- Bitget

- Research

- Daily Industry Highlights

- Bitget Daily Digest (March 20) | Fed to slow pace of balance sheet reduction in April, Trump to attend Digital Asset Summit in New York

Bitget Daily Digest (March 20) | Fed to slow pace of balance sheet reduction in April, Trump to attend Digital Asset Summit in New York

远山洞见

2025/03/20

Today's preview

1.U.S. initial jobless claims for the week ending March 15 will be announced today. Previous value: 220,000.

2.U.S. Q4 current account balance to be released today; previous value: -$310.9 billion.

3.CEX to delist multiple spot trading pairs, including XR, GOAL, KP3R, LBR, LAMB, BZZ, and GPT.

4.Voting for Starknet Staking V2 begins today.

Key market highlights

1.

Trump will attend the Digital Asset Summit in New York today and deliver a speech, marking the first time a sitting U.S. president has spoken at a cryptocurrency industry event. Observers expect him to unveil future crypto policies. The summit will also bring together key figures, including U.S. Representatives Ro Khanna and Tom Emmer, as well as Strategy CEO Michael Saylor and Ripple CEO Brad Garlinghouse.

Former FOX reporter Eleanor Terrett suggests Trump may offer further signals about the crypto market, which is drawing significant attention.

2.The Federal Reserve kept benchmark interest rates unchanged at 4.25%–4.50%, in line with market expectations, and

announced a slower pace of balance sheet reduction starting April 1. The dot plot indicates most officials expect a cumulative 50-basis-point rate cut in 2025. The head of Allspring noted the earliest window for a rate cut could be May or later, with year-end rates possibly dropping to around 3.75%.

Some institutions have raised their full-year rate cut forecasts from two to three.

3.A Hyperliquid whale, using 50x leverage, aggressively traded during the Fed's rate decision, tactfully capitalizing on market volatility with dual long-short trades for maximum profit. The market remains fixated on this, though on-chain detective ZachXBT previously accused the whale of being a cybercriminal involved in phishing scams and laundering funds through gambling, with promises of full evidence soon. The whale later deleted verified X posts, renamed their account to "falllling," and had earlier changed their DeBank profile to "MELANIA."

While their true identity remains unconfirmed, their bold moves and murky background continue to captivate the market.

Market overview

1.BTC is seeing steady short-term gains alongside broad market upticks. Boosted by the CEX's "Vote to List" move, the top five gainers include three BSC ecosystem tokens—TUT, $BROCCOLI, and $KOMA—showing strong rises, while $ARC, after recent sluggishness, ranks sixth.

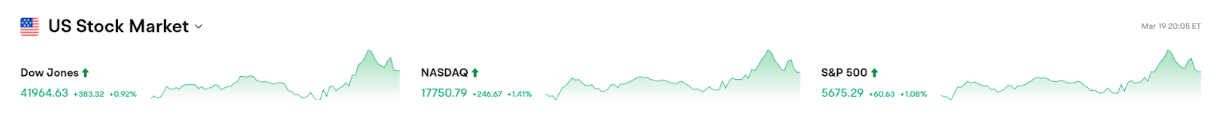

2.The S&P 500 posted its biggest Fed decision-day rebound in eight months, U.S. bonds surged, gold hit a new high, while Turkish stocks, bonds, and currency faced a triple sell-off.

