- Bitget

- Research

- Daily Industry Highlights

- Bitget Daily Digest (March 21) | SEC claims PoW is not a securities offering; Trump reaffirms end to "regulatory war"

Bitget Daily Digest (March 21) | SEC claims PoW is not a securities offering; Trump reaffirms end to "regulatory war"

远山洞见

2025/03/21

Today's preview

1.John Williams, permanent voting member of the FOMC and president of the New York Fed, is scheduled to speak today.

2.The U.S. SEC's crypto assets unit will host a roundtable with industry players.

3.Immutable (IMX) will unlock 24.52 million coins today, valued at $13.4 million, accounting for 1.39% of its circulating supply.

Key market highlights

1.The Federal Reserve has announced a slowdown in its balance sheet runoff (quantitative tightening), lowering the monthly cap on maturing treasuries that won't be reinvested to $5 billion. This move has prompted Wall Street to push back expectations for the end of QT. Barclays and Bank of America now expect it to continue through mid or late 2026, reflecting growing uncertainty in short-term funding markets.

Powell noted that while reserves are still ample, early signs of liquidity strain are emerging. The QT adjustment is aimed at avoiding a repeat of the 2019 liquidity crunch.

2.

Ethereum ETFs eye staking; Trump reiterates pro-crypto stance. NYSE Arca has filed a 19b-4 application with the SEC, proposing to allow staking for Bitwise's Ethereum ETF. If approved, this would allow institutional investors to earn ETH staking yields within a regulatory framework,

potentially expanding ETH's role in capital markets. Meanwhile, Trump gave a brief two-minute speech at a digital assets summit, falling short of market expectations for policy detail. However, he reaffirms his support for congressional legislation to establish clear rules for stablecoins and market structure, once again pledging to end the "war on crypto regulation".

3.

The SEC has officially stated that PoW mining is not considered a securities issuance. Miner earnings are recognized as compensation for network contributions, not investment returns. This solidifies PoW's compliance status and lays the regulatory groundwork for the decentralized compute economy. In related news, Bitnomial has launched the first CFTC-regulated XRP futures in the U.S. and voluntarily withdrawn its lawsuit against the SEC—a significant step forward in crypto regulation. T

he entry of XRP futures into regulated markets signals growing institutional access and a shift in U.S. crypto policy from suppression to regulation.

4.Pump.fun has unveiled

PumpSwap, its own DEX platform, where all tokens that complete the bonding curve process will be directly migrated. Highlights include zero migration fees, enhanced liquidity, and a revenue-sharing model for creators. PumpSwap is expected to become a key piece of permissionless trading infrastructure on Solana. The trading fee is set at 0.25%, with 0.20% going to liquidity providers and 0.05% to the protocol. A creator revenue-sharing mechanism is also in the pipeline, and several projects have already committed to building liquidity directly on PumpSwap.

Market overview

1.BTC fluctuates widely, dropping from 87,000 to $83,000 in short-term volatility. Among the top 50 coins, price action is mixed. Desci tokens like $RIF and $URO, along with SHIB ecosystem token $BONE, surge, while small-cap tokens such as $DMAIL also see pumps.

2.U.S. stocks briefly rebound ahead of Triple Witching Day. Nasdaq slips 0.3%. Chinese stocks drop. Nvidia CEO Jensen Huang said he is unaware of any quantum computing IPOs, sending quantum stocks plunging. D-Wave falls 18%, and QMCO drops 16%. Meanwhile, crude oil futures rises over 1%, and gold prices pull back from record highs.

