Bitget: Ranked top 4 in global daily trading volume!

BTC market share60.44%

New listings on Bitget:Pi Network

Altcoin season index:0(Bitcoin season)

BTC/USDT$84159.01 (+0.26%)Fear and Greed Index32(Fear)

Total spot Bitcoin ETF netflow +$83.1M (1D); +$549.9M (7D).Coins listed in Pre-MarketNIL,PAWS,WCTWelcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app. Download now

Bitget: Ranked top 4 in global daily trading volume!

BTC market share60.44%

New listings on Bitget:Pi Network

Altcoin season index:0(Bitcoin season)

BTC/USDT$84159.01 (+0.26%)Fear and Greed Index32(Fear)

Total spot Bitcoin ETF netflow +$83.1M (1D); +$549.9M (7D).Coins listed in Pre-MarketNIL,PAWS,WCTWelcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app. Download now

Bitget: Ranked top 4 in global daily trading volume!

BTC market share60.44%

New listings on Bitget:Pi Network

Altcoin season index:0(Bitcoin season)

BTC/USDT$84159.01 (+0.26%)Fear and Greed Index32(Fear)

Total spot Bitcoin ETF netflow +$83.1M (1D); +$549.9M (7D).Coins listed in Pre-MarketNIL,PAWS,WCTWelcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app. Download now

Coin-related

Price calculator

Price history

Price prediction

Technical analysis

Coin buying guide

Crypto category

Profit calculator

FUD priceFUD

Listed

Quote currency:

USD

$0.{7}6011+0.90%1D

Price chart

TradingView

Last updated as of 2025-03-22 19:50:36(UTC+0)

Market cap:--

Fully diluted market cap:--

Volume (24h):$274,763.61

24h volume / market cap:0.00%

24h high:$0.{7}6096

24h low:$0.{7}5683

All-time high:$0.{6}9359

All-time low:$0.{7}4970

Circulating supply:-- FUD

Total supply:

75,490,000,000,000FUD

Circulation rate:0.00%

Max supply:

--FUD

Price in BTC:0.{12}7140 BTC

Price in ETH:0.{10}3012 ETH

Price at BTC market cap:

--

Price at ETH market cap:

--

Contracts:--

How do you feel about FUD today?

Note: This information is for reference only.

Price of FUD today

The live price of FUD is $0.{7}6011 per (FUD / USD) today with a current market cap of $0.00 USD. The 24-hour trading volume is $274,763.61 USD. FUD to USD price is updated in real time. FUD is 0.90% in the last 24 hours. It has a circulating supply of 0 .

What is the highest price of FUD?

FUD has an all-time high (ATH) of $0.{6}9359, recorded on 2024-10-03.

What is the lowest price of FUD?

FUD has an all-time low (ATL) of $0.{7}4970, recorded on 2025-03-12.

FUD price prediction

When is a good time to buy FUD? Should I buy or sell FUD now?

When deciding whether to buy or sell FUD, you must first consider your own trading strategy. The trading activity of long-term traders and short-term traders will also be different. The Bitget FUD technical analysis can provide you with a reference for trading.

According to the FUD 4h technical analysis, the trading signal is Neutral.

According to the FUD 1d technical analysis, the trading signal is Sell.

According to the FUD 1w technical analysis, the trading signal is Sell.

What will the price of FUD be in 2026?

Based on FUD's historical price performance prediction model, the price of FUD is projected to reach $0.{7}8568 in 2026.

What will the price of FUD be in 2031?

In 2031, the FUD price is expected to change by +39.00%. By the end of 2031, the FUD price is projected to reach $0.{6}1450, with a cumulative ROI of +141.36%.

FUD price history (USD)

The price of FUD is -88.95% over the last year. The highest price of FUD in USD in the last year was $0.{6}9359 and the lowest price of FUD in USD in the last year was $0.{7}4970.

TimePrice change (%) Lowest price

Lowest price Highest price

Highest price

Lowest price

Lowest price Highest price

Highest price

24h+0.90%$0.{7}5683$0.{7}6096

7d+1.52%$0.{7}5345$0.{6}1082

30d-21.46%$0.{7}4970$0.{6}1082

90d-75.75%$0.{7}4970$0.{6}2969

1y-88.95%$0.{7}4970$0.{6}9359

All-time-76.40%$0.{7}4970(2025-03-12, 11 days ago )$0.{6}9359(2024-10-03, 171 days ago )

FUD market information

FUD market

FUD holdings by concentration

Whales

Investors

Retail

FUD addresses by time held

Holders

Cruisers

Traders

Live coinInfo.name (12) price chart

FUD ratings

Average ratings from the community

4.6

This content is for informational purposes only.

