- Bitget

- Research

- Daily Industry Highlights

- Bitget Daily Digest (March 24) | Trump pumps $TRUMP on social media; U.S. tariff policy shifts again

Bitget Daily Digest (March 24) | Trump pumps $TRUMP on social media; U.S. tariff policy shifts again

远山洞见

2025/03/24

Today's preview

1.The U.S. S&P Global Manufacturing PMI (preliminary for March) will be released today, with the previous reading at 52.7.

2.Berachain will reopen its airdrop claim portal today.

3.Sky Governance has approved a reduction in Sky's savings rate to 4.5%, effective at 2:00 PM (UTC).

4.Omni Network will conduct its first staking upgrade today.

Key market highlights

1.

The U.S. tariff policy is undergoing a significant shift, with the White House considering a reduction in the scope of tariffs set to take effect on April 2. Industries such as autos, pharmaceuticals, and semiconductors may be exempted from these tariffs. The new strategy emphasizes reciprocal tariffs, specifically targeting countries like China, the EU, India, and Canada—those with larger shares of U.S. trade. Exemptions for sectors such as oil and steel remain unclear. The revised policy aims to curb trade imbalances and tighten foreign trade control, taking effect on April 2.

2.Ethereum recorded a

daily low burn rate on-chain last Saturday, with just 53.07 ETH burned in a single day, signaling a steep drop in on-chain activity. The 7-day moving average for active addresses has fallen to its lowest level since October 2024. New address creation, transaction counts, and daily trading volume are

all trending downward. Meanwhile, Standard Chartered has slashed its 2025 ETH price target from $10,000 to $4000. Geoffrey Kendrick, Head of Digital Asset Research, stated that

Layer 2 solutions—especially Base—are now capturing a disproportionate share of Ethereum's value.

3.Trump promoted the $

TRUMP token on social media, posting, "I love $TRUMP. Very cool. They're all amazing," which the market interpreted as a direct endorsement, causing a short-term pump in $TRUMP's price. Meanwhile, CZ opened a long position on $MUBARAK on-chain, later clarifying it was to test for MEV (miner extractable value) activity. Rumors are swirling that Wintermute may become a market maker for $MUBARAK. These developments could fuel further speculative interest in both tokens.

4.Projects involved in early-March market maker incidents have begun buybacks.

MyShell.AI has already repurchased 73% of its target, totaling $8 million.

GoPlus announced a GPS token buyback plan last night, pledging to update the community weekly and burn repurchased tokens.

Market overview

1.BTC has broken higher and is approaching a 4-hour resistance level. The broader market remains mixed, with the top 50 tokens showing divergent trends. MUBARAK, $X, and $BMT have climbed into the top 10 by trading volume. Most new listings have declined, except for $BR.

2.U.S. stocks rebound late Friday. Tesla jumped over 5%, while Boeing surged after securing a major contract for next-gen fighter jets. The U.S. dollar index rose, while gold and industrial metals dropped.

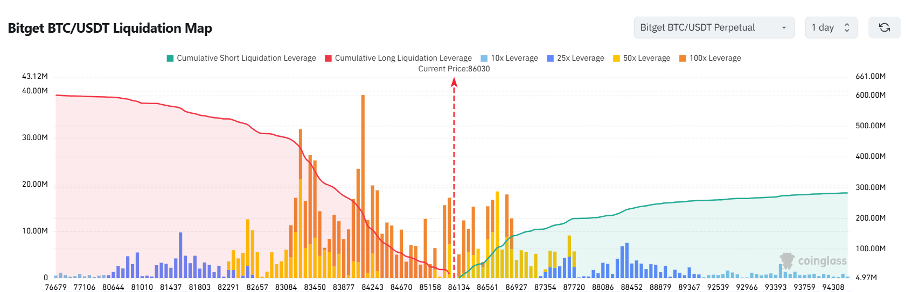

3.Currently standing at 86,030 USDT, Bitcoin is in a potential liquidation zone. A 1000-point drop to around 85,030 USDT could trigger

over $40 million in cumulative long-position liquidations. Conversely, a rise to 87,030 USDT could lead to

more than $210 million in cumulative short-position liquidations. With short liquidation volumes far surpassing long positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

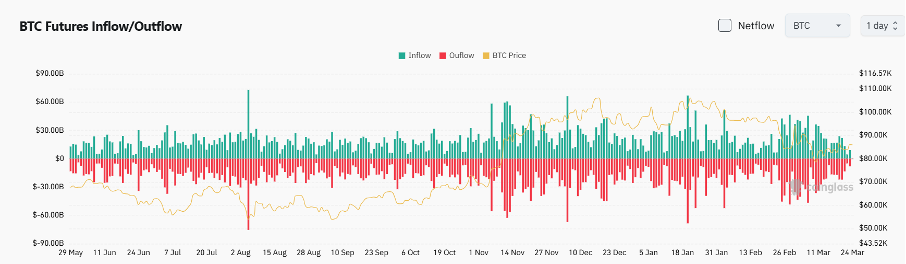

4.Over the past 24 hours, the BTC spot market recorded $9.1 billion in inflows and $8.1 billion in outflows, resulting in a

net inflow of $1 billion.

