News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

The Canary Capital TRON ETF proposal faces uncertainty given the US Securities and Exchange Commission (SEC) past stance on staking.

The cryptocurrency landscape is continually shaped by groundbreaking narratives, and among the most structurally transformative are those centered on public blockchains. From Bitcoin’s genesis, which established the foundation for decentralized finance, to Ethereum’s smart contract functionality catalyzing the DeFi Summer, and Solana’s innovation in high-performance chains, each iteration of blockchain technology has driven industry-wide evolution. … <a href="https://beincrypto.com

“The selected use cases span all EU/EEA regions and represent a wide range of industry sectors and regulatory topics,” the European Blockchain Sandbox says.

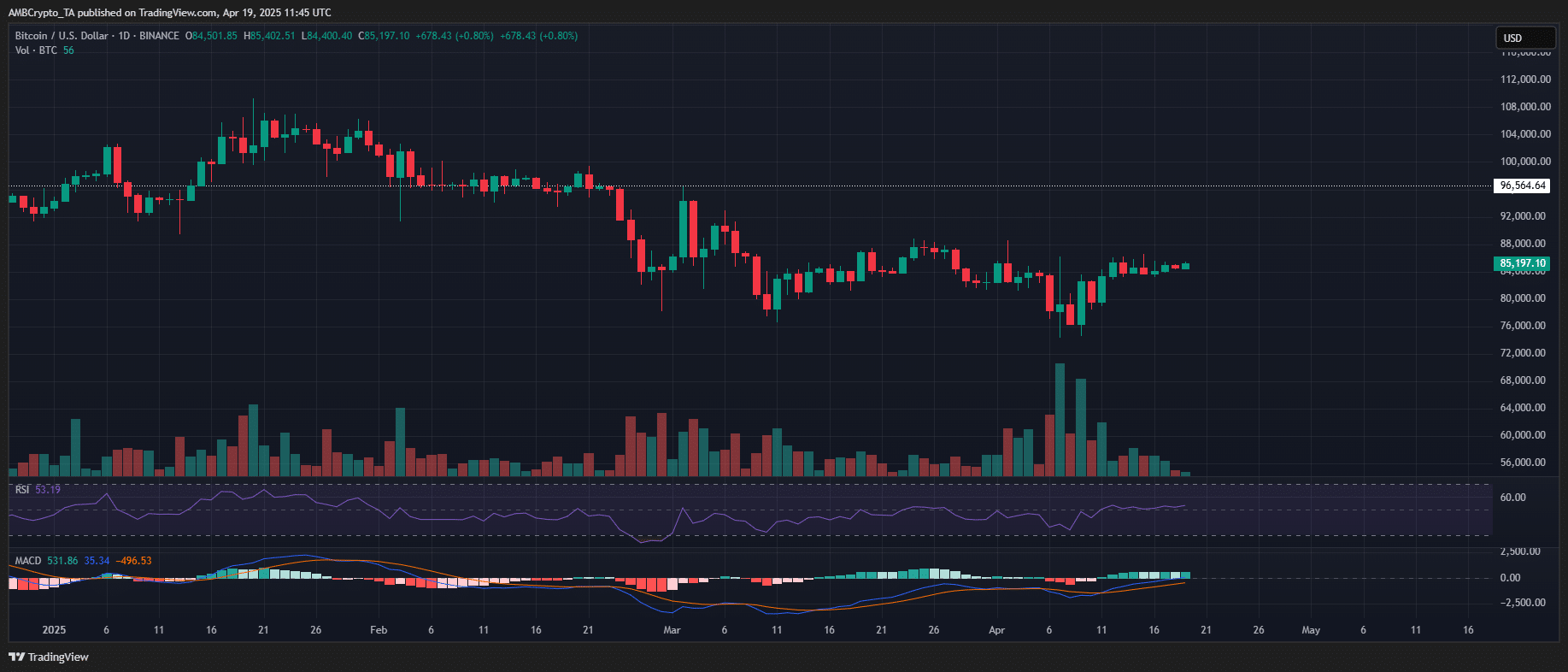

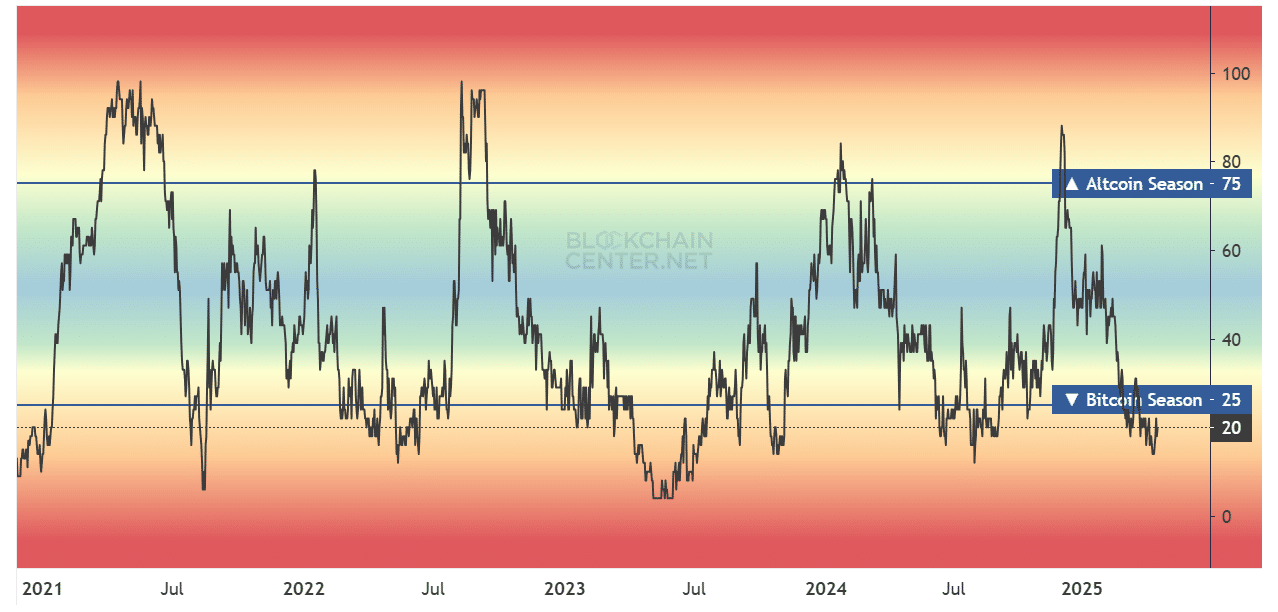

Dogecoin (DOGE) could rally during the next 3 months and surge to $0.75 according to this analyst's predictions.

The TRUMP meme coin struggles to recover, with bearish technical signals and weak market response pointing to ongoing downside risks.

- 22:31Tesla Has Made No Cryptocurrency Transactions in the Past Three Months, Currently Holds Nearly $1 Billion in BitcoinAccording to Jinse, Tesla holds nearly $1 billion in Bitcoin. The Financial Accounting Standards Board now requires digital assets to be marked to market quarterly. Tesla's first-quarter revenue was $19.34 billion, falling short of analysts' expectations, who