News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (4.29)|Trump Seeks to Mitigate Auto Tariff Impact, Arizona House Passes Bitcoin Reserve Bill2Ethereum researcher proposes 100-fold 'exponential' gas limit boost to improve mainnet scaling3Pudgy Penguins (PENGU) Rockets 34%, Approaches Three-Month High of $0.019

Ethereum’s Price Drop Signals Potential Buying Opportunities for Long-Term Investors

In Brief The recent price drop of Ethereum may offer strategic buying opportunities. Historical data supports potential recovery after dips below realized price. Investor psychology plays a crucial role during uncertain market conditions.

Cointurk·2025/04/08 22:11

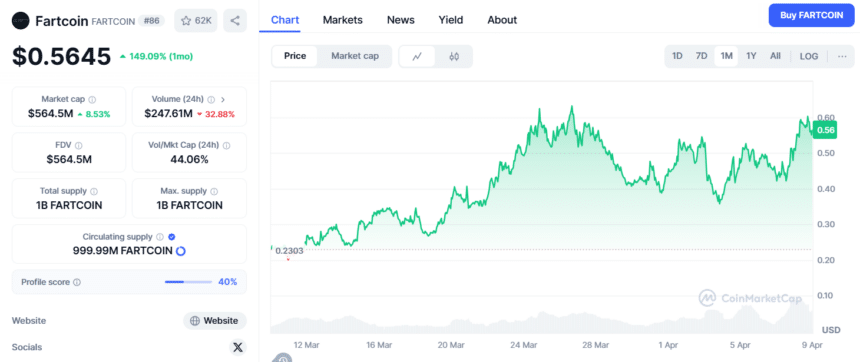

Whale Makes Bold $1.89M Bet on Fartcoin, Would it play out?

Cryptotimes·2025/04/08 21:00

FIL Price Over $150 Emerges as Filecoin Shows Highly Bullish Signals Amid Bitcoin Mirroring 2024 Correction

Cryptonewsland·2025/04/08 20:33

What a 1% Fed Rate Cut Could Mean for Crypto if Trump’s Tariff Triggers The Simpsons Prediction

Cryptonewsland·2025/04/08 20:33

Ethereum ETFs Hold Steady as Cumulative Inflows Hit $2.36B

Cryptonewsland·2025/04/08 20:33

Bitcoin shows resilience as stocks and gold falter

Grafa·2025/04/08 19:50

Analyst sees rising odds of US Bitcoin purchase in 2025

Grafa·2025/04/08 19:50

Ripple forecasts $18.9T tokenisation market by 2033

Grafa·2025/04/08 19:50

BlackRock CEO Forecast: Will a Recovery Follow the Crypto Market Crash ?