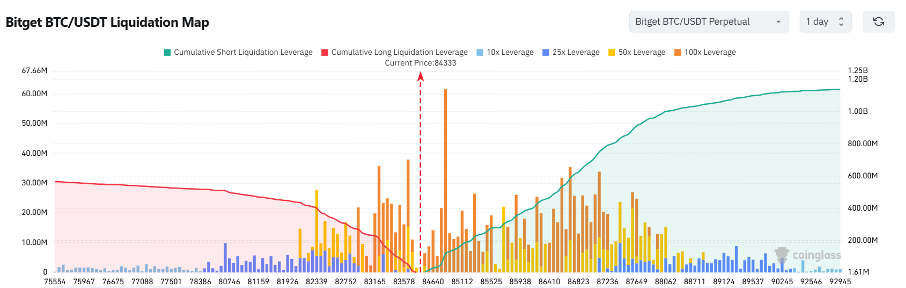

3.Currently standing at 84,333 USDT, Bitcoin is in a potential liquidation zone. A 1000-point drop to around 83,333 USDT could trigger

over $151 million in cumulative long-position liquidations. Conversely, a rise to 85,333 USDT could lead to

more than $257 million in cumulative short-position liquidations. With short liquidation volumes far surpassing long positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

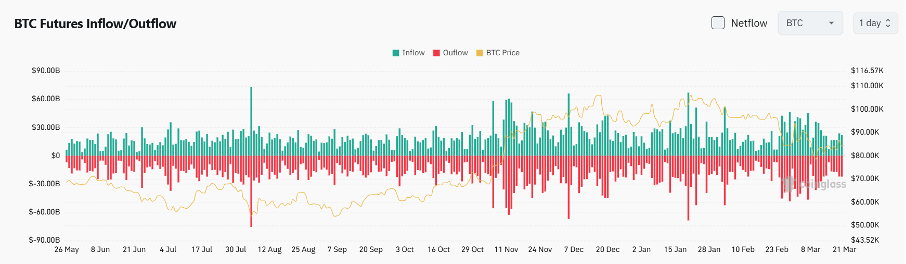

4.Over the past day, Bitcoin has seen $2.25 billion in spot inflows and $2.48 billion in outflows, resulting in

a net outflow of $230 million.

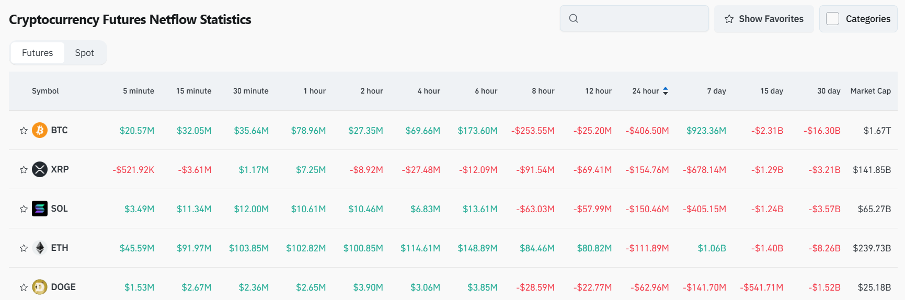

5.In the last 24 hours, $BTC, $XRP, $SOL, $ETH, and $DOGE led in

net outflows in futures trading, signaling potential trading opportunities.

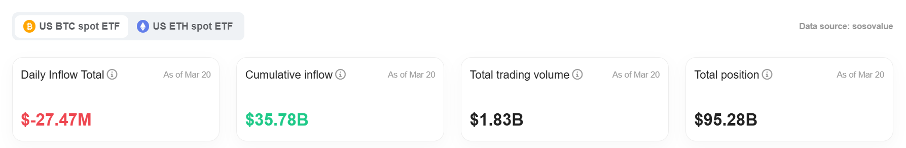

6.According to the latest data from SoSoValue, U.S. BTC spot ETFs recorded a single-day outflow of $27.4764 million, though cumulative inflows stand at $35.775 billion, with total holdings reaching $95.28 billion. The market starts to see outflows compared to the previous day.

Institutional insights

Greeks.live: Block trades reveal growing market disagreement on future direction. Divergence in market sentiment increases.

Read the full article here:

https://x.com/BTC__options/status/1902748373058523283

BlackRock: Staking could be a game changer for Ethereum ETFs

Read the full article here:

https://www.cnbc.com

News updates

1.U.S. SEC: Solo and pooled mining activities are not considered securities transactions.

