Bitget:全球日交易量排名前 4!

BTC 市占率60.50%

Bitget 新幣上架:Pi Network

山寨季指數:0(比特幣季)

BTC/USDT$84122.47 (+0.31%)恐懼與貪婪指數32(恐懼)

比特幣現貨 ETF 總淨流量:+$83.1M(1 天);+$549.9M(7 天)。盤前交易幣種NIL,PAWS,WCTBitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

Bitget:全球日交易量排名前 4!

BTC 市占率60.50%

Bitget 新幣上架:Pi Network

山寨季指數:0(比特幣季)

BTC/USDT$84122.47 (+0.31%)恐懼與貪婪指數32(恐懼)

比特幣現貨 ETF 總淨流量:+$83.1M(1 天);+$549.9M(7 天)。盤前交易幣種NIL,PAWS,WCTBitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

Bitget:全球日交易量排名前 4!

BTC 市占率60.50%

Bitget 新幣上架:Pi Network

山寨季指數:0(比特幣季)

BTC/USDT$84122.47 (+0.31%)恐懼與貪婪指數32(恐懼)

比特幣現貨 ETF 總淨流量:+$83.1M(1 天);+$549.9M(7 天)。盤前交易幣種NIL,PAWS,WCTBitget 新用戶立享 6,200 USDT 歡迎禮包!立即領取

到 Bitget App 隨時隨地輕鬆交易!立即下載

BloodLoop 價格BLS

上架

報價幣種:

TWD

NT$0.6575-6.63%1D

價格走勢圖

TradingView

最近更新時間 2025-03-22 13:48:24(UTC+0)

市值:NT$34,462,776.85

完全稀釋市值:NT$34,462,776.85

24 小時交易額:NT$507,139.82

24 小時交易額/市值:1.47%

24 小時最高價:NT$0.7044

24 小時最低價:NT$0.6486

歷史最高價:NT$16.59

歷史最低價:NT$0.6341

流通量:52,418,330 BLS

總發行量:

306,247,500BLS

流通率:17.00%

最大發行量:

350,000,000BLS

以 BTC 計價:0.{6}2372 BTC

以 ETH 計價:0.{4}1004 ETH

以 BTC 市值計價:

NT$1,049,134.28

以 ETH 市值計價:

NT$150,716

合約:

0x46B9...ADCAF9D(Avalanche C-Chain)

更多

您今天對 BloodLoop 感覺如何?

注意:此資訊僅供參考。

BloodLoop 今日價格

BloodLoop 的即時價格是今天每 (BLS / TWD) NT$0.6575,目前市值為 NT$34.46M TWD。24 小時交易量為 NT$507,139.82 TWD。BLS 至 TWD 的價格為即時更新。BloodLoop 在過去 24 小時內的變化為 -6.63%。其流通供應量為 52,418,330 。

BLS 的最高價格是多少?

BLS 的歷史最高價(ATH)為 NT$16.59,於 2024-07-03 錄得。

BLS 的最低價格是多少?

BLS 的歷史最低價(ATL)為 NT$0.6341,於 2025-03-15 錄得。

BloodLoop 價格預測

什麼時候是購買 BLS 的好時機? 我現在應該買入還是賣出 BLS?

在決定買入還是賣出 BLS 時,您必須先考慮自己的交易策略。長期交易者和短期交易者的交易活動也會有所不同。Bitget BLS 技術分析 可以提供您交易參考。

根據 BLS 4 小時技術分析,交易訊號為 賣出。

根據 BLS 1 日技術分析,交易訊號為 強力賣出。

根據 BLS 1 週技術分析,交易訊號為 賣出。

BLS 在 2026 的價格是多少?

根據 BLS 的歷史價格表現預測模型,預計 BLS 的價格將在 2026 達到 NT$1.01。

BLS 在 2031 的價格是多少?

