Bitget:全球日交易量排名前 4!

BTC 市占率60.48%

Bitget 新幣上架:Pi Network

山寨季指數:0(比特幣季)

BTC/USDT$84177.55 (+0.35%)恐懼與貪婪指數32(恐懼)

比特幣現貨 ETF 總淨流量:+$83.1M(1 天);+$549.9M(7 天)。盤前交易幣種NIL,PAWS,WCTBitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

Bitget:全球日交易量排名前 4!

BTC 市占率60.48%

Bitget 新幣上架:Pi Network

山寨季指數:0(比特幣季)

BTC/USDT$84177.55 (+0.35%)恐懼與貪婪指數32(恐懼)

比特幣現貨 ETF 總淨流量:+$83.1M(1 天);+$549.9M(7 天)。盤前交易幣種NIL,PAWS,WCTBitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

Bitget:全球日交易量排名前 4!

BTC 市占率60.48%

Bitget 新幣上架:Pi Network

山寨季指數:0(比特幣季)

BTC/USDT$84177.55 (+0.35%)恐懼與貪婪指數32(恐懼)

比特幣現貨 ETF 總淨流量:+$83.1M(1 天);+$549.9M(7 天)。盤前交易幣種NIL,PAWS,WCTBitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

Fuel Network 價格FUEL

上架

報價幣種:

TWD

NT$0.5219+3.68%1D

價格走勢圖

TradingView

最近更新時間 2025-03-22 17:24:43(UTC+0)

市值:NT$2,285,237,206.27

完全稀釋市值:NT$2,285,237,206.27

24 小時交易額:NT$176,738,129.69

24 小時交易額/市值:7.73%

24 小時最高價:NT$0.5673

24 小時最低價:NT$0.4947

歷史最高價:NT$2.79

歷史最低價:NT$0.3286

流通量:4,378,291,700 FUEL

總發行量:

10,068,769,792.5FUEL

流通率:43.00%

最大發行量:

--FUEL

以 BTC 計價:0.{6}1881 BTC

以 ETH 計價:0.{5}7950 ETH

以 BTC 市值計價:

NT$12,574.08

以 ETH 市值計價:

NT$1,808.98

合約:

0x675B...192079c(Ethereum)

更多

您今天對 Fuel Network 感覺如何?

注意:此資訊僅供參考。

Fuel Network 今日價格

Fuel Network 的即時價格是今天每 (FUEL / TWD) NT$0.5219,目前市值為 NT$2.29B TWD。24 小時交易量為 NT$176.74M TWD。FUEL 至 TWD 的價格為即時更新。Fuel Network 在過去 24 小時內的變化為 3.68%。其流通供應量為 4,378,291,700 。

FUEL 的最高價格是多少?

FUEL 的歷史最高價(ATH)為 NT$2.79,於 2024-12-29 錄得。

FUEL 的最低價格是多少?

FUEL 的歷史最低價(ATL)為 NT$0.3286,於 2025-03-13 錄得。

Fuel Network 價格預測

FUEL 在 2026 的價格是多少?

根據 FUEL 的歷史價格表現預測模型,預計 FUEL 的價格將在 2026 達到 NT$0.6235。

FUEL 在 2031 的價格是多少?

2031,FUEL 的價格預計將上漲 +38.00%。 到 2031 底,預計 FUEL 的價格將達到 NT$1.26,累計投資報酬率為 +129.78%。

Fuel Network 價格歷史(TWD)

過去一年,Fuel Network 價格上漲了 -69.47%。在此期間,FUEL 兌 TWD 的最高價格為 NT$2.79,FUEL 兌 TWD 的最低價格為 NT$0.3286。

時間漲跌幅(%) 最低價

最低價 最高價

最高價

最低價

最低價 最高價

最高價

24h+3.68%NT$0.4947NT$0.5673

7d+27.12%NT$0.3793NT$0.5454

30d+41.80%NT$0.3286NT$0.5673

90d-63.49%NT$0.3286NT$2.79

1y-69.47%NT$0.3286NT$2.79

全部時間-20.88%NT$0.3286(2025-03-13, 10 天前 )NT$2.79(2024-12-29, 84 天前 )