About FUD (FUD)

What Is FUD?

FUD is a meme coin on the Sui blockchain. It is designed to reward early Sui NFT communities and builders, embodying a fun and playful spirit with its branding centered around a pug. FUD aims to raise awareness of the unique technological opportunities offered by the Sui network, providing a lighthearted yet impactful way to engage users and promote blockchain innovation. The project was launched in May 2024.

Resources

Official Website:

https://fudthepug.com/

How Does FUD Work?

FUD operates on the Sui blockchain, leveraging its advanced capabilities to support a vibrant ecosystem of decentralized finance (DeFi) platforms and games. This meme coin is integrated with several DeFi applications, including Turbos, Cetus, Aftermath, and Typus, allowing users to participate in various financial activities such as lending, borrowing, and trading. Additionally, FUD is featured in multiple games like WinX, Buck You CNY, Suilette, and Moonshot, providing entertainment while promoting

cryptocurrency adoption and utility.

What Is FUD Token?

FUD is the native token of the FUD platform. The meme coin's distribution model is designed to foster community growth and long-term development. FUD has a total supply of 100 trillion tokens.

What Determines FUD’s Price?

FUD's price is primarily determined by supply and demand within the blockchain and web3 ecosystems. Key factors include the latest news and cryptocurrency trends, which influence market interest in FUD's integrations with DeFi platforms and games. Positive cryptocurrency price predictions can boost its value, positioning it as a potential best crypto investment for 2024 and beyond. However, investors should also consider cryptocurrency risks and the impact of social media buzz on this meme coin's price dynamics.

For those interested in investing or trading FUD, one might wonder: Where to buy FUD? You can purchase FUD on leading exchanges, such as Bitget, which offers a secure and user-friendly platform for cryptocurrency enthusiasts.

FUD to local currency

1 FUD to MXN$01 FUD to GTQQ01 FUD to CLP$01 FUD to UGXSh01 FUD to HNLL01 FUD to ZARR01 FUD to TNDد.ت01 FUD to IQDع.د01 FUD to TWDNT$01 FUD to RSDдин.01 FUD to DOP$01 FUD to MYRRM01 FUD to GEL₾01 FUD to UYU$01 FUD to MADد.م.01 FUD to AZN₼01 FUD to OMRر.ع.01 FUD to SEKkr01 FUD to KESSh01 FUD to UAH₴0

- 1

- 2

- 3

- 4

- 5

Last updated as of 2025-03-22 19:50:36(UTC+0)

How to buy FUD(FUD)

Create Your Free Bitget Account

Sign up on Bitget with your email address/mobile phone number and create a strong password to secure your account.

Verify Your Account

Verify your identity by entering your personal information and uploading a valid photo ID.

Convert FUD to FUD

Use a variety of payment options to buy FUD on Bitget. We'll show you how.

Learn MoreJoin FUD copy trading by following elite traders.

After signing up on Bitget and successfully buying USDT or FUD tokens, you can also start copy trading by following elite traders.