2031,BLS 的價格預計將上漲 +25.00%。 到 2031 底,預計 BLS 的價格將達到 NT$2.04,累計投資報酬率為 +212.21%。

BloodLoop 價格歷史(TWD)

過去一年,BloodLoop 價格上漲了 -89.81%。在此期間,BLS 兌 TWD 的最高價格為 NT$16.59,BLS 兌 TWD 的最低價格為 NT$0.6341。

時間漲跌幅(%) 最低價

最低價 最高價

最高價

最低價

最低價 最高價

最高價

24h-6.63%NT$0.6486NT$0.7044

7d+0.63%NT$0.6486NT$0.7758

30d-42.65%NT$0.6341NT$1.18

90d-84.12%NT$0.6341NT$6.25

1y-89.81%NT$0.6341NT$16.59

全部時間-89.81%NT$0.6341(2025-03-15, 7 天前 )NT$16.59(2024-07-03, 262 天前 )

BloodLoop 持幣分布集中度

巨鯨

投資者

散戶

BloodLoop 地址持有時長分布

長期持幣者

游資

交易者

coinInfo.name(12)即時價格表

BloodLoop 評級

社群的平均評分

4.4

此內容僅供參考。

BLS 兌換當地法幣匯率表

1 BLS 兌換 MXN$0.41 BLS 兌換 GTQQ0.151 BLS 兌換 CLP$18.521 BLS 兌換 UGXSh72.911 BLS 兌換 HNLL0.511 BLS 兌換 ZARR0.361 BLS 兌換 TNDد.ت0.061 BLS 兌換 IQDع.د26.051 BLS 兌換 TWDNT$0.661 BLS 兌換 RSDдин.2.161 BLS 兌換 DOP$1.261 BLS 兌換 MYRRM0.091 BLS 兌換 GEL₾0.061 BLS 兌換 UYU$0.841 BLS 兌換 MADد.م.0.191 BLS 兌換 OMRر.ع.0.011 BLS 兌換 AZN₼0.031 BLS 兌換 SEKkr0.21 BLS 兌換 KESSh2.571 BLS 兌換 UAH₴0.83

- 1

- 2

- 3

- 4

- 5

最近更新時間 2025-03-22 13:48:24(UTC+0)

如何購買 BloodLoop(BLS)

建立您的免費 Bitget 帳戶

使用您的電子郵件地址/手機號碼在 Bitget 註冊,並建立強大的密碼以確保您的帳戶安全

認證您的帳戶

輸入您的個人資訊並上傳有效的身份照片進行身份認證

將 BloodLoop 兌換為 BLS

我們將為您示範使用多種支付方式在 Bitget 上購買 BloodLoop

交易 BLS 永續合約

在 Bitget 上註冊並購買 USDT 或 BLS 後,您可以開始交易衍生品,包括 BLS 合約和槓桿交易,增加收益。

BLS 的目前價格為 NT$0.6575,24 小時價格變化為 -6.63%。交易者可透過做多或做空 BLS 合約獲利。

BloodLoop 動態

比特幣上漲!美國 2 月通膨率達 2.8%,CPI 低於市場預期

Abmedia•2025-03-12 04:48

貝萊德 CEO:美國民族主義政策將推高通脹

Blockcast•2025-03-11 16:44

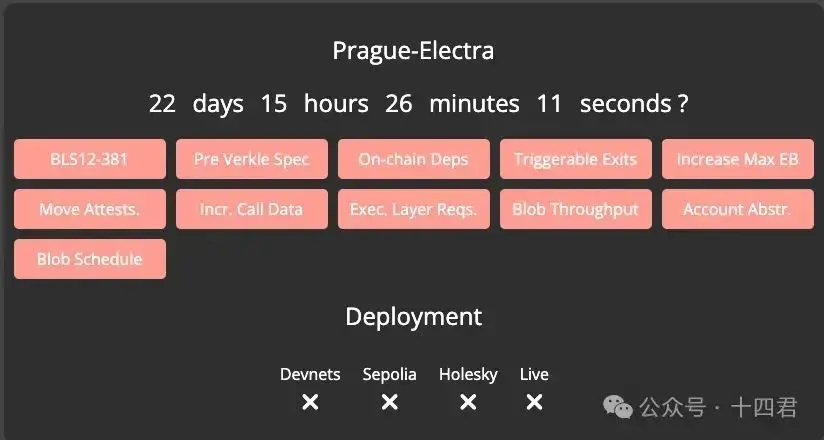

以太坊布拉格升級解析:不斷妥協調整的折衷方案

每 1-2 年一次的以太坊大版本硬分叉升級,都將從他自身,逐漸輻射到各個以太坊系列的 L2,再擴大到多個 L1 的發展,而每一次硬分叉所包含的 Eip,都代表著以太坊核心社區的高度精華,是收益與成本的平衡結果。

Chaincatcher•2025-03-07 03:33

美國一月就業數據:非農就業人數成長放緩,低於預期

Abmedia•2025-02-07 05:46

購買其他幣種

用戶還在查詢 BloodLoop 的價格。

BloodLoop 的目前價格是多少?

