News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

Solana’s price is slipping as technical indicators show deepening bearish momentum. With support levels in sight, here’s what could come next.

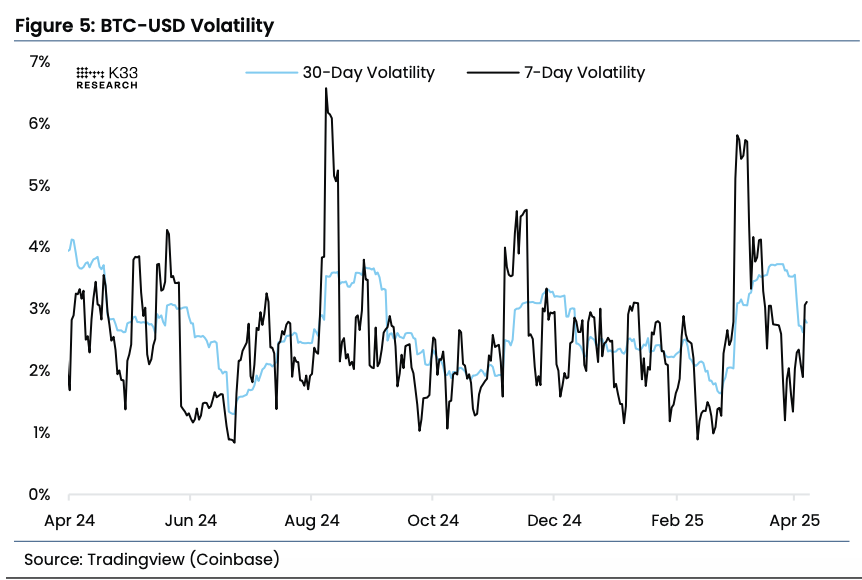

There are signs of cautious optimism in the crypto markets for now

Paul Atkins takes over as SEC chair, aiming to ease crypto regulation and scale back corporate disclosure requirements.

XCN has jumped over 30% in a day, breaking out of its consolidation phase and sparking bullish predictions of a potential 300% rally.

Cardano founder Charles Hoskinson believes Bitcoin’s price could rise over 100% to reach $250,000 this year.

Crypto analyst Ali Martinez used the Mayer Multiple to predict that Bitcoin could skyrocket to $208K if it breaks above $86,900.

- 22:09Offshore RMB Rises 39 Points Against USD Compared to Last Friday's New York ClosingAccording to a Jinse report, the offshore RMB (CNH) was trading at 7.2846 against the USD at 04:59 Beijing time, up 39 points from last Friday's New York close. The day's trading range was between 7.3026 and 7.2828.

- 21:40Deutsche Bank: U.S. Assets Still Face Resistance from Overseas BuyersAccording to a report by Jinse, Deutsche Bank has stated that despite a market recovery in the past week, foreign investors are still refusing to buy U.S. assets. To “real-time” observe the actions of overseas investors in recent weeks, Deutsche Bank's Head of FX Strategy, George Saravelos, studied the flows into various funds channeling foreign investments into U.S. stocks and bonds. Saravelos wrote that the data indicates a “sudden stop” in overseas purchases of U.S. assets over the past two months, with no signs of reversal even as the clouds over the market seemed to begin clearing last week.

- 21:34Gold Prices Rebound Strongly Amid Dip BuyingAccording to Jinse, gold prices reversed their decline on Monday and rose due to dip buying, as the market focused on trade developments and a series of economic data. Spot gold in the U.S. market rose nearly 1%, trading at $3,349 per ounce, after having dropped 1.8% earlier. TD Securities commodity strategist Daniel Ghali stated, "We are beginning to see preliminary signs of exhaustion in selling momentum," adding that the downside risk for gold is extremely limited. "Western investors, especially self-directed traders or macro funds, were fully underinvested in gold during the last wave of price increases, so the selling activity is limited, and the price rise reflects this."