FUD news

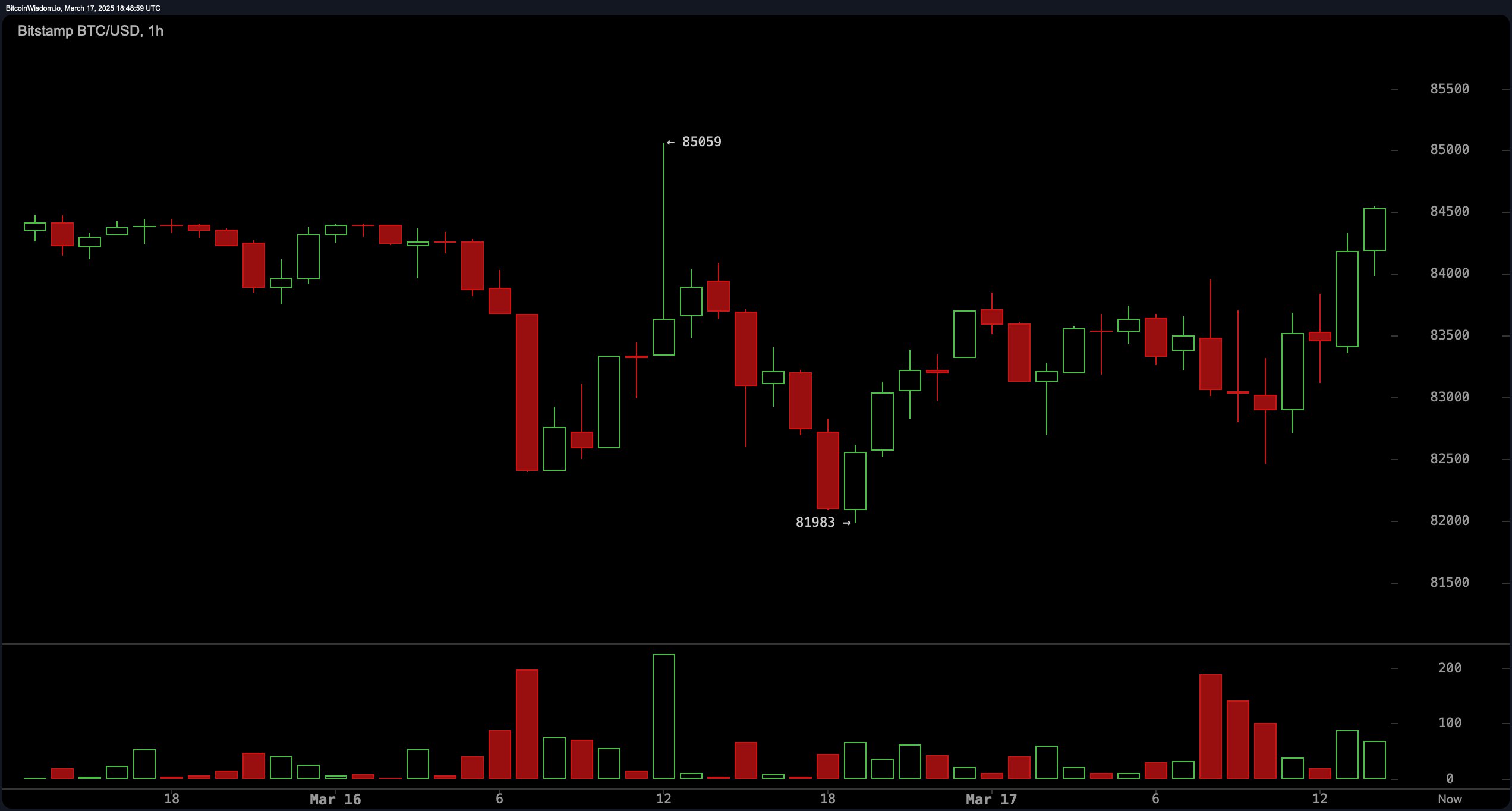

Bitcoin futures 'deleveraging' wipes $10B open interest in 2 weeks

Cointelegraph•2025-03-19 07:29

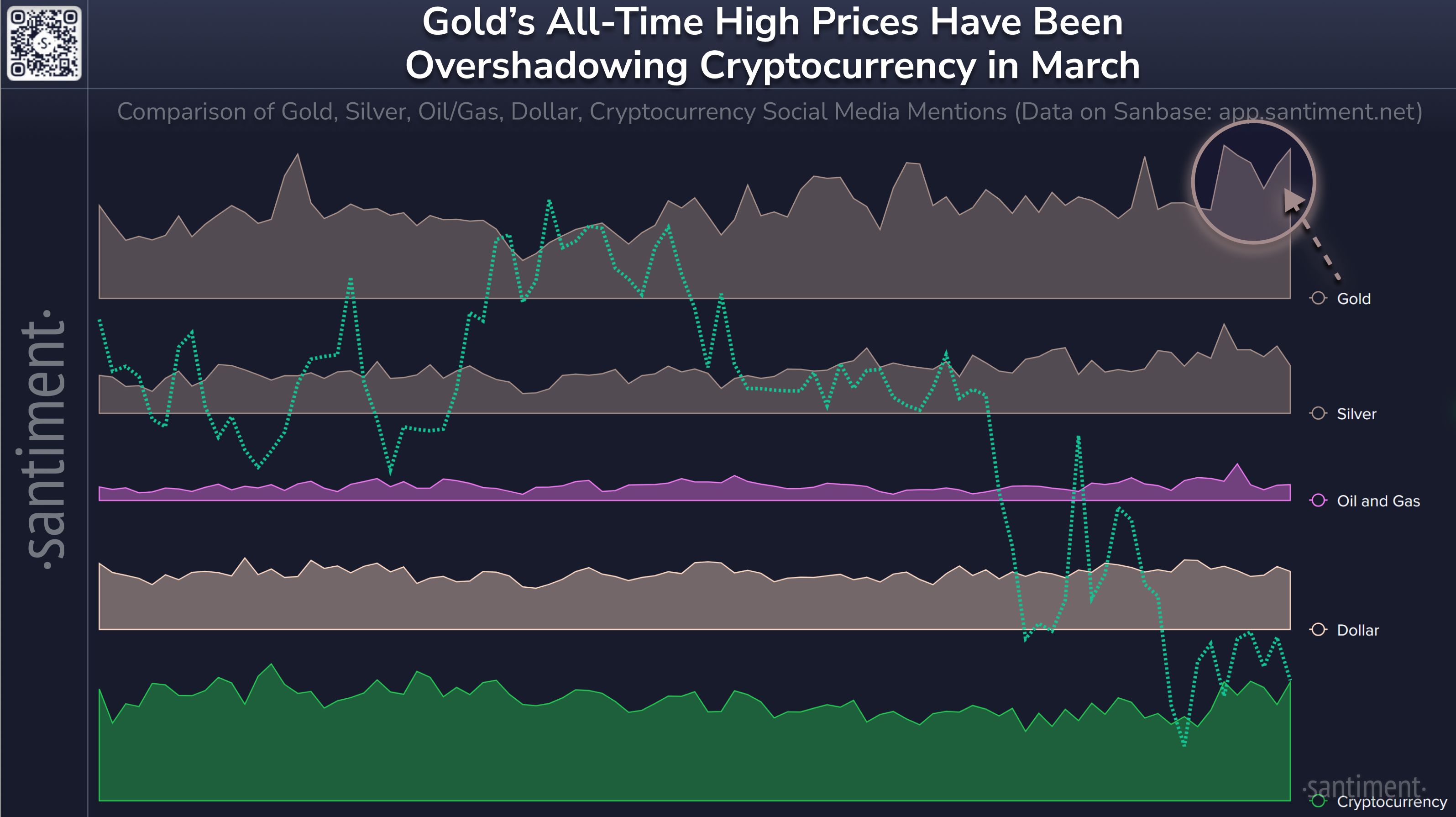

'Digital Gold' No Match For Real Gold?

Santiment•2025-03-19 00:44

Michael Saylor’s Strategy outperforms Bitcoin. Is a reversal coming?

Share link:In this post: Strategy’s stock is outperforming Bitcoin amid Bitcoin’s price struggles, with a 358.5% return in 2024—three times Bitcoin’s gains. Michael Saylor’s company holds 499,096 BTC, worth $42 billion, but its market cap is $77.4 billion, showing a massive premium. Leverage is fueling the gains, but if Bitcoin drops, Strategy’s stock could crash harder due to its debt-heavy balance sheet.

Cryptopolitan•2025-03-18 10:33

Hyperliquid Trader’s 40x BTC Short Nears $3.7M Floating Loss as Bitcoin Tests Key Levels

Bitcoin.com•2025-03-18 08:22

Bitcoin 'bullish cross' with 50%-plus average returns flashes again

Cointelegraph•2025-03-18 01:34

Buy more

FAQ

What is the current price of FUD?

The live price of FUD is $0 per (FUD/USD) with a current market cap of $0 USD. FUD's value undergoes frequent fluctuations due to the continuous 24/7 activity in the crypto market. FUD's current price in real-time and its historical data is available on Bitget.

What is the 24 hour trading volume of FUD?

Over the last 24 hours, the trading volume of FUD is $274,763.61.

What is the all-time high of FUD?

The all-time high of FUD is $0.{6}9359. This all-time high is highest price for FUD since it was launched.

Can I buy FUD on Bitget?

Yes, FUD is currently available on Bitget’s centralized exchange. For more detailed instructions, check out our helpful How to buy FUD guide.

Can I get a steady income from investing in FUD?

Of course, Bitget provides a strategic trading platform, with intelligent trading bots to automate your trades and earn profits.

Where can I buy FUD with the lowest fee?

