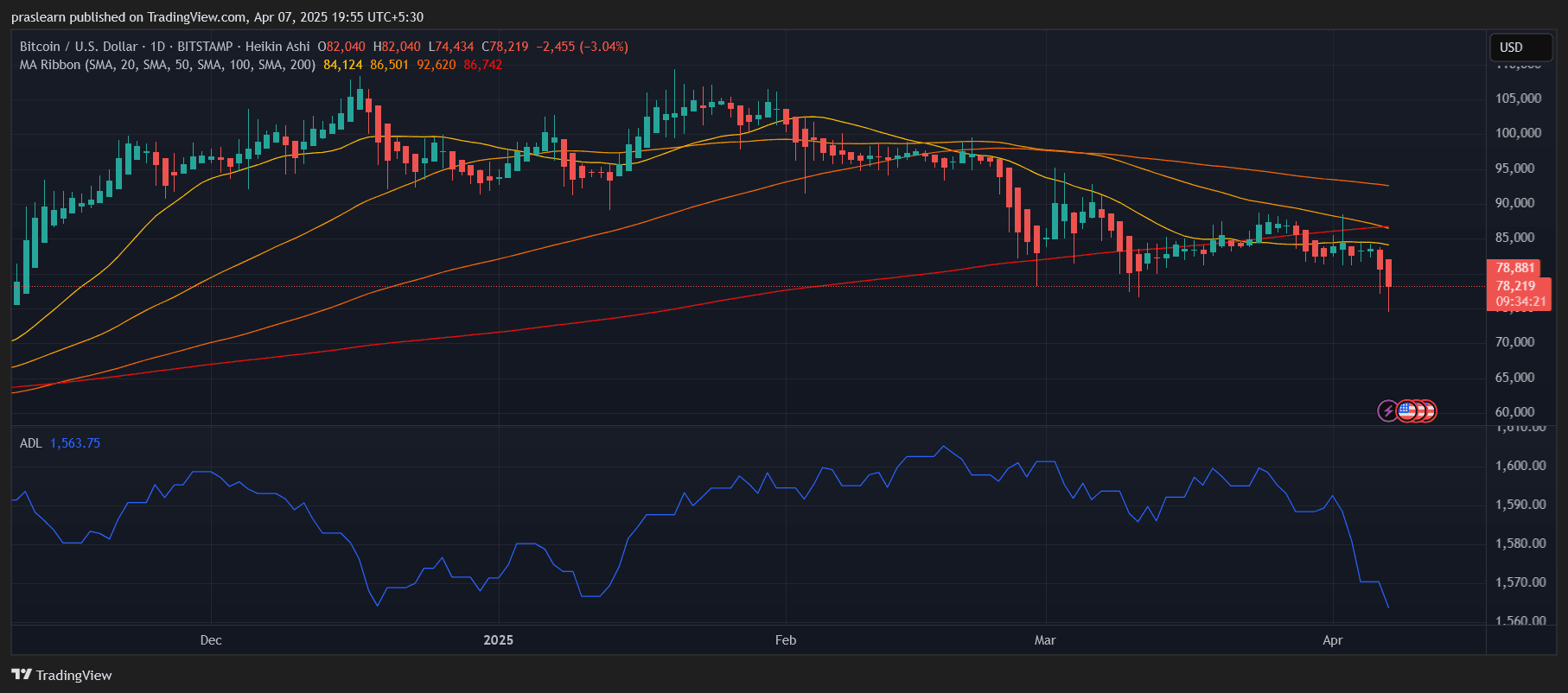

How Low Can Bitcoin Price Go in the Next 7 Days? Market Panic Signals Breakdown

Cryptoticker·2025/04/08 02:44

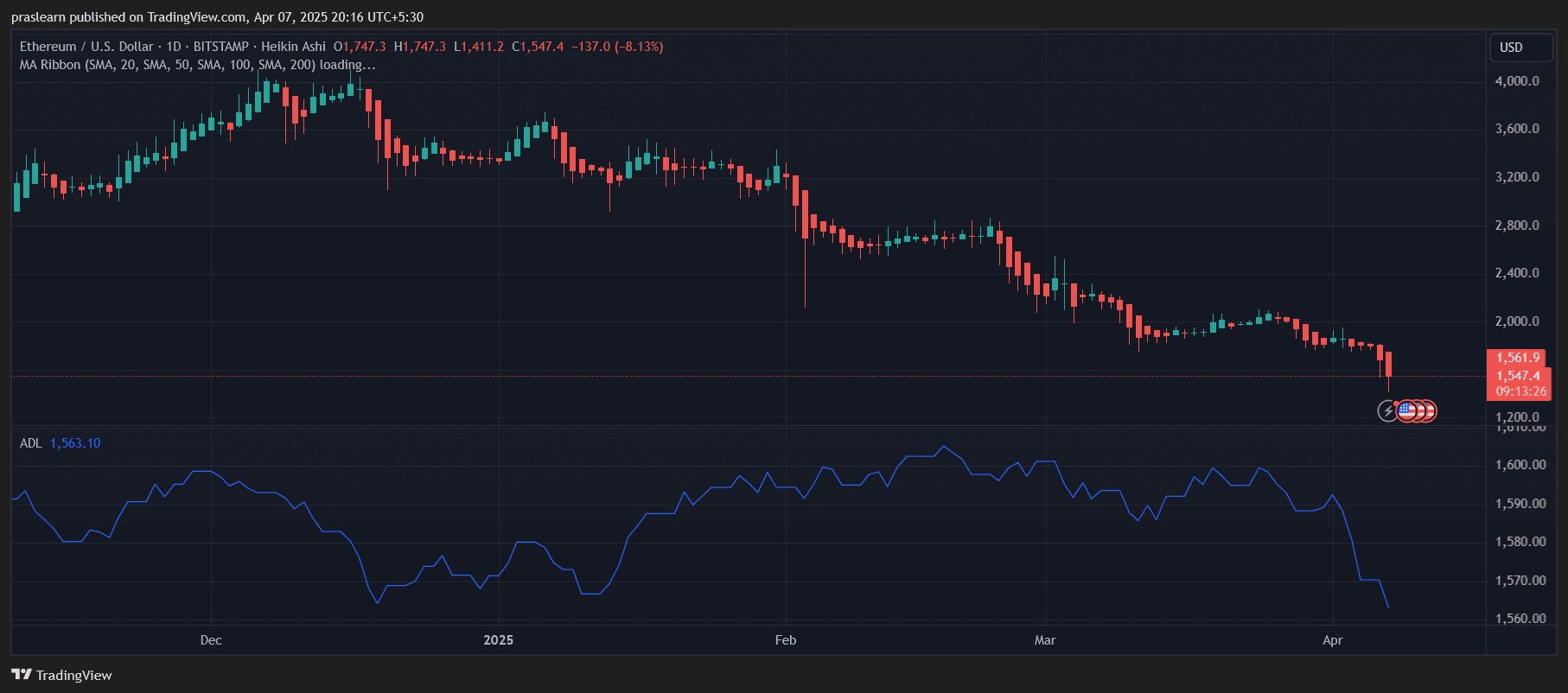

How Low Can Ethereum Price Go in April? Crash Fears Grip Crypto Investors

Cryptoticker·2025/04/08 02:44

$106 Million In Ethereum Liquidated: Crypto Whale Erased By The Ongoing Storm

Cointribune·2025/04/07 22:55

Conor McGregor's REAL Token: A Resounding Failure

Cointribune·2025/04/07 22:55

The CAC 40 Below 6900 Points: Geopolitical Tensions Weigh Heavily On The Market

Cointribune·2025/04/07 22:55

Flash

- 16:14Analysis: As Bitcoin Rises, "Speculative Funds" Return to the MarketOn April 29, Cointelegraph reported that as Bitcoin rises, short-term Bitcoin holders (STHs) are returning to the market, marking the entry of "speculative capital." Glassnode indicates a surge in Bitcoin "hot capital." As BTC prices hover at multi-month highs, new investors are entering the market. Glassnode noted that the amount of Bitcoin transferred in the past week has reached its highest level since early February. This metric reflects the activity of short-term holders and serves as a reference for measuring the entry of speculative capital into the market. Over the past week alone, "hot capital" has grown by more than 90%, approaching $40 billion. Since the local low at the end of March, "hot capital" has cumulatively increased by $21.5 billion, highlighting changes in market sentiment due to this "surge in capital turnover."

