News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

Share link:In this post: The Czech government lowered its economic growth forecast for 2025 to 2% due to reduced corporate investment linked to U.S. tariffs. Exports, particularly in the auto industry, are slowing overall economic expansion, while household spending remains a key growth driver. The U.S. tariffs, especially on auto parts, have negatively impacted companies’ investment plans and may further slow Czech growth to 1.6% in 2025.

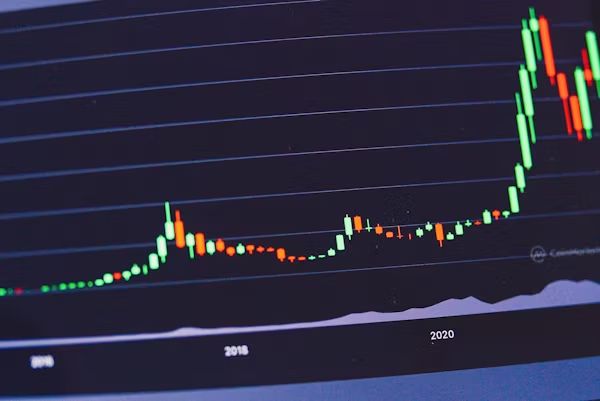

Analysts suggest that Bitcoin price is facing a strong wall at $84,000, which could lead to a breakout for BTC toward $96,000.

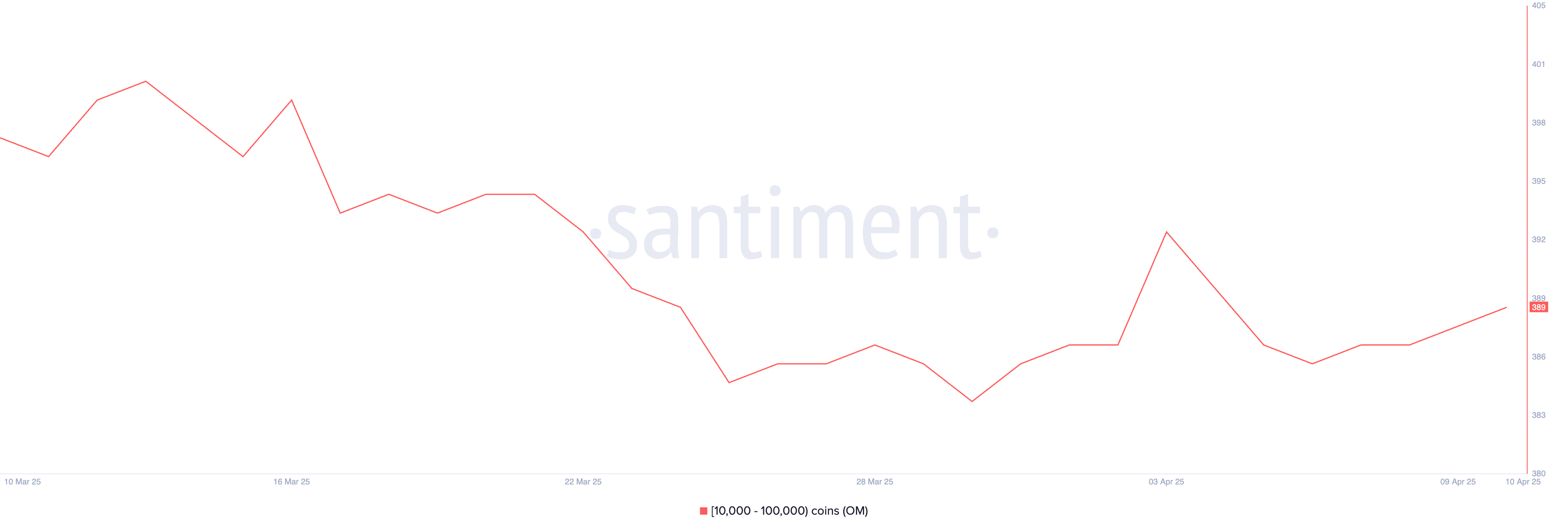

Ethereum continues to underperform but the rising bearish sentiment could signal a bullish rally for the cryptocurrency, according to Santiment.

Vitalik Buterin has proposed a roadmap to fix privacy on the Ethereum Layer-1 chain, setting a new benchmark for protocol functionality.

- 14:46Data: Layer Price Hits New High, Now at $2.21Data shows that Solana ecosystem payment protocol Solayer's token Layer has risen to a new all-time high, now trading at 2.21 USDT.

- 14:46Neiro: Collaboration Deal Reached with Own The Doge and Acquisition of Neiro IPNeiro announced on the X platform that it has reached a collaboration deal with Own The Doge and obtained the exclusive IP rights of DOGE prototype Shiba Inu KABOSU. Neiro stated that acquiring the exclusive rights to the Neiro IP is not just a milestone but also a responsibility. This responsibility entails respecting Atsuko's creation, ensuring the creator receives due recognition and support, and promoting the Neiro brand with integrity and care.

- 14:45Sophon Launches Smart Contract Account System "Sophon Account", Supporting Multiple Login Methods Including Google AccountThe modular blockchain Sophon, based on ZKsync, announced the launch of its smart contract account system "Sophon Account". This system supports user login via Google accounts, Passkey, or existing wallets. Sophon Account is one of the five core modules of the SophonOS operating system. The other core modules include Sophon Home, Sophon+, a blockchain based on the ZK-stack, and the Social Oracles data platform supported by zkTLS. Sophon stated that this account system will be fully launched in the Sophon ecosystem, supporting applications in gaming, content, and digital culture scenarios. Relevant developer documentation and integration guidelines will be released soon, aiming to enable more developers to build the next-generation crypto consumer experience based on this.