Bitget offers industry-leading trading fees and depth to ensure profitable investments for traders. You can trade on the Bitget exchange.

Where can I buy FUD (FUD)?

Video section — quick verification, quick trading

How to complete identity verification on Bitget and protect yourself from fraud

1. Log in to your Bitget account.

2. If you're new to Bitget, watch our tutorial on how to create an account.

3. Hover over your profile icon, click on “Unverified”, and hit “Verify”.

4. Choose your issuing country or region and ID type, and follow the instructions.

5. Select “Mobile Verification” or “PC” based on your preference.

6. Enter your details, submit a copy of your ID, and take a selfie.

7. Submit your application, and voila, you've completed identity verification!

Cryptocurrency investments, including buying FUD online via Bitget, are subject to market risk. Bitget provides easy and convenient ways for you to buy FUD, and we try our best to fully inform our users about each cryptocurrency we offer on the exchange. However, we are not responsible for the results that may arise from your FUD purchase. This page and any information included are not an endorsement of any particular cryptocurrency. Any price and other information on this page is collected from the public internet and can not be consider as an offer from Bitget.

Bitget Insights

BGUSER-EWL0HQX1

3h

A crypto analyst has predicted that the XRP price could hit $27 soon. He describes the cryptocurrency’s current price action as a “ Bermuda Triangle or boredom phase” — a period where the market moves slowly or sideways, fuelling doubt and uncertainty among traders and investors before a price rally.

XRP Price Boredom Phase To Trigger $27 Surge

Crypto analyst Egrag Crypto has warned that the XRP price is in a Bermuda Triangle, a boredom phase characterized by price stagnation and market uncertainty designed to shake out weak hands before a significant price move. According to his prediction, while traders and investors are growing impatient and questioning why XRP has not experienced any notable price increases, this phase is merely a set-up for a strong rally toward $27.

Following a predicted downturn in mid-March, XRP has struggled to recover its bullish momentum. The cryptocurrency was one of the top-performing altcoins in this bull cycle, jumping from a $0.5 low to over $3 for the first time in seven years.

Due to the current market decline, Egrag Crypto revealed that many traders are now wondering why “XRP hasn’t mooned.” The analyst explained that this price decline was intentional, forcing investors to second-guess themselves and make emotional trading decisions.

He also disclosed that the XRP market is now filled with ‘What ifs’, as Fear, Uncertainty, and Doubt (FUD) cloud traders’ minds. Moreover, concerns over potential dips to $1.60 or $1.30 could push investors to panic-sell or attempt risky trades.

The analyst also revealed that the XRP market is currently controlled by sharks and larger players, also called Whales. These large holders tend to influence price movements, triggering stop-losses and shaking out weak hands before a major rally.

Egrag Crypto warns that new investors and traders are especially vulnerable, as frustration and boredom can lead to making financial mistakes. He disclosed that the best strategy to implement during this current market phase is to do nothing. He suggested investors stay disciplined and patient, recognizing that boredom phases are normal in crypto market cycles.

The analyst also urged investors to remain vigilant and hold their positions while accumulating at ideal prices rather than react impulsively to rapid changes in the market.

XRP Breakout Point Hints At New ATH

In other analyses, market expert ‘Steph Is Crypto’ has announced that XRP is currently retesting breakout levels to trigger a surge to a fresh ATH. The analyst’s price chart shows a Falling Wedge pattern which has been broken above the resistance at the upper trend line.

After breaking out, $XRP now retests this level to confirm a larger upward move. The large green arrow on the chart points to the cryptocurrency’s projected price target, suggesting a bullish continuation if the Falling Wedge breakout holds.

XRP’s upside potential is predicted to be $4 or higher if its bullish momentum is maintained. As of writing, the cryptocurrency is trading at $2.4, reflecting a 3.5% decline in the last 24 hours, according to CoinMarketCap. If its price rises to $4, it would represent a significant 66.7% increase from current levels.

$XRP

SOON-2.96%

MOVE+1.39%

Crypto_Elle

4h

XRP Price To $27: Why Current ‘Boredom Phase’ Could Trigger Epic Rally

A crypto analyst has predicted that the XRP price could hit $27 soon. He describes the cryptocurrency’s current price action as a “ Bermuda Triangle or boredom phase” — a period where the market moves slowly or sideways, fuelling doubt and uncertainty among traders and investors before a price rally.