Fuel Network 市場資訊

Fuel Network 行情

Fuel Network 持幣

Fuel Network 持幣分布矩陣

Fuel Network 持幣分布集中度

巨鯨

投資者

散戶

Fuel Network 地址持有時長分布

長期持幣者

游資

交易者

coinInfo.name(12)即時價格表

Fuel Network 評級

社群的平均評分

4.3

此內容僅供參考。

FUEL 兌換當地法幣匯率表

1 FUEL 兌換 MXN$0.321 FUEL 兌換 GTQQ0.121 FUEL 兌換 CLP$14.71 FUEL 兌換 UGXSh57.871 FUEL 兌換 HNLL0.41 FUEL 兌換 ZARR0.291 FUEL 兌換 TNDد.ت0.051 FUEL 兌換 IQDع.د20.681 FUEL 兌換 TWDNT$0.521 FUEL 兌換 RSDдин.1.711 FUEL 兌換 DOP$11 FUEL 兌換 MYRRM0.071 FUEL 兌換 GEL₾0.041 FUEL 兌換 UYU$0.671 FUEL 兌換 MADد.م.0.151 FUEL 兌換 AZN₼0.031 FUEL 兌換 OMRر.ع.0.011 FUEL 兌換 SEKkr0.161 FUEL 兌換 KESSh2.041 FUEL 兌換 UAH₴0.66

- 1

- 2

- 3

- 4

- 5

最近更新時間 2025-03-22 17:24:43(UTC+0)

如何購買 Fuel Network(FUEL)

建立您的免費 Bitget 帳戶

使用您的電子郵件地址/手機號碼在 Bitget 註冊,並建立強大的密碼以確保您的帳戶安全

認證您的帳戶

輸入您的個人資訊並上傳有效的身份照片進行身份認證

將 Fuel Network 兌換為 FUEL

我們將為您示範使用多種支付方式在 Bitget 上購買 Fuel Network

交易 FUEL 永續合約

在 Bitget 上註冊並購買 USDT 或 FUEL 後,您可以開始交易衍生品,包括 FUEL 合約和槓桿交易,增加收益。

FUEL 的目前價格為 NT$0.5219,24 小時價格變化為 +3.68%。交易者可透過做多或做空 FUEL 合約獲利。

Fuel Network 動態

平均回報率達 400%,這三個收益超高的加密 IDO 平台你都知道嗎?

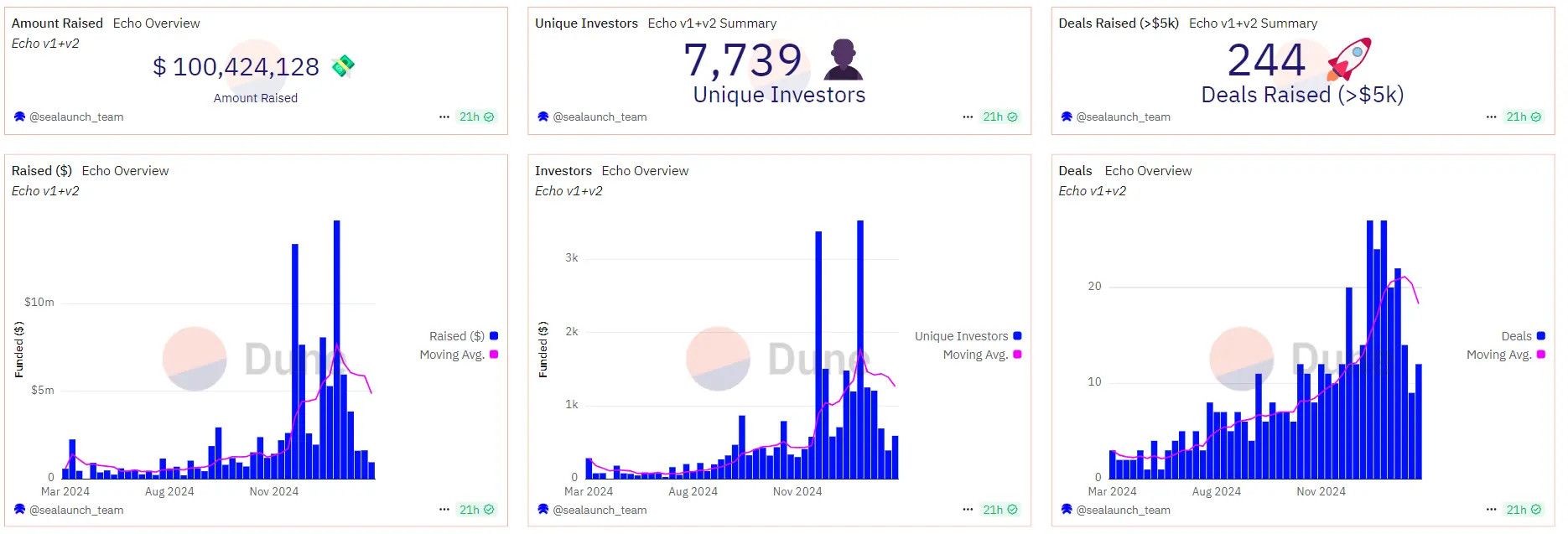

加密社區對“高估值、高 FDV、低流通量”的 VC 幣早已不滿,IDO 成為項目方吸引社區支持的熱門選擇,這也推動了 Echo、Legion、Buidlpad 等新興 IDO 平台的崛起。