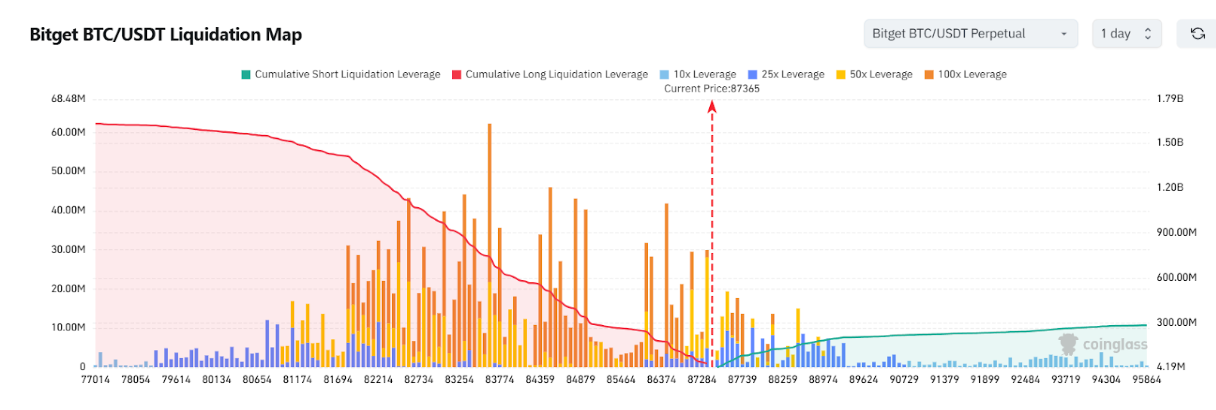

3.Currently standing at 87,365 USDT, Bitcoin is in a potential liquidation zone. A 1000-point drop to around 86,365 USDT could trigger

over $151 million in cumulative long-position liquidations. Conversely, a rise to 88,365 USDT could lead to

more than $158 million in cumulative short-position liquidations. Both long and short positions should exercise caution and manage leverage prudently to avoid large-scale liquidations.

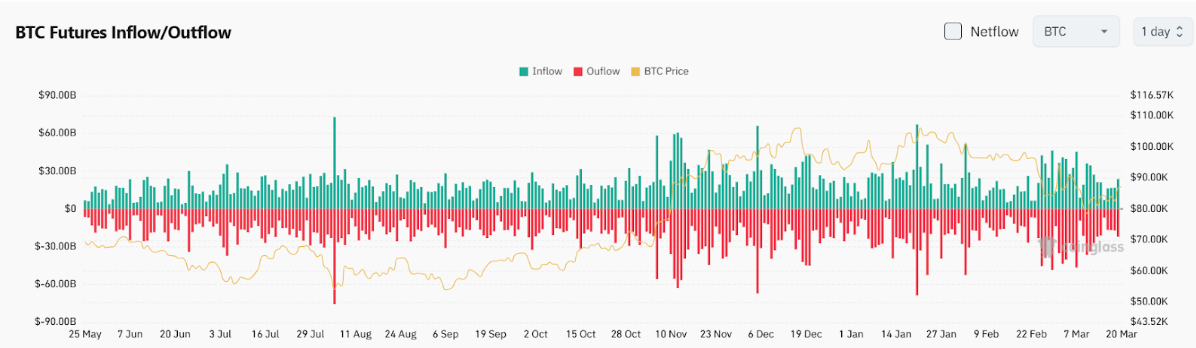

4.Over the last 24 hours, BTC spot saw $23 billion in inflows and $22 billion in outflows, resulting in

a net inflow of $1 billion.