XRP Price Boredom Phase To Trigger $27 Surge

Crypto analyst Egrag Crypto has warned that the XRP price is in a Bermuda Triangle, a boredom phase characterized by price stagnation and market uncertainty designed to shake out weak hands before a significant price move. According to his prediction, while traders and investors are growing impatient and questioning why XRP has not experienced any notable price increases, this phase is merely a set-up for a strong rally toward $27.

Following a predicted downturn in mid-March, XRP has struggled to recover its bullish momentum. The cryptocurrency was one of the top-performing altcoins in this bull cycle, jumping from a $0.5 low to over $3 for the first time in seven years.

Due to the current market decline, Egrag Crypto revealed that many traders are now wondering why “XRP hasn’t mooned.” The analyst explained that this price decline was intentional, forcing investors to second-guess themselves and make emotional trading decisions.

He also disclosed that the XRP market is now filled with ‘What ifs’, as Fear, Uncertainty, and Doubt (FUD) cloud traders’ minds. Moreover, concerns over potential dips to $1.60 or $1.30 could push investors to panic-sell or attempt risky trades.

The analyst also revealed that the XRP market is currently controlled by sharks and larger players, also called Whales. These large holders tend to influence price movements, triggering stop-losses and shaking out weak hands before a major rally.

Egrag Crypto warns that new investors and traders are especially vulnerable, as frustration and boredom can lead to making financial mistakes. He disclosed that the best strategy to implement during this current market phase is to do nothing. He suggested investors stay disciplined and patient, recognizing that boredom phases are normal in crypto market cycles.

The analyst also urged investors to remain vigilant and hold their positions while accumulating at ideal prices rather than react impulsively to rapid changes in the market.

XRP Breakout Point Hints At New ATH

In other analyses, market expert ‘Steph Is Crypto’ has announced that XRP is currently retesting breakout levels to trigger a surge to a fresh ATH. The analyst’s price chart shows a Falling Wedge pattern which has been broken above the resistance at the upper trend line.

After breaking out, $XRP now retests this level to confirm a larger upward move. The large green arrow on the chart points to the cryptocurrency’s projected price target, suggesting a bullish continuation if the Falling Wedge breakout holds.

XRP’s upside potential is predicted to be $4 or higher if its bullish momentum is maintained. As of writing, the cryptocurrency is trading at $2.4, reflecting a 3.5% decline in the last 24 hours, according to CoinMarketCap. If its price rises to $4, it would represent a significant 66.7% increase from current levels.

$XRP

SOON-2.96%

MOVE+1.39%

J0n

6h

Bitcoin’s Rise: A Bullish Sign at 1.3% of Global Money Supply

Bitcoin $BTC has hit a remarkable milestone. With a market capitalization of $1.7 trillion, it now accounts for 1.3% of the global money supply. For a decentralized digital asset that started as an experiment just over 15 years ago, this is a staggering achievement and a clear signal that we’re still in the early innings of its potential.

The Numbers Tell the Story

The global money supply, encompassing cash, bank deposits, and other liquid instruments (often measured as M2), is estimated to hover around $130 trillion. Bitcoin’s $1.7 trillion market cap might seem like a drop in the bucket by comparison, but that’s exactly why the bullish case is so compelling. At just 1.3%, Bitcoin has already outpaced the market value of many national currencies and established itself as a legitimate player in the financial world all without a central bank, government backing, or physical form.

Consider this: if Bitcoin were a country, its "economy" would rank among the top 20 globally by GDP. Yet, unlike traditional economies, Bitcoin’s growth isn’t constrained by geography, politics, or resource scarcity. Its fixed supply of 21 million coins and decentralized nature make it a unique asset, one that’s increasingly catching the eye of investors, institutions, and even skeptics turning into believers.

Why This Matters

Reaching 1.3% of global money isn’t just a fun statistic it’s a testament to Bitcoin’s staying power and adoption. The asset has weathered brutal bear markets, regulatory uncertainty, and endless FUD (fear, uncertainty, and doubt) to emerge stronger each cycle. This resilience is drawing in a wave of new participants, from retail hodlers to Wall Street giants.

Institutional adoption is accelerating. Companies like MicroStrategy have made Bitcoin a core treasury asset, while ETFs in the U.S. and beyond have opened the floodgates for traditional investors. Meanwhile, nations like El Salvador have embraced it as legal tender, and others are quietly exploring similar moves. The network effect is kicking in: the more people use Bitcoin, the more valuable and entrenched it becomes.