Chaincatcher•2025-02-27 13:00

Bitget LaunchX 支持 Jambo 為衛星發射計劃籌集 500 萬美元

Zombit•2025-01-18 01:55

Bitget LaunchX 支持 Jambo 為衛星發射計劃籌集 500 萬美元

Abmedia•2025-01-17 20:00

FUELUSDT 現已上架合約交易和交易BOT

Bitget Announcement•2025-01-02 05:00

購買其他幣種

用戶還在查詢 Fuel Network 的價格。

Fuel Network 的目前價格是多少?

Fuel Network 的即時價格為 NT$0.52(FUEL/TWD),目前市值為 NT$2,285,237,206.27 TWD。由於加密貨幣市場全天候不間斷交易,Fuel Network 的價格經常波動。您可以在 Bitget 上查看 Fuel Network 的市場價格及其歷史數據。

Fuel Network 的 24 小時交易量是多少?

在最近 24 小時內,Fuel Network 的交易量為 NT$176.74M。

Fuel Network 的歷史最高價是多少?

Fuel Network 的歷史最高價是 NT$2.79。這個歷史最高價是 Fuel Network 自推出以來的最高價。

我可以在 Bitget 上購買 Fuel Network 嗎?

可以,Fuel Network 目前在 Bitget 的中心化交易平台上可用。如需更詳細的說明,請查看我們很有幫助的 如何購買 指南。

我可以透過投資 Fuel Network 獲得穩定的收入嗎?

當然,Bitget 推出了一個 策略交易平台,其提供智能交易策略,可以自動執行您的交易,幫您賺取收益。

我在哪裡能以最低的費用購買 Fuel Network?

Bitget提供行業領先的交易費用和市場深度,以確保交易者能够從投資中獲利。 您可通過 Bitget 交易所交易。

您可以在哪裡購買 Fuel Network(FUEL)?

影片部分 - 快速認證、快速交易

如何在 Bitget 完成身分認證以防範詐騙

1. 登入您的 Bitget 帳戶。

2. 如果您是 Bitget 的新用戶,請觀看我們的教學,以了解如何建立帳戶。

3. 將滑鼠移到您的個人頭像上,點擊「未認證」,然後點擊「認證」。

4. 選擇您簽發的國家或地區和證件類型,然後根據指示進行操作。

5. 根據您的偏好,選擇「手機認證」或「電腦認證」。

6. 填寫您的詳細資訊,提交身分證影本,並拍攝一張自拍照。

7. 提交申請後,身分認證就完成了!

加密貨幣投資(包括透過 Bitget 線上購買 Fuel Network)具有市場風險。Bitget 為您提供購買 Fuel Network 的簡便方式,並且盡最大努力讓用戶充分了解我們在交易所提供的每種加密貨幣。但是,我們不對您購買 Fuel Network 可能產生的結果負責。此頁面和其包含的任何資訊均不代表對任何特定加密貨幣的背書認可,任何價格數據均採集自公開互聯網,不被視為來自Bitget的買賣要約。

Bitget 觀點

Market-Maker

13小時前

BIG MONEY BETTING AGAINST BITCOIN!

Someone just opened a MASSIVE $332 MILLION SHORT on BTC using 40x leverage…

And guess what?

Their liquidation level is $85,300!

Is this a smart money move or a mega gamble waiting to get REKT?

Are they predicting a crash… or about to fuel the next ATH pump?

Drop your thoughts below

⬇️ Bearish or Bullish?

$BTC

BTC+0.12%

X-17.74%

vickycrypto

17小時前

XRP’s Road to $100+: Is the Dream Finally Becoming Reality? $XRP $BTC $PI $ETH

The cryptocurrency market has seen its fair share of highs and lows, but one digital asset that continues to captivate the community is XRP. With a passionate fan base, real-world adoption, and ongoing legal battles finally reaching resolution, many are wondering: Can XRP realistically hit $100?