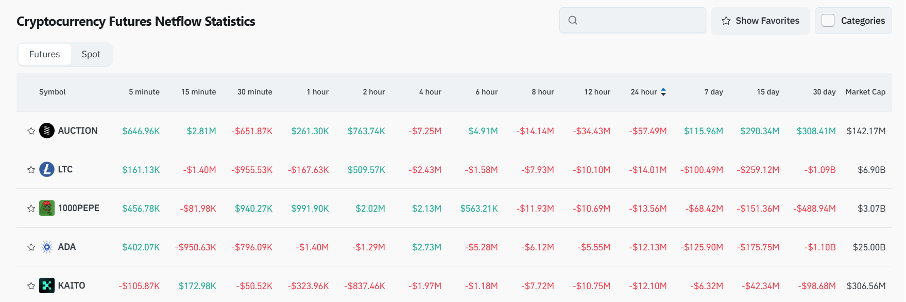

5.Over the last 24 hours, $AUCTION, $LTC, $PEPE, $ADA, and $KAITO have led in futures trading

net outflows, signaling potential trading opportunities.

Institutional insights

SlowMist: Coinbase was reportedly targeted by a supply chain attack via GitHub Actions CI/CD pipelines. Companies are advised to assess their exposure to similar risks.

Greeks.live: The market is currently trading sideways. Key BTC levels to watch: $83,000 – $84,000.

Read the full article here:

https://x.com/BTC__options/status/1903807634047926398

News updates

1.Pakistan's crypto committee has proposed using surplus energy for BTC mining.

2.The U.S. Stablecoin Bill is set to move forward in the House Committee on April 2.

3.SEC Commissioner Hester Peirce voiced support for using NFTs to raise funds, suggesting such projects could be exempt from securities regulations.

4.South Korea's financial watchdog is planning to block non-compliant crypto exchanges.

Project updates

1.Kaito founder Yu Hu has personally purchased and staked 1 million KAITO tokens.

2.TON Foundation clarified it has not raised $400 million in funding—some VCs simply hold Toncoin.

3.CZ responds to "going long on MUBARAK with BNB": this is the first on-chain futures trade to test for MEV-related issues.

4.Trump shouts out for TRUMP token: "I like the TRUMP token".

5.MyShell.AI has completed approximately 73% of its token buyback, totaling $8 million.

6.Michael Saylor hints at increasing Bitcoin holdings again, sharing another investment tracking chart.

7.NFT trading volume fell by 3.19% over the last seven days to $102 million, but both buyer and seller numbers increased by around 70%.

8.Movement co-founder Cooper announces a $250 million liquidity initiative to strengthen the ecosystem.

9.Bounce Brand denies any team involvement in manipulating the price of AUCTION tokens.

10.GoPlus has launched a token buyback plan; all buyback tokens will be sent to a burn address.

Highlights on X

@connectfarm1: BNB chain sentiment slump and long-term strategy — from short-term turbulence to long-term upside

BNB chain sentiment is currently at a low point, with many investors having exited memecoin projects. Still, @connectfarm1 remains bullish and is holding firmly for the long term. With OKX Wallet exiting the space, a new flywheel dynamic built on the triad of "exchange + wallet + chain" is emerging on Binance. Short-term volatility may continue, but from a macro perspective, we are likely near a bottom. Flagship projects like $MUBARAK are seeing steady capital inflows, while other tokens like $TUT, $BNBCARD, and $QUG each represent distinct strategic pillars within the BNB chain ecosystem. This diversity points to healthy ecosystem growth. There may be short-term pain, but if the strategy holds, the long-term upside is worth the wait.

@Chris_Defi: The crypto market cycle from a metaphysical perspective

In 2024, the winning path on Solana no longer applies to Binance Smart Chain (BSC). Interestingly, those who lost money in 2022 by relying too much on "momentum plays" are now the leaders on BSC in 2024. Players who missed the Trump-related market wave in 2024 are starting to shine in 2025 on BSC. Financial luck is influenced by the Five Elements (Wu Xing in Chinese) — those who are favored by wood-fire elements will see better luck overall. But over-reliance on BSC of users with wood element could still lead to losses. Overall, everyone has their ups and downs; metaphysics offers a mental framework to help navigate cycles and tailor your strategy accordingly.

@bitfool1: How to invest in BSC memecoins – five common strategies broken down

Here are five popular tactics in the BSC memecoin scene: Name-sniping: Jump into tokens with catchy or promising names (e.g., $TST, $TUT, $TNT, $TBT), capitalize on early hype, and exit fast with a profit. Info-based trading: Track official announcements or subtle signals — like CZ's intern reference to the BNBCARD — to identify undervalued projects. Micro-cap scouting: Spot ultra-early projects (e.g., $CZOO) and get in before the crowd for bigger returns. Follow the frontrunners: Ride on the coattails of trending tokens like $MOUTAI or $ZHONGHUA. There is risk of loss, but the hype can be profitable. Builder mode: Unlike PvP trading, this approach involves contributing to projects (like $ALANDALDS) with a longer time horizon. While short-term profits might be limited, the long-term payoff can be substantial.

@Ryan Watkins: A rational take on today's market — beyond the extremes

Extreme takes like "altcoins are dead" or "the memecoin era is over" are far too black-and-white. While they may drive engagement on social media, they are not practical in the real world. In fact, the market is complex: there may be fewer winning altcoins, but they still exist. Memecoin mania has cooled, but speculative plays continue to pop up. Fundamentals matter more now, but speculation still rules the game; VC fatigue seems to arise, yet top-tier VC coins are still delivering returns; we might not see explosive gains like before, but over a 3–5 year timeframe, strong assets can still generate impressive growth.

Disclaimer: This content includes third-party opinions, and we do not guarantee its accuracy. Cryptocurrency prices are highly volatile, so please conduct your own research and make judgments accordingly.