Cryptoticker·2025/04/08 18:33

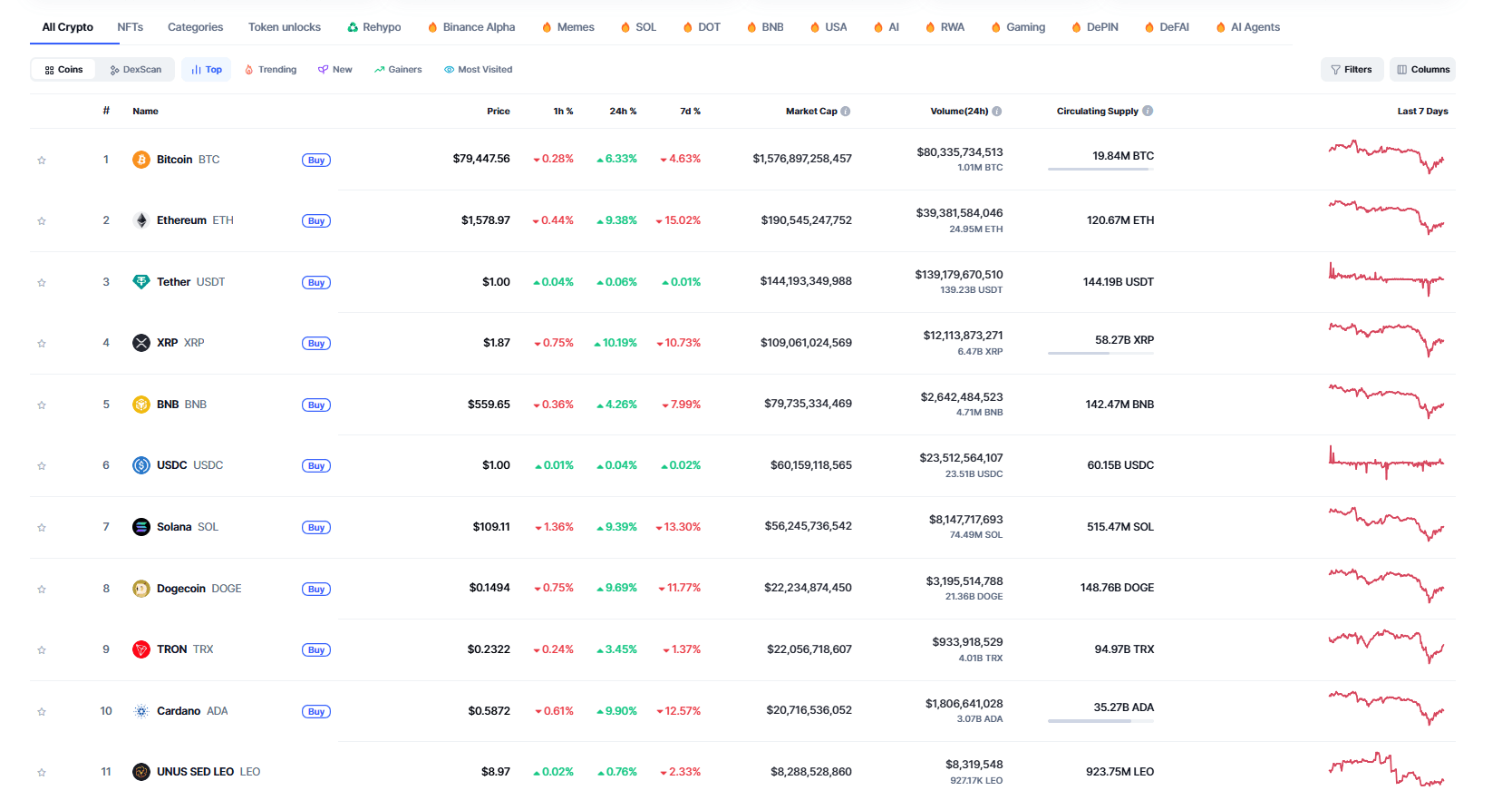

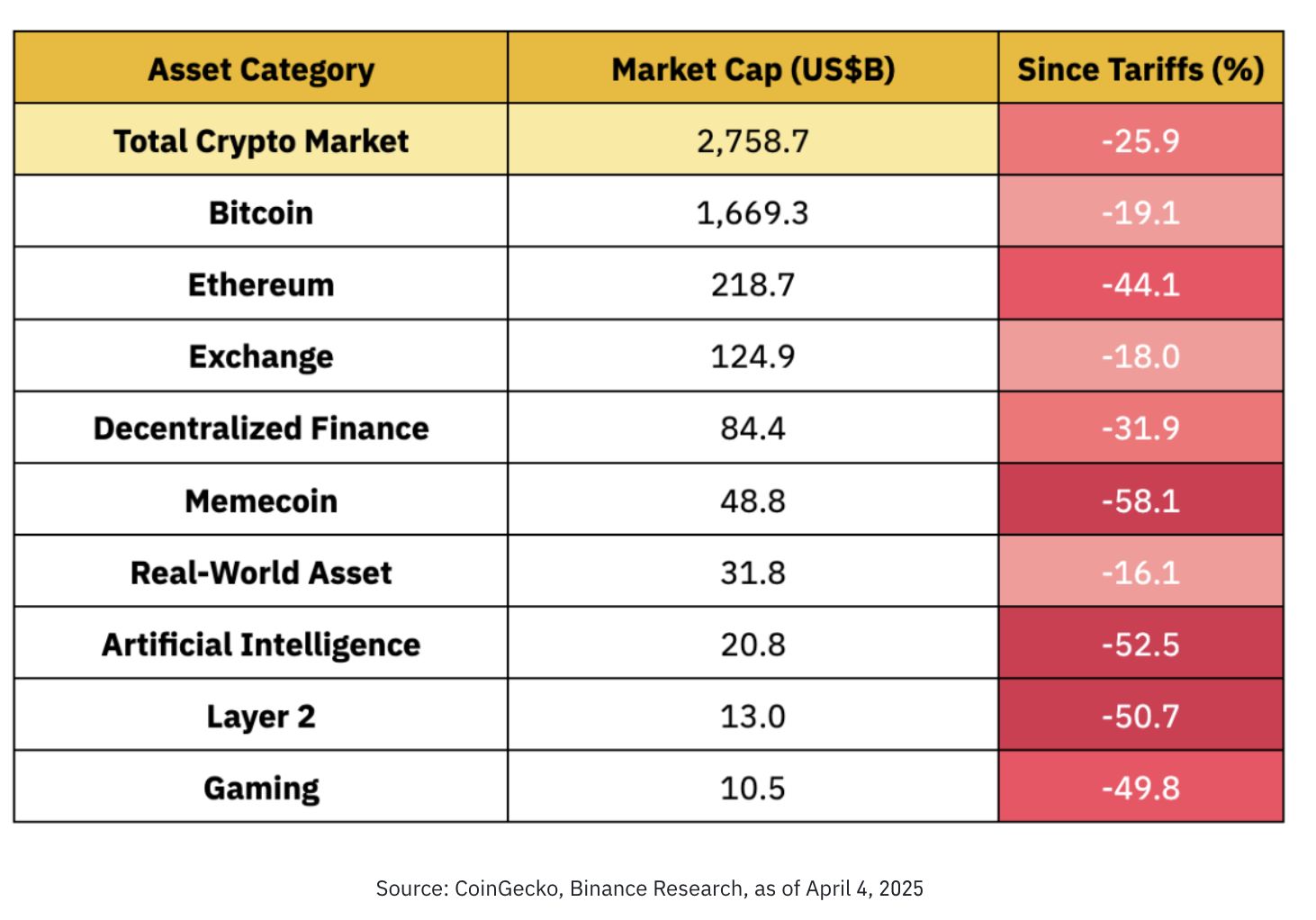

Altcoin liquidity’s dropped since President Trump’s tariff announcement: Kaiko Research

An altcoin season is looking less and less likely as the reciprocal tariffs loom

Blockworks·2025/04/08 16:11

Flash

- 02:06VIRTUAL surpasses $1.5 with a 24-hour increase of 41.5%According to Jinse, market data shows that VIRTUAL has surpassed $1.5, currently priced at $1.48, with a 24-hour increase of 41.5%. The market is highly volatile, so please exercise risk control.

- 02:04Data: Today's Fear and Greed Index Rises to 60, Turning to "Greed State"According to ChainCatcher, data from Alternative.me indicates that today's cryptocurrency Fear and Greed Index has risen to 60 (yesterday it was 54), showing that the market has shifted from a "neutral state" to a "greed state".

- 02:04Bitcoin Exchange Supply Drops to Lowest Level in 7 YearsPANews April 29 - According to a report from Decrypt, CryptoQuant data shows that Bitcoin exchange supply has fallen to a seven-year low, dropping to 2.488 million BTC last Friday. The exchange reserve is currently at 2.492 million BTC, having increased by about 40,000 BTC over the weekend, but this level is still the lowest since October 2018. However, CoinShares reported that for the week ending April 28, Bitcoin funds saw an inflow of $3.2 billion. The combination of decreasing exchange balances and increased inflows suggests a new accumulation phase is on the horizon. During the past week's rally, retail investors have seemingly played a larger role than in recent weeks. This is evident in the "Exchange Whale Ratio," which has declined from 0.512 on April 17 to 0.36 on April 27.