As a blockchain writer and crypto educator deeply engaged with platforms like DOEX, Kupia Security, and MEXC, I’ve seen firsthand how narratives shape market sentiment. Beyond the hype, let's break down the key factors that could drive XRP to the triple-digit mark.

1. The Growing Utility of XRP

Unlike meme coins that rely purely on speculation, XRP has strong real-world use cases. Developed by Ripple, XRP is designed for fast and cost-effective cross-border payments. Major financial institutions, banks, and fintech companies are integrating XRP to replace outdated SWIFT systems.

Key Developments Fueling Adoption:

Ripple’s Partnerships: Ripple has secured partnerships with global banks, remittance services, and financial institutions to use ODL (On-Demand Liquidity).

CBDC & Institutional Interest: Many central banks are exploring Ripple’s technology for CBDCs, which could increase XRP’s demand.

Regulatory Clarity: The long-standing SEC vs. Ripple lawsuit is nearing resolution, reducing uncertainty and opening doors for institutional investors.

With global adoption on the rise, XRP’s utility could be the foundation for its exponential price growth.

2. XRP Tokenomics & Market Dynamics

For XRP to hit $100, let’s crunch some numbers.

Total Supply: 100 billion XRP

Circulating Supply: ~54 billion XRP

Market Cap at $100 XRP: $5.4 trillion

A $5.4 trillion market cap seems ambitious but not impossible. Bitcoin has reached a market cap of $1.4 trillion, and the total crypto market could surpass $10 trillion+ in the coming decade. If XRP captures a significant portion of global remittances and institutional payments, a $100 valuation could be within reach.

3. The Influence of DeFi, NFTs & Tokenization

As a DeFi trader and blockchain writer, I see firsthand how new trends fuel token growth.

XRP in DeFi: If XRP expands into staking, yield farming, and lending, demand will surge.

NFTs & XRP Ledger (XRPL): XRPL already supports NFTs and smart contracts, driving additional utility.

Tokenized Real-World Assets (RWA): XRP’s integration with USDz, Anzen, and other asset-backed tokens could solidify its role in global finance.

With platforms like MEXC, BitgetWallet, and Whitebite onboarding XRP traders, liquidity is improving, making it easier for whales and institutions to accumulate.

4. The Power of Community & Social Influence

One thing I’ve learned in my years as a crypto educator, shiller, and promoter is that community drives price action.

XRP Army’s Influence: The XRP Army is one of the most dedicated communities in crypto, constantly advocating for mass adoption.

Social Media & Marketing: With AI-powered ad targeting and viral campaigns, awareness can skyrocket.

Whale Accumulation: If whales start accumulating XRP before regulatory clarity, it could trigger a supply shock, sending prices higher.

With XRP positioned for global financial integration, the community’s support could accelerate its parabolic rise.

Conclusion: Is $100 XRP a Dream or a Reality?

While reaching $100 won’t happen overnight, the fundamentals, adoption, and regulatory progress suggest that XRP is undervalued. If Ripple continues to secure major partnerships, DeFi and tokenization thrive, and institutional money flows in, XRP could surpass expectations.

The key to watch:

✅ SEC Lawsuit Resolution → Unlocking institutional demand

✅ Mass Adoption by Banks & CBDCs → Increasing real-world usage

✅ DeFi, NFTs & RWAs on XRPL → Boosting token demand

✅ Community & Whale Accumulation → Driving exponential price growth

XRP’s road to $100 isn’t just speculation—it’s a possibility backed by real-world adoption. The only question is: Are you ready for the ride?

Let me know your thoughts Are you bullish on XRP’s future?

BTC+0.12%

FUEL-1.37%

ShadowWolfTrading

21小時前

Strategy announces 10% preferred stock offering to buy more Bitcoin

Strategy has announced the pricing of its latest round of perpetual preferred stock, which the company does before announcing more Bitcoin BTCUSD

acquisitions.

According to Strategy, the latest round of preferred stock will be sold at $85 per share, with a 10% coupon, and will bring the company approximately $711 million in revenue.

Market analyst Jesse Myers said that the annual 11.8% dividend distributed to investors from the latest offering suggests that Strategy can now siphon investors from the bond market, which only offers 4.2% interest.

Strategy’s most recent BTC purchase occurred on March 17, when the company acquired 130 BTC, valued at roughly $10.7 million, bringing its total holdings to 499,226 BTC, valued at $41.8 billion.