BloodLoop 的即時價格為 NT$0.66(BLS/TWD),目前市值為 NT$34,462,776.85 TWD。由於加密貨幣市場全天候不間斷交易,BloodLoop 的價格經常波動。您可以在 Bitget 上查看 BloodLoop 的市場價格及其歷史數據。

BloodLoop 的 24 小時交易量是多少?

在最近 24 小時內,BloodLoop 的交易量為 NT$507,139.82。

BloodLoop 的歷史最高價是多少?

BloodLoop 的歷史最高價是 NT$16.59。這個歷史最高價是 BloodLoop 自推出以來的最高價。

我可以在 Bitget 上購買 BloodLoop 嗎?

可以,BloodLoop 目前在 Bitget 的中心化交易平台上可用。如需更詳細的說明,請查看我們很有幫助的 如何購買 指南。

我可以透過投資 BloodLoop 獲得穩定的收入嗎?

當然,Bitget 推出了一個 策略交易平台,其提供智能交易策略,可以自動執行您的交易,幫您賺取收益。

我在哪裡能以最低的費用購買 BloodLoop?

Bitget提供行業領先的交易費用和市場深度,以確保交易者能够從投資中獲利。 您可通過 Bitget 交易所交易。

您可以在哪裡購買 BloodLoop(BLS)?

影片部分 - 快速認證、快速交易

如何在 Bitget 完成身分認證以防範詐騙

1. 登入您的 Bitget 帳戶。

2. 如果您是 Bitget 的新用戶,請觀看我們的教學,以了解如何建立帳戶。

3. 將滑鼠移到您的個人頭像上,點擊「未認證」,然後點擊「認證」。

4. 選擇您簽發的國家或地區和證件類型,然後根據指示進行操作。

5. 根據您的偏好,選擇「手機認證」或「電腦認證」。

6. 填寫您的詳細資訊,提交身分證影本,並拍攝一張自拍照。

7. 提交申請後,身分認證就完成了!

加密貨幣投資(包括透過 Bitget 線上購買 BloodLoop)具有市場風險。Bitget 為您提供購買 BloodLoop 的簡便方式,並且盡最大努力讓用戶充分了解我們在交易所提供的每種加密貨幣。但是,我們不對您購買 BloodLoop 可能產生的結果負責。此頁面和其包含的任何資訊均不代表對任何特定加密貨幣的背書認可,任何價格數據均採集自公開互聯網,不被視為來自Bitget的買賣要約。

Bitget 觀點

JunaidGhouri30

2025/03/16 12:12

US Core PPI Disappoints: Implications for Inflation, Interest Rates, and the Economy*

The US Bureau of Labor Statistics (BLS) recently released the Producer Price Index (PPI) data for February, which showed a disappointing 0.1% increase in core PPI. This was below market expectations of a 0.2% rise. In this article, we'll analyze the implications of this data for inflation, interest rates, and the economy.

*What is Core PPI?*

Core PPI measures the change in prices of goods and services at the production level, excluding food and energy prices. It's a key indicator of inflationary pressures in the economy.

*Implications for Inflation*

The disappointing core PPI data suggests that inflationary pressures may be easing. This could be due to various factors, such as:

1. *Weakening demand*: Softening demand for goods and services could be contributing to lower price pressures.

2. *Increased productivity*: Improving productivity could be helping businesses to keep prices in check.

3. *Global economic slowdown*: A slowdown in global economic growth could be reducing inflationary pressures.