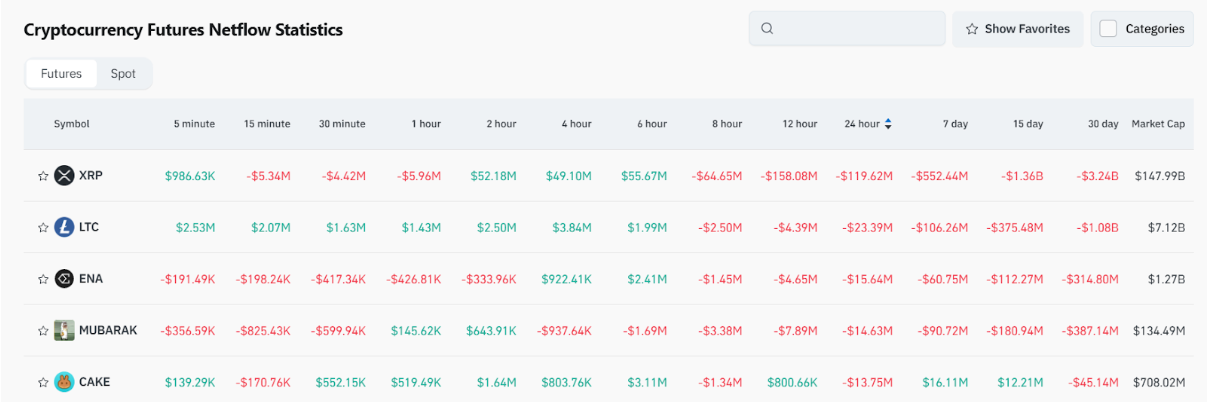

5.In the last 24 hours, $XRP, $LTC, $ENA, $MUBARAK, and $CAKE led in

net outflows in futures trading, signaling potential trading opportunities.

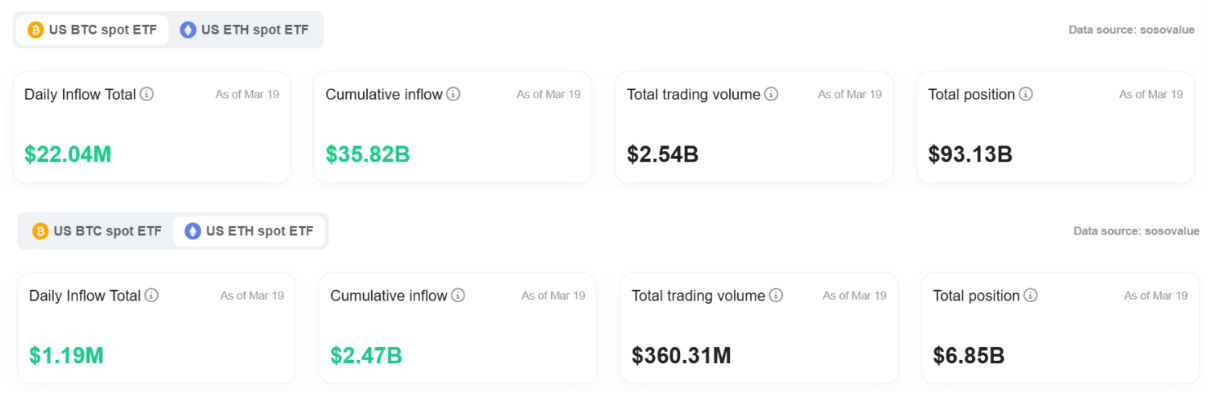

6.According to the latest data from SoSoValue, U.S. spot Bitcoin ETFs recorded a single-day outflow of $22.0367 million, while the cumulative inflows amount to $35.812 billion, with total holdings at $93.127 billion. U.S. spot Ethereum ETFs saw a single-day outflow of $1.1899 million, with cumulative inflows of $2.462 billion and total holdings of $6.85 billion. Funds have started flowing in compared to the previous day.

Institutional insights

Matrixport: Futures cool off while Bitcoin ETFs hold steady; the market awaits a new catalyst.

Read the full article here:

https://x.com/Matrixport_CN/status/1902253712229462072

Glassnode: Bitcoin liquidity is drying up, reducing trading depth and potentially amplifying short-term volatility.

Read the full article here:

https://decrypt.co/310576/bitcoin-liquidity-drying-up-as-market-adjusts-to-sharp-correction

10x Research: Unlike the long-term bear market of 2021/2022, we now see shorter, mini-bear cycles punctuated by sharp rallies.

News updates

1.Trump to attend the U.S. Digital Asset Summit.

2.Fed dot plot: Still expects two rate cuts in 2025.

3.North Dakota Senate passes crypto ATM bill, setting a $2000 daily transaction cap.

4.North Carolina's new Bitcoin reserve bill will authorize 10% of public funds for Bitcoin purchases.

5.Arizona's Bitcoin reserve bill advances to second reading in the House, marking the fastest progress among states.

Project updates

1.Telegram founder: Telegram's monthly active users have surpassed 1 billion, making it the world's second-largest messaging app after WeChat.