The March 17 acquisition was the company’s smallest purchase on record and followed a three-week break in buying. However, Strategy co-founder Michael Saylor has signaled that the company will raise more debt and sell more equity to fuel its accumulation of Bitcoin.

Strategy seeks fresh capital for BTC buying spree

On March 10, Strategy announced it would periodically sell shares of its 8% Series A perpetual strike preferred stock as part of its plan to raise an additional $21 billion to buy more Bitcoin.

The company followed through on March 18 by announcing a tranche of 5 million shares in Series A perpetual preferred stock to raise additional capital.

Data from SaylorTracker shows the company is still up approximately 26% all-time on its investment and is sitting on over $8.6 billion in unrealized gains despite the recent market downturn.

However, shares of Strategy declined by over 26% in early March since their highest point in January 2025 and plummeted by over 44% since the all-time high of roughly $543 reached on Nov. 21.

Shares of Strategy are currently trading at around $299, up by 29% from the recent low of $231 recorded on March 11.

The company’s inclusion in the Nasdaq 100, a weighted stock index that tracks the top 100 companies by market capitalization on the tech-focused stock exchange, injected fresh capital flows into the company but also exposed it to broader downturns in the tech market.

$BTC

BTC+0.12%

FUEL-1.37%

CCN

1天前

#Bitcoin mining isn’t just about rewards anymore—it’s reshaping global energy infrastructure. 🌍⚡

Andy Fajar Handika explains how miners fuel economic growth, monetize hashrate, and turn excess energy into opportunity. ⬇️

FUEL-1.37%

S+1.60%

Coinedition

1天前

Could These High FDV Altcoins Be the Driving Force Behind the Next Bull Run?

Altcoins with high Fully Diluted Valuations (FDV) are making some significant moves, and these shifts have some experts wondering if we’re seeing the early signs of a new bull run.

XRP, in particular, has seen its FDV skyrocket to $251 billion, pushing it past Ethereum. Meanwhile, other altcoins like SUI and HYPE have also been gaining traction, even surpassing some of the more established players like XLM, HBAR, and AVAX.

This has definitely got people talking about whether these high FDV altcoins could be the ones to kick off the next big wave of bullish momentum in the market.

XRP’s impressive surge in FDV has put it ahead of Ethereum and also significantly outperformed BNB, Solana, and Cardano in terms of projected valuation.

Related: High FDV, Low Circulating Supply Projects: Analyzing Market Potential and Risks

This jump suggests that investors are increasingly looking at assets with the potential for high future valuations.

BNB has also shown it can hold its own, increasing by 2.85% to reach $624.05.

Interestingly, its FDV matches its current market cap at $88.91 billion, and trading volume saw a big jump of 27.57% to $2.42 billion. This kind of performance usually indicates strong investor interest.

Similarly, Solana has climbed 1.80% to $130.47, with a FDV of $77.62 billion. What’s really notable with Solana is the massive 54.35% increase in trading volume, which points to growing excitement, likely fueled by its increasing use in decentralized applications.

Related: Ethereum Scaling Solutions Take Center Stage: Top 5 Layer 2 Tokens by FDV

Cardano, priced at $0.7315, has recorded a modest 0.25% increase. Its FDV stands at $32.91 billion, with a market cap of $25.77 billion. While Cardano’s growth might be steady rather than explosive, its potential is still considered strong thanks to its ongoing technological advancements.

Meanwhile, Sui’s valuation has surged , reaching an FDV of $24.47 billion. Its price increase of 2.92% to $2.44 indicates growing investor confidence in the platform.

Hyperliquid’s FDV has climbed to $14.72 billion, positioning it above Stellar, Hedera, and Avalanche. While its price did dip slightly by 1.78% to $14.73, its trading volume surged by 33.66%, indicating a lot of interest in this newer player.

Stellar and Hedera have faced declines, with their prices dropping to $0.2843 and $0.1915, respectively. Their FDVs stand at $14.21 billion and $9.57 billion , suggesting they may need stronger catalysts to regain momentum.

Avalanche has also experienced a decline, with its price falling 3.10% to $18.84. Despite this, its FDV of $13.5 billion still places it among top contenders.

With investor sentiment potentially shifting, these altcoins with high FDVs are definitely gaining attention. If they keep attracting significant investment, they could very well be the ones to fuel the next big rally across the crypto market.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

PEOPLE+6.48%

HYPE-1.00%

相關資產

最近新增

最近新增的加密貨幣

相近市值

在所有 Bitget 資產中,這8種資產的市值最接近 Fuel Network。

.png)