*Implications for Interest Rates*

The Federal Reserve closely monitors inflation data when setting interest rates. With core PPI coming in below expectations, the Fed may be less likely to raise interest rates in the near term. This could lead to:

1. *Lower borrowing costs*: With interest rates potentially remaining lower for longer, borrowing costs for consumers and businesses may decrease.

2. *Support for economic growth*: Lower interest rates could provide a boost to economic growth, as cheaper borrowing costs encourage spending and investment.

*Implications for the Economy*

The disappointing core PPI data has several implications for the economy:

1. *Slowing economic growth*: Weakening inflationary pressures could be a sign of slowing economic growth.

2. *Reduced consumer spending*: Lower inflation expectations could lead to reduced consumer spending, as households may delay purchases in anticipation of lower prices.

3. *Increased uncertainty*: The unexpected core PPI data may increase uncertainty among businesses and investors, potentially leading to reduced investment and hiring.

*Conclusion*

The disappointing core PPI data has significant implications for inflation, interest rates, and the economy. While the data suggests easing inflationary pressures, it also raises concerns about slowing economic growth and reduced consumer spending. As the economic landscape continues to evolve, it's essential to monitor incoming data and adjust expectations accordingly.

*What's Next?*

In the coming weeks and months, we can expect:

1. *Further inflation data*: The release of additional inflation data, such as the Consumer Price Index (CPI), will provide further insights into the inflationary landscape.

2. *Fed policy decisions*: The Federal Reserve will continue to monitor inflation data and adjust its policy decisions accordingly.

3. *Economic growth updates*: Regular updates on economic growth, such as GDP data, will provide a clearer picture of the economy's trajectory.

CORE+0.51%

NEAR+1.32%

BGUSER-MZ35A86A

2025/03/08 14:35

The Non-Farm Payrolls (NFP) report is indeed a highly anticipated monthly economic indicator that provides valuable insights into the US labor market. Released by the US Bureau of Labor Statistics (BLS), it reveals the number of jobs added or lost in the US economy, excluding the agricultural sector ¹.

The NFP report serves as a key measure of economic health, reflecting employment trends and labor market conditions. Its impact on financial markets is significant, as traders closely analyze the data to gauge potential shifts in economic policy and market sentiment. This information enables them to make informed trading decisions in forex and other financial markets.

Some of the key aspects of the NFP report include:

- *Job creation*: The number of jobs added or lost in the US economy.

- *Unemployment Rate*: The percentage of the labor force currently unemployed.

- *Wage growth*: The rate of change in average hourly earnings.

- *Labor market conditions*: Insights into the overall health of the labor market.

The latest NFP report showed that the US economy added 151,000 jobs in February, slightly below market expectations of 160,000 ². The Unemployment Rate edged higher to 4.1%, while annual wage inflation rose to 4%. These numbers provide valuable insights into the current state of the US labor market and its potential impact on economic policy and financial markets.

ROSE+2.24%

FARM+43.49%

Sureshkumar45y

2025/02/09 15:54

The Nonfarm Payrolls (NFP) report, released by the U.S. Bureau of Labor Statistics (BLS) on the first Friday of every month, measures job growth in the U.S. economy, excluding farm workers and some other sectors. It is a key economic indicator that influences financial markets, including cryptocurrencies.

1. How NFP Data Affects the Crypto Market?

✅ Bullish Scenario (Positive for Crypto)

If NFP is weaker than expected (job growth is slowing):

✔️ Lower Employment Growth → Weaker USD: The Federal Reserve (Fed) may adopt a dovish (less aggressive) stance on interest rates, potentially leading to rate cuts or a slowdown in hikes.

✔️ Risk-On Sentiment: A weaker job market may push investors towards riskier assets like Bitcoin, Ethereum, and altcoins as traditional markets weaken.

✔️ Liquidity Increase: If the Fed signals monetary easing (rate cuts, quantitative easing), more liquidity enters the financial system, benefiting crypto markets.

Example:

If NFP data is lower than expected, Bitcoin and altcoins may see an immediate price spike due to expectations of looser monetary policy.

❌ Bearish Scenario (Negative for Crypto)

If NFP is stronger than expected (higher job growth):

🚨 Stronger Labor Market → Higher Inflation → Fed Tightening: The Fed may see this as a reason to keep raising interest rates to control inflation.

