- Bitget

- Research

- Daily Industry Highlights

- Bitget Daily Digest (March 28) | PCE data may trigger market volatility again, Ghibli concept gains popularity

Bitget Daily Digest (March 28) | PCE data may trigger market volatility again, Ghibli concept gains popularity

远山洞见

2025/03/28

Today's preview

1.The U.S. February core PCE price index will be released today, with the previous value at 2.60%.

2.The preliminary University of Michigan Consumer Sentiment Index for March will also be announced today, with the previous reading at 57.9.

3.Velo (VELO) will unlock approximately 182 million tokens today, representing 2.47% of the current circulating supply, valued at around $2.4 million.

4.The Artificial Superintelligence Alliance (FET) will unlock about 3.24 million tokens today, representing 0.12% of the current circulating supply, valued at approximately $1.7 million.

Key market highlights

1.Recent Federal Reserve comments have raised concerns about tariffs and inflation. Boston Fed President Collins stated that tariffs will "inevitably" push up inflation in the short term and emphasized that maintaining interest rates for an extended period is the right approach. She pointed out how import prices quickly respond to tariff changes, though the cost transmission to consumers remains uncertain. Collins also cautioned that inflationary pressures may persist longer than expected.

The uncertainty surrounding new tariffs, immigration, and tax policies is undermining market confidence, leading to more conservative spending by both consumers and businesses.

2.On the other hand, the number of initial jobless claims in the U.S. decreased from a revised 225,000 to 224,000,

signaling resilience in the labor market. The U.S. fourth-quarter GDP growth was revised to 2.4%, up from the previous market expectation of 2.3%, with price indicators softening slightly.

3.South Carolina's latest Bitcoin Reserve Bill (H4256) allows the State Treasurer to

allocate up to 10% of state funds into Bitcoin, with a reserve cap of 1 million BTC. Proposed by Representative Jordan Pace, this signals a step toward U.S. sovereign funds tentatively positioning Bitcoin as a viable asset.

4.Memecoin images inspired by Hayao Miyazaki's animation have surfaced on X, blending classic memecoin visuals with the distinct artistic aesthetics of Studio Ghibli. This unique fusion of nostalgia with absurdity has fueled the popularity of the $

Ghibli token. This trend has been amplified by OpenAI's recent release of the multimodal GPT-4o model, which excels at generating high-fidelity recreations of Ghibli-style art, driving further hype around $Ghibli.

Market overview

1.BTC shows signs of consolidation with reduced short-term volatility. CEX voting has concluded, with tokens like MUBARAK, $BROCCOLI714, $TUT, and $BANANAS31 have been listed. On the BSC ecosystem, tokens like $SIREN, $KOMA, and $MUBARAK are leading declines.

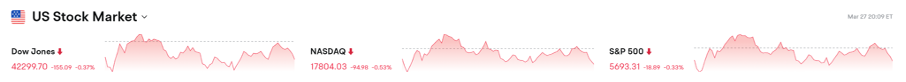

2.U.S. stocks experienced a second consecutive drop, with General Motors falling more than 7% and Stellantis down over 4%. Following target price upgrades from Goldman Sachs and Bank of America, gold prices rose by more than 1%, reaching a new historical high.

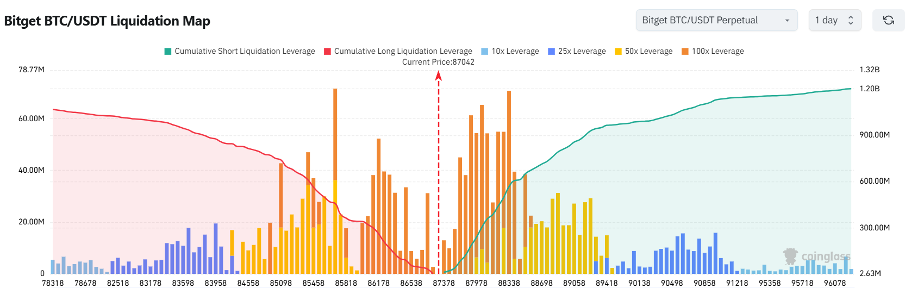

3.Currently standing at 87,042 USDT, Bitcoin is in a potential liquidation zone. A 1000-point drop to around 86,042 USDT could trigger

over $340 million in cumulative long-position liquidations. Conversely, a rise to 88,042 USDT could lead to

more than $210 million in cumulative short-position liquidations. With long liquidation volumes far surpassing short positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