- 16:14Data: Solana Hot Money Soars 100% in 7 Days, Crypto Assets Rebound But Remain Below Cycle HighsAccording to Glassnode data, Solana ($SOL) hot capital reached $9.46 billion on April 28, marking a new high since March 12, with a growth of $4.72 billion (+100%) over the past 7 days. During the same period, XRP hot capital surged from $920 million to $2.17 billion, an increase of 134.9%. Despite the strong rebound, hot capital in major crypto assets remains significantly below cycle highs: BTC (-60.8%), ETH (-60.3%), SOL (-38.4%), XRP (-71.7%). Analysts believe that the inflow of funds into SOL will provide more liquidity support for stablecoins in the Solana ecosystem.

- 15:45Analysis: As Bitcoin Rises, "Speculative Funds" Return to the MarketAccording to Cointelegraph, as Bitcoin rises, short-term Bitcoin holders (STHs) are returning to the market, signaling the entry of "speculative capital." Glassnode reports a surge in Bitcoin "hot capital." With BTC prices hovering at multi-month highs, new investors are entering the market. Glassnode notes that the amount of Bitcoin transferred in the past week has reached its highest level since early February. This metric reflects the activity of short-term holders and serves as a reference indicator for the influx of speculative capital into the market. In just the past week, "hot capital" has grown by more than 90%, nearing $40 billion. Since the local low at the end of March, "hot capital" has cumulatively increased by $21.5 billion. This "surge in capital turnover" highlights a shift in market sentiment.