2.White House Press Secretary says Trump has the right to criticize the Fed's decisions—he has made it clear that he favors lower interest rates.

3.U.S. initial jobless claims for the week ending March 15 were 223,000, expected 224,000.

4.Trump plans to impose reciprocal tariffs on India starting April 2.

5.Pakistan government plans to establish a legal framework for cryptocurrency trading to attract foreign investment.

Project updates

1.Pump.fun officially launches its DEX platform, PumpSwap, aiming to become the core trading infrastructure on Solana.

2.Canary submits an S-1 filing to the SEC for its PENGU ETF.

3.TON Foundation raises over $400 million through a token sale.

4.FLock partners with Base, integrating its FLock model to replace Claude in Base's MCP system.

5.ZachXBT reports that the "Hyperliquid 50x leverage whale" may be scammer William Parker, who has a history of criminal charges.

6.Aave community proposes a new staking module to support AAVE buybacks and fee conversion.

7.Bybit CEO shares latest on hack investigation—88.87% of stolen funds are still traceable.

8.Henlo launches Henlock staking vault, giving users a chance to earn more ecosystem incentives.

9.Ripple CEO says an XRP ETF could debut by the end of 2025, and an IPO "isn’t off the table."

10.The analyst reports the SHELL token buyback plan is 74% complete, with the buyback address holding 19.95 million SHELL.

Highlights on X

TraderS: Fed's QT cut signals potential liquidity turning point

The Fed's latest FOMC statement reveals that starting April 1, the monthly cap on Treasury roll-offs will drop from $25 billion to $5 billion—effectively slashing the pace of quantitative tightening (QT) in half. While the MBS cap remains unchanged, this shift suggests a more accommodative liquidity stance. Historically, the Fed's liquidity cycle follows a pattern: QT → QT slowdown → pause QT → QE. We're now firmly in the "QT slowdown" phase, potentially marking a major liquidity inflection point. Think of it like Bitcoin's cycle: a downtrend gives way to consolidation, and then comes the next breakout.

Crypto_Painter: Shorts piling in—Futures liquidity is in the spotlight again. Could bulls strike back?

BTC is once again seeing a dense cluster of short positions around the $87,700 level, showing that bears are still aggressively increasing their positions. Meanwhile, spot market momentum remains weak, offering little help in triggering short squeezes. However, this trading structure is typical of a choppy market—price often probes and flushes out these concentrated zones. While declining spot premiums usually signal selling pressure, short- to medium-term traders should keep a close eye on areas of high liquidity—they often become short-term "wick zones." Currently, short liquidations could end up fueling the next move, with bears unwittingly taking the exit orders of spot sellers — potentially setting the stage for another wave of momentum.

Phyrex: Is the altcoin season dead?

Phyrex argues that true altcoin seasons are fueled by abundant liquidity—but with global liquidity still near the bottom, broad-based alt rallies are unlikely in the near term. Like the Russell 2000 in traditional finance, altcoins pump hard when liquidity is flowing, and dump even harder when it dries up Only when the monetary policy shifts to easing, QT ending, or implements measures like QE starting, can the altcoin season truly begin. For now, BTC and other large-cap assets are still sucking up most of the market's capital. Altcoin rotations will have to wait for liquidity to trickle down.

@Chris_Defi: BTC's three-year "metaphysics chart"

In a metaphysics take, @Chris_Defi lays out a mystical 3-year script for BTC's price action. Based on past cycles, BTC could form a top between April and May this year, potentially forming a head-and-shoulders or symmetrical triangle. By November, we might see the "right shoulder" take shape. The Year of the Fire Horse (2026) could bring a breakdown of key support—kicking off an "altcoin month" and a prolonged correction lasting two to three years. For investors, it could be a window where great fortunes are made — or lost. But predictions are just predictions — trading requires rationality. As always: Skill sets the floor, luck sets the ceiling.

Disclaimer: This content includes third-party opinions, and we do not guarantee its accuracy. Cryptocurrency prices are highly volatile, so please conduct your own research and make judgments accordingly.