We’re Still Early Really Early

If 1.3% sounds impressive, here’s the kicker: there’s still so much room to grow. Imagine Bitcoin capturing 5% of global money supply that’s a $6.5 trillion market cap at current estimates. Push it to 10%, and we’re talking $13 trillion, nearly rivaling gold’s total market value. These aren’t pie-in-the-sky projections; they’re plausible scenarios given Bitcoin’s trajectory and the cracks forming in traditional financial systems.

Inflation, currency devaluation, and distrust in centralized institutions are tailwinds propelling Bitcoin forward. Fiat currencies are losing purchasing power look at the U.S. dollar’s 20%+ decline in real value over the past decade. Bitcoin, with its capped supply, offers a hedge that’s hard to ignore. And with only about 5-10% of the world’s population owning crypto, according to most estimates, the adoption curve is barely starting to steepen.

The Bullish Case in One Word: Scarcity

Bitcoin’s killer feature is its scarcity. Only 21 million BTC will ever exist, and with millions already lost to forgotten wallets or hodlers who won’t sell, the effective circulating supply is even smaller. Compare that to fiat, where central banks can print trillions at will (see: $6 trillion in COVID era stimulus). As demand rises and it is rising Bitcoin’s price could see exponential gains.

At $1.7 trillion, Bitcoin is no longer a niche experiment; it’s a global force. Yet, at 1.3% of the money supply, it’s nowhere near saturation. The next decade could see it challenge gold, bonds, or even equities as a store of value. Early adopters aren’t just sitting on gains they’re positioned for a paradigm shift.

BTC+0.10%

CORE+2.08%

BGUSER-NWZFS33F

13h

Pi Network faces manipulation from fake exchanges, scammers, FUD spreaders, and possible delays. OTC traders set false prices, and future whales may manipulate the market. Have you seen any signs of this?

FUD+4.13%

PI+0.21%

LADYWIZZ

1d

Pi Coin Price Prediction: Failure of Coinbase and Binance Listings Pushes Price Below $1

Pi Network’s native cryptocurrency, Pi Coin (PI), has experienced a major drop in value, falling below the $1 mark. As of recent market data, Pi has lost more than 18% in the last 24 hours, raising concerns among investors. If PI fails to maintain its $0.95 support level, further declines could push the coin to as low as $0.87. On the other hand, a shift in sentiment could see it rise back to $1.34 and beyond, but bulls face a difficult challenge to regain momentum.

Why is Pi Coin Falling?

Several factors have contributed to Pi Coin’s sharp decline in value, and the situation has left investors scrambling for answers.

Binance and Coinbase Listing Failures

A factor behind Pi’s downfall is the delay in listing the coin on major exchanges like Binance and Coinbase. Both platforms previously teased the possibility of listing PI, sparking speculation and optimism among investors. However, the failure of these listings to materialize has dampened sentiment, leading to a drop in demand for Pi Coin. The lack of official exchange listings has left many to question the coin’s future and viability in the broader market.

Decreasing Supply and Deflationary Pressures

Although Pi Network has not formally announced a coin burn, the supply of Pi is steadily shrinking. Several mechanisms have contributed to this decrease:

Transaction Fees: Pi’s transaction fees are burned permanently, with over 528,671 PI tokens burned by early March at a rate of 3,000–4,000 tokens daily. While this may sound beneficial from a supply reduction perspective, the deflationary pressure has not been enough to offset the broader market sentiment surrounding the coin.

Unverified Accounts: Tokens held by users who missed the Know Your Customer (KYC) deadline have been burned, further reducing the coin’s total supply. As of now, the circulating supply stands at approximately 6.8 billion PI tokens. These measures aim to address fake and abandoned accounts, but they have also intensified the perception of a decreasing supply.

Investor Sentiment: FUD or a Genuine Concern?

The drop in Pi Coin’s value has sparked widespread fear, uncertainty, and doubt (FUD) in the market. Sentiment has worsened by 80% within a single day, with some users even claiming “manipulation” and “panic” selling. Trading volume has decreased by 37%, signaling a reduction in market activity.

$PI

FUD+4.13%

MAJOR-9.78%

Related assets

Popular cryptocurrencies

A selection of the top 8 cryptocurrencies by market cap.

Recently added

The most recently added cryptocurrencies.

Comparable market cap

Among all Bitget assets, these 8 are the closest to FUD in market cap.