Funding Rate Arbitrage on Bitget - Website Guide

[Estimated Reading Time: 4 Minutes]

This guide provides an overview of the Funding Rate Arbitrage Bot on Bitget. Learn how this bot helps you profit from funding rate differences in the futures market by leveraging long and short positions, and follow the steps to configure and manage the bot for optimal results.

What Is the Funding Rate Arbitrage Bot?

The Funding Rate Arbitrage Bot is a tool designed to exploit funding rate differences in the futures market. It automates long and short positions across perpetual contracts to generate consistent returns based on positive or negative funding rates. Traders can capitalize on market-neutral strategies while minimizing exposure to price fluctuations.

Key Features:

-

Arbitrage Strategy: Leverages funding rate discrepancies between long and short positions.

-

Automation: Automatically manages positions to ensure efficient arbitrage trading.

-

Market Neutrality: Reduces exposure to price volatility by simultaneously holding long and short positions.

-

Customizable Settings: Adjust batch size, order placement, and risk management tools like sell-at-termination.

How Does Funding Rate Arbitrage Work?

1. Funding Rates: Perpetual futures contracts have periodic funding payments exchanged between long and short traders. Positive funding rates mean long traders pay short traders, while negative funding rates mean short traders pay long traders.

2. Arbitrage Opportunity: By simultaneously opening a long position in one market and a short position in another, traders can capture funding rate payments while maintaining a market-neutral stance.

3. Profit Generation: The bot automates this process, ensuring consistent execution and monitoring to maximize arbitrage returns.

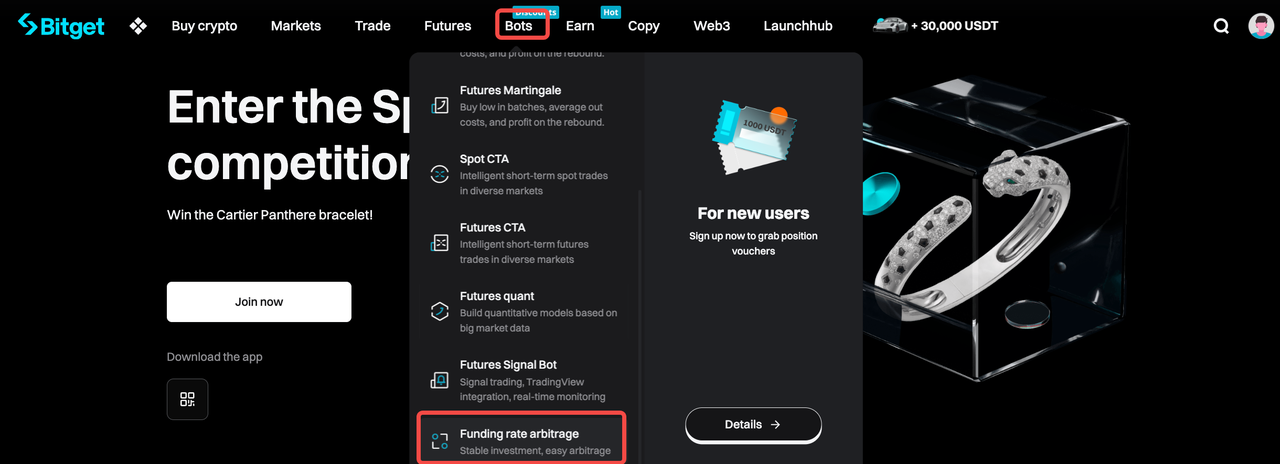

Step 1: Access the Bot

1. Navigate to the Bots tab on the main menu.

2. Select Funding Rate Arbitrage Bot from the available options.

3. Choose your trading pair, such as BTC/USDT, from the dropdown menu.

Step 2: Funding Rate Arbitrage Bot Disclaimer Agreement

1. Upon accessing the Funding Rate Arbitrage Bot for the first time, a pop-up disclaimer agreement will appear.

2. Read the disclaimer carefully, which explains the bot's trading terms, risks, and conditions.

3. Check the agreement box to confirm you understand and accept the risks involved.

4. Click Confirm to proceed to the bot setup page.

Step 3: Review Funding Rate Data

1. Check the Funding Rate and Basis Rate displayed at the top of the bot interface.

2. Analyze the Expected Arbitrage APR (last 3, 30, and 90 days) to assess potential profitability.

3. Review historical trends using the funding rate and basis rate chart.

Step 4: Set the Investment Amount

1. Enter the total amount of USDT to allocate for arbitrage.

2. Ensure your Available Balance meets the Required Margin displayed.

Step 5: Adjust Advanced Settings (Optional)

1. Place Orders in Batches:

-

Specify the batch size for smoother execution of trades.

2. Sell at Termination:

-

Enable this option to convert holdings into USDT automatically when the bot is stopped.

Step 6: Launch the Bot

1. Verify all settings, including investment amount, batch preferences, and disclaimer agreement.

2. Click Create to activate the Funding Rate Arbitrage Bot.

3. Monitor the bot’s performance and funding rate payouts in the Current bots section.

Step 7: Terminate the Bot (If Needed)

1. Go to the "Current bots" tab.

2. Select the bot you want to stop.

3. Click "Terminate" and confirm the action.

4. Once terminated, all open positions will be closed automatically at market price, and any remaining funds will be returned to your account.

Note: Termination is final and stops all trading immediately. Use "Suspend" if you plan to resume later.

Key Considerations

1. Market Neutrality:

-

The bot aims to maintain neutrality by holding equal-value long and short positions, minimizing exposure to price changes.

2. Funding Rate Variability:

-

Returns depend on the funding rate remaining favorable. Monitor funding rate trends to ensure profitability.

3. Sufficient Margin:

-

Ensure you have enough funds in your Futures Account to cover potential margin requirements for both long and short positions.

4. Market Volatility:

-

While the strategy is market-neutral, extreme market movements may still impact performance due to slippage or funding rate changes.

5. Transaction Fees:

-

Standard trading fees apply for each position opened or closed. Ensure fees are factored into your profitability calculations.

FAQs

1. What is the Funding Rate Arbitrage Bot?

It’s an automated tool that captures funding rate payments by holding simultaneous long and short futures positions.

2. What is the minimum investment required?

The minimum investment amount depends on the selected trading pair and is displayed as the "Required Margin" during setup.

3. Can I customize order placement?

Yes, the bot allows you to place orders in batches to reduce slippage.

4. Does the bot guarantee profits?

No, profits depend on favorable funding rates and market conditions. Past performance does not guarantee future returns.

5. What happens if I stop the bot?

If the "Sell at Termination" option is enabled, all positions will be closed and converted to USDT.

Disclaimer and Risk Warning

All trading tutorials provided by Bitget are for educational purposes only and should not be considered financial advice. The strategies and examples shared are for illustrative purposes and may not reflect actual market conditions. Cryptocurrency trading involves significant risks, including potential losses exceeding your initial investment. Always conduct thorough research and understand the risks involved. Bitget is not responsible for any trading decisions made by users.

Join Bitget, the World's Leading Crypto Exchange and Web 3 Company

Share