had previously projected revenue of $21.37 billion. As of March 31, Tesla's digital asset holdings were valued at $951 million, down from $1.076 billion on December 30 of the previous year, due to a drop in Bitcoin prices. Tesla currently holds 11,509 bitcoins on its balance sheet. Data from Arkham indicates that Tesla has not conducted any transactions in the past three months.

- 22:31Fed Official Kashkari: Must Ensure Tariffs Do Not Trigger Persistent InflationJinse reports that Minneapolis Fed President Neel Kashkari stated that the Federal Reserve is responsible for ensuring that tariffs do not trigger persistent inflation issues, echoing recent remarks by Fed Chairman Powell. "We are just not sure if this will have a one-time effect on inflation or a long-term impact," Kashkari said at a U.S. Chamber of Commerce event in Washington on Tuesday. "Our job at the Federal Reserve is to ensure that this does not lead to a longer-term effect."

- 22:31Trump: Trade Losses Brought by the Biden Administration Will Never ReturnJinse reports that U.S. President Trump stated that in the last year of Biden's term, we were losing $5 billion every day, and their actions in trade were simply a disaster. However, now this number has significantly decreased because we have imposed a 25% tariff on the automotive industry, and also a 25% tariff on steel and aluminum, with a basic tariff of 10%. We almost lost $2 trillion in trade. But those days are gone, and we won't let them happen again. We will not allow such things to happen again.