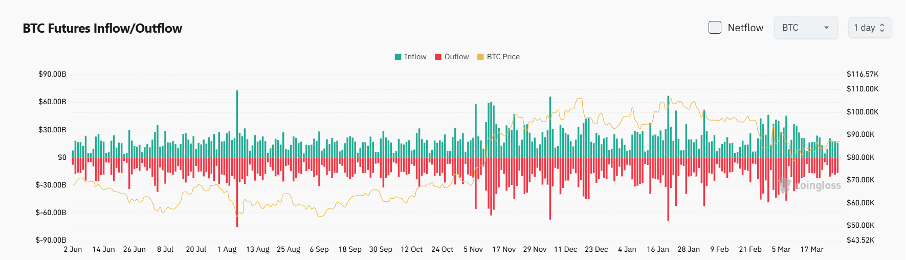

4.Over the past 24 hours, the BTC spot market recorded $16 billion in inflows and $16.5 billion in outflows, resulting in a

net outflow of $500 million.

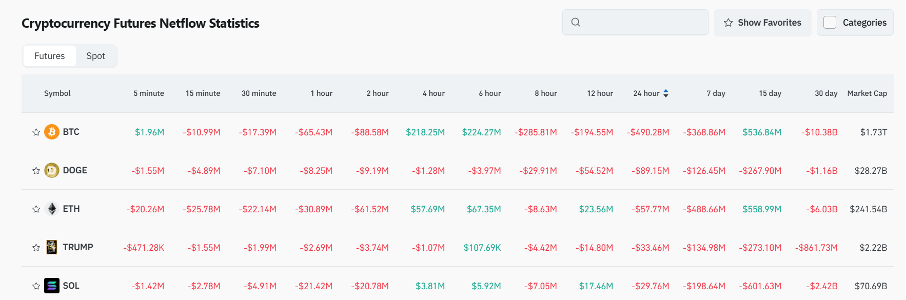

5.In the last 24 hours, $BTC, $DOGE, $ETH, $TRUMP, and $SOL led in

net outflows in futures trading, signaling potential trading opportunities.

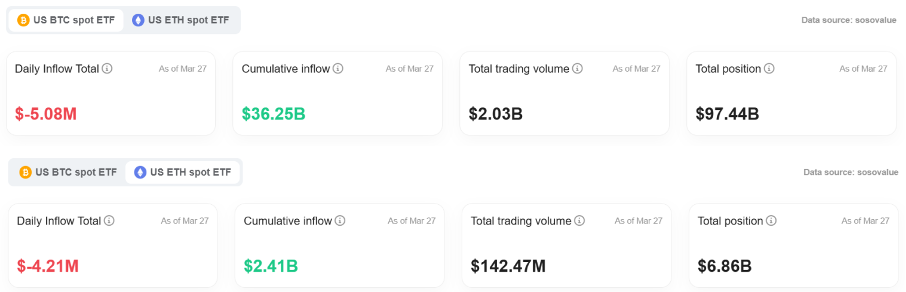

6.According to the latest data from SoSoValue, U.S. spot Bitcoin ETFs recorded a single-day outflow of $5.0891 million, while the cumulative inflows amount to $36.246 billion, with total holdings at $97.434 billion. U.S. spot Ethereum ETFs saw a single-day outflow of $4.2158 million, with cumulative inflows of $2.405 billion and total holdings of $6.853 billion.

Institutional insights

CryptoQuant: BTC whales are reducing their leveraged positions, a trend typically indicative of bearish sentiment.

JP Morgan: The market share of yield-bearing stablecoins may rise to 50%.

Read the full article here:

https://www.theblock.co/post/348449/jpmorgan-yield-bearing-stablecoins-growth

Greeks.live: The market remains in a low-volatility, sideways phase, with BTC traders closely monitoring Trump's tariff policies set to take effect on April 2.

Read the full article here:

https://x.com/BTC__options/status/1905248440381997481

News updates

1.Incoming SEC Chair Paul Atkins comments that current regulations are overly complex, and crypto industry oversight will be a top priority.

2.Spot gold reached a new all-time high, breaking the $3060 mark.

3.U.S. Congressman Emmer reintroduced the "Securities Clarity Act" to establish clearer regulatory boundaries for crypto assets.

4.The SEC has terminated lawsuits against Kraken, ConsenSys, and Cumberland.