🚨 Risk-Off Sentiment: Investors might shift funds to traditional markets (stocks, bonds, USD), reducing capital inflows into crypto.

🚨 Stronger USD: A strong NFP report can push the U.S. Dollar Index (DXY) higher, causing Bitcoin and altcoins to decline as they often have an inverse correlation with the USD.

Example:

If NFP data is higher than expected, Bitcoin might drop sharply due to fears of higher interest rates and reduced liquidity.

2. Historical Impact of NFP on Crypto

📌 May 2023: A strong NFP report led to Bitcoin dropping 3% within hours as investors feared further Fed rate hikes.

📌 November 2023: A weaker-than-expected NFP report saw Bitcoin rally over 5%, as markets anticipated a potential Fed pivot.

3. Trading Strategies for Crypto During NFP Releases

📌 Pre-NFP Strategy:

Low Volatility Before Release: Prices often consolidate as traders wait for the data.

Watch the USD & Interest Rate Expectations: If expectations lean toward a dovish Fed, crypto may pump.

📌 Post-NFP Strategy:

Trade Based on the Actual Numbers vs. Forecasts:

Weak NFP = Long BTC/ETH (Buy crypto as USD weakens)

Strong NFP = Short BTC/ETH (Sell crypto as USD strengthens)

Wait for Initial Volatility to Settle: Markets can be choppy within the first 15-30 minutes after release.

4. Final Thoughts

NFP is a High-Impact Event for crypto, similar to CPI (inflation data) and FOMC meetings.

Traders Should Monitor:

✔️ U.S. Dollar Index (DXY)

✔️ Interest Rate Expectations (Fed Futures)

✔️ Bitcoin’s Correlation with Stocks & Bonds

BTC+0.06%

ETH+1.10%

Cryptô•Majnoo

2025/02/09 14:58

How NFP data Affects Bullish or Bearish Scenario:-

The Nonfarm Payrolls (NFP) report, released by the U.S. Bureau of Labor Statistics (BLS) on the first Friday of every month, measures job growth in the U.S. economy, excluding farm workers and some other sectors. It is a key economic indicator that influences financial markets, including cryptocurrencies.

1. How NFP Data Affects the Crypto Market?

✅ Bullish Scenario (Positive for Crypto)

If NFP is weaker than expected (job growth is slowing):

✔️ Lower Employment Growth → Weaker USD: The Federal Reserve (Fed) may adopt a dovish (less aggressive) stance on interest rates, potentially leading to rate cuts or a slowdown in hikes.

✔️ Risk-On Sentiment: A weaker job market may push investors towards riskier assets like Bitcoin, Ethereum, and altcoins as traditional markets weaken.

✔️ Liquidity Increase: If the Fed signals monetary easing (rate cuts, quantitative easing), more liquidity enters the financial system, benefiting crypto markets.

Example:

If NFP data is lower than expected, Bitcoin and altcoins may see an immediate price spike due to expectations of looser monetary policy.

❌ Bearish Scenario (Negative for Crypto)

If NFP is stronger than expected (higher job growth):

🚨 Stronger Labor Market → Higher Inflation → Fed Tightening: The Fed may see this as a reason to keep raising interest rates to control inflation.

🚨 Risk-Off Sentiment: Investors might shift funds to traditional markets (stocks, bonds, USD), reducing capital inflows into crypto.

🚨 Stronger USD: A strong NFP report can push the U.S. Dollar Index (DXY) higher, causing Bitcoin and altcoins to decline as they often have an inverse correlation with the USD.

Example:

If NFP data is higher than expected, Bitcoin might drop sharply due to fears of higher interest rates and reduced liquidity.

2. Historical Impact of NFP on Crypto

📌 May 2023: A strong NFP report led to Bitcoin dropping 3% within hours as investors feared further Fed rate hikes.

📌 November 2023: A weaker-than-expected NFP report saw Bitcoin rally over 5%, as markets anticipated a potential Fed pivot.

3. Trading Strategies for Crypto During NFP Releases

📌 Pre-NFP Strategy:

Low Volatility Before Release: Prices often consolidate as traders wait for the data.

Watch the USD & Interest Rate Expectations: If expectations lean toward a dovish Fed, crypto may pump.