2.TRC20-USDT issuance surpasses 64.7 billion, hitting a new all-time high.

3.Hyperliquid to introduce staking tiers on April 30, with transaction fees based on the amount of HYPE staked.

4.Jupiter's revenue in February reached $31.7 million, a new all-time high.

5.Ronin announced that it will expand its DeFi business and evolve into a consumer chain.

6.Initia announced the extension of the account migration for Initia Wallet Extension until March 21.

7.Bitget Wallet to launch a KOL trading rebate program.

8.The proposal for additional token issuance of Hifi Finance has been approved, with an additional 25 million HIFI tokens to be issued, increasing the total supply to 171.25 million tokens.

9.Nillion releases new airdrop check tool and removes the 90-day lock-up limit for pre-staking rewards.

10.The Ethereum Foundation is set to launch the Pectra upgrade on the Hoodi testnet on March 26.

Highlights on X

Aylo: Crypto's current state and future outlook — stagnation, loss of faith, and potential recovery paths

The crypto market is stagnant, lacking clear bullish catalysts. With the exception of BTC and ETH, most assets have seen little growth over the past four years, and trading volumes remain flat, reflecting a lack of faith in many projects. Total global liquidity hasn't expanded significantly, and most countries remain heavily in debt. In the long run, liquidity injections might be the strongest bull case for BTC, but in the short-term, the market is still influenced by macroeconomic factors and Fed policy. Speculative hype is shrinking, most altcoins lack value support, and retail funds are hesitant to enter. While quick-profit games persist, making money is increasingly challenging. Only widespread blockchain adoption can spark new growth.

@ai_9684xtpa: The rise of BSC memecoins — data on the evolution of the memecoin craze

Looking back at BSC memecoins' journey, from the initial skepticism to today's boom, the data tells the story. DEX trading volume on BSC has surpassed that on Ethereum, topping public chains, with net inflows via cross-chain bridges consistently leading. Four.Meme has surged, reaching nearly 56% of Pump.fun's volume. Compared to the Solana ecosystem, BSC has rapidly produced community hits like $Mubarakah and $TUT, creating a highly active market. As Pump.fun's successful token launches drop and Four.Meme incubates at high frequency for days, funds and sentiment are shifting. BSC's memecoin heat is undeniable, even drawing SOL players to BSC to relive last year's Solana boom vibes.

Crypto_Painter: Market sentiment warms, but the next QT direction remains uncertain

Market sentiment has noticeably warmed, spurred by comments from Nick Timiraos. A clear Fed timeline to end quantitative tightening (QT) would be a major boon for risk assets, plugging the capital outflow. However, due to ongoing inflation pressures, QT might not conclude until the next Fed meeting at the earliest. Tonight's rebound leans towards expectation-driven trading. With quantitative easing (QE) and rate cuts unlikely to happen any time soon, this upswing is more a post-crash trend correction rather than a full rebound. While expectations have formed, the market's future direction now depends on the Fed's plan and Powell's messaging, as risk assets remain fragile.

@DtDt666: Is the BTC four-year cycle still valid?

Bitcoin's four-year cycle still persists, with two tops in the last cycle (2021). If history repeats, this cycle may peak between November and December 2025. Now a trillion-dollar asset, BTC is increasingly influenced by macro factors such as Fed policy and global money supply. Despite the weakening effect of Bitcoin halving, rising money supply, stable rates, and a bullish stock outlook provide a foundation for BTC's potential rise toward $150,000 in Q4 2025. Analyzing S&P 500 trends, interest rates, M2 supply, inflation, and unemployment, today's environment mirrors the late 2017 expansion — financial conditions are tightening but haven’t yet turned recessionary. More importantly, the market is in a "smart money reshuffle" phase. The real bullish peak will come along the peak of FOMO, not the recent panic-driven consolidation. Patience is key. Whales are repositioning, and the bull run continues.

Disclaimer: This content includes third-party opinions, and we do not guarantee its accuracy. Cryptocurrency prices are highly volatile, so please conduct your own research and make judgments accordingly.