Project updates

1.Ethereum core developer Terence announced that the Ethereum testnet Pectra is scheduled to launch on the mainnet on April 30.

2.MOVE buyback address withdraws another 10 million tokens from a CEX, worth $4.94 million.

3.Ripple partners with Chipper Cash to expand XRP payments in the African market.

4.Polyhedra launches an 8-week bonus staking program, where ZKJ stakers can earn extra tokens such as ZRO and ETH on top of regular incentives.

5.Uniswap's timelock contract releases 27.9 million UNI, with a portion already transferred to a CEX.

6.Jupiter launches Quick Accounts, enabling instant, signature-free transactions

7.uDEX completes the first round of UUU token burn, accounting for 37.2% of the total supply.

8.BONK announces its acquisition of the art market platform Exchange Art.

9.KiloEx releases the KILO tokenomics, with 10% allocated for airdrops.

10.Hyperliquid sees a net outflow of $184 million in the past 24 hours.

Highlights on X

@Aylo: Recap of the HYPE incident — Why I'm still holding strong

Although I missed out on yesterday's HYPE drama, I'm still holding my position with confidence. It's no secret that Hyperliquid is currently centralized—that's actually part of its roadmap toward gradual decentralization. Unlike traditional centralized exchanges, its goal is to evolve into a decentralized protocol over time, and that's a key part of my investment thesis. Rather than aiming for full decentralization right away and risking failure, it's better to survive first and decentralize step by step. The protocol's decision to intervene this time to protect system security was the right call and reflects responsibility. It's important to note that most DeFi protocols today are still governed by multisigs and remain upgradable—they're not truly decentralized yet. The fact that major CEXs are teaming up to take down Hyperliquid only reinforces the idea that it poses a real threat to them. Despite recent negative events, I am more concerned with whether Hyperliquid can retain its user base. The data over the next few weeks will be crucial. All things considered, HYPE is one of the few altcoins that I believe has the potential for outsized returns over the long term. Of course, it comes with systemic risks—but that's the price of high rewards. I choose to hold because I believe in Hyperliquid's long-term potential.

@Phyrex: The rebound isn't a reversal — markets remain driven by macro events

While the market is showing signs of a rebound, it's not yet a true reversal. The biggest uncertainties lie in the Fed's rate-cuts and Trump's tariff policies. Mixed signals on tariffs, coupled with a decline in U.S. durable goods orders, point to growing corporate caution about the economic outlook. The Fed has also signaled that inflation may remain above 2% for an extended period, making it unlikely that rate cuts will speed up. Bitcoin remains closely tied to U.S. equities, with trading volumes at two-year lows and turnover steadily declining—signs that the market has entered "garbage time," a phase marked by low activity and minor price fluctuations. All things considered, with macro uncertainty still looming, BTC will likely remain driven by events in the short term, making it hard to establish a sustained trend for now.

@0xJeff: The industry lifecycle of Web3 AI agents and investment opportunities

The Web3 AI agent space is evolving much faster than traditional industries. The full cycle—from inception, growth, peak, shakeout, to equilibrium—can play out in just a few months. We're currently between the "shakeout" and "equilibrium" phases, with leading projects capturing a large share of the market. However, truly productive Web3-native applications are still scarce, which means there's still room for new players to spark the next wave of innovation. As AI development costs continue to fall, the barrier to rapidily achieving product-market fit (PMF) is getting lower. For investors, this is an ideal window of opportunity—valuations are low, yet innovation remains vibrant. The next breakout AI agent won't come from simply following trends, but from building something the market doesn't yet realize it needs.

@hoeem: The growth logic behind the Sonic ecosystem and $SHADOW's upside potential

The Sonic chain's momentum is fueled by expectations of a $S token airdrop, ultra-low transaction fees, and the upcoming launch of an algorithmic stablecoin—all of which are driving rapid growth in TVL and on-chain activity. Based on this, $SHADOW, as Sonic's main DEX token, is seeing significant upside. With high transaction fee revenue and projected annual earnings of $60 million, its current market cap of just $20 million suggests substantial room for a valuation rebound. As liquidity continues to pour into the Sonic ecosystem, $SHADOW—positioned as a core infrastructure asset—has strong potential to rise in tandem with the ecosystem's expansion.

Disclaimer: This content includes third-party opinions, and we do not guarantee its accuracy. Cryptocurrency prices are highly volatile, so please conduct your own research and make judgments accordingly.