📌 Post-NFP Strategy:

Trade Based on the Actual Numbers vs. Forecasts:

Weak NFP = Long BTC/ETH (Buy crypto as USD weakens)

Strong NFP = Short BTC/ETH (Sell crypto as USD strengthens)

Wait for Initial Volatility to Settle: Markets can be choppy within the first 15-30 minutes after release.

4. Final Thoughts

NFP is a High-Impact Event for crypto, similar to CPI (inflation data) and FOMC meetings.

Traders Should Monitor:

✔️ U.S. Dollar Index (DXY)

✔️ Interest Rate Expectations (Fed Futures)

✔️ Bitcoin’s Correlation with Stocks & Bonds

BTC+0.06%

ETH+1.10%

Sureshkumar45y

2025/02/09 03:44

What Is Non Farm Payrolls?

Non farm payrolls, often referred to as NFP, is a key economic indicator released by the United States Bureau of Labor Statistics (BLS) on a monthly basis. It provides valuable information about the number of jobs added or lost in the nonfarm sector of the US economy, excluding agricultural and government employment.

The NFP report is closely watched by market participants, including economists, investors, and traders, as it offers insights into the health and momentum of the labor market. It is considered a significant indicator of overall economic strength and can have a notable impact on fin ancial markets, particularly in the United States.

Here are a few key points about the Nonfarm Payrolls report:

Data included: The report includes data on the number of jobs added or lost in various sectors such as manufacturing, construction, healthcare, retail, finance, and more. It also provides information on the average workweek hours, average hourly earnings, and the unemployment rate.

Release schedule: The NFP report is typically released on the first Friday of each month, covering the employment data for the previous month. For example, the report released in February provides data for January.

Market impact: The NFP report has the potential to significantly impact financial markets, particularly currencies, bonds, and stock markets. Stronger-than-expected job growth in the report can be seen as positive for the economy and may lead to increased demand for the currency and higher stock prices. Conversely, weaker-than-expected job growth can have the opposite effect.

Volatility and trading opportunities: The release of the NFP report often leads to increased market volatility, with sharp price movements observed in various asset classes. Traders and investors may utilize this volatility to capitalize on short-term trading opportunities or adjust their positions based on the implications of the report.

It's important to note that while the NFP report is a widely followed economic indicator, it is just one piece of the overall economic puzzle. It is often analyzed alongside other economic indicators and factors to get a comprehensive view of the labor market and the broader economicomy .

Is NFP Good For Crypto?

The Nonfarm Payrolls (NFP) report, which provides insights into the US labor market, may indirectly impact the cryptocurrency market, but its direct influence is relatively limited.

Cryptocurrencies, such as $BTC or $ETH , are decentralized digital as sets that operate independently of traditional economic indicators.

However, there are a few indirect ways in which the NFP report and other economic indicators can affect cryptocurrencies:

Overall market sentiment: Positive or negative NFP data can influence general market sentiment and risk appetite. If the NFP report indicates strong job growth and a robust economy, it may boost investor confidence and lead to increased risk-taking across various asset classes, including cryptocurrencies .

Macroeconomic factors: The state of the broader economy can indirectly affect the demand for cryptocurrencies. If the NFP report reflects a healthy labor market and a strong economy, it may contribute to increased disposable income and consumer spending, potentially lead ing to higher adoption and usage of cryptocurrencies.

Impact on traditional financial markets: The NFP report can have a more direct impact on traditional financial markets such as stocks, bonds, and currencies. Significant movements in these markets may spill over into the cryptocurrency market as traders and investors ad just their portfolios or seek alternatives investments.

It's essential to remember that cryptocurrencies are influenced by a wide range of factors beyond traditional economic indicators. These factors include technological developments, regulatory changes, market sentiment specific to cryptocurrencies, and the overall adoption and acceptance of digital assets.

While keeping an eye on general economic indicators like the Non farm payrolls report can provide a broader context, they should not be the sole determining factor for cryptocurrency trading decisions.

BTC+0.06%

ETH+1.10%

相關資產

最近新增

最近新增的加密貨幣

相近市值

在所有 Bitget 資產中,這8種資產的市值